Fin management materials / P4AFM-Session11_j08

.pdf

SESSION 11 – BUSINESS PLANNING AND EVALUATION

OVERVIEW

Objective

¾To discuss the nature of strategic, tactical and operational planning.

¾To be familiar with theories and practical approaches to dividend policy.

¾To appreciate specific issues regarding international dividend policy.

¾To calculate all commonly used ratios.

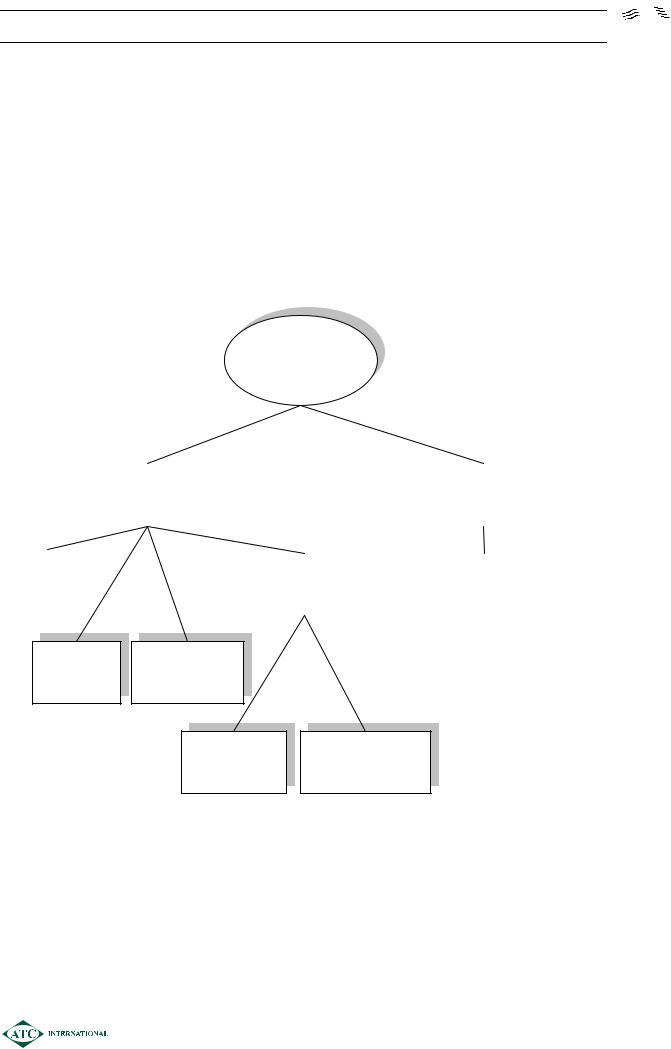

BUSINESS

PLANNING &

EVALUATION

|

|

|

|

|

|

|

|

PLANNING |

|

|

|

EVALUATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STRATEGIC |

|

|

|

DIVIDEND |

|

|

|

RATIO ANALYSIS |

|

|

|

|

|

|

POLICY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TACTICAL OPERATIONAL

DOMESTIC INTERNATIONAL

1101

SESSION 11 – BUSINESS PLANNING AND EVALUATION

1PLANNING AND CONTROL

1.1Levels

¾There are three levels of corporate planning and control:

strategic planning

tactical planning

operational planning

1.2Strategic planning

¾Strategic planning usually follows six main steps:

Step |

Action |

Detail |

|

1 |

Assessment of strategic |

– |

internal strengths and weaknesses, external |

|

position |

|

opportunities and threats (SWOT analysis) |

|

|

– |

competitive position re power of suppliers, power |

|

|

|

of customers, threat of substitutes, competitive |

|

|

|

rivalry, threat of new entrants (Porter’s 5 forces) |

|

|

– |

assessment of existing products as cash cows, stars, |

|

|

|

problem child or dogs (BCG matrix) |

2 |

Establishment of |

– |

should be measurable, e.g. 10% growth in earnings |

|

objectives |

|

per share |

3 |

Choice of strategies |

– |

organic growth vs. growth by acquisitions |

|

|

– |

stay with existing products/markets or develop |

|

|

|

new products/enter new markets (Ansoff’s matrix) |

4 |

Evaluation of strategy |

– |

Gap analysis i.e. is projected return sufficient? |

|

|

– |

is it feasible? |

5 |

Establishment of |

– |

a series of annual plans with full supporting |

|

budgets |

|

schedules analysed by responsibility |

6 |

Implementing plan |

– |

comparing actual results with target |

|

and monitoring results |

|

|

1102

SESSION 11 – BUSINESS PLANNING AND EVALUATION

1.3Tactical planning

¾This is shorter term than strategic planning and usually takes place at a functional/department level. The aim is to ensure that resources are used effectively in achieving strategic objectives.

¾Examples - pricing decisions, outsourcing decisions.

1.4Operational planning

¾Very short term and very detailed.

¾Examples – daily delivery schedules, materials usage information.

¾Controlled by variance analysis.

1.5Conflicts between long and short term planning

Conflicts may occur for the following reasons:

¾Bonus or share option schemes encouraging excessive focus on short term results – “myopia”.

¾Fear of disappointing market expectations e.g. for quarterly rises in EPS.

¾Managers are simply too busy dealing with short term crises.

1.6Top down and bottom up planning

¾In top down systems senior management announce instructions which are then filtered down through the organisation.

¾Bottom up systems gather information from lower down the organisation and this information is consolidated at board level.

¾The best system is usually considered to be a compromise between the two where line managers participate but long term strategy is the responsibility of the board.

1.7Investment and long term planning

An important part of long term planning is involved with investment decisions, such as;

¾Committing funds to new projects

¾Withdrawing from projects

¾Mergers & acquisitions

¾Divestment decisions

¾Distributing the returns from investments i.e. dividend policy

1103

SESSION 11 – BUSINESS PLANNING AND EVALUATION

2DOMESTIC DIVIDEND POLICY

A parent company must decide whether group profits should be returned to investors as a dividend or retained within the business for reinvestment into new projects. Many different policies and theories are available:

2.1Stable dividend

¾Stable level of dividends or constant level of growth to avoid sharp movements in share price.

¾Maintains the level of dividends in the face of fluctuating earnings.

¾Very common approach for quoted companies.

2.2 |

Constant payout ratio |

|

¾ |

Constant proportion of earnings paid out as dividend. |

|

¾ |

Not particularly suitable for quoted companies as dividends will fluctuate. |

|

2.3 |

Residual dividend policy |

|

¾Remaining earnings, after funding all attractive projects, are paid out as dividend i.e. dividend = operating cash flow – interest – tax – capital expenditure.

¾Links to Pecking Order Theory i.e. a dividend is only paid if more cash is available than required for reinvestment back into the business.

¾However it is likely to lead to fluctuating dividends and may not be particularly suitable for quoted companies. Shareholders must fully understand the policy and have confidence in the investment criteria adopted by the company

2.4Clientele theory

¾The company’s historical dividend policy may have attracted particular investors to whom the policy is suited in terms of tax, need for current income, etc.

¾The company should then maintain a stable dividend policy or risk losing key investors.

¾Management should view shareholders as their “clientele”.

2.5Bird in the Hand Theory

¾Shareholders may prefer higher dividends (and therefore lower potential capital gains) as a cash dividend today is without risk whereas future share price growth is uncertain.

1104

SESSION 11 – BUSINESS PLANNING AND EVALUATION

2.6Dividend Irrelevance Theory

¾A firm requiring funds for investment has two choices: Retain earnings (i.e. reduce dividends)

or

Maintain dividends and raise external finance

¾According to Modigliani and Miller the choice of dividend policy is irrelevant to the value of the company and shareholders’ wealth.

¾Shareholders either receive the dividend in the form of cash (if paid) or in the form of a capital gain (if retained).

¾M&M argue that if no dividend is paid in a year due to investment opportunities then the shareholders can manufacture their own “home made” dividends either by:

selling some shares (which will now have a higher price) while keeping the total value of their holding the same or,

borrowing by using the value of the shares as security.

¾It is not dividends themselves that are irrelevant but the timing of dividends.

¾The theory is based on the following perfect capital market assumptions:

Investors are rational and risk averse

Perfect information

No transaction costs

No tax distortions

¾In practice there are likely to be distortions due to the personal tax system which may tax dividends differently than capital gains. Also there are usually transaction costs on “manufactured” dividends.

2.7Dividend Valuation Model

Po =

where

D0(1 +g) |

= |

D1 |

|

re −g |

re −g |

||

|

Po = current share price

Do = most recent dividend

D1 = dividend in one year

g = growth rate

re = required return of equity investors

¾The growth rate of future dividends is a function of the retention rate i.e. proportion of profits reinvested, and the return on reinvested profits.

1105

SESSION 11 – BUSINESS PLANNING AND EVALUATION

¾Therefore higher dividends today will reduce the long term growth rate, and vice versa.

¾The firm should set its payout ratio in order to maximize the share price.

2.8Share Buy Back Programmes

¾In recent years there has been a trend for traditional dividend payments to be replaced by share repurchase schemes.

¾With approval from shareholders the company uses surplus cash to buy back part of its share capital, on the assumption that shareholders can reinvest this cash more effectively than the company.

¾The buy back can be performed either by writing directly to all shareholders with an offer to buy shares at a fixed price (a “tender offer”) or by purchasing shares via the stock market at the prevailing price.

¾The shares are either cancelled or held by the company as Treasury Shares for possible future reissue. If held by the company the shares carry no voting rights or dividend.

¾The result of a buy back programme is that there will be fewer shares in issue, and hence the share price should rise.

¾Ratios such as Earnings Per Share (EPS) and Return on Equity (ROE) should also improve.

2.9Special Dividends

¾If a quoted company announces a larger than expected dividend this may raise market expectations of at least the same in future.

¾To avoid raising expectations to an unsustainable level the dividend may be announced as a “special” dividend – basically a bonus dividend.

¾The company is telling the markets that, from time to time, any exceptional cash surplus will be returned in this way, but that this should not be built into dividend per share forecasts.

2.10Scrip Dividends

¾A scrip dividend is where the company gives its shareholders a choice of:

−cash dividend

−shares in lieu of cash

¾If shareholders choose to receive their dividend in the form of additional shares this allows the company to retain more cash within the business for reinvestment - the preferred source of finance under “pecking order theory”.

¾Shareholders may choose the additional shares as as a method of building their holding without incurring trading commissions.

1106

SESSION 11 – BUSINESS PLANNING AND EVALUATION

2.11Practical considerations

¾Company law - a dividend can only be legally paid if there is a credit balance on retained earnings in the balance sheet.

¾Level of inflation i.e. the need to at least maintain the dividend in real terms.

¾Liquidity position i.e. cash, more than profits, is required to pay a dividend.

¾The company must retain sufficient funds for reinvestment purposes.

¾Stability of earnings – if earnings are stable, a larger dividend can be more easily maintained.

¾Information content/”signalling” − capital markets tend not to be perfect markets and in the absence of perfect information a company’s dividend declaration is seen as an important signal of the future prosperity of the company.

¾Personal taxation − some shareholders prefer dividends and others capital gains.

¾Transaction costs − reduce the “manufacturing” of dividends expected by M&M.

3INTERNATIONAL DIVIDEND POLICY

3.1Tax planning

¾If the parent company has a subsidiary located overseas then it must consider the tax cost of repatriating profits in the form of a dividend.

¾Assuming that the subsidiary has not been established in a “tax haven” its profits will be subject to local corporate tax. However on payment of a dividend it may also have to deduct withholding tax.

¾The parent receiving the dividend will usually be entitled to relief for this withholding tax against its eventual tax liability on the dividend.

¾However there may be no liability in the hands of the parent, either because the dividend is not treated as taxable income in the parent’s country, or because the parent has tax allowable deductions which reduce the taxable amount.

¾Therefore the group may suffer withholding tax that cannot be recovered.

¾A possible solution to this problem is to establish an “offshore” holding company between the subsidiary and ultimate parent. This can in fact lead to three potential tax benefits:

Withholding tax minimization; in certain cases the careful use of an offshore holding company can reduce the withholding tax burden compared to direct repatriation of income from the subsidiary to parent.

1107

SESSION 11 – BUSINESS PLANNING AND EVALUATION

Increased double tax relief; the use of an offshore “mixer” company can increase credits for double tax relief by combining dividends from high and low taxed subsidiaries before they are paid up to the parent

Capital gains protection; if the holding company is established in an appropriate jurisdiction any gains on the sale of the subsidiary may completely avoid tax

3.2Blocked remittances

¾As part of their exchange control regulations, many developing countries create barriers that discriminate against dividends being paid to overseas shareholders. Whilst such policies may reduce capital flight they also tend to reduce foreign direct investment and hence access to technology and knowledge.

¾If a multinational company finds that remittances are blocked it may have to consider other methods of transferring profit from the overseas subsidiary to the parent company. Commonly used techniques include:

−Transfer pricing

−Management fees

−Royalty payments

−Interest payments

¾The use of such techniques for avoiding exchange controls must be subject to the company’s ethical standards, particularly if also used for tax manipulation.

4RATIO ANALYSIS

4.1 |

Profitability ratios |

|

|

|

|

|

Gross profit margin = |

Grossprofit |

×100 |

|

|

|

|

|

|

|

||||

|

|

Sales |

|

|

||

Operating profit margin = |

Profit beforeinterestandtax |

×100 |

|

|

||

|

|

|

||||

|

|

Sales |

|

|

||

Return on Capital Employed (ROCE) = |

Profit beforeinterestandtax |

|

×100 |

|||

Shareholders'funds+ non - currentliabilities |

||||||

Return on Equity (ROE) = |

Profitaftertaxpreferencedividends |

×100 |

|

|||

Ordinaryshareholders'funds |

|

|||||

|

|

|

|

|||

1108

SESSION 11 – BUSINESS PLANNING AND EVALUATION

4.2Liquidity ratios

Current ratio = |

Currentassets |

|

|

Currentliabilities |

|||

|

|||

Quick or acid test ratio = |

Currentassets−inventory |

||

|

|

||

Currentliabilities |

|||

|

|||

4.3Efficiency/activity ratios

Accounts receivable days = |

Average accounts receivable |

|

×365 |

|||

Annual credit sales |

|

|

||||

|

|

|

|

|||

Accounts payable days = |

Averageaccountspayable |

× |

365 |

|||

Annual creditpurchases |

||||||

|

|

|

|

|||

Inventory days = |

Averageinventory |

×365 |

|

|

|

|

|

|

|

|

|||

|

Annual costof sales |

|

|

|

||

Cash conversion cycle = inventory days + receivables days – payables days

Total asset turnover = |

Sales |

|

|

Total assets |

|||

|

|||

Fixed asset turnover = |

Sales |

||

Fixedassets |

|||

|

|||

4.4Gearing/Risk ratios

Financial gearing: |

|

|

|

|

Debt to equity = |

Non-currentliabilities |

|

×100 |

|

Capital+reserves |

||||

|

|

|||

Debt to total capital = |

Non - current liabilities |

×100 |

||

Capital employed |

||||

|

|

|||

¾ gearing can also be referred to as leverage Operational gearing:

Fixedoperating costs |

×100 or |

Fixedoperating costs |

×100 |

|

Variableoperating costs |

Total operating costs |

|||

|

|

Interest cover = |

Profit before interest and tax |

|

|

Interest expense |

|||

|

|||

Cash flow coverage = |

Cash generated from operations |

||

|

|

||

Interest expense |

|||

|

|||

1109

SESSION 11 – BUSINESS PLANNING AND EVALUATION

4.5Investor ratios

Earnings per ordinary share (EPS)

= |

Profitafter taxpreferencedividends |

Weightedaveragenumberof ordinarysharesin issue |

Diluted EPS should also be calculated where a company has a complex capital structure that includes Potentially Dilutive Securities (PDS’s). These are securities in issue which involve an obligation to issue shares in the future e.g. convertible debt, warrants.

Diluted EPS = |

Profitaftertaxpreferencedividends+PDS adjustments |

|

|

|||||||

Weightedaverageordinaryshares+PDS'soutstanding |

||||||||||

|

||||||||||

Dividend cover = |

Profit ater tax - preference dividend |

|||||||||

|

|

|

|

|

|

|

|

|||

Ordinary dividend |

||||||||||

|

|

|||||||||

Dividend payout ratio = |

Ordinarydividend |

|||||||||

|

|

|

|

|

|

|

|

|||

Profit after tax - preferencedividend |

||||||||||

|

|

|||||||||

Dividend yield = |

Dividend per ordinary share |

×100 |

||||||||

|

|

|

||||||||

|

|

Ordinary share price |

||||||||

Price earnings ratio (P/E ratio) = |

Ordinary share price |

|

||||||||

EPS |

||||||||||

|

|

|||||||||

|

|

EPS |

||||||||

Earnings yield = |

|

× 100 |

|

|||||||

Ordinaryshareprice |

||||||||||

Total Shareholder Return (TSR) = |

Year -end share price +dividends |

× 100 |

||||||||

|

||||||||||

|

|

Share price at start of year |

||||||||

1110