- •1. Heating a house

- •1.1 Transfer of heat

- •1.2 Heat losses

- •1.3 Conduction heat loss

- •1.4 Convection heat loss

- •1.5 Radiation losses

- •1.6 Seasonal heating

- •1.7 Choice of installation

- •2. Investment

- •2.1 The value of money

- •3. Growth of money

- •3.1 Growth of a fixed amount

- •3.2 Growth of regular investment

- •4. Hire purchase

- •5. Buying a house

- •6. Income tax

- •6.1 Allowances

- •6.2 Taxable income

- •6.3 Standard rate and reduced rates of tax

- •6.4 Tax deducted by employer

- •7. Rates

- •7.1 Rateable value

- •7.2 Lp rate

- •7.3 The rates

5. Buying a house

A house is probably the biggest item of expenditure most people ever have and the majority have to borrow money to pay for it. Loans are made by Building Societies. As they have far less risk to run than a Hire Purchase Company, they can afford to charge a lower rate of interest and do charge it on the outstanding loan. The main structure of a house is after all relatively indestructible and the Building Society will insist that you insure it. A loan on a house or property is called a 'mortgage'.

The Building Society estimates the value of a house and will generally lend up to 80 % of their valuation on a new house and 75 % on one over 30 years old. The loan may be increased to 90 % or even 95 % if suitable guarantees are available. Each month the same sum is paid; part of this is the interest on the outstanding loan and part is the repayment of the capital. The rates of interest normally vary from 6 to 8-5 % p.a.

If, for example, Ј100 is borrowed for 10 years then Ј1-45 is paid back each month for 10 years. In the first month, Ј0-64 of this is interest, that is 71 % of Ј100/12, and Ј0-81 repayment of the loan. As the months pass, the proportion of interest reduces until in the last month, practically all the payment is repayment of the loan. The income tax authorities at present allow the interest part of the payment to be charged as an allowance against income tax. The effective payments especially at the beginning are then appreciably less than shown.

Exercise I

-

Suppose you wish to buy a house costing Ј6000 and you pay cash of Ј500 and borrow the balance. Use Table 3 to determine how much you would have to pay per month over a period of a) 10 years; b) 20 years.

-

If the real value of your house does not drop what would be the value of your Ј6000 home 10 years later? Assume the purchasing power of the pound varies as in Figure 3.

-

A house costing Ј800 in 1936 was worth about Ј4000 in 1964.

-

Use Figure 3 to find what the Ј800 would have amounted to if invested in a Building Society paying a tax free interest of 4 %.

6. Income tax

We tend to grumble when we have to pay tax but should realize that the services provided by a modern society have to be paid for. Name some of the things for which you pay and a few ways in which the taxes are levied.

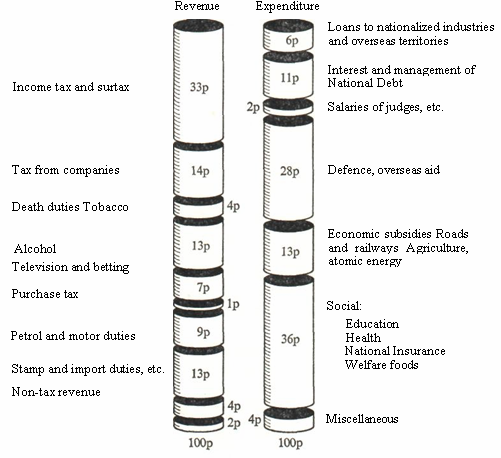

Figure 6.1 shows the ways in which tax is raised and how it is spent. You will see that Income Tax provides by far the greatest source of revenue.

Fig.6.1 The amount of Income Tax you pay is determined by:

a) your wages or salary, and unearned income;

b) the allowances you claim;

c) the rates of tax.

6.1 Allowances

An allowance is a reduction in taxation that the government will permit when a wage earner undertakes certain responsibilities. For example, where he provides for children or elderly relatives or where he undertakes to pay life insurance or superannuation (which is a payment towards his pension).

When the Inland Revenue (a branch of the government) have all this information, they can calculate the amount he has to pay. Example 6 shows the sort of calculation that is made.

Example 5

The following figures are given only as a sample of the various allowances; they will, of course, differ from person to person. They refer to a married man in 1964, with two young children, paying superannuation of Ј45 and Endowment Life Insurance of Ј35. Besides his income, he is receiving Ј12 in interest from bank deposits and Ј21 from Family Allowances.

Ј

i) Superannuation (Q of premium only) 35

ii) Personal allowance 340

iii) Children 230

iv) Life Insurance (f of premium only) 14

v) National Insurance 22

Total allowances Ј641

Deduct

Interest (from investments not taxed at source) 12

vi) Family allowances (J of receipts only) 16

28

Allowances to be set against pay Ј613

Notes

-

Superannuation is a deduction for a pension,

-

A single man is allowed Ј220

-

For a child under 11, Ј115. For a child 11 to 16, Ј140. For a child over 16, Ј165 if still studying or in training

-

f of the premium paid may be counted as an allowance

-

For a person under 18 the allowance is Ј10 for girls and Ј12 for boys,

-

Family allowances consist of a payment from the Government of Ј0-40 per week for the second child and Ј0-50 per week for each child thereafter.

The allowances and fractions mentioned in the table may vary from time to time and are reviewed annually by the Chancellor of the Exchequer.