Финансовый учет. Ридер

.pdf

210

574 chapter 11 Reporting and Analyzing Stockholders’ Equity

now may choose S corporation treatment. One of the primary criteria is that the company cannot have more than 75 shareholders. Other forms of organization include limited partnerships, limited liability partnerships (LLPs), and limited liability companies (LLCs).

DECISION TOOLKIT |

A SUMMARY |

|

||

DECISION CHECKPOINTS |

INFO NEEDED FOR DECISION |

TOOL TO USE FOR DECISION |

HOW TO EVALUATE RESULTS |

|

Should the company incorporate? |

Capital needs, growth |

|

Corporations have limited liability, |

Must carefully weigh the costs |

|

expectations, type of business, |

easier capital raising ability, and |

and benefits in light of the |

|

|

tax status |

|

professional managers; but they |

particular circumstances. |

|

|

|

suffer from additional taxes, |

|

|

|

|

government regulations, and |

|

|

|

|

separation of ownership from |

|

|

|

|

management. |

|

FORMING A CORPORATION

A corporation is formed by grant of a state charter. The charter is a document that describes the name and purpose of the corporation, the types and number of shares of stock that are authorized to be issued, the names of the individuals that formed the company, and the number of shares that these individuals agreed to purchase. Regardless of the number of states in which a corporation has operating divisions, it is incorporated in only one state. It is to the company’s advantage to incorporate in a state whose laws are favorable to the corporate form of business organization. For example, although General Motors has its headquarters in Michigan, it is incorporated in New Jersey. In fact, more and more corporations have been incorporating in states with rules that favor existing management. For example, Gulf Oil changed its state of incorporation to Delaware to thwart possible unfriendly takeovers. There, certain defensive tactics against takeovers can be approved by the board of directors alone, without a vote by shareholders.

Upon receipt of its charter from the state of incorporation, the corporation establishes by-laws. The by-laws establish the internal rules and procedures for conducting the affairs of the corporation. Corporations engaged in interstate commerce must also obtain a license from each state in which they do business. The license subjects the corporation’s operating activities to the general corporation laws of the state.

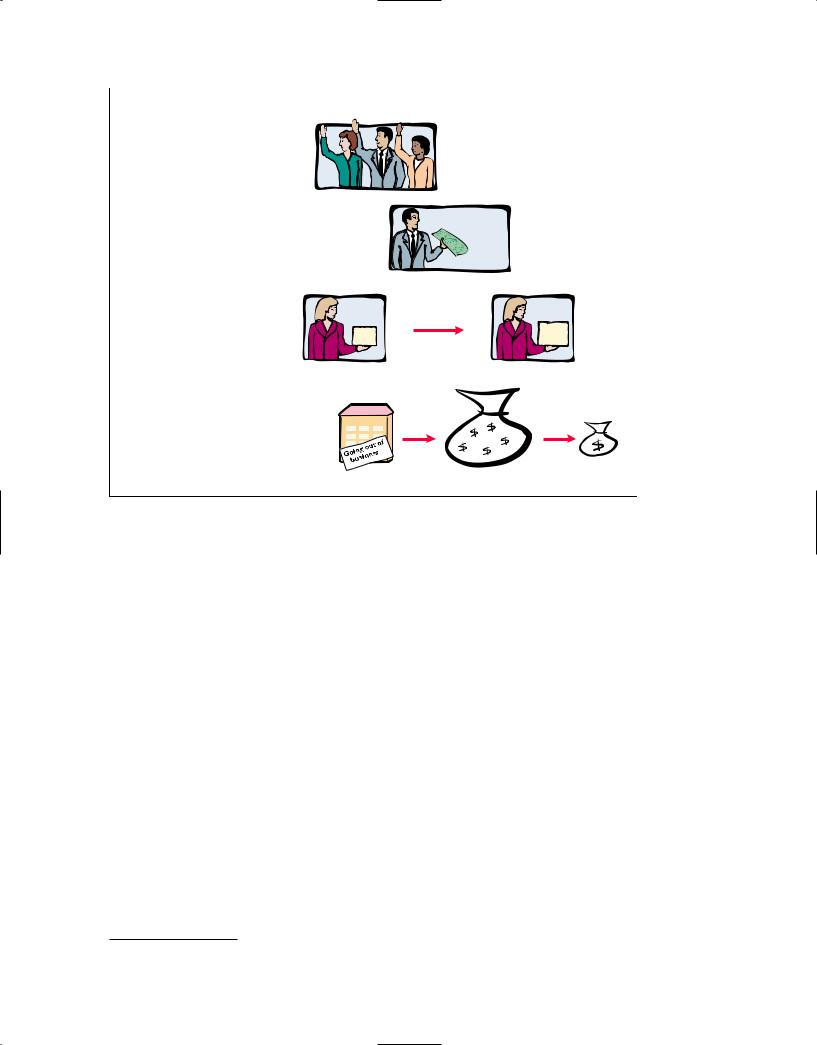

STOCKHOLDER RIGHTS

When chartered, the corporation may begin selling shares of stock. When a corporation has only one class of stock, it is identified as common stock. Each share of common stock gives the stockholder the ownership rights pictured in Illustration 11-3. The articles of incorporation or the by-laws state the ownership rights of a share of stock.

Proof of stock ownership is evidenced by a printed or engraved form known as a stock certificate. As shown in Illustration 11-4, the face of the certificate shows the name of the corporation, the stockholder’s name, the class and special features of the stock, the number of shares owned, and the signatures of authorized corporate officials. Certificates are prenumbered to ensure proper control over their use; they may be issued for any quantity of shares.

|

211 |

|

|

Stock Issue Considerations 575 |

|

|

|

Illustration 11-3 |

Stockholders have the right to: |

|

|

|

Ownership rights of |

|

|

|

stockholders |

1. Vote in election of board of directors at annual meeting and vote on actions that require stockholder approval.

2. Share the corporate |

|

Dividends |

earnings through receipt |

|

|

|

|

|

of dividends. |

|

|

|

Before |

After |

3. Keep the same percentage |

|

New shares issued |

ownership when new |

|

|

shares of stock are issued |

14% |

14% |

(preemptive right1). |

||

|

|

Lenders |

4. Share in assets upon liquidation in |

|

|

proportion to their holdings. This is |

|

Stockholders |

called a residual claim because |

GON Corp. |

|

owners are paid with assets that |

|

|

remain after all other claims have |

|

|

been paid. |

|

|

|

|

Creditors |

Illustration 11-4 A stock certificate

Stock Issue Considerations

Although Nike incorporated in 1968, it did not sell stock to the public until 1980. At that time, Nike evidently decided it would benefit from the infusion of cash that a public sale of its shares would bring. When a corporation decides to

1A number of companies have eliminated the preemptive right because they believe it places an unnecessary and cumbersome demand on management. For example, IBM, by stockholder approval, has dropped its preemptive right for stockholders.

212

576 chapter 11 Reporting and Analyzing Stockholders’ Equity

issue stock, it must resolve a number of basic questions: How many shares should it authorize for sale? How should it issue the stock? What value should it assign to the stock? We address these questions in the following sections.

AUTHORIZED STOCK

Authorized stock is the amount of stock that a corporation is authorized to sell as indicated in its charter. If the corporation has sold all of its authorized stock, then it must obtain permission from the state to change its charter before it can issue additional shares.

|

The authorization of common stock does not result in a formal ac- |

|

|

counting entry. The reason is that the event has no immediate effect on either |

|

|

corporate assets or stockholders’ equity. However, the corporation must disclose |

|

|

in the stockholders’ equity section of the balance sheet the number of shares |

|

|

authorized. |

|

International Note U.S. and U.K. |

ISSUANCE OF STOCK |

|

A corporation can issue common stock directly to investors. Alternatively, it can |

||

corporations raise most of their |

||

capital through millions of outside |

issue common stock indirectly through an investment banking firm that spe- |

|

shareholders and bondholders. In |

cializes in bringing securities to the attention of prospective investors. Direct is- |

|

contrast, companies in Germany, |

sue is typical in closely held companies. Indirect issue is customary for a pub- |

|

France, and Japan acquire financ- |

licly held corporation. |

|

ing mostly from large banks or |

New issues of stock may be offered for sale to the public through various |

|

other financial institutions. Conse- |

organized U.S. or foreign securities exchanges. Based on recent figures, the top |

|

quently, in the latter environment, |

five exchanges by value of shares traded are the New York Stock Exchange, |

|

shareholders are somewhat less |

Nasdaq stock market, London Stock Exchange, Tokyo Stock Exchange, and |

|

important. |

Euronext. |

ANATOMY OF A FRAU D

The president, chief operating officer, and chief financial officer of SafeNet, a software encryption company, were each awarded employee stock options by the company’s board of directors as part of their compensation package. Stock options enable an employee to buy a company’s stock sometime in the future at the price that existed when the stock option was awarded. For example, suppose that you received stock options today, when the stock price of your company was $30. Three years later, if the stock price rose to $100, you could “exercise” your options and buy the stock for $30 per share, thereby making $70 per share. After being awarded their stock options, the three employees changed the award dates in the company’s records to dates in the past, when the company’s stock was trading at historical lows. For example, using the previous example, they would choose a past date when the stock was selling for $10 per share, rather than the $30 price on the actual award date. In our example, this would increase the profit from exercising the options to $90 per share.

Total take: $1.7 million

THE MISSING CONTROL

Independent internal verification. The company’s board of directors should have ensured that the awards were properly administered. For example, the date on the minutes from the board meeting should be compared to the dates that were recorded for the awards. In addition, the dates should again be confirmed upon exercise.

213

Stock Issue Considerations 577

PAR AND NO-PAR VALUE STOCKS

Par value stock is capital stock that has been assigned a value per share in the corporate charter. Years ago, par value was used to determine the legal capital that must be retained in the business for the protection of corporate creditors. That amount is not available for withdrawal by stockholders. Thus, in the past, most states required the corporation to sell its shares at par or above.

However, the usefulness of par value as a device to protect creditors was limited because par value was often immaterial relative to the value of the company’s stock in the securities markets—even at the time of issue. For example, Loews Corporation’s par value is $0.01 per share, yet a new issue in 2010 would have sold at a market value in the $35 per share range. Thus, par has no relationship with market value and in the vast majority of cases is an immaterial amount. As a consequence, today many states do not require a par value. Instead, they use other means to protect creditors.

No-par value stock is capital stock that has not been assigned a value in the corporate charter. No-par value stock is fairly common today. For example, Nike and Procter & Gamble both have no-par stock. In many states, the board of directors assigns a stated value to the no-par shares.

before you go on...

Do it! Indicate whether each of the following statements is true or false.

_____ 1. Similar to partners in a partnership, stockholders of a corporation have unlimited liability.

_____ 2. It is relatively easy for a corporation to obtain capital through the issuance of stock.

_____ 3. The separation of ownership and management is an advantage of the corporate form of business.

_____ 4. The journal entry to record the authorization of capital stock includes a credit to the appropriate capital stock account.

_____ 5. All states require a par value per share for capital stock.

Solution

1.False. The liability of stockholders is normally limited to their investment in the corporation.

2.True.

3.False. The separation of ownership and management is a disadvantage of the corporate form of business.

4.False. The authorization of capital stock does not result in a formal accounting entry.

5.False. Many states do not require a par value.

Related exercise material: BE11-1 and Do it! 11-1.

CORPORATE

ORGANIZATION

Action Plan

•Review the characteristics of a corporation and understand which are advantages and which are disadvantages.

•Understand that corporations raise capital through the issuance of stock, which can be par or no-par.

ACCOUNTING FOR COMMON STOCK ISSUES

The stockholders’ equity section of a corporation’s balance sheet includes

(1) paid-in (contributed) capital and (2) retained earnings (earned capital).

The distinction between paid-in capital and retained earnings is important from both a legal and an economic point of view. Paid-in capital is the amount stockholders paid to the corporation in exchange for shares of ownership. Retained earnings is earned capital held for future use in the business. In this section,

study objective 2

Record the issuance of common stock.

214

578 chapter 11 Reporting and Analyzing Stockholders’ Equity

Helpful Hint Stock is sometimes issued in exchange for services (payment to attorneys or consultants, for example) or for noncash assets (land or buildings). The value recorded for the shares issued is determined by either the market value of the shares or the value of the good

or service received, depending upon which value the company can more readily determine.

we discuss the accounting for paid-in capital. In a later section, we discuss retained earnings.

Let’s now look at how to account for new issues of common stock. The primary objectives in accounting for the issuance of common stock are (1) to identify the specific sources of paid-in capital and (2) to maintain the distinction between paid-in capital and retained earnings. As shown below, the issuance of common stock affects only paid-in capital accounts.

As discussed earlier, par value does not indicate a stock’s market value. The cash proceeds from issuing par value stock may be equal to, greater than, or less than par value. When a company records the issuance of common stock for cash, it credits the par value of the shares to Common Stock, and records in a separate paid-in capital account the portion of the proceeds that is above or below par value.

To illustrate, assume that Hydro-Slide, Inc. issues 1,000 shares of $1 par value common stock at par for cash. The entry to record this transaction is:

A = L + SE

1,000 |

|

Cash |

1,000 |

|

1,000 CS |

Common Stock |

|

1,000 |

|

Cash Flows |

|

(To record issuance of 1,000 shares of $1 par |

|

|

common stock at par) |

|

|

||

1,000 |

|

|

|

|

|

|

|||

Now assume Hydro-Slide, Inc. issues an additional 1,000 shares of the $1 par value common stock for cash at $5 per share. The amount received above the par value, in this case $4 ($5 $1), would be credited to Paid-in Capital in Excess of Par Value. The entry is:

A = L + SE

5,000 |

Cash |

5,000 |

|

1,000 CS |

Common Stock (1,000 $1) |

|

1,000 |

4,000 CS |

Paid-in Capital in Excess of Par Value |

|

4,000 |

|

(To record issuance of 1,000 shares of common |

|

|

Cash Flows |

|

|

|

stock in excess of par) |

|

|

|

5,000 |

|

|

|

|

|

|

Illustration 11-5

Stockholders’ equity— paid-in capital in excess of par value

The total paid-in capital from these two transactions is $6,000. If Hydro-Slide, Inc. has retained earnings of $27,000, the stockholders’ equity section of the balance sheet is as shown in Illustration 11-5.

HYDRO-SLIDE, INC.

Balance Sheet (partial)

Stockholders’ equity |

|

|

|

Paid-in capital |

|

|

|

Common stock |

$ 2,000 |

|

|

Paid-in capital in excess of par value |

|

4,000 |

|

Total paid-in capital |

6,000 |

|

|

Retained earnings |

27,000 |

|

|

|

|

|

|

Total stockholders’ equity |

$33,000 |

|

|

|

|

|

|

215

Accounting for Treasury Stock 579

Some companies issue no-par stock with a stated value. For accounting purposes, companies treat the stated value in the same way as the par value. For example, if in our Hydro-Slide example the stock was no-par stock with a stated value of $1, the entries would be the same as those presented for the par stock except the term “Par Value’’ would be replaced with “Stated Value.’’ If a company issues no-par stock that does not have a stated value, then it credits to the Common Stock account the full amount received. In such a case, there is no need for the Paid-in Capital in Excess of Stated Value account.

Investor Insight

How to Read Stock Quotes

Organized exchanges trade the stock of publicly held companies at dollar prices per share established by the interaction between buyers and sellers. For each listed security, the financial press reports the high and low prices of the stock during the year, the total volume of stock traded on a given day, the high and low prices for the day, and the closing market price, with the net change for the day. Nike is listed on the New York Stock Exchange. Here is a recent listing for Nike:

|

|

52 Weeks |

|

|

|

|

|

|

|

|

|

|

|

||

Stock |

|

High |

|

Low |

|

Volume |

|

High |

|

Low |

|

Close |

Net Change |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nike |

78.55 |

48.76 |

5,375,651 |

72.44 |

69.78 |

70.61 |

1.69 |

||||||||

These numbers indicate the following: The high and low market prices for the last 52 weeks have been $78.55 and $48.76. The trading volume for the day was 5,375,651 shares. The high, low, and closing prices for that date were $72.44, $69.78, and $70.61, respectively. The net change for the day was a decrease of $1.69 per share.

?For stocks traded on organized exchanges, how are the dollar prices per share established? What factors might influence the price of shares in the marketplace? (See page 619.)

before you go on...

Cayman Corporation begins operations on March 1 by issuing 100,000 shares of $10 par value common stock for cash at $12 per share. Journalize the issuance of the shares.

Cayman Corporation begins operations on March 1 by issuing 100,000 shares of $10 par value common stock for cash at $12 per share. Journalize the issuance of the shares.

Solution

Mar. 1 |

|

Cash |

|

1,200,000 |

|

||

|

|

|

|||||

|

|

Common Stock |

|

|

1,000,000 |

||

|

|

Paid-in Capital in Excess of Par Value |

|

|

200,000 |

||

|

|

(To record issuance of 100,000 shares at |

|

|

|

||

|

|

$12 per share) |

|

|

|

||

|

|

|

|

||||

|

|

|

|

|

|

|

|

Related exercise material: BE11-2, BE11-3, |

|

11-2, and E11-1. |

|

|

|||

Do it! |

|

|

|||||

ISSUANCE OF STOCK

Action Plan

•In issuing shares for cash, credit Common Stock for par value per share.

•Credit any additional proceeds in excess of par value to a separate paid-in capital account.

Accounting for Treasury Stock

Treasury stock is a corporation’s own stock that has been reacquired by the corporation and is being held for future use. A corporation may acquire treasury stock for various reasons:

1.To reissue the shares to officers and employees under bonus and stock compensation plans.

study objective 3

Explain the accounting for the purchase of treasury stock.

216

580chapter 11 Reporting and Analyzing Stockholders’ Equity

2.To increase trading of the company’s stock in the securities market. Companies expect that buying their own stock will signal that management believes the stock is underpriced, which they hope will enhance its market value.

3.To have additional shares available for use in acquiring other companies.

4.To reduce the number of shares outstanding and thereby increase earnings per share.

Another infrequent reason for purchasing treasury shares is that management may want to eliminate hostile shareholders by buying them out.

Many corporations have treasury stock. For example, in the United States approximately 70% of companies have treasury stock.2 In the first quarter of 2007, companies in the Standard & Poor’s 500-stock index spent a record of about $118 billion to buy treasury stock. In a recent year, Nike purchased more than 6 million treasury shares. At one point, stock repurchases were so substantial that a study by two Federal Reserve economists suggested that a sharp reduction in corporate purchases of treasury shares might result in a sharp drop in the value of the U.S. stock market.

PURCHASE OF TREASURY STOCK

The purchase of treasury stock is generally accounted for by the cost method. This method derives its name from the fact that the Treasury Stock account is maintained at the cost of shares purchased. Under the cost method, companies increase (debit) Treasury Stock by the price paid to reacquire the shares.

Treasury Stock decreases by the same amount when the company later sells the shares.

To illustrate, assume that on January 1, 2012, the stockholders’ equity section for Mead, Inc. has 100,000 shares of $5 par value common stock outstanding (all issued at par value) and Retained Earnings of $200,000. Illustration 11-6 shows the stockholders’ equity section of the balance sheet before purchase of treasury stock.

Illustration 11-6

Stockholders’ equity with no treasury stock

MEAD, INC.

Balance Sheet (partial)

Stockholders’ equity |

|

|

|

Paid-in capital |

|

|

|

Common stock, $5 par value, 400,000 shares authorized, |

|

|

|

100,000 shares issued and outstanding |

$500,000 |

||

Retained earnings |

|

200,000 |

|

Total stockholders’ equity |

$700,000 |

|

|

|

|

|

|

On February 1, 2012, Mead acquires 4,000 shares of its stock at $8 per share. The entry is:

A = L + SE

32,000 TS |

Feb. 1 |

Treasury Stock |

32,000 |

|

||

32,000 |

|

|

Cash |

|

32,000 |

|

|

|

|

(To record purchase of 4,000 shares of |

|

|

|

Cash Flows |

|

|

|

|||

|

treasury stock at $8 per share) |

|

|

|||

32,000 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2Accounting Trends & Techniques—2009 (New York: American Institute of Certified Public |

||||

|

|

Accountants). |

|

|

||

217

Accounting for Treasury Stock 581

The Treasury Stock account would increase by the cost of the shares purchased ($32,000). The original paid-in capital account, Common Stock, would not be affected because the number of issued shares does not change.

Companies show treasury stock as a deduction from total paid-in capital and retained earnings in the stockholders’ equity section of the balance sheet. Illustration 11-7 shows this presentation for Mead, Inc. Thus, the acquisition of treasury stock reduces stockholders’ equity.

Ethics Note The purchase of treasury stock reduces the cushion for creditors. To protect creditors, many states require that a portion of retained earnings equal to the cost of the treasury stock purchased be restricted from being paid as dividends.

MEAD, INC.

Balance Sheet (partial)

Stockholders’ equity |

|

|

|

Paid-in capital |

|

|

|

Common stock, $5 par value, 400,000 shares authorized, |

|

|

|

100,000 shares issued and 96,000 shares outstanding |

$500,000 |

||

Retained earnings |

200,000 |

|

|

|

|

|

|

Total paid-in capital and retained earnings |

700,000 |

||

Less: Treasury stock (4,000 shares) |

32,000 |

|

|

Total stockholders’ equity |

$668,000 |

|

|

|

|

|

|

Illustration 11-7

Stockholders’ equity with treasury stock

Helpful Hint Treasury Stock is a contra stockholders’ equity account.

Companies disclose in the balance sheet both the number of shares issued (100,000) and the number in the treasury (4,000). The difference is the number of shares of stock outstanding (96,000). The term outstanding stock means the number of shares of issued stock that are being held by stockholders.

In a bold (and some would say risky) move, Reebok at one time bought back nearly a third of its shares. This repurchase of shares dramatically reduced Reebok’s available cash. In fact, the company borrowed significant funds to accomplish the repurchase. In a press release, management stated that it was repurchasing the shares because it believed that the stock was severely underpriced. The repurchase of so many shares was meant to signal management’s belief in good future earnings.

Skeptics, however, suggested that Reebok’s management was repurchasing shares to make it less likely that the company would be acquired by another company (in which case Reebok’s top managers would likely lose their jobs). Acquiring companies like to purchase companies with large cash reserves so they can pay off debt used in the acquisition. By depleting its cash, Reebok became a less likely acquisition target.

before you go on...

Santa Anita Inc. purchases 3,000 shares of its $50 par value common stock for $180,000 cash on July 1. It expects to hold the shares in the treasury until resold. Journalize the treasury stock transaction.

Santa Anita Inc. purchases 3,000 shares of its $50 par value common stock for $180,000 cash on July 1. It expects to hold the shares in the treasury until resold. Journalize the treasury stock transaction.

Solution

July 1 |

|

Treasury Stock |

|

180,000 |

|

|

|

|

|||

|

|

Cash |

|

|

180,000 |

|

|

(To record the purchase of 3,000 shares |

|

|

|

|

|

at $60 per share) |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

TREASURY STOCK

Action Plan

•Record the purchase of treasury stock at cost.

•Report treasury stock as a deduction from stockholders’ equity (contra account) at the bottom of the stockholders’ equity section.

Related exercise material: Do it! 11-3, E11-2, and E11-5.

218

582 chapter 11 Reporting and Analyzing Stockholders’ Equity

Preferred Stock

study objective 4

Differentiate preferred stock from common stock.

A = L + SE

120,000

100,000 PS

20,000 PS

Cash Flows

120,000

To appeal to a larger segment of potential investors, a corporation may issue an additional class of stock, called preferred stock. Preferred stock has contractual provisions that give it preference or priority over common stock in certain areas. Typically, preferred stockholders have a priority in relation to (1) dividends and (2) assets in the event of liquidation. However, they sometimes do not have voting rights. adidas has no outstanding preferred stock, whereas Nike has a very minor amount outstanding. Approximately 7% of U.S. companies have one or more classes of preferred stock.3

Like common stock, companies may issue preferred stock for cash or for noncash consideration. The entries for these transactions are similar to the entries for common stock. When a corporation has more than one class of stock, each paid-in capital account title should identify the stock to which it relates (e.g., Preferred Stock, Common Stock, Paid-in Capital in Excess of Par Value— Preferred Stock, and Paid-in Capital in Excess of Par Value—Common Stock).

Assume that Stine Corporation issues 10,000 shares of $10 par value preferred stock for $12 cash per share. The entry to record the issuance is:

Cash |

120,000 |

|

Preferred Stock |

|

100,000 |

Paid-in Capital in Excess of Par Value—Preferred Stock |

|

20,000 |

(To record the issuance of 10,000 shares of $10 par |

|

|

value preferred stock) |

|

|

|

|

Preferred stock may have either a par value or no-par value. In the stockholders’ equity section of the balance sheet, companies show preferred stock first because of its dividend and liquidation preferences over common stock.

DIVIDEND PREFERENCES

As indicated above, preferred stockholders have the right to share in the distribution of corporate income before common stockholders. For example, if the dividend rate on preferred stock is $5 per share, common shareholders will not receive any dividends in the current year until preferred stockholders have received $5 per share. The first claim to dividends does not, however, guarantee dividends. Dividends depend on many factors, such as adequate retained earnings and availability of cash.

For preferred stock, companies state the per share dividend amount as a percentage of the par value of the stock or as a specified amount. For example, EarthLink specifies a 3% dividend, whereas Nike pays 10 cents per share on its $1 par preferred stock.

Cumulative Dividend

Preferred stock contracts often contain a cumulative dividend feature. This right means that preferred stockholders must be paid both current-year dividends and any unpaid prior-year dividends before common stockholders receive dividends. When preferred stock is cumulative, preferred dividends not declared in a given period are called dividends in arrears.

To illustrate, assume that Scientific Leasing has 5,000 shares of 7%, $100 par value cumulative preferred stock outstanding. Each $100 share pays a $7 dividend (.07 $100). The annual dividend is $35,000 (5,000 $7 per share). If dividends are two years in arrears, preferred stockholders are entitled to receive in the current year the dividends as shown in Illustration 11-8.

3Accounting Trends & Techniques—2009 (New York: American Institute of Certified Public Accountants).

219

|

|

|

|

|

Preferred Stock 583 |

|

|

|

|

|

Illustration 11-8 |

Dividends in arrears ($35,000 2) |

$ |

70,000 |

|

||

|

Computation of total |

||||

Current-year dividends |

|

|

35,000 |

|

|

|

|

|

dividends to preferred |

||

Total preferred dividends |

$105,000 |

|

stock |

||

|

|

|

|

|

|

|

|

|

|

|

|

No distribution can be made to common stockholders until Scientific Leasing pays this entire preferred dividend. In other words, companies cannot pay dividends to common stockholders while any preferred stock dividend is in arrears.

Dividends in arrears are not considered a liability. No obligation exists until the board of directors formally “declares” that the corporation will pay a dividend. However, companies should disclose in the notes to the financial statements the amount of dividends in arrears. Doing so enables investors to assess the potential impact of this commitment on the corporation’s financial position.

The investment community does not look favorably upon companies that are unable to meet their dividend obligations. As a financial officer noted in discussing one company’s failure to pay its cumulative preferred dividend for a period of time, “Not meeting your obligations on something like that is a major black mark on your record.”

LIQUIDATION PREFERENCE

Most preferred stocks have a preference on corporate assets if the corporation fails. This feature provides security for the preferred stockholder. The preference to assets may be for the par value of the shares or for a specified liquidating value. For example, Commonwealth Edison issued preferred stock that entitled the holders to receive $31.80 per share, plus accrued and unpaid dividends, in the event of involuntary liquidation. The liquidation preference is used in litigation pertaining to bankruptcy lawsuits involving the respective claims of creditors and preferred stockholders.

before you go on...

MasterMind Corporation has 2,000 shares of 6%, $100 par value preferred stock outstanding at December 31, 2012. At December 31, 2012, the company declared a $60,000 cash dividend. Determine the dividend paid to preferred stockholders and common stockholders under each of the following scenarios.

MasterMind Corporation has 2,000 shares of 6%, $100 par value preferred stock outstanding at December 31, 2012. At December 31, 2012, the company declared a $60,000 cash dividend. Determine the dividend paid to preferred stockholders and common stockholders under each of the following scenarios.

1.The preferred stock is noncumulative, and the company has not missed any dividends in previous years.

2.The preferred stock is noncumulative, and the company did not pay a dividend in each of the two previous years.

3.The preferred stock is cumulative, and the company did not pay a dividend in each of the two previous years.

Solution

1.The company has not missed past dividends and the preferred stock is noncumulative; thus, the preferred stockholders are paid only this year’s dividends. The dividend paid to preferred stockholders would be $12,000 (2,000 .06 $100). The dividend paid to common stockholders would be $48,000 ($60,000 $12,000).

2.The preferred stock is noncumulative; thus, past unpaid dividends do not have to be paid. The dividend paid to preferred stockholders would be $12,000 (2,000 .06 $100). The dividend paid to common stockholders would be $48,000 ($60,000 $12,000).

3.The preferred stock is cumulative; thus, dividends that have been missed (dividends in arrears) must be paid. The dividend paid to preferred stockholders would be $36,000 (3 2,000 .06 $100). The dividend paid to common stockholders would be $24,000 ($60,000 $36,000).

PREFERRED STOCK DIVIDENDS

Action Plan

•Determine dividends on preferred shares by multiplying the dividend rate times the par value of the stock times the number of preferred shares.

•Understand the cumulative feature: If preferred stock is cumulative, then any missed dividends (dividends in arrears) and the current year’s dividend must be paid to preferred stockholders before dividends are paid to common stockholders.

Related exercise material: Do it! 11-4.