Финансовый учет. Ридер

.pdf

200

62 chapter 2 A Further Look at Financial Statements

activities. In order to maintain production at 10,000 computers, MPC invested $15,000 in equipment. It chose to pay $5,000 in dividends. Its free cash flow was $80,000 ($100,000 $15,000 $5,000). The company could use this $80,000 to purchase new assets to expand the business, to pay off debts, or to increase its dividend distribution. In practice, analysts often calculate free cash flow with the formula shown below. (Alternative definitions also exist.)

Free Cash |

Cash Provided |

|

Capital |

|

Cash |

Flow |

by Operations |

|

Expenditures |

|

Dividends |

We can calculate Best Buy’s 2009 free cash flow as follows (dollars in millions).

Cash provided by operating activities |

$1,877 |

||

Less: Expenditures on property, plant, and equipment |

1,303 |

|

|

Dividends paid |

|

222 |

|

|

|

|

|

Free cash flow |

$ 352 |

|

|

|

|

|

|

Best Buy generated free cash flow of $352 million which is available for the acquisition of new assets, the retirement of stock or debt, or the payment of additional dividends. Long-term creditors consider a high free cash flow amount an indication of solvency. hhgregg’s free cash flow for 2009 is $7.7 million. Given that hhgregg is considerably smaller than Best Buy, we would expect its free cash flow to be much lower.

DECISION TOOLKIT

DECISION TOOLKIT

DECISION CHECKPOINTS |

INFO NEEDED FOR DECISION |

|

TOOL TO USE FOR DECISION |

|

HOW TO EVALUATE RESULTS |

|

How much cash did the |

Cash provided by operating |

Free |

Cash |

Capital |

Cash |

Significant free cash flow |

|

|

|

|

|

||

company generate to |

activities, cash spent on |

cash |

provided by expenditures dividends |

indicates greater potential to |

||

expand operations, pay |

fixed assets, and cash |

flow |

operations |

|

|

finance new investment and |

off debts, or distribute |

dividends |

|

|

|

|

pay additional dividends. |

dividends? |

|

|

|

|

|

|

|

|

|

|

|

|

|

before you go on...

RATIO ANALYSIS

Do it! The following information is available for Ozone Inc.

|

|

2012 |

|

2011 |

Current assets |

$ 88,000 |

$ 60,800 |

||

Total assets |

400,000 |

341,000 |

||

Current liabilities |

40,000 |

38,000 |

||

Total liabilities |

120,000 |

150,000 |

||

Net income |

100,000 |

50,000 |

||

Cash provided by operating activities |

110,000 |

70,000 |

||

Preferred stock dividends |

10,000 |

10,000 |

||

Common stock dividends |

5,000 |

2,500 |

||

Expenditures on property, plant, and equipment |

45,000 |

20,000 |

||

Shares outstanding at beginning of year |

60,000 |

40,000 |

||

Shares outstanding at end of year |

120,000 |

60,000 |

||

201

Financial Reporting Concepts 63

(a)Compute earnings per share for 2012 and 2011 for Ozone, and comment on the change. Ozone’s primary competitor, Frost Corporation, had earnings per share of $2 in 2012. Comment on the difference in the ratios of the two companies.

(b)Compute the current ratio and debt to total assets ratio for each year, and comment on the changes.

(c) Compute free cash flow for each year, and comment on the changes.

Solution

(a) Earnings per share |

|

|

|

|

|

|

|

|||

|

2012 |

|

|

|

2011 |

|

|

|

||

|

($100,000 $10,000) |

$1.00 |

($50,000 $10,000) |

$0.80 |

||||||

|

|

(120,000 60,000)/2 |

|

|

(60,000 40,000)/2 |

|

||||

|

|

|

|

|

|

|

||||

Ozone’s profitability, as measured by the amount of income available to each share of common stock, increased by 25% [($1.00 $0.80) $0.80] during 2012. Earnings per share should not be compared across companies because the number of shares issued by companies varies widely. Thus, we cannot conclude that Frost Corporation is more profitable than Ozone based on its higher EPS.

(b) |

2012 |

|

|

2011 |

|

|||

$88,000 |

2.20:1 |

$60,800 |

1.60:1 |

|||||

Current ratio |

||||||||

|

$40,000 |

|

|

$38,000 |

|

|

||

Debt to total assets ratio |

$120,000 |

30% |

$150,000 |

44% |

||||

|

$400,000 |

|

|

$341,000 |

|

|

||

The company’s liquidity, as measured by the current ratio, improved from 1:60:1 to 2.20:1. Its solvency also improved, as measured by the debt to total assets ratio, which declined from 44% to 30%.

(c) Free cash flow

2012: $110,000 $45,000 ($10,000 $5,000) $50,000 2011: $70,000 $20,000 ($10,000 $2,500) $37,500

The amount of cash generated by the company above its needs for dividends and capital expenditures increased from $37,500 to $50,000.

Related exercise material: BE2-3, BE2-5, BE2-6, Do it! 2-3, E2-7, E2-9, E2-10, and E2-11.

Action Plan

•Use the formula for earnings per share (EPS): (Net income Preferred stock dividends) (Average common shares outstanding).

•Use the formula for the current ratio: Current assets Current liabilities.

•Use the formula for the debt to total assets ratio: Total liabilities Total assets.

•Use the formula for free cash flow: Cash provided by operating activities Capital expenditures Cash dividends.

Financial Reporting Concepts

In Chapter 1, you learned about the four financial statements, and in this chapter, we introduced you to some basic ways to interpret those statements. In this last section, we will discuss concepts that underly these financial statements. It would be unwise to make business decisions based on financial statements without understanding the implications of these concepts.

THE STANDARD-SETTING ENVIRONMENT

How does Best Buy decide on the type of financial information to disclose? What format should it use? How should it measure assets, liabilities, revenues, and expenses? Best Buy and all other U.S. companies get guidance from a set of rules and practices that have authoritative support, referred to as generally accepted accounting principles (GAAP). Standard-setting bodies, in consultation with the accounting profession and the business community, determine these accounting standards.

study objective 6

Explain the meaning of generally accepted accounting principles.

202

64 chapter 2 A Further Look at Financial Statements

International Note Over 100 countries use international standards (called IFRS). For example, all companies in the European Union follow international standards. The differences between U.S. and international standards are not generally significant. In this book, we highlight any major differences using International Notes like

this one, as well as a more indepth discussion in the A Look at IFRS section at the end of each chapter.

The Securities and Exchange Commission (SEC) is the agency of the U.S. government that oversees U.S. financial markets and accounting standardsetting bodies. The Financial Accounting Standards Board (FASB) is the primary accounting standard-setting body in the United States. The International Accounting Standards Board (IASB) issues standards called International Financial Reporting Standards (IFRS), which have been adopted by many countries outside of the United States. Today, the FASB and IASB are working closely together to minimize the differences in their standards. Recently, the SEC announced that foreign companies that wish to have their shares traded on U.S stock exchanges no longer have to prepare reports that conform with GAAP, as long as their reports conform with IFRS. The SEC is currently evaluating whether the United States should eventually adopt IFRS as the required set of standards for U.S. publicly traded companies. Another relatively recent change to the financial reporting environment was that, as a result of the Sarbanes-Oxley Act, the Public Company Accounting Oversight Board (PCAOB) was created. Its job is to determine auditing standards and review the performance of auditing firms. If the United States adopts IFRS for its accounting standards, it will also have to coordinate its auditing regulations with those of other countries.

study objective 7

Discuss financial reporting concepts.

International Insight

The Korean Discount

If you think that accounting standards don’t matter, consider recent events in South Korea. For many years, international investors complained that the financial reports of South Korean companies were inadequate and inaccurate. Accounting practices there often resulted in huge differences between stated revenues and actual revenues. Because investors did not have faith in the accuracy of the numbers, they were unwilling to pay as much for the shares of these companies relative to shares of comparable companies in different countries. This difference in share price was often referred to as the “Korean discount.”

In response, Korean regulators decided that, beginning in 2011, companies will have to comply with international accounting standards. This change was motivated by a desire to “make the country’s businesses more transparent” in order to build investor confidence and spur economic growth. Many other Asian countries, including China, India, Japan, and Hong Kong, have also decided either to adopt international standards or to create standards that are based on the international standards.

Source: Evan Ramstad, “End to ‘Korea Discount’?” Wall Street Journal (March 16, 2007).

?What is meant by the phrase “make the country’s businesses more transparent”? Why would increasing transparency spur economic growth? (See page 96.)

QUALITIES OF USEFUL INFORMATION

Recently, the FASB and IASB completed the first phase of a joint project in which they developed a conceptual framework to serve as the basis for future accounting standards. The framework begins by stating that the primary objective of financial reporting is to provide financial information that is useful to investors and creditors for making decisions about providing capital. According to the FASB, useful information should possess two fundamental qualities, relevance and faithful representation, as shown in Illustration 2-17.

203

Financial Reporting Concepts 65

Tell me what |

Relevance Accounting information is considered relevant if |

I need to know. |

it would make a difference in a business decision. Information |

|

|

|

is considered relevant if it provides information that has |

|

predictive value, that is, helps provide accurate expectations |

|

about the future, and has confirmatory value, that is, |

BIG |

confirms or corrects prior expectations. |

SHOT |

|

|

|

Faithful Representation Faithful representation means that information accurately depicts what really happened. To provide a faithful representation, information must be complete (nothing important has been omitted) and neutral (is not biased toward one position or another).

Illustration 2-17

Fundamental qualities of useful information

Enhancing Qualities

In addition to the two fundamental qualities, the FASB and IASB also describe a number of enhancing qualities of useful information. These include comparability, consistency, verifiability, timeliness, and understandability. In accounting, comparability results when different companies use the same accounting principles. Another characteristic that enhances comparability is consistency. Consistency means that a company uses the same accounting principles and methods from year to year. Information is verifiable if we are able to prove that it is free from error. As noted in Chapter 1, certified public accountants (CPAs) perform audits of financial statements to verify their accuracy. For accounting information to be relevant, it must be timely. That is, it must be available to decision makers before it loses its capacity to influence decisions. The SEC requires that public companies provide their annual reports to investors within 60 days of their year-end. Information has the quality of understandability if it is presented in a clear and concise fashion, so that reasonably informed users of that information can interpret it and comprehend its meaning.

Accounting Across the Organization

What Do These Companies Have in Common?

Another issue related to comparability is the accounting time period. An accounting period that is one-year long is called a fiscal year. But a fiscal year need not match the calendar year. For example, a company could end its fiscal year on April 30, rather than December 31.

Why do companies choose the particular year-ends that they do? For example, why doesn’t every company use December 31 as the accounting year-end? Many companies choose to end their accounting year when inventory or operations are at a low point. This is advantageous because compiling accounting information requires much time and effort by managers, so they would rather do it when they aren’t as busy operating the business. Also, inventory is easier and less costly to count when its volume is low.

Some companies whose year-ends differ from December 31 are Delta Air Lines, June 30; Walt Disney Productions, September 30; and Dunkin’ Donuts, Inc., October 31. In the notes to its financial statements, Best Buy states that its accounting year-end is the Saturday nearest the end of February.

? What problems might Best Buy’s year-end create for analysts? (See page 96.)

204

66 chapter 2 A Further Look at Financial Statements

ASSUMPTIONS IN FINANCIAL REPORTING

To develop accounting standards, the FASB relies on some key assumptions, as shown in Illustration 2-18. These include assumptions about the monetary unit, economic entity, periodicity, going concern, and accrual basis.

Illustration 2-18 Key assumptions in financial reporting

Ethics Note The importance of the economic entity assumption is illustrated by scandals involving Adelphia. In this case, senior company employees entered into transactions that blurred the line between the employees’ financial interests and those of the company. For example, Adelphia guaranteed over $2 billion of loans to the founding family.

|

|

|

Monetary Unit Assumption The monetary unit |

|

|

Acct. |

assumption requires that only those things that can be |

|

- |

Records |

expressed in money are included in the accounting records. |

|

|

Salaries |

|

Measure of |

paid |

This means that certain important information needed by |

|

|

|

||

employee |

Salaries paid |

|

|

|

|

||

satisfaction |

|

|

investors, creditors, and managers, such as customer |

Total number |

Percent of |

|

|

of employees |

international |

|

satisfaction, is not reported in the financial statements. |

employees |

|

||

|

|

||

FORD |

|

CHRYSL |

ER |

General Motor |

|

Ford

Ford

Chrysler

GM

s

Economic Entity Assumption The economic entity assumption states that every economic entity can be separately identified and accounted for. In order to assess a company’s performance and financial position accurately, it is important that we not blur company transactions with personal transactions (especially those of its managers) or transactions of other companies.

2004 |

2014 |

2006 |

2008 |

|

2010 |

|

2012 |

Start of |

1 |

2 |

3 |

4 |

End of |

|

QTR |

QTR |

QTR |

QTR |

|

business |

|

|

|

|

business |

|

J F M A M J J A S O N D |

|

|||

Periodicity Assumption Notice that the income statement, retained earnings statement, and statement of cash flows all cover periods of one year, and the balance sheet is prepared at the end of each year. The periodicity assumption states that the life of a business can be divided into artificial time periods and that useful reports covering those periods can be prepared for the business.

|

|

Going Concern Assumption The going concern |

|

|

|

|

|

assumption states that the business will remain in operation |

|

|

for the foreseeable future. Of course, many businesses do |

|

|

fail, but in general, it is reasonable to assume that the |

Now |

Future |

business will continue operating. |

|

|

|

|

|

|

|

|

|

|

|

Accrual Basis Accrual-basis accounting means that |

Bob's B |

ait |

Barn |

Bob's |

Bait Barn |

transactions that change a company’s financial statements |

|

|

||||

We |

|

|

|

|

are recorded in the periods in which the events occur. |

Paint! |

|

|

|

|

|

PAINTPAINT |

|

|

|

|

Accrual-basis accounting is addressed in more detail in |

PAINT |

|

|

|

|

|

Purchased paint, painted building, paid employees Chapter 4. |

|||||

PRINCIPLES IN FINANCIAL REPORTING

Measurement Principles

GAAP generally uses one of two measurement principles, the cost principle or the fair value principle. Selection of which principle to follow generally relates to trade-offs between relevance and faithful representation.

205

Financial Reporting Concepts 67

COST PRINCIPLE. The cost principle (or historical cost principle) dictates that companies record assets at their cost. This is true not only at the time the asset is purchased but also over the time the asset is held. For example, if land that was purchased for $30,000 increases in value to $40,000, it continues to be reported at $30,000.

FAIR VALUE PRINCIPLE. The fair value principle indicates that assets and liabilities should be reported at fair value (the price received to sell an asset or settle a liability). Fair value information may be more useful than historical cost for certain types of assets and liabilities. For example, certain investment securities are reported at fair value because market price information is often readily available for these types of assets. In choosing between cost and fair value, the FASB uses two qualities that make accounting information useful for decision making— relevance and faithful representation. In determining which measurement principle to use, the FASB weighs the factual nature of cost figures versus the relevance of fair value. In general, the FASB indicates that most assets must follow the cost principle because market values may not be representationally faithful. Only in situations where assets are actively traded, such as investment securities, is the fair value principle applied.

Full Disclosure Principle

The full disclosure principle requires that companies disclose all circumstances and events that would make a difference to financial statement users. If an important item cannot reasonably be reported directly in one of the four types of financial statements, then it should be discussed in notes that accompany the statements.

CONSTRAINTS IN FINANCIAL REPORTING

Efforts to provide useful financial information can be costly to a company. Therefore, the profession has agreed upon constraints to ensure that companies apply accounting rules in a reasonable fashion, from the perspectives of both the company and the user. The constraints are the materiality and cost constraints, as shown in Illustration 2-19.

Materiality Constraint The materiality constraint relates to a financial statement item’s impact on a company’s overall financial condition and operations. An item is material when its size makes it likely to influence the decision of an investor or creditor. It is immaterial if it is too small to impact a decision maker. If the item does not make a difference, the company does not have to follow GAAP in reporting it.

|

|

Cost Constraint The cost constraint relates to the fact that |

|

|

providing information is costly. In deciding whether companies |

|

|

should be required to provide a certain type of information, |

|

Benefits |

accounting standard-setters weigh the cost that companies |

|

will incur to provide the information against the benefit that |

|

Costs |

|

|

|

financial statement users will gain from having the information |

|

|

|

|

|

|

available. |

|

|

|

Illustration 2-19

Constraints in financial reporting

206

preview of chapter 11

Corporations like Nike and adidas have substantial resources at their disposal. In fact, the corporation is the dominant form of business organization in the United States in terms of sales, earnings, and number of employees. All of the 500 largest U.S. companies are corporations. In this chapter, we look at the essential features of a corporation and explain the accounting for a corporation’s capital stock transactions.

The content and organization of the chapter are as follows.

Reporting and Analyzing Stockholders’ Equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial |

|

The Corporate |

|

|

Stock Issue |

|

Accounting for |

|

|

|

|

|

Dividends and |

|

|

Statement |

|

Form of |

|

|

|

|

|

Preferred Stock |

|

|

|

|

Presentation and |

|||

|

|

|

Considerations |

|

Treasury Stock |

|

|

|

Retained Earnings |

|

|

||||

|

Organization |

|

|

|

|

|

|

|

|

|

Corporate |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Performance |

• |

Characteristics |

|

• |

Authorized stock |

|

• Purchase of |

|

• |

Dividend |

|

• |

Cash dividends |

|

• |

Balance sheet |

• |

Formation |

|

• |

Issuance |

|

treasury stock |

|

|

preferences |

|

• |

Stock dividends |

• |

Statement of |

|

|

|

|

|

|

|

|

|||||||||

• |

Stockholder |

|

• |

Par and no-par |

|

|

|

• |

Liquidation |

|

• |

Stock splits |

|

cash flows |

|

|

|

|

|

|

preference |

|

|

|

|||||||

|

rights |

|

|

value |

|

|

|

|

|

• |

Retained |

• |

Dividend record |

||

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

• |

Accounting for |

|

|

|

|

|

|

|

earnings |

• |

Earnings |

|

|

|

|

|

common stock |

|

|

|

|

|

|

|

restrictions |

|

performance |

|

|

|

|

|

issues |

|

|

|

|

|

|

|

|

|

• |

Debt vs. equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

decision

study objective 1

Identify and discuss the major characteristics of a corporation.

The Corporate Form of Organization

A corporation is created by law. As a legal entity, a corporation has most of the rights and privileges of a person. The major exceptions relate to privileges that can be exercised only by a living person, such as the right to vote or to hold public office. Similarly, a corporation is subject to the same duties and responsibilities as a person. For example, it must abide by the law and it must pay taxes.

We can classify corporations in a variety of ways. Two common classifications are by purpose and by ownership. A corporation may be organized for the purpose of making a profit (such as Nike or General Motors), or it may be a nonprofit charitable, medical, or educational corporation (such as the Salvation Army or the American Cancer Society).

Classification by ownership differentiates publicly held and privately held corporations. A publicly held corporation may have thousands of stockholders, and its stock is traded on a national securities market such as the New York Stock Exchange. Examples are IBM, Caterpillar, and General Electric. In contrast, a privately held corporation, often referred to as a closely held corporation, usually has only a few stockholders and does not offer its stock for sale to the general public. Privately held companies are generally much smaller than publicly held companies, although some notable exceptions exist. Cargill Inc., a private corporation that trades in grain and other commodities, is one of the largest companies in the United States. This chapter deals primarily with issues related to publicly held companies.

CHARACTERISTICS OF A CORPORATION

In 1964, when Nike’s founders, Knight and Bowerman, were just getting started in the running shoe business, they formed their original organization as a partnership. In 1968, they reorganized the company as a corporation. A number of

570

207

The Corporate Form of Organization 571

characteristics distinguish a corporation from sole proprietorships and partnerships. The most important of these characteristics are explained below.

Separate Legal Existence

As an entity separate and distinct from its owners, the corporation acts under its own name rather than in the name of its stockholders. Nike, for example, may buy, own, and sell property, borrow money, and enter into legally binding contracts in its own name. It may also sue or be sued. It pays taxes as a separate entity.

In contrast to a partnership, in which the acts of the owners (partners) bind the partnership, the acts of corporate owners (stockholders) do not bind the corporation unless such owners are agents of the corporation. For example, if you owned shares of Nike stock, you would not have the right to purchase inventory for the company unless you were designated as an agent of the corporation.

WKK |

Corp. |

Stockholders |

Legal existence separate |

from owners |

Limited Liability of Stockholders

Since a corporation is a separate legal entity, creditors ordinarily have recourse only to corporate assets to satisfy their claims. The liability of stockholders is normally limited to their investment in the corporation. Creditors have no legal claim on the personal assets of the stockholders unless fraud has occurred. Thus, even in the event of bankruptcy of the corporation, stockholders’ losses are generally limited to the amount of capital they have invested in the corporation.

Transferable Ownership Rights

Ownership of a corporation is held in shares of capital stock, which are transferable units. Stockholders may dispose of part or all of their interest in a corporation simply by selling their stock. The transfer of an ownership interest in a partnership requires the consent of each partner. In contrast, the transfer of stock is entirely at the discretion of the stockholder. It does not require the approval of either the corporation or other stockholders.

The transfer of ownership rights among stockholders normally has no effect on the operating activities of the corporation. Nor does it affect the corporation’s assets, liabilities, and total stockholders’ equity. The transfer of ownership rights is a transaction between individual owners. The company does not participate in the transfer of these ownership rights after the original sale of the capital stock.

Ability to Acquire Capital

It is relatively easy for a corporation to obtain capital through the issuance of stock. Buying stock in a corporation is often attractive to an investor because a stockholder has limited liability and shares of stock are readily transferable. Also, numerous individuals can become stockholders by investing small amounts of money.

WKK |

Corp. |

Stockholders |

Limited liability |

of stockholders |

Transferable ownership rights

Ability to acquire capital

Continuous Life

The life of a corporation is stated in its charter. The life may be perpetual or it may be limited to a specific number of years. If it is limited, the company can extend the period of existence through renewal of the charter. Since a corporation is a separate legal entity, its continuance as a going concern is not affected by the withdrawal, death, or incapacity of a stockholder, employee, or officer. As a result, a successful corporation can have a continuous and perpetual life.

Corporation Management

Continuous life |

Although stockholders legally own the corporation, they manage it indirectly through a board of directors they elect. Philip Knight is the chairman of Nike’s

208

572 chapter 11 Reporting and Analyzing Stockholders’ Equity

Illustration 11-1

Corporation organization chart

board of directors. The board, in turn, formulates the operating policies for the company. The board also selects officers, such as a president and one or more vice presidents, to execute policy and to perform daily management functions. As a result of the Sarbanes-Oxley Act, the board is now required to monitor management’s actions more closely. Many feel that the failures at Enron and WorldCom could have been avoided by more diligent boards.

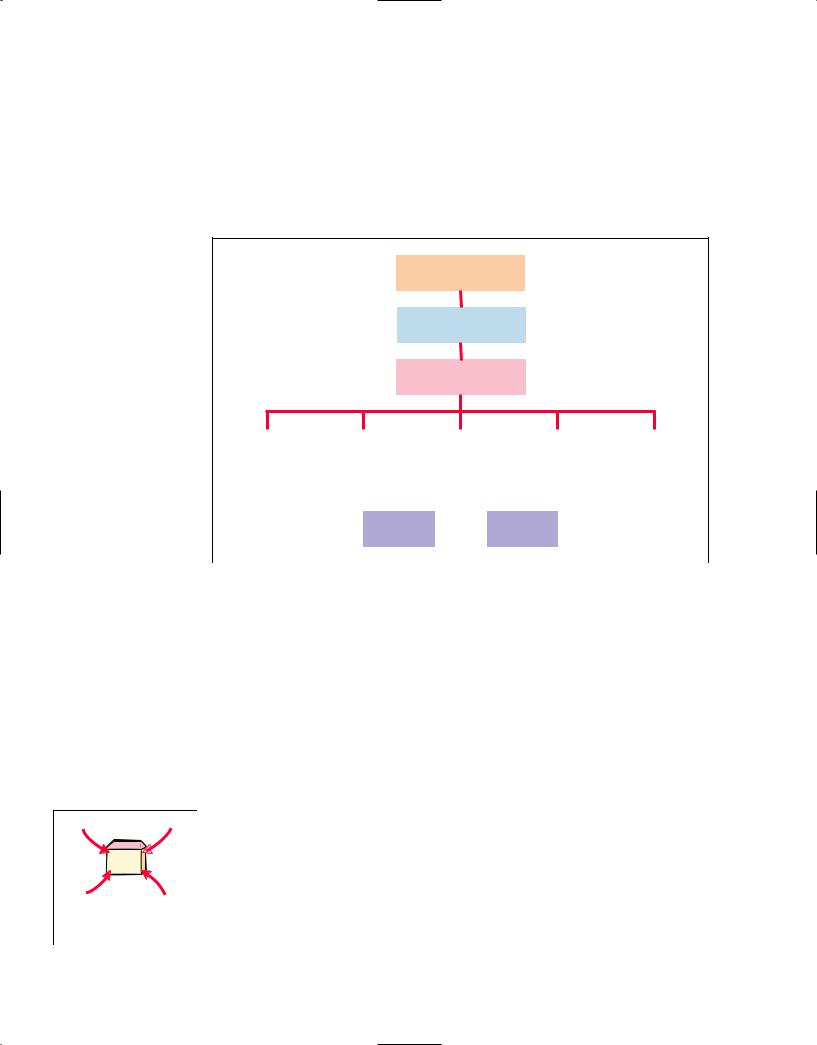

Illustration 11-1 depicts a typical organization chart showing the delegation of responsibility.

Stockholders

Chairman and

Board of Directors

President and

Chief Executive Officer

General |

|

Vice President |

|

Vice President |

|

|

Vice President |

|

Vice President |

||

Counsel and |

|

Marketing |

|

Finance/Chief |

|

|

Operations |

|

Human |

||

Secretary |

|

|

|

|

Financial Officer |

|

|

|

|

Resources |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Treasurer |

Controller |

Ethics Note Managers who are not owners are often compensated based on the performance of the company. They thus may be tempted to exaggerate company performance by inflating income figures.

State laws |

SEC laws |

WKK  Corp.

Corp.

Stock

exchange Federal requirements regulations

exchange Federal requirements regulations

Government regulations

The chief executive officer (CEO) has overall responsibility for managing the business. As the organization chart shows, the CEO delegates responsibility to other officers. The chief accounting officer is the controller. The controller’s responsibilities are to (1) maintain the accounting records, (2) maintain an adequate system of internal control, and (3) prepare financial statements, tax returns, and internal reports. The treasurer has custody of the corporation’s funds and is responsible for maintaining the company’s cash position.

The organizational structure of a corporation enables a company to hire professional managers to run the business. On the other hand, the separation of ownership and management often reduces an owner’s ability to actively manage the company.

Government Regulations

A corporation is subject to numerous state and federal regulations. For example, state laws usually prescribe the requirements for issuing stock, the distributions of earnings permitted to stockholders, and acceptable methods for retiring stock. Federal securities laws govern the sale of capital stock to the general public. Also, most publicly held corporations are required to make extensive disclosure of their financial affairs to the Securities and Exchange Commission (SEC) through quarterly and annual reports. The Sarbanes-

Oxley Act increased the company’s responsibility for the accuracy of these reports. In addition, when a corporate stock is listed and traded on organized securities exchanges, the corporation must comply with the reporting requirements of these exchanges.

209

The Corporate Form of Organization 573

Accounting Across the Organization

Wall Street No Friend of Facebook

In the 1990s, it was the dream of every young technology entrepreneur to start a company and do an initial public offering (IPO), that is, list company shares on a stock exchange. It seemed like there was a never-ending supply of 20-something yearold technology entrepreneurs that made millions doing IPOs of companies that never made a profit and eventually failed. In sharp contrast to this is Mark Zuckerberg, the 25-year-old founder and CEO of Facebook. If Facebook did an IPO, he would make billions of dollars. But, he is in no hurry to go public. Because his company doesn’t need to invest in factories, distribution systems, or even marketing, it doesn’t need to raise a lot of cash. Also, by not going public, Zuckerberg has more control over the direction of the company. Right now, he and the other founders don’t have to answer to outside shareholders, who might be more concerned about short-term investment horizons rather than long-term goals. In addition, publicly traded companies face many more financial reporting disclosure requirements.

Source: Jessica E. Vascellaro, “Facebook CEO in No Rush to ‘Friend’ Wall Street,” Wall Street Journal Online (March 4, 2010).

?Why has Mark Zuckerberg, the CEO and founder of Facebook, delayed taking his company’s shares public through an initial public offering (IPO)? (See page 618.)

Additional Taxes |

|

|

Owners of proprietorships and partnerships report their share of earnings on |

|

|

their personal income tax returns. The individual owner then pays taxes on this |

|

|

amount. Corporations, on the other hand, must pay federal and state income |

|

|

taxes as a separate legal entity. These taxes can be substantial: They can amount |

|

|

to as much as 40% of taxable income. |

Additional taxes |

|

In addition, stockholders are required to pay taxes on cash dividends. Thus, |

||

|

many argue that corporate income is taxed twice (double taxation)—once at the corporate level and again at the individual level.

Illustration 11-2 shows the advantages and disadvantages of a corporation compared to a sole proprietorship and partnership.

|

Advantages |

Disadvantages |

Illustration 11-2 |

|

|

Advantages and |

|||

|

|

|

|

|

• Separate legal existence |

• Corporation management—separation |

disadvantages of a |

||

• Limited liability of stockholders |

of ownership and management |

corporation |

||

• Transferable ownership rights |

• Government regulations |

|

||

• |

Ability to acquire capital |

• Additional taxes |

|

|

• |

Continuous life |

|

|

|

• Corporation management— professional managers

Other Forms of Business Organization

A variety of “hybrid” organizational forms—forms that combine different attributes of partnerships and corporations—now exist. For example, one type of corporate form, called an S corporation, allows for legal treatment as a corporation but tax treatment as a partnership—that is, no double taxation. Because of changes to the S corporation’s rules, more smalland medium-sized businesses