Fin management materials / P4AFM-Session01_j08

.pdf

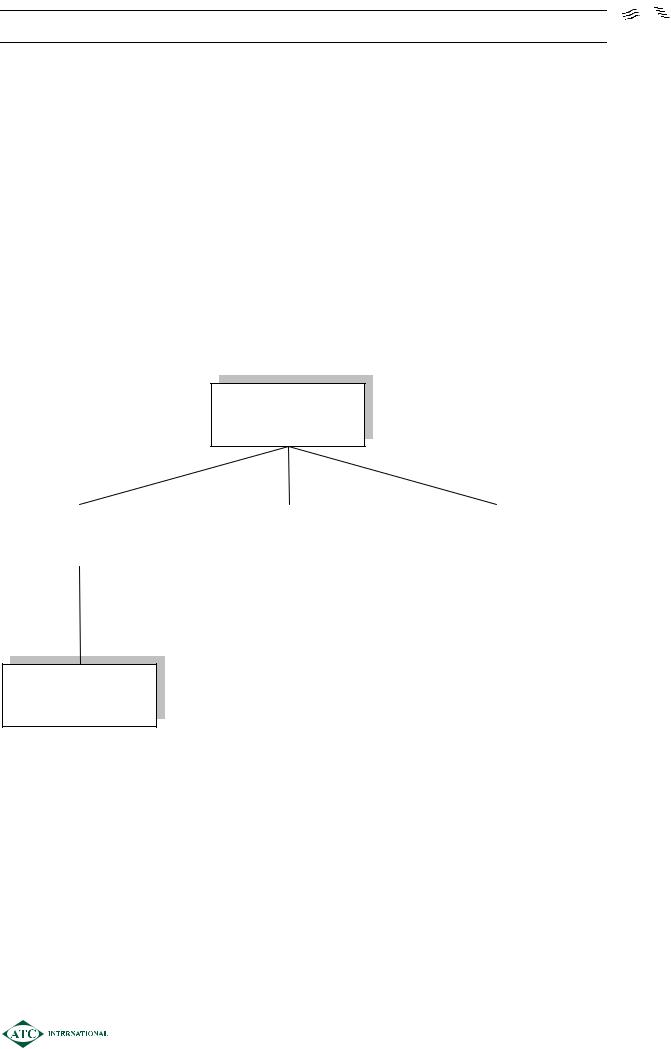

SESSION 01 – THE ROLE OF FINANCIAL STRATEGY

OVERVIEW

Objective

¾To consider the role of the senior financial executive.

¾To identify the objectives of stakeholders and potential conflicts of interest.

¾To consider the main codes on corporate governance.

¾To consider environmental and ethical issues.

ROLE OF SENIOR

FINANCIAL

EXECUTIVE

|

|

|

|

|

|

|

|

|

|

|

|

IDENTIFY |

|

|

|

CORPORATE |

|

|

|

ETHICS |

|

|

CORPORATE |

|

|

|

|

|

|

|

||

|

|

|

|

GOVERNANCE |

|

|

|

|

||

|

OBJECTIVES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RESOLVE

CONFLICTS OF

INTEREST

0101

SESSION 01 – THE ROLE OF FINANCIAL STRATEGY

1ROLE OF THE SENIOR FINANCIAL EXECUTIVE/ADVISOR

¾To advise the board of directors in setting the financial goals of the business and in its financial policy development. Specific areas include:

Investment selection and capital resource allocation

Minimising the firm’s cost of capital

Distribution and retention policy

Communicating financial policy and corporate goals to internal and external stakeholders

Financial planning and control

The management of risk

¾Develop strategies for the achievement of the firm’s goals in line with its agreed policy framework.

¾Recommend strategies for the management of the financial resources of the firm such that they are utilised in an efficient, effective and transparent way.

¾Establish an ethical financial policy for the financial management of the firm which is grounded in good governance, the highest standards of probity and is fully aligned with the ethical principles of the ACCA.

¾Explore the areas within the ethical framework of the firm which may be undermined by agency effects and/or stakeholder conflicts and establish strategies for dealing with them.

¾Prepare advice on personal finance to individual as well as groups of investors, covering areas such as investment and financing.

Clearly, before any strategies can be developed for the firm its objectives must be identified.

2CORPORATE OBJECTIVES

2.1Corporate objectives in practice

In practice companies are likely to have a variety of different objectives which may include a number of the following:

¾profit targets;

¾market share targets;

¾share price growth;

¾local and environmental concerns;

¾contented workforce;

¾meeting short-term targets;

¾long-term plans.

0102

SESSION 01 – THE ROLE OF FINANCIAL STRATEGY

These objectives can be classified as follows:

¾Profit goals – objectives which lead directly to increased profits (e.g. cost reduction measures);

¾Surrogate profit goals – objectives which lead indirectly to increased profits (e.g. maintaining a contented workforce);

¾Constraints on profit – objectives which actually restrict profit (e.g. ensuring that the company’s operations do no harm to the environment);

¾Dysfunctional goals – objectives which do not provide a benefit even in the long run (e.g. the pursuit of market leadership at all costs).

A company may aim at either maximising or satisficing these objectives:

¾Maximising involves seeking the best possible outcome;

¾Satisficing involves finding an adequate outcome.

2.2Maximisation of shareholders’ wealth

In theoretical terms a single corporate objective is assumed and this is “the maximisation of shareholder wealth”.

Shareholder wealth is the combination of dividend and share price growth – together referred to as Total Shareholder Returns (TSR).

The objective of maximising shareholder wealth can be justified in the following ways:

¾The company which provides the highest returns for its investors will find it easiest to raise new finance and grow in the future. If a company does not provide competitive returns it will inevitably decline.

¾The directors of a company have a legal duty to run the company on behalf of the shareholders. It is generally considered a reasonable assumption that the purchaser of a share in a listed company buys that share in an attempt to maximise his wealth.

Criticisms of the above include the following:

¾It ignores the needs of society that will not necessarily be provided by the free market, such as health, education and defence;

¾It ignores the other interest groups in the company, such as the employees.

In practice a company will often seek to maximise profit subject to satisficing a number of other objectives.

0103

SESSION 01 – THE ROLE OF FINANCIAL STRATEGY

2.3Public limited companies and private companies

The assumed objective of listed PLC’s is therefore to maximise the wealth of their shareholders as measured by the share price.

For a private company, however, there is no share price to be maximised. Smaller private companies may also have a close relationship between the owners and the managers, and therefore the directors may be aware of the real objectives of the owners.

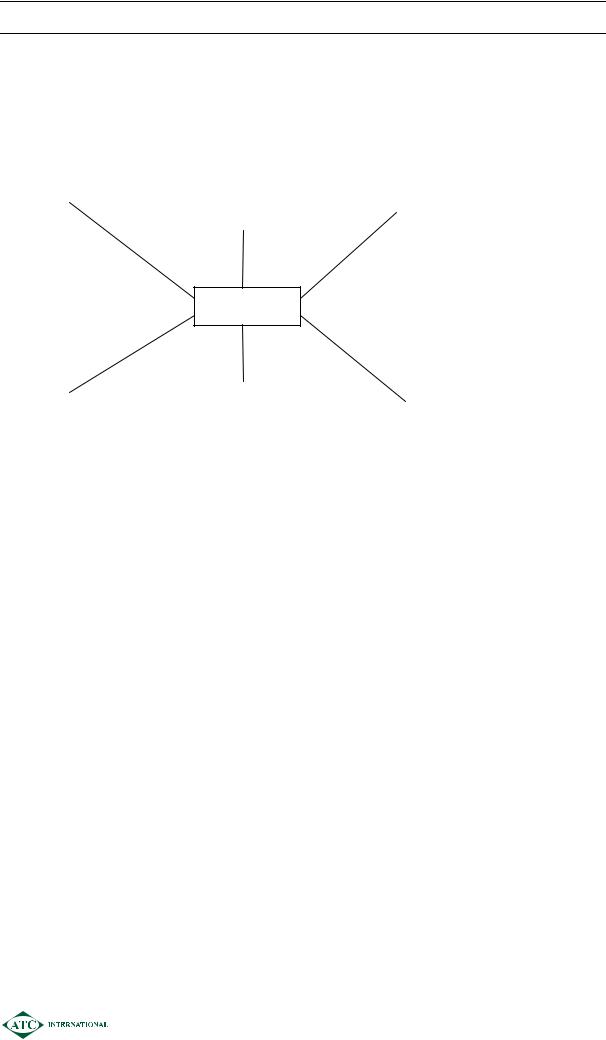

3CONFLICTS OF INTEREST

3.1Agency theory

Agency theory examines the duties and conflicts that occur between the parties within a company that have an agency relationship.

PRINCIPAL |

Shareholders |

Directors |

Loan creditors |

AGENT |

Directors |

Employees |

Shareholders |

AGENT’S RESPONSIBILITY |

Generate maximum |

Work to |

Minimise risk |

|

return for |

maximum |

from uses of |

|

shareholders |

efficiency |

borrowed funds |

A company can be viewed as a set of contracts between each of these various interest groups. The company will not succeed unless all of the groups are working towards the same objectives.

0104

SESSION 01 – THE ROLE OF FINANCIAL STRATEGY

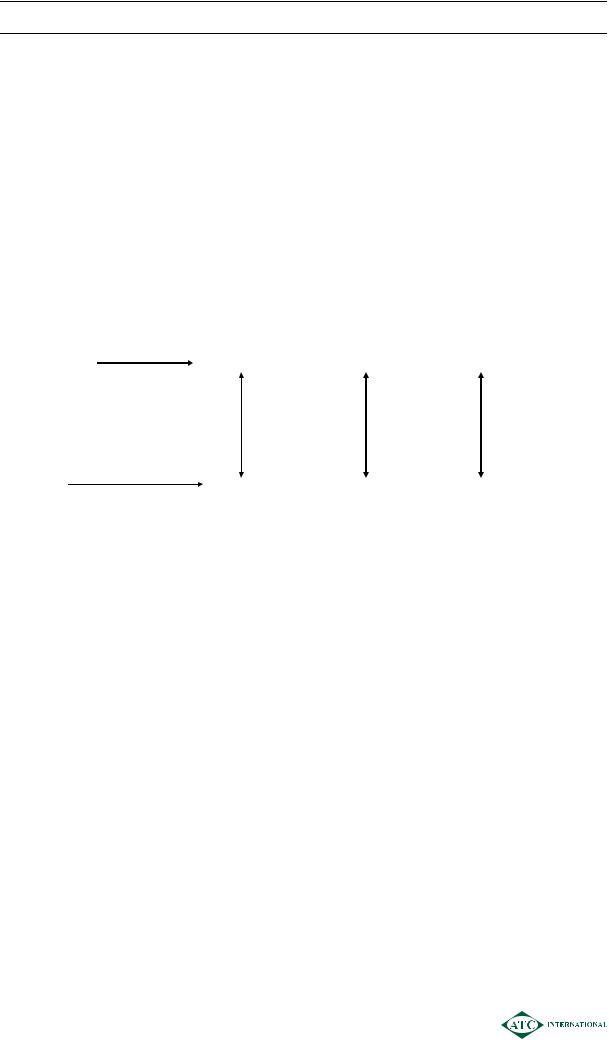

3.2Stakeholders

Companies are made up of a variety of different interest groups or “stakeholders” all of whom are likely to have different interests in and objectives for the company:

Equity shareholders |

Directors |

Employees |

||

maximum wealth |

|

remuneration |

|

pay and conditions |

|

|

power |

|

job security |

|

|

esteem |

|

|

COMPANY

Loan creditors |

Trade creditors |

Community |

|

|

security |

short term |

environmental |

|

cash flow |

cash flow |

issues |

long term prospects

While shareholders are clearly the key stakeholder modern corporate governance suggests that directors should take into account the objectives of a wider range of interested parties. Directors are therefore expected to show responsibility to creditors e.g. reasonable payment terms, responsibility to employees e.g. health and safety, and ultimately to society as a whole e.g. minimising pollution, investing in social projects – Corporate Social Responsibility (CSR).

Therefore the overall corporate objective may become “satisficing” i.e. producing satisfactory rather than maximum returns for shareholders. With the rise of the “ethical investor” on world stock markets it appears that many shareholders are in fact willing to accept slightly lower returns in exchange for their companies following a wide range of both financial and non-financial objectives.

0105

SESSION 01 – THE ROLE OF FINANCIAL STRATEGY

3.3Directors and shareholders

In larger companies the shareholders entrust the management of the company to the directors – referred to as the separation of ownership from control. The directors are managing the company on behalf of the shareholders and should therefore always act in the best interests of the shareholders, while taking into account the objectives of other stakeholder groups.

This may not always be the case as the directors may have other personal objectives such as:

¾increasing personal remuneration levels;

¾maximising bonus payments;

¾empire building;

¾job security.

In addition to the personal aspects shown above a small number of directors have been guilty of not fulfilling their fiduciary duties by;

¾creative accounting, by choosing creative accounting policies the directors can flatter the accounts – known as “window dressing”.

¾off balance sheet finance e.g. via the use of “special purpose vehicles”.

¾takeovers; in defending the company from takeovers some directors have been accused of trying to protect their own jobs rather than acting in the interests of their shareholders.

¾disregard for environmental issues; directors may allow processes which emit pollution or test products on animals.

If directors follow personal objectives which conflict with those of their shareholders this leads to “agency costs” i.e. lost potential returns for shareholders.

Good corporate governance procedures should be implemented to minimise the impact of agency costs.

It can be argued that the actual return to shareholders = maximum potential return – agency costs – cost of following Corporate Social Responsibility.

To some degree shareholders themselves should be more active in monitoring the behaviour of directors. Most shares in listed companies are held by institutional investors e.g. pension funds. Fund managers have often been guilty of operating in a very passive way, for example not even using the proxy voting rights given to them by the fund’s investors. Until there is a rise in shareholder activism it remains likely that some directors will continue to work in their own best interest.

0106

SESSION 01 – THE ROLE OF FINANCIAL STRATEGY

3.4Goal congruence

Goal congruence is where each of the parties within an organisation is seeking to achieve personal objectives which are also within the best interests of the company as a whole.

For example managers should be encouraged to aim for long-term growth and prosperity rather than short-term reported profitability.

Methods of encouraging goal congruence between directors and shareholders:

¾Executive Share Option Plans (ESOP’s) – although the evidence is mixed regarding the success of such schemes in motivating directors to improve performance e.g. a company’s share price may rise due to a general rise in the stock market rather than the quality of its management.

¾Long Term Incentive Plans (LTIP’s) – paying a bonus to directors if over several years the company’s performance is good when benchmarked against that of competitors.

¾Transparency in corporate reporting.

¾Improved corporate governance e.g. through the appointment of truly independent non-executive directors.

¾Increased shareholder activism e.g. using voting rights.

3.5Environmental concerns

An area of growing concern to all parties, companies included, is that of the environment or “green” issues.

Due to this increased emphasis on environmental issues in all walks of life it is important that managers understand the impact of the operations of the organisation on the environment, in order to satisfy public concerns and, increasingly, to avoid any penalties or costs due to environmental regulations.

For these reasons environmental reporting is becoming more common as part of general company financial reporting.

‘Environmental Management Accounting’ (EMA) attempts to measure the full environmental impact of a company’s operations e.g. the cost of inefficient energy usage due to poor insulation of buildings.

0107

SESSION 01 – THE ROLE OF FINANCIAL STRATEGY

4CORPORATE GOVERNANCE

4.1Definition

Corporate governance is defined as “the system by which companies are directed and controlled”.

The objective of corporate governance may be considered as the reduction of agency costs to a level acceptable to shareholders.

4.2Corporate governance around the world

UK

¾The Cadbury Report

¾The Greenbury Code

¾The Combined Code

¾The Turnbull Report

Detail on each of these documents in provided later in this section.

US:

¾SEC imposes quarterly reporting requirements

¾audit committees required for all listed companies

¾Sarbanes – Oxley Act introduced in 2002 as a response to a series of high profile corporate scandals e.g. Enron, WorldCom, Global Crossing, and Tyco International.

Germany:

¾two-tier board system - separate management and supervisory board.

¾banks providing credit often have long term equity holding.

Japan:

¾traditionally companies doing business together would hold shares in each other although this system is now reducing.

¾three-tier board system – policy, functional and monocractic.

0108

SESSION 01 – THE ROLE OF FINANCIAL STRATEGY

4.3Sarbanes — Oxley Act

Introduced in 2002 the Sarbanes – Oxley Act represents the most significant review of US corporate governance since the Securities Exchange Act of 1934.

Sarbanes – Oxley imposes new responsibilities on Chief Executive Officers (CEO’s) and Chief Financial Officers (CFO’s) and exposes them to much greater potential liability.

It applies to all companies listed on a US stock market – including their foreign subsidiaries. Compliance is mandatory.

One of the main provisions is that the CEO and CFO should sign off personally on company accounts. Fraudulent certification (i.e. signing accounts known to be inaccurate) leads to criminal penalties – fines of up to $5m and up to 20 years in prison.

However some CEO’s and CFO’s have tried to avoid their responsibilities under the Sarbanes – Oxley Act by asking divisional heads to certify their division’s accounts before they are sent to head office.

Furthermore the level of detail required in reporting compliance with Sarbanes-Oxley is very high. Such high compliance costs have discouraged many companies from listing their shares in New York – often choosing London where corporate governance codes are based more upon principles than detail.

4.4The Cadbury Report

The Cadbury Committee was set up in 1991 to review aspects of corporate governance − specifically related to financial reporting and accountability.

The Cadbury Report was published in 1992 and the boards of all UK listed companies had to comply with the Code of Best Practice contained in the report.

The main provisions of the Code are:

¾Board of directors

meet regularly

monitor executive management

division of responsibility at head of company

include non-executive directors (“NEDs”)

¾Non-executive directors

bring independent judgement to bear on matters of strategy, performance, resources

should sit on remuneration committee

0109

SESSION 01 – THE ROLE OF FINANCIAL STRATEGY

¾Executive directors

service contracts not exceeding 3 years

pay subject to recommendations of remuneration committee

total emoluments disclosed fully and clearly

¾Audit committee

made up of at least 3 NEDs

liaise with external auditors

recommend appointment and fees of external auditor

review company statement on internal controls

¾Directors statements

must report on effectiveness of company’s system of internal control

should report that company is a going concern.

4.5The Greenbury Code

The Greenbury Committee (formally known as The Study Group on Directors’ Remuneration) issued its report in 1995 covering best practice recommendations in the realm of executive and director compensation. Its principles have drawn far more criticism than those drafted by Cadbury, but institutional investors in Britain accept the main points as valuable. The Greenbury Code includes the following key recommendations:

¾The compensation committee should be composed exclusively of independent outsiders.

¾Companies should annually outline their compliance with the Greenbury Code, including explanations if they do not comply.

¾The annual compensation committee report should disclose pay details for all executive directors, including pension provisions, incentive pay, option plans, performance measurements, severance agreements and comparisons with similar companies.

¾Executive pay should not be “excessive”.

¾Employment contracts should extend for no longer than one year so as to rule out multiyear golden handshake payouts in the event an executive is dismissed or the company taken over.

¾New long-term incentive plans should replace, not supplement, existing stock option plans.

¾Performance-related pay should “align the interest of directors and shareholders”, while performance criteria should be “relevant, stretching and designed to enhance the business. Upper limits should always be considered”.

¾Executive stock option awards should be phased rather than given all at once, and options should never be awarded at a discount.

0110