- •Министерство образования республики беларусь

- •Part a: Money and its Functions. The History of Money. Getting started

- •Adjectives

- •Verbs and verb phrases

- •1. Fill in the missing prepositions to the following sentences:

- •The Money Questionnaire

- •Part b: Introduction to Banking

- •1. Read the text “On the Money-go-round” in which some advice are given to Englishmen travelling abroad.

- •English banknotes and coins

- •American money

- •Bank operations

- •Here comes the cyber-dollars

- •Пластиковая безопасность

1. Read the text “On the Money-go-round” in which some advice are given to Englishmen travelling abroad.

Money, usually the lack of it - is a universal problem for travellers. Whatever the amount they take, there is a variety of ways to carry it. Since each has both advantages and disadvantages, a combination of two or three is advisable, the mixture depending on financial circumstances as well as destination.

Traveller's Cheques: One more possibility of making payments without using your cash is traveller's cheques. Traveller's cheques can provide you a safe and convenient way of travelling with large amounts of money. They come in twenty, fifty and one hundred dollar denominations. Traveller's cheques are insured against loss and theft and are treated as cash by most businesses. You may purchase traveller's cheques at most banks. Traveller's Cheques will be replaced if lost or stolen, theoretically within 24 hours. You pay 1 to 1.5 percent of the value of the cheques but usually get a better rate when cashing them.

Foreign Currency: Carry a small amount (for taxis, porters, telephone calls, snacks) until you can get to a bank. Most UK banks need advance notice of your requirements, otherwise change sterling at the airport or port (though exchange rates are less favourable).

The commission and rate of exchange vary but shopping around is rather impractical. Some countries (in particular, Greece) restrict the amount of their currency that you can import. You should also carry some sterling for necessary expenses when you return.

Postcheques: Each cheque, when accompanied by a Postcheque Card (included free with your first order of cheques) can now be used to draw up to £100 in local currency from 90,000 post offices in most of Europe and around the Mediterranean as well as Hong Kong, the Bahamas and Japan.

Credit Cards: Access (linked to Mastercard in the United States and Euro-card in Europe) and Barclaycard (linked to Visa) are accepted in nearly five million outlets each though they vary in their acceptability - Barclaycard, for example, is stronger in France, Spain and Italy, whereas Access is most useful in Germany and the United States. Their acceptance in Continental petrol stations, too, is not always certain. They may also be used for cash advances and instead of a deposit on car hire.

Charge Cards: American Express and Diners Club are less widely accepted than credit cards and the interest-free settlement period is shorter but there is no pre-sent spending limit. In addition to the initial starting and annual fee for the cards, both charge a one-percent processing fee for bills converted into sterling.

Eurocheques: can be used to withdraw local currency as well as pay for hotels, restaurants, garages and other services in nearly five million, mostly European, outlets. The cheques, made out to the exact amount you require, are then debited to your account in the same way as a domestic cheque.

Individual Cheques: can be cashed for up to a maximum of £100 or equivalent in local currency.

There is no limit to the number of cheques you can use to make а purchase. You pay around £3.50 for the card and there is also a commission 1.25 percent on the value of the transaction, plus roughly a 30-pence handling fee per cheque.

Notes:

shopping around - искать более выгодные условия

2. Answer to the following questions:

1. What happens if you lose your traveller's cheques?

2. Where should the British traveller exchange sterling into foreign currency?

3. Why is the British traveller advised to carry sterling?

4. Where can you use Postcheques?

5. What are the advantages of credit cards?

6. What disadvantages do charge cards have?

7. How do you pay for Eurocheques?

8. What is the limit of a Eurocheque?

Text 5

1. Read the text ”Counterfeiting”. Sum up what the text says about the security features of American banknotes.

Counterfeiting of money is one of the oldest crimes in history. In the United States, for example, it was a serious problem in the past, when each bank issued its own currency. Therefore they adopted a national currency in 1863. But it did not solve the counterfeiting problem. The national currency, or the dollar, was soon counterfeited so widely, that it became necessary for the US Government to take special measures. In 1865 the United States Secret Service was established to suppress counterfeiting. It curtailed counterfeiting to a certain extent but this crime still exists.

The US dollars are now the most counterfeited currency in the world. Modern photographic and printing devices, colour copies, laser scanners have made the production of counterfeit money relatively easy. A lot of special security features are usually used in making banknotes of every country.

In making American dollars, for example, the following security features are used:

- red and blue fibres, embedded in the paper

- the intaglio printing of some features and many others.

Besides, not long ago, a few more new security features were added to US dollars. These features are as follows:

- invisible thread embedded in the paper

- micro printing and others.

These new features appeared first in banknotes of certain denominations only. Other denominations will be gradually made with the same security features.

Notes:

curtail - сокращать, урезывать

embed - запечатлеть

intaglio printing - глубокая печать

thread - нить

2. Complete the sentences with the following words: crime(s), currency, counterfeiting, established, features.

1)… of money is one of oldest... in history.

2) Thеу adopted a national ... in 1863.

3) In 1865 the United States Secret Service was ... to suppress...

4) It curtailed … to a certain extent but this ... still exists.

5) The US dollar is now the most counterfeited ... in the world.

6) New security ... is added to the dollar from time to time.

3. Give the English equivalents for the following:

метод защиты, глубокая печать; волокна, вкрапленные в бумагу; невидимая нить, микропечать, современные ксероксы, цветные принтеры, лазерный сканер, подделывать деньги, средства защиты денег, национальная валюта

Text 6

1. Scan through the text “Money laundering”.

Criminals use the financial system to put money which has been obtained illegally into legal business and bank accounts, so that they can hide it or use it. These activities are commonly referred to as money laundering. In January 1989 the Basle Statement of Principles on Money Laundering was circulated to all institutions authorised under the Banking Act. The Statement of Principles does not restrict itself to drug related money laundering, but extends to all aspects of laundering through the banking system, i.e. the deposit, transfer and / or concealment of money derived from illicit activities whether robbery, terrorism, fraud or drugs. The Statement of Principles seeks to deny to those who involved money laundering by the application of the following principles:

(a) Know your customer - banks should make reasonable efforts to determine the customer's true identity, and have effective procedures for verifying the bona fides of new customers, that is, they are who they say they are.

(b) Compliance with laws - banks should ensure that business is conducted in conformity with high ethical standards and laws; that a service is not provided where there is good reason to suppose the transactions are associated with laundering activities.

(с) Сooperation with law enforcement agencies - within any соnstraints imposed by rules relating to customer confidentiality banks should co-operate fully with national law enforcement agencies including, where there are reasonable grounds of suspecting money laundering, taking appropriate measures which are consistent with the law.

Notes:

Money-laundering - отмывание денег; laundered money -отмытые деньги; circulate / extend -распространять;

concealment - утаивание;

illicit - незаконный;

deny - не допускать;

verify - удостоверять подлинность;

bona fides - добросовестность, честность;

law compliance - соблюдение закона;

constraints - ограничения;

consistent - согласующийся;

mistaken identity -принятие одного лица за другое.

2. Work in pairs to answer the questions that follow.

1) What is commonly referred to as money laundering?

2) What was circulated to all banks in 1989?

3) What does the Statement of Principles extend to?

4) How many principles are included in the Statement of Principles?

5) What is the first one?

6) What is the second one?

7) What is the third one?

3. Agree or disagree with the following statements.

1) Banks should determine the customer's mistaken identity.

2) Banks should not check the bona fides of new customers.

3) If you check someone's bona fides, you check that they are who they say they are. 4) Banks should ensure that business is conducted in a way that obeys rules.

5) Banks should make it certain that a service is not provided where there are laundering activities.

6) Banks should disobey law enforcement agencies.

7) Banks should take correct or suitable measures against money laundering.

4. Complete the following statements.

1) Criminals use ... 2) These activities are referred to as… 3)... was circulated to ... 4) The Statement of Principles does not restrict ... but extends to ... 5) Banks should make… 6) Banks should have ... for verifying ... 7) Banks should ensure that business is ... 8) Banks should ensure that a service is ... 9) Banks should co-operate ... including taking ...

5. Translate the following words, phrases and statements from Russian into English.

Ошибочное опознание личности; применение; разумный; подлинный; опознание личности; удостоверять подлинность; добросовестность; соблюдение закона; обеспечивать; соответствие; предоставлять; предполагать; распространять; трансферт; утаивание; незаконный; мошенничество; искать; не пускать; сделка; отмывание денег; узаконить; отмытые деньги; ограничивать; ассоциироваться; полицейский орган; ограничения; конфиденциальность; согласующийся. Отмытые деньги - это средства, посланные последовательно через большое число депозитарных институтов в попытке скрыть источник денег. Гангстеры отмывают деньги для придания видимости легальности нелегальным источникам своего обогащения.

DEVELOPING VOCABULARY

1. Fill in the gaps with the words: value, cost, price.

1. He learnt the ... of a friend.

2. The oil ... is falling in the world-market.

3. The ... of living has risen, whereas wages have remained the same.

4. The ...of this information is enormous.

5. He set a high ... on this time.

6. At Christmas sales one can buy goods at reduced ....

2. Put each of the following words or phrases in the correct space in the sentences below.

broke hard-up in debt well-off make ends meet

a) She earns a lot of money. She's very... .

b) He never has a lot of money. He can't afford luxuries. He's always... .

c) I'll have to get an extra job in the evenings. I can't... on my salary.

d) I'm sorry I can't lend you any money. I haven't got any. I'm absolutely... .

e) He's ... He owes money to me and to bank too.

3. Match the following terms with the correct definitions:

current account, cheque, cash, liability, stock exchange, clearance, securities

means of borrowing money and raising new capital issued by companies, financial institutions, governments;

deposit which can be withdrawn on demand and which is used by depositor to finance day-to-day personal and business transactions;

coins and bank-notes which are in circulation in a country;

a market where company stocks and shares as well as government bonds are bought and sold;

a form of debt, for instance, a loan;

a means of transferring or withdrawing money from a bank or building society current account;

settling liabilities through the Clearing House.

4. Put a suitable form of these words into each space.

afford charge cost rise pay economise reduce owe sell

1 I... the bank so much that I couldn't take a holiday abroad.

2. When I... the rent, I felt as if I had been robbed.

3.I paid in cash and they didn't... me so much.

4. After I had ... my house, I realized I had made a mistake.

5. We ... so that we could buy a new fridge.

6. The cost of living keeps ... all the time.

7. We only could … last year's holiday by cutting down on luxuries.

8. How much did a double room...?

9. The shop on the corner has ... everything by fifty percent.

5. Choose the appropriate word from the brackets.

1. (Whenever/elsewhere) a man has to (issue a deposit / settle a debt) or has to make a purchase, he can do it with either cash or a (time deposit/chequing account).

2. Bank notes bring in no (interest/profit) at all.

3. The (temporary /net) suppliers of loan funds are households whereas business firms and the government are the main (temporary/ net) demanders of loans.

4. (Liability / clearance) function is performed in commodities markets by the International Commodities Clearing House.

5. There are enough workers in the factory to (owe / handle) all the available machinery.

6. It is typical to (issue / withdraw) bonds for the period of several years.

7. The bank (borrows/ lends) the (deposited/ withdrawn) money to customers who need capital.

8. Cheques may be written not only against bank (securities / deposits) but also against (interest-bearing/net) building society accounts.

9. Nowadays a bank's main function is to be an intermediary between (lenders / depositors) and borrowers.

10. It does not make sense (He имеет смысла) for two banks to make two inter-bank (clearing/transactions). They calculate the (debt/net) flows and settle them.

6. Translate the following sentences from Russian into English.

1. У нее есть много денег на банковском счете.

2. При оплате наличными это будет стоить тебе 10 $.Если ты рассчитаешься чеком, это будет дороже.

3. Не могли бы вы обменять эту купюру на монету для пользования кофе-автоматом.

4. Я заплатил более $2000 за свой компьютер, но сейчас он уже не стоит этих денег.

5. Боюсь, я зря потратил деньги на эти СD-диски, потому что я их никогда не слушаю.

DISCOVERING LANGUAGE

1. Make these sentences 1) interrogative 2) negative:

1. There are some new commercial banks in our city.

2. There are state chartered banks that offer many services.

3. There are some non-deposit financial institutions in the USA.

4. There is an insurance company and some pension funds on the list below.

5. There is a growing number of small finance companies in the USA today.

2. Fill in the blanks with the pronouns some, any, and no:

1. Are there _ commercial banks in your town?

Yes, there are _.

2. Is there _ money in your savings account?

No, there isn't_.

3. Does a credit union lend _ money to its members?

Yes, it does. It lends _ money to its members.

4. Do pension funds invest _ money into the industry?

No, they don't. They invest _ money into the industry.

5. There are _ commercial finance companies that provide collateralized loans to

business.

3. Fill in the blanks with adjectives many and much:

1. _ insurance companies protect their customers against risk.

2. It takes one _ money to join a credit union.

3 Starting a business without financial support from the bank may cause you _

_trouble.

4. Banks in the USA are subject to _ government regulations.

5. Savings and Loan Associations attract _ small savers who do not want to have any

risk.

4. Fill in the missing prepositions where it is necessary.

1. The bank lends the deposited money ... customers who need ... capital.

2. Cheques may be written not only ... bank deposits but also ... interest-bearing building society accounts.

3. The demand ... money is determined ... the quantity needed to handle ... business transactions.

4. Nowadays banks handle ... huge amounts ... money deposited ... them.

5. If a cheque is... soft currency, one may have some trouble cashing it... abroad.

6. The Central Bank ... Russia uses its reserves to help repay ... Russia's foreign debt.

7. The bank borrows the funds ... the public ... the specific purpose ... lending them ... again ... their customers.

8. Regulations ... America and Japan prevent commercial banks ... trading ... securities.

9. Creditors are persons or businesses ... whom an individual or firm owes money ... goods or services that they have supplied but ... which they have not yet been paid, or because they have made ... a loan.

10. Considerable fluctuations ... prices ... industrial shares are expected to take place ... the stock exchange ... a period of weeks and months.

5. Complete the sentences with the appropriate modal verbs in the correct form.

1. Since the prices of shares and government securities fluctuate, a seller … receive more or less than he paid for them.

2. Commercial banks …. required to deposit more of their cash reserves in special deposits at the Central Bank than before.

3. The Central Bank has withdrawn this bank's license. The latter … unable to meet its liabilities.

4. The owner of the firm hopes the bank …defer repayment of the loan.

5. The bank is calling in its loans. Its depositors …withdrawn a lot of their deposits lately or the bank …accumulating funds for a major lending or investment project.

6. If the bank has refused to issue a deposit, it means they …dissatisfied with the information you gave them about yourself.

7. Banks …said to provide financial services.

8. The coffee market … grown considerably in Russia in recent years but the purchasing power of population fell after the 1998 financial crisis.

6. Complete the sentences with the appropriate tense form. Translate them from English into Russian paying attention to the phrasal verbs in bold.

1 There's nothing in our bank account. We…run out of money.

2 John… putting money by for his holiday all year; he's saved over £500!

3 I … take out a loan to buy my new car. I’ll pay back the money I borrowed over three years.

4 Doing this course … really eating into my savings! Every week I have to pay £50.

5 If you leave your job, what …. live on?

6 We're spending too much money every week! We… cut down on luxuries.

LISTENING

1. Paul and Maria are colleagues. It is Paul's first trip to Uruguay and Maria is giving him advice about money. Read and listen to dialogue 1.

Paul: Hello, Maria. Have you got a minute? I need some advice.

Maria: Hi, Paul. Of course. What's the problem?

Paul: Well. I'm doing a trip to Uruguay next week. It's my first trip there. I'm taking my credit cards, but can I use them everywhere?

Maria: Oh, I see. You can use them in some places, like hotels, but not all. For example, you can't always buy petrol with credit cards, or pay for car parks or train tickets. Cash is essential, but in dollars. Not in local currency.

Paul: I see. So traveller’s cheques, then?

Maria: Yes, they're useful. But take them in dollars. You can use traveller’s cheques in dollars everywhere.

Paul: What about Eurocheques? In Europe we use them everywhere. We use them just like ordinary cash or cheques.

Maria: No. Eurocheques aren't very useful. Not useful at all. Nobody uses Eurocheques.

2. Listen to dialogues 2 and 3 and complete the table.

|

|

Uruguay |

northern Europe USA |

|

credit cards are used |

some places, like hotels |

|

|

credit cards are not used |

petrol, car parks, train tickets |

|

|

travellers' cheques are used |

everywhere |

|

|

Eurocheques |

not useful |

|

3. You are going to watch an episode "Money that doesn’t exist” of the video film ”Economics made easy”. Here are some words that might seem unfamiliar to you:

• gilt, n - позолота, деньги

• gild, v - золотить

• custody - опека

• solvent - платежеспособный, кредитоспособный

• holders -арендатор, владелец, держатель

• bill - счет, расходы, стоимость

• interest - процент

• short -term bank loan - краткосрочный банковский кредит

• to be in the red - быть в долгу

• overdraw - превысить кредит (в банке); overdraft - превышение кредита, овердрафт, задолженность банку

4. As you watch this episode for the second time, pay attention to the facts you'll hear and be ready to say whether the following sentences are true or false:

1. A few centuries ago in Paris Mario Linland offered their customers a special service, they accepted the gold of their customers in safe custody and, as an exchange, gave them a kind of receipt-certificates.

2. These certificates could be exchanged for the gold again at any time by anybody not just for original owner. So these certificates were accepted everywhere as gold and were easier and less dangerous to carry around. And so a kind of paper gold was created.

3. The system continued to function as long as gilt minters didn't stay solvent, as long as they were not able to return gold to any holders who asked for it.

4. The man in the restaurant has had enough coins to pay for a fine meal.

5. He can pay the bill because he has got a check and he can pay with his check despite the fact that he hasn't got any money at his bank account at the moment or perhaps he is in the red as he got debts. All the same restaurants accept his check just as equal cash.

6. After a certain agreed limit the bank doesn't guarantee its customers' debts. The customer later doesn't have to pay back the money for the restaurant bill to the bank plus interest. He isn't allowed to overdraw his account by means of a check, money, as we can say, that doesn't exist!

FOCUS ON FUNCTIONS

1. The passive is very often used when we describe a process or a procedure because we are less concerned with who has done something than with what is done. For example, read this description of an export transaction involving a British firm and an Australian one:

First of all, the goods are sent to a port and loaded on board ship. They are inspected and if everything is fine, a 'clean' Bill of Lading (B/L) is signed by the captain and a copy sent to the exporting firm. Then a Bill of Exchange (B/E) requiring the Australian firm to pay on a future date is drawn up by the British firm and presented, together with the insurance certificate and the B/L, to a British bank. Next, the documentation is sent to the Australian bank. At this stage the B/E is accepted by the importer who is now given the B/L and is able to collect the goods when they arrive and pay his/her bank on the due date.

Note that is/are do not have to be repeated when the second verb (e.g. loaded/presented) follows 'and'.

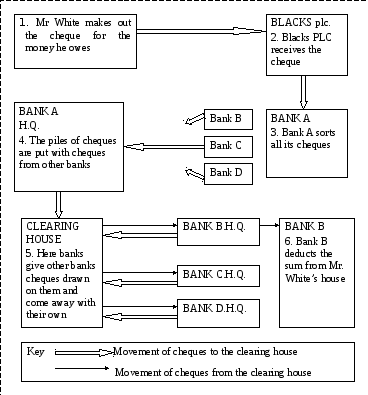

2. See the picture below. Imagine a man called Mr. White owes Blacks plc. a sum of money. If he has an account at Bank В and the firm an account with Bank A what happens to the cheque he makes out?

The life story of a cheque

3. Complete the blanks with the following verbs:

credit send draw exchange deduct pay sort put send on

First of all, when Blacks plc. receives the cheque it 1______ into Bank A and

2___to the firm's account. Then, at the end of each working day all the cheques which 3_______on other banks and 5_____to Bank A's headquarters. Here they 6________ into piles together with cheques from other Banks (В, C, D, etc.) and 7____________to the clearing house where all the cheques 8______. Bank B's headquarters now sends Mr. White's cheque back to Bank В (where he has an account) and the sum 9______ from his account.

SPEAKING

Read and translate the following dialogues.

OPENING AN ACCOUNT

I

Man: Good morning.

Cashier: Good morning, sir.

M: I'd like to open an account, please.

C: Certainly, sir. Do you live in Geneva?

M: Yes. I'm at the Interpreters' School.

C: Are you a student?

M: Yes.

C: What sort of account would you like?

M: A current account, I think.

C: Have you got any large sums to deposit?

M: No, only a thousand euros or so a month.

C: Well, we can open a current account with a cheque book for you as long as the initial

sum is at least three thousand euros. But I'd advise you in your case to take an account

that gives you more interest, and which is more practical. We normally advise students

to open deposit accounts.

M: Can I take out money whenever I like?

C: Yes. There are two or three types of account. They permit you to withdraw up to ten

thousand euros a month.

M: Can I receive money directly from abroad?

C: Certainly.

M: And can I withdraw at a branch office?

C: Certainly, though it may be more convenient to open your account in our branch near the University.

M: No, I live quite near here. Do I need a passport?

C: Yes.

M: I'm afraid I haven't got it. Will my student card do?

C: No, I'm afraid not.

M: I'll come back later, then.

C: Very good, sir.

II

Bank Clerk: Good morning. What can I do for you?

Oleg Martynov: Good morning. I would like to open a savings account. I’d like to open

it with a deposit of one thousand dollars.

Clerk: Would you please fill in this application. Besides you need to write a deposit

ticket for 1000 dollars. If you have any questions, I'll be glad to assist you.

O.M. fills in the application and deposit ticket.

Clerk: Everything is correct. Here is your pass-book. The bank will pay you 5% interest.

Oleg Martynov: Thank you for your assistance.

III

Clerk: Good afternoon. May I help you?

O.M.: Good afternoon. I’m here to open a checking account. My name is Oleg Martynov. My wife's name is Lena.

C: Do you want a joint account with your spouse?

O.M.: Yes. I do. Is there a minimum balance required?

C: If you open a checking account you are supposed to maintain an average daily balance

of 1000 dollars. As long as you keep this average balance, you won’t be charged for

banking services of six dollars a month and you wont' be charged for you transactions.

O.M.: What is meant by transaction charge?

C: You'll have to pay 25 cents for each check made by you or your spouse and also 25 cents for each cash withdrawal.

O.M.: I'd like to open a checking account with a deposit or 1500 dollars. Is that o’kay?

C: It's perfectly all right. You can order your check books after having filled in an application and your deposit ticket.

O.M. is filling in an application and deposit ticket.

O.M.: Is anything wrong?

C: Everything is correct. Now you can order your check books.

O.M.: Thanks a lot for your assistance.

WITHDRAWING MONEY FROM THE ACCOUNT

I

A: Good morning.

B: Good morning, sir.

A: I’d like to draw two thousand dollars from my account, please. Here is the

number.

B: Thank you. One moment, please, sir. I'm sorry, sir. Your account has a balance of

545 dollars.

A: All right. Give me 500 dollars, then, and I’ll draw the rest from my deposit

account. This is the number.

B: One moment, please. Yes that's all right, sir. How would you like it?

A: Two notes of a thousand, please. Thank you. Good-bye.

II

A: Good morning. I'd like to draw a thousand euro from account number С 6.287.55,

please.

B: Is it your own account?

A: Yes, here is my passport.

B: Thank you. One moment, please. How would you like it?

A: In hundreds, please. Thanks.

B: Good bye, sir.

III

A: I’d like to draw some money from my husband’s account, please.

B: Have you got power of attorney, madam?

A: Yes.

B: Do you know the number of the account?

A: Yes. Here is my cheque book.

B: How much would you like to draw?

A: Two hundred dollars, please.

B: One moment, please, madam. Yes, that's all right. How would you like it?

A: In tens, please. Thank you.

B: Thank you. Good-bye, madam.

IV

Man: Good morning.

Cashier: Good morning, sir.

M: I’d like to take out some money, please.

C: Certainly, sir. Do you know the number of your account?

M: No. I'm not sure of it.

С: What's your name?

M: Klaus Bright.

C: Is it a checking account?

M: Well, I've got a checking account and a savings account.

C: And which account would you like to draw from?

M: I'd like two thousand dollars from my checking account.

C: I'll just check the number, sir. It's 53.875, sir. Could you sign here, please ... and here. Thank you. One moment, please, sir. How would you like it, sir?

M: Two bills of a thousand, please. Thank you. Good bye.

V

Mr. Smith: Good morning.

Bank Clerk: Good morning, sir.

S.: I'd like to withdraw 950 dollars.

C: What notes would you like?

S.: Nine 100 dollar notes and one 50.

C: Here you are, sir. It's 950.

S.: Thank you. Please, could you give me some information? I'm going to South

America for one month. What do you suggest I take - traveler's checks or cash?

C: Oh, it's better to take traveller's checks. It's safer.

S.: Thank you. Good-bye!

C: Good-bye, sir.

CHANGING FOREIGN CURRENCY

I

Customer: Could you change dollars into English pounds sterling?

Cashier: Certainly, sir. I'll just check the exchange rates. How much would you like

to change?

Customer: One thousand dollars. And what is the rate of exchange today?

Cashier: One dollar to seventy five pence.

Customer: And what rate can you offer for two thousand dollars?

Cashier: One dollar to ninety pence.

Customer: Oh, the difference is not very big. Change one thousand, please. Here is

the money.

Cashier: Thank you. May I have your passport for a moment, please? We are always

to write down the number of the customer's passport if we change thousand

dollars or more.

Customer: Here it is. No problem.

Cashier: Here is your passport. How would you like the money, sir?

Customer: Oh, give it to me in hundred pound notes, please.

Cashier: Good. One hundred, two hundred ... seventy pounds, seventy five pounds.

Customer: Thank you. Good-bye.

Cashier: Good bye, sir.

II

M: Good afternoon.

C: Good afternoon, sir.

M: I've just arrived from Boston and I've got some foreign currency that I'd like to

change into roubles. Is that possible?

C: We can take the bank notes but I'm afraid we can’t take the small change.

M: Then could you change these notes, please?

C: Certainly, sir. I'll just check the exchange rate.

III

M: Good morning.

C: Good morning, madam.

M: I've just come back from a trip to Russia and I'd like to change on these roubles, please.

C: We can change but I'm afraid we can pay a very low rate of exchange on Russian currency, madam.

M: Oh, that doesn't matter. I can't use them anyway.

C: All right, madam. Just one moment, please.

2. Find the English equivalents for the following sentences in the above dialogues:

1. Я бы хотел открыть счет.

2. Какой счет Вы бы хотели открыть?

3. Вы хотите положить большую сумму?

4. Я бы посоветовал в Вашем случае ...

5. Могу ли я снять деньги, когда захочу?

6. А могу я снимать в одном из отделений банка?

7. Я бы хотел открыть сберегательный счет.

8. Я пришел сюда открыть чековый счет.

9. Я бы хотел открыть счет в банке.

10. Если вы открываете чековый счет, вам положено поддерживать средний ежедневный баланс в размере 1000 долларов.

11. Я бы хотел снять деньги со счета.

12. Какова плата за банковские услуги?

13. Плата за банковские услуги составляет 6 долларов в месяц.

14. Я бы хотел открыть чековый счет с вкладом в 1500 долларов.

15.Вы можете заказать чековые книжки после заполнения заявление вашего приходного ордера.

16. Если у Вас есть вопросы, я буду рад помочь Вам.

17. На Вашем счете 545 долларов.

18. Я сниму остальные с депозитного счета.

19. Этот счет на Ваше имя?

20. У Вас есть нотариально заверенное разрешение?

21. Я бы хотел снять 950 евро.

22. Какими купюрами (банкнотами) Вы хотели бы взять?

23. Если Вы едете в Южную Америку, Вам лучше взять дорожные чеки.

24. Я бы хотел получить деньги по дорожному чеку.

3. Read the Dialogue. Dick and Sally, university tutors, are discussing their financial problems.

D: Hello, Sally!

S: Hi, Dick! Happy to see you again. How are things with you?

D: Not bad. And how are you doing?

S: I've a problem, you know. I've just wrecked my new automobile. It has been an accident. And I need money to have it repaired.

D: Oh, I think I can help you. Haven't you heard about the credit union that we formed?

S: Why, no! Could you tell me what it is?

D: It was a great idea! The members of our department pooled their money and now anyone can apply for a loan if necessary.

S: And may I join the union?

D: Of course you may. As a rule, a credit union consists of members of a specific group, such as university employees. And we belong to the same university.

S: Great! And how much do I have to pay?

D: Well, we require a minimum deposit - something about 100 dollars. And our credit union pays a higher interest rate than many other financial institutions pay on similar accounts.

S: That also sounds good. And who manages the pool?

D: I do.

S: Fine! Then I'll have my car repaired pretty soon!

4. Work in pairs. Act out similar dialogues with your partner.

5. Choose one topic to speak about a) credit card; b) the best known cards in the UK; c) credit cardholders; d) money laundering

WRITING

1. Here is a story about some problems a man had with his bank. The sentences have been mixed up. Put them in the correct order, and add any other words you need to link the story together, e.g. so, because, but, and, etc.

1. He was overdrawn.

2. He opened a deposit account.

3. He got a statement in the post.

4. He forgot about his standing order for £50.

5. He paid for a new shirt by cheque.

6. He transferred £160 back to his current account.

7. He closed his deposit account.

8. He had to pay bank charges.

9. He wanted to earn more interest on his savings.

10. He transferred £160 to his deposit account.

You are a bank manager and you were asked for a loan. Consider the things:

you worry about the loan and the questions you want to be answered;

you should give particular consideration to:

— whether you will have sufficient funds to make this loan,

— whether you think the customer will be able to repay the loan and the interest,

— whether you would offer everything or part of what is being asked,

— whether you need any further evidence of the creditworthiness of your customer

and how you would get it,

— what sort of security would you accept,

— what kind of terms would you offer.

3. Conduct the interview:

a) if you refuse the loan, write to the client setting out the reasons why you have done so;

b) if you grant the loan, write to the client setting out the precise terms of the loan.

SUPPLEMENTARY READING

1. Read the texts about English and American money.