- •1. Heating a house

- •1.1 Transfer of heat

- •1.2 Heat losses

- •1.3 Conduction heat loss

- •1.4 Convection heat loss

- •1.5 Radiation losses

- •1.6 Seasonal heating

- •1.7 Choice of installation

- •2. Investment

- •2.1 The value of money

- •3. Growth of money

- •3.1 Growth of a fixed amount

- •3.2 Growth of regular investment

- •4. Hire purchase

- •5. Buying a house

- •6. Income tax

- •6.1 Allowances

- •6.2 Taxable income

- •6.3 Standard rate and reduced rates of tax

- •6.4 Tax deducted by employer

- •7. Rates

- •7.1 Rateable value

- •7.2 Lp rate

- •7.3 The rates

2. Investment

How do the following institutions obtain the money to pay for the necessary work?

-

A town council which decides that it has to provide housing for 2000 families.

-

A government of a new territory which needs to build main roads throughout the territory.

-

An industry which finds that it has to renew all its machine tools if it is to remain competitive.

-

A commercial enterprise which needs to set up three new factories, properly to satisfy the demand for its goods.

If there is not sufficient money available from taxes or profits, the project must be abandoned or the money borrowed. People lend money to institutions if, in return, they get back a little more than they lend. When an individual lends money to an institution in the hope of making a profit, he is said to be making an ' investment'. The extra amount that is obtained is called the ''interest'' on the investment and it is usually measured as a certain percentage of the investment, paid annually.

(The process of lending money to an institution is usually carried out by buying stock or shares issued by the government or company. These can be sold back if you wish to withdraw your loan.)

It is possible to invest in other ways than those described, for example, by buying insurance policies.

2.1 The value of money

During the nineteenth century, if a hoard of Ј100 was hidden in a stocking under the floorboards, then, provided a thief did not find it, it would still have been worth approximately Ј100 or have even increased in value 10, 20 or perhaps 50 years later. However, in the last 50 years there have been big changes.

One hundred pound notes hidden in 1912 might have purchased a certain quantity of goods; by 1922, they might purchase only half of that quantity and, by 1965, less than a quarter. How much dearer would you expect things to be in 1965 than in 1938?

Is it worth trying to save money? This is really two questions. Do you want to have money in reserve for future plans? Do you think that keeping money (remembering how it is losing value) is better than, for example, keeping a new car or a picture which you could sell at a later date?

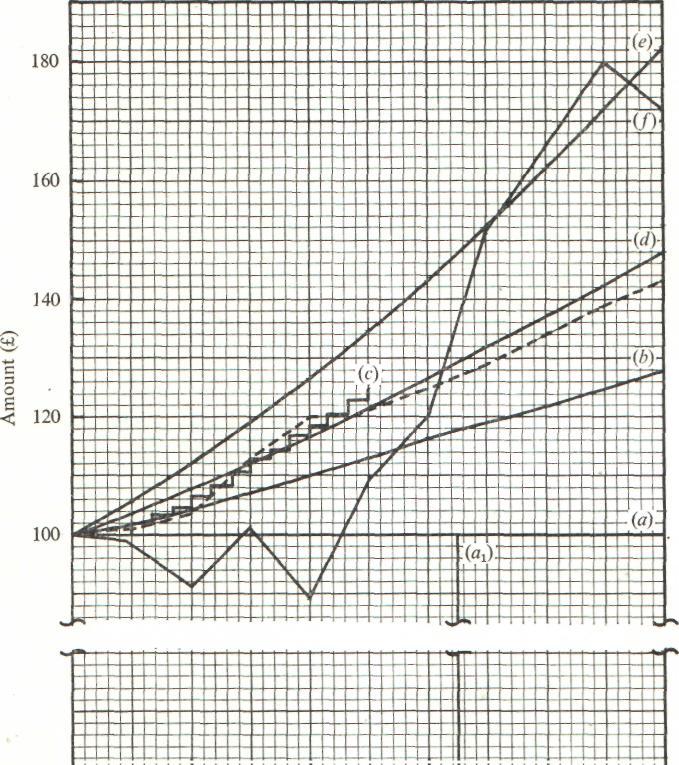

One of the purposes of investing money, though not the only one, is to try to counter this loss of value of money you save. Figure 3 shows the result of investing Ј100 in different ways. The figures are taken over a fairly typical, recent period often years. As it has been a time when the value of the pound has been falling, the dotted line has been put in to show the number of pounds that you would need to maintain the purchasing power of Ј100 in the first year. Unless the value of your investment is above this dotted line, you will have less purchasing power at the end of the period than at the beginning.

-

shows the effect of hiding Ј100 under the mattress. What explanation can you give to (a)?

-

shows the effect of putting your money into a Post Office or Trustee Savings Bank at 2-5 %. If you have Ј50 in the Post Office Savings Bank, then you can start investing in the Post Office Savings Bank Investment Account and obtain 6/ %.

-

shows the effect of buying savings certificates from the Post Office. This is the 'Twelfth Issue' which lasts for five years.

-

shows the effect of one way of putting your money into a Building Society that is a member of the Building Societies' Association. Interest of 4 % is shown on the graph.

(e) shows the effect of investment in a 6 % loan. This is typical of loans raised by city councils in this country.

f) shows the effect of investment in a well-established Unit Trust. This clearly has its ups and downs and it is not much good as a means of investment if the money is required at a definite date. However, if one is prepared to wait until a good price is offered then, at least over the last 30 years, this would have been a good investment.

Income tax is normally paid on all income from investment (unless you are at school or receiving full-time training) and this obviously lessens the amount of money you receive. Nothing of this is shown in Figure 4 except in the cases of Unit Trusts f) and the Building Societies d).

Note that rates of interest are liable to fluctuate.

There are two other forms of investment which are not shown on Figure 2.1, house purchases and insurance policies. House purchase is dealt with in another Section; all we shall say here is that money spent in the purchase of a house is considered to increase because, at least at the moment, the value of houses is increasing faster than the value of money is diminishing.

Fig. 2.1 Growth of Ј100 invested in different ways.

One of the most effective ways of saving is by taking out an Endowment Insurance policy. You lend money to an insurance company, usually by paying them annually or monthly a fixed amount called the 'premium'. In return you are paid a minimum agreed sum after a certain number of years: if you should die before this fixed number of years, the money is given to your dependents. The point is that the money paid to you is more than the money you pay to the company. Types of policy vary widely, but with a good company, the effective rate of interest may be as high as 6 %.

Exercise F

Use Figures 2.1 and your slide rule to answer this exercise.

-

What does an investment of Ј20 become in 5 years time through each method of investment (b), (c), (d) and (e) of Figure 4?

-

What does the investment in Question 1 (e) become if the Government charges Ј0-41 income tax on each Ј of interest earned?

-

How many Ј's at the start of the 10-year period of Figure 4 would have had the same purchasing power as:

a) Ј100 at the end; b) Ј60 at the end?

4. What is the percentage decrease in the value of the Ј, that is in its purchasing power, over the war-time periods:

a) 1914-18; b) 1939-45?

-

Interest on Savings Certificates may be added only every 4 months. A Ј1 Savings Certificate jumps in value at the end of the 28th month from Ј1-06 to Ј1-08. What percentage increase is this?

-

Beef cost 32 p a half-kilogram in 1968 and 8 p a half-kilogram in 1938. How does this compare with the change in the purchasing power of the pound?

-

Can you suggest why the value of the pound increased after the First World War yet fell after the Second?