Fin management materials / 2P4AFM-Session03_j08

.pdf

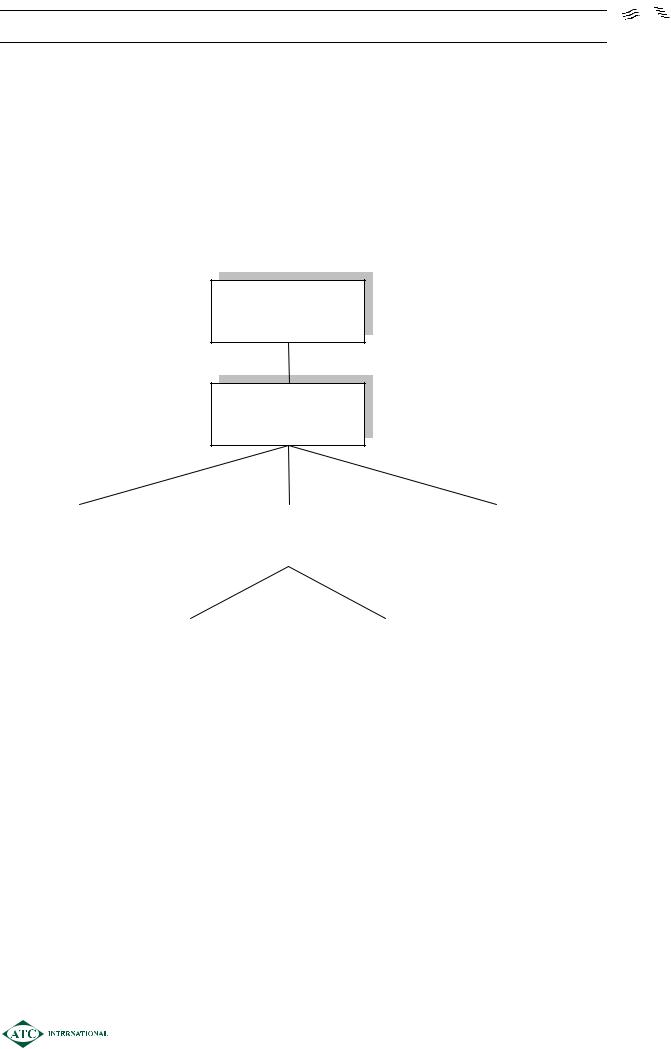

SESSION 03 – WEIGHTED AVERAGE COST OF CAPITAL AND GEARING

OVERVIEW

Objective

¾To estimate the weighted average cost of capital (WACC) of a company.

¾To apply and evaluate the various theories of how capital structure affects the WACC.

¾To discuss practical influences on gearing.

WEIGHTED

AVERAGE COST

OF CAPITAL

THE IMPACT OF

GEARING ON

WACC

|

|

|

|

|

|

|

|

|

|

|

|

STATIC TRADE- |

|

|

|

MODIGLIANI |

|

|

|

PECKING ORDER |

|

|

|

|

|

AND MILLER’S |

|

|

|

|

||

|

OFF THEORY |

|

|

|

|

|

|

THEORY |

|

|

|

|

|

|

THEORIES |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WITHOUT |

|

|

|

WITH |

|

|

TAX |

|

|

|

TAX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0301

SESSION 03 – WEIGHTED AVERAGE COST OF CAPITAL AND GEARING

1WEIGHTED AVERAGE COST OF CAPITAL

1.1Calculation of WACC

¾A firm’s long-term finance is often a mixture of both equity and debt i.e. using some degree of financial gearing/leverage. The average cost of long-term finance is known as the WACC - the weighted average cost of capital.

¾We have already seen how to calculate the cost of equity and the cost of various types of corporate debt.

¾We now weight the various costs of long-term finance using their respective market values.

WACC = Keg E +ED + Kd E D+ D Where:

E = Total market value of equity D = Total market value of debt

Keg = Cost of equity of a geared company

Kd = Cost of debt to the company (i.e. the post tax cost of debt) In the exam the formula is given as follows:

|

Ve |

|

Vd |

|

|

WACC = |

|

ke + |

|

kd(1 − T) |

|

|

|

||||

Ve + Vd |

Ve + Vd |

||||

Where: |

|

|

|

|

|

Ve = Total market value of equity |

Vd = Total market value of debt |

||||

Ke = Cost of equity geared |

|

|

|||

Kd = Pre-tax cost of debt |

|

T = corporation tax rate |

|||

Note that the post tax cost of debt only = Kd (1 – T) for irredeemable debentures or bank loans.

If you are given a redeemable bond then you should calculate the IRR of its post-tax cash flows which directly gives you the post tax cost of debt.

¾At any moment in time a firm can estimate its existing WACC.

¾The existing WACC may be a suitable discount rate for estimating the NPV of potential projects – but is not automatically the appropriate rate.

0302

SESSION 03 – WEIGHTED AVERAGE COST OF CAPITAL AND GEARING

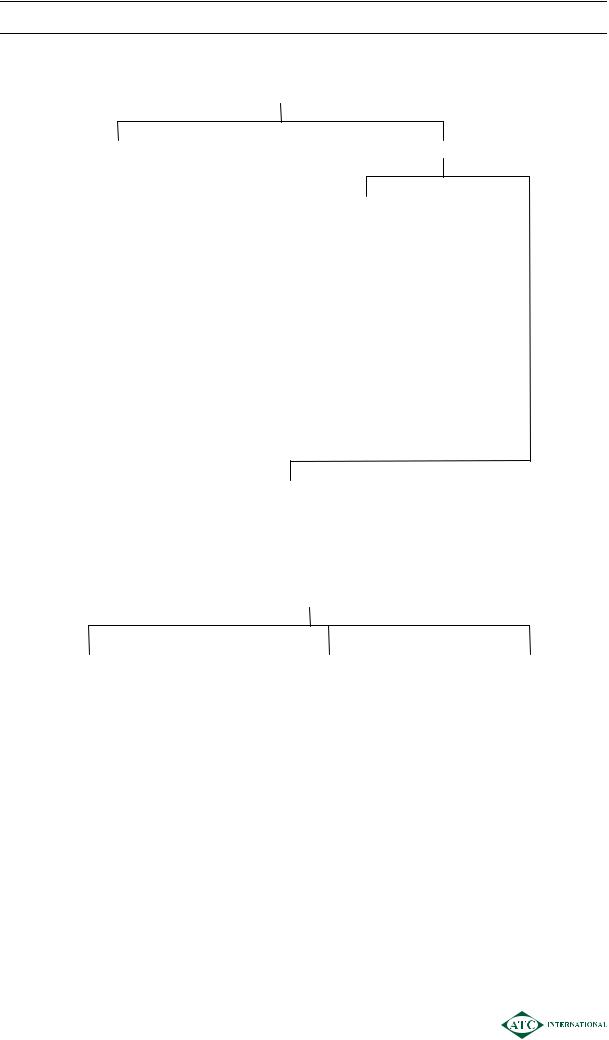

A company’s existing WACC should only be used as the discount rate for a potential project if

|

Proportion of |

|

debt to equity |

|

does not change |

Project is financed |

Project has same |

by existing pool of funds |

business risk as |

|

existing operations |

i.e. a company’s existing WACC can only be used as the discount rate for a potential project if that project does not change the company’s:

¾Gearing level i.e. Financial Risk

¾Operational risk i.e. Business Risk

More detail on the important concepts of Financial Risk and Business Risk is found in the next section.

Example 1

A company has in issue:

45 million $1 ordinary shares

10% irredeemable loan stock with a book value of $55million

The loan stock is trading at par. |

|

Share price |

$1.50 |

Dividend |

15c (just paid) |

Dividend growth |

5% pa |

Corporation tax |

33% |

Estimate the WACC. |

|

Solution

0303

SESSION 03 – WEIGHTED AVERAGE COST OF CAPITAL AND GEARING

1.2Limitations of WACC

LIMITATIONS

THEORETICAL

Assumes perfect capital market

Assumes

−market value of shares

=present value of dividend stream

−market value of debt

=present value of interest/principal

Current WACC can only be used to assess projects

which

−have similar business risk to that of existing operations

−do not change the company’s gearing level i.e. financial risk.

PRACTICAL

CALCULATION

OF Ke

Estimation of “g”

−lack of historical data

−Gordon’s model only applies to all equity financed companies

Assumes constant growth

CALCULATION OF Kd

Assumes constant tax rates

Complexities e.g.

BANK OVERDRAFT |

CONVERTIBLE |

FOREIGN LOANS |

|

LOAN STOCK |

|

Current liability but often has a permanent core

Must be split between permanent and fluctuating element

Include permanent element in calculation of WACC

Investor has option of

(i)taking the redemption value, or

(ii)converting into shares

Assume it will be redeemed unless data is available to suggest conversion

Exchange rates will affect the value of the loans to be included and the effective cost

0304

SESSION 03 – WEIGHTED AVERAGE COST OF CAPITAL AND GEARING

¾These problems are particularly acute for unquoted companies which have no share price available and often make irregular dividend payments.

¾In this case it may be advisable to estimate the WACC of a quoted company in the same industry and with similar gearing and then add a (subjective) premium to reflect the higher return required by investors in unquoted companies due to the perceived higher risk.

2THE EFFECTS OF GEARING

¾The existing WACC reflects the current risk profile of the company:

Business risk – the volatility of operating profit due to the nature of the industry, country and level of operational gearing i.e. proportion of fixed to variable operating costs.

and

Financial risk – The additional variability in the return to equity as a result of introducing debt i.e. using financial gearing. Interest on debt is also a fixed cost which leads to even more volatile profits for shareholders.

¾As a company introduces debt into its capital structure two things happen.

WACC = |

Ke E + Kd D |

|

E + D |

Ke increases due to the increased financial risk.

All else equal, this pushes up the value of WACC

The proportion of debt relative to equity in the capital structure increases.

Since Kd < Ke this pushes the value of WACC down, all else equal

¾The effect of increased financial gearing on the WACC depends on the relative sizes of these two opposing effects.

¾There are two main schools of thought

Traditional view – static trade-off theory

Modigliani and Miller’s theories

0305

SESSION 03 – WEIGHTED AVERAGE COST OF CAPITAL AND GEARING

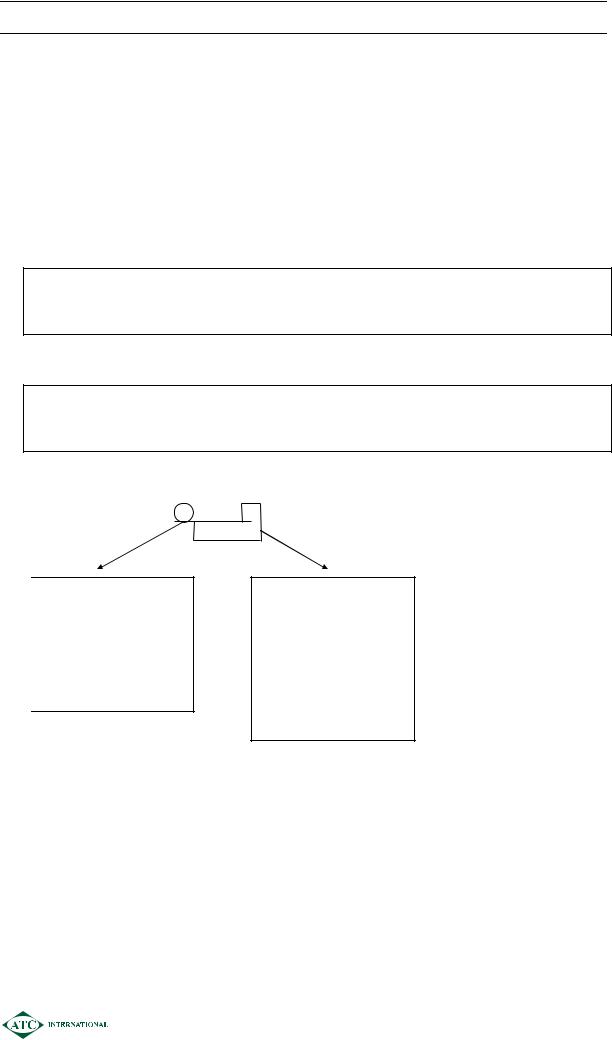

3STATIC TRADE-OFF THEORY

3.1Reasoning

¾The traditional view has little theoretical foundation – often described as the “intuitive approach”. It is based upon the trade-off caused by financial gearing i.e. using more (relatively cheap) debt results in a rising cost of equity.

¾It is believed that Ke rises only slowly at low levels of gearing and therefore the benefit of using lower cost debt finance outweighs the rising Ke.

¾At higher levels of gearing the increased financial risk outweighs this benefit and WACC rises.

Cost of |

|

capital |

Ke |

WACC

Kd

D/E

Optimal gearing

¾Note that at very high levels of gearing the cost of debt rises. This is due to the risk of default on debt payments i.e. credit risk.

¾This is referred to as financial distress risk – not to be confused with financial risk which occurs even at relatively safe levels of debt.

3.2Conclusions

¾There is an optimal gearing level (minimum WACC).

¾However there is no method of calculating Ke or WACC or indeed the optimal capital structure. The latter needs to be found by trial and error.

0306

SESSION 03 – WEIGHTED AVERAGE COST OF CAPITAL AND GEARING

4MODIGLIANI AND MILLER’S THEORIES

4.1Introduction

¾Modigliani and Miller (MM) constructed a mathematical model to attempt to provide a basis for financial managers to make finance decisions.

¾Mathematical models predict outcomes that would occur based on simplifying assumptions.

¾Comparison of the model’s conclusions to the real world observations then allows researchers to understand the impact of the simplifying assumptions. By relaxing these assumptions in turn the model can be moved towards real life.

¾MM’s assumptions include:

Rational investors

Perfect capital market

No tax (either corporate or personal) – although they later relaxed the assumption of no corporate tax.

Investors are indifferent between personal and corporate borrowing

No financial distress risk i.e. no risk of default, even at very high levels of debt.

There is a single risk-free rate of borrowing

Corporate debt is irredeemable.

4.2Theory without tax

¾MM expressed their theory as two propositions.

¾MM considered two companies - both with the same size and in the same line of business therefore both having the same level of business risk.

One company was ungeared − Co U

One company was geared − Co G

¾MM’s basic theory was that because each firm would have the same operating profit it would have the same total market value (V) and the same WACC (proposition 1)

Vg = |

Vu |

WACCg = WACCu

0307

SESSION 03 – WEIGHTED AVERAGE COST OF CAPITAL AND GEARING

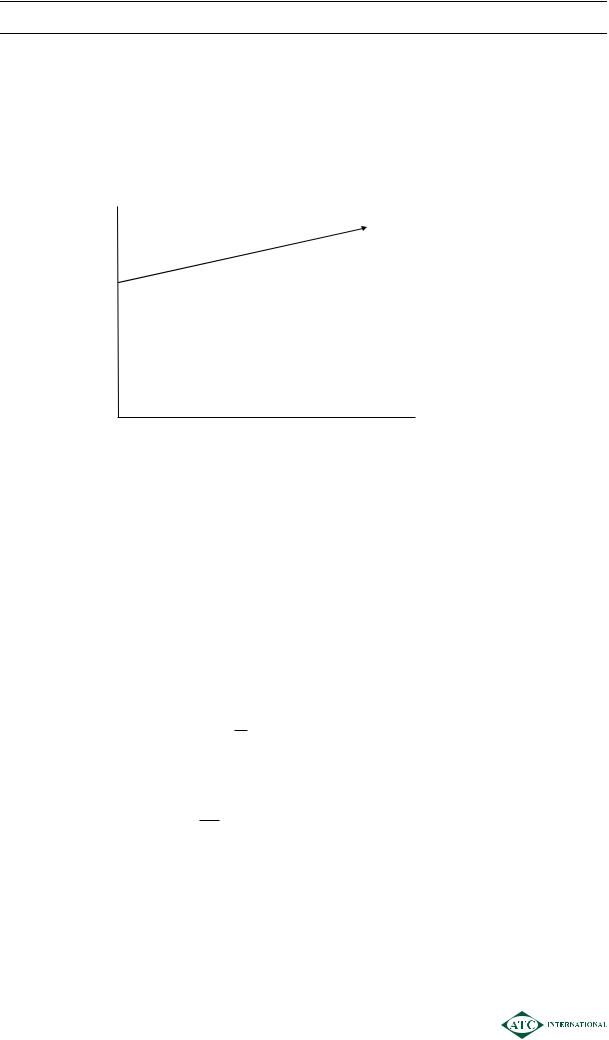

¾MM argued that the individual costs of capital would change as gearing changed in the following manner:

kd would remain constant whatever the level of gearing

ke would increase at a constant rate as gearing increased due to the increased financial risk (proposition 2)

the rising ke would exactly offset the benefit of the cheaper debt in order for the WACC to remain constant.

This can be shown as a graph:

Cost of

capital

Ke

WACC

Kd

D/E

¾Conclusion

There is no optimal gearing level;

The value of the company is independent of the finance decisions

Only investment decisions affect the value of the company.

¾This is not true in practice because the assumptions are too simplistic. There are differences between the real world and the model

¾Note that MM never claimed that gearing does not matter in the real world. They said that it would not matter in a world where their assumptions were correct. They were then in a position to relax the assumptions to see how the model predictions would change.

¾The first assumption they relaxed was the no corporate tax assumption.

0308

SESSION 03 – WEIGHTED AVERAGE COST OF CAPITAL AND GEARING

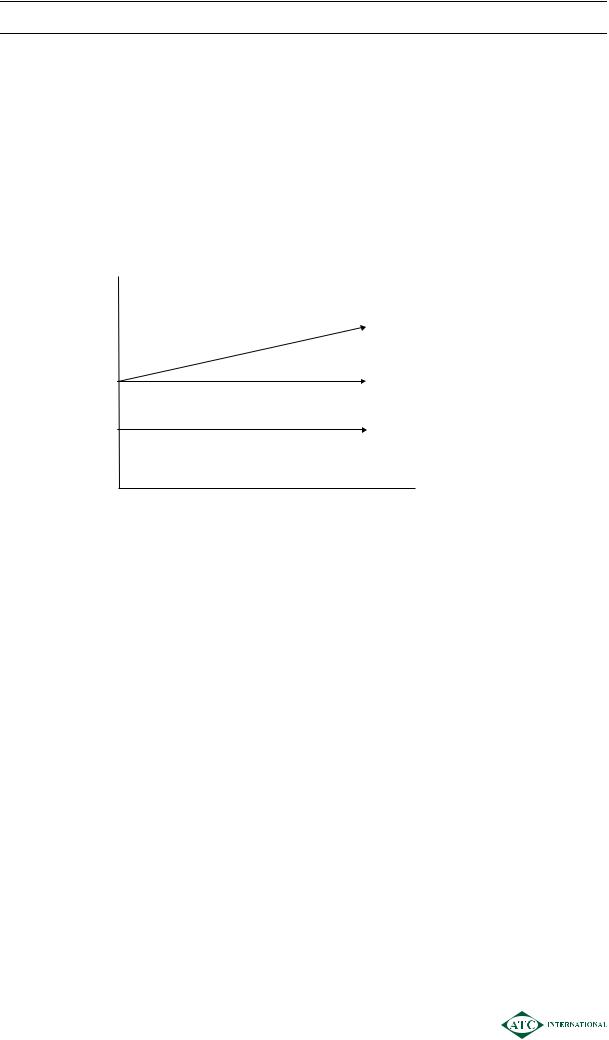

4.3Theory with tax

Illustration 1

Consider two companies, one ungeared, Co U, and one geared, Co G, both of the same size and level of business risk.

|

Co U |

Co G |

|

$m |

$m |

EBIT |

100 |

100 |

Interest |

− |

20 |

|

____ |

____ |

PBT |

100 |

80 |

Tax @ 35% |

35 |

28 |

|

____ |

____ |

Dividends |

65 |

52 |

|

____ |

____ |

Returns to the investors: |

|

|

Equity |

65 |

52 |

Debt |

− |

20 |

|

____ |

____ |

Total return |

65 |

72 |

|

____ |

____ |

The investors in G receive $7m more than the investors in U. This is due to the tax relief on debt interest and is known as the tax shield.

Tax shield |

= |

kd × D × t |

where kd |

= |

required return of debt holders |

D= current market value of the debt

t |

= |

tax rate |

MM assume that the tax shield will be in place each year to perpetuity and therefore has a present value, which can be found by discounting at the rate applicable to the debt, kd.

PV of tax shield = |

|

Kd×D×t |

|

kd |

|

|

|

|

= |

D × t |

|

The difference in market value between G and U should therefore be that G has a higher market value due to the tax shield and this extra value is made up of the present value of the tax shield.

MM expressed this as:

MVg = |

MVu + Dt |

0309

SESSION 03 – WEIGHTED AVERAGE COST OF CAPITAL AND GEARING

¾When corporation tax is introduced MM argue that the individual costs of capital change as follows:

Kd (the required return of the debt holders) remains constant at all levels of gearing

Ke increases as gearing levels increase to reflect additional financial risk

WACC falls as gearing increases due to the additional tax relief on the debt interest.

Cost of |

Ke |

capital |

|

WACC

WACC

Kd

Kd

D/E

¾The relationship between the WACC of a geared company and the WACC of an ungeared company is:

|

|

|

1 |

|

Dt |

|

WACC |

= |

Keu |

− |

|

|

|

|

||||||

|

|

|

|

|

E + D |

|

where |

Keu |

= cost of equity in an ungeared company |

|

D |

= market value of debt in the geared company |

|

E |

= market value of equity in the geared company |

|

t |

= corporate tax rate |

This formula is not provided in the exam.

¾The formula for the cost of equity is: Keg = Keu + (1 – T) (Keu – kd) DE

¾This is provided on the formulae sheet in the following format:

ke = kei + (1 – T) (kei – kd) Vd Ve

Where kd = pre-tax cost of debt

0310