Fin management materials / P4AFM-Session10_j08

.pdf

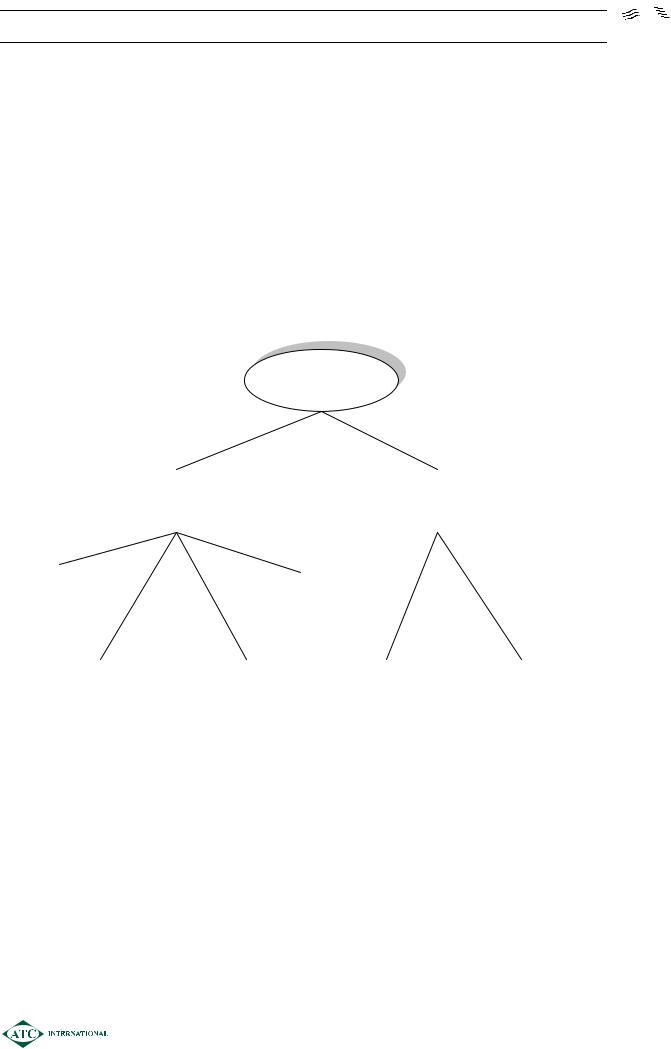

SESSION 10 – EQUITY & DEBT ISSUES

OVERVIEW

Objective

¾To understand how companies issue debt and equity.

¾To obtain an understanding of the domestic capital markets.

¾To obtain an understanding of the Euromarkets.

EQUITY &

DEBT ISSUES

|

|

|

|

|

|

|

|

EQUITY |

|

|

|

DEBT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TYPES OF |

|

|

|

|

|

|

|

|

|

ROLE OF |

|

|

|

ISSUE |

|

|

|

|

|

|

|

|

|

SPONSOR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADVANTAGES & |

|

|

|

STOCK |

|

|

|

DOMESTIC |

|

|

|

EUROMARKETS |

|

|

DISADVANTAGES |

|

|

|

EXCHANGE |

|

|

|

|

|

|

|

||

|

OF LISTING |

|

|

|

RULES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1001

SESSION 10 – EQUITY & DEBT ISSUES

1EQUITY ISSUES

1.1Key areas

¾The key points for companies that wish to become listed include:

The parties involved in a floatation/listing/quotation,

Preparation for a floatation,

Methods of issuing shares for companies coming to the market and for companies with a listing,

An overview of the regulatory system.

1.2The Stock Exchange

¾The Stock Exchange is responsible by law for controlling companies that are listed and those who are applying for a listing.

¾The Exchange’s rules serve to ensure that:

Applicants are suitable for a listing,

Securities are brought to the market in such a way that open and fair trading is ensured,

There is a balance between providing issuers with capital and protecting investors,

Relevant information is provided by companies.

1.3Parties involved in a floatation

1.3.1The Sponsor

¾The Sponsor is usually a member firm of The Stock Exchange, though not always.

¾The Sponsor’s responsibilities include ensuring that:

The company complies with The Stock Exchange rules, and

The directors understand their responsibilities.

¾In addition to the above, if the sponsor is a member firm, it will provide a market for the shares on the first day of trading.

1.3.2The Accountant

¾The accountant is required for an initial listing to prepare the Long Form Report which is a very detailed report giving information about the company’s organisation, commercial activities, personnel, fixed assets, accounting systems, financial results, future prospects, and any other relevant areas.

1002

SESSION 10 – EQUITY & DEBT ISSUES

1.3.3 Lawyers

¾ Solicitors ensure that all documents are phrased in an exact and acceptable form from a legal viewpoint.

1.3.4 Public relations Advisors

¾The PR advisor tries to market the shares effectively so that the shares are taken up and subsequently the share price rises.

2APPLYING FOR A LISTING

2.1Reasons for wanting a listing

¾Whenever a new company is formed, particularly with the assistance of venture capitalists, one of the aspirations of the directors and/or shareholders will be for the company to seek a listing in the future. In reality, very few companies ever actually come to the market and it is important to consider the reasons why a listing may be appropriate or not.

2.2Advantages of a listing

Exit route

Floatation of the company will enable investors to realise their investment. This may be a major factor where the company has venture capital or private equity investors who need to realise their gains within a set time scale. One of the first questions a venture capitalist will ask when assessing a business is the feasibility of various exit routes, including floatation.

Immediate source of long term capital for the business

The company will be able to issue new shares and obtain long term capital. This will enable the business to expand its markets, make acquisitions and reduce gearing levels.

Ongoing source of capital

The ability to issue new shares in the future, subject to investor sentiment, or to issue listed debt will give the company more flexibility in its financing options. This will translate into lower costs and will assist the company in its expansion plans.

Share for share acquisitions

The ability to issue shares as consideration when making an acquisition will give the company more options when implementing a strategy of growth.

Raised profile

The listing will give the company more credibility with potential customers and suppliers and will also be a source of publicity, leading to lower costs and higher revenues.

1003

SESSION 10 – EQUITY & DEBT ISSUES

Share incentive schemes

It will be easier to introduce share option schemes for employees and directors of a listed company since there is a readily ascertainable market price and a liquid market in which to dispose of a holding.

Personal factors

The directors of the company may feel attracted by the prestige of being the directors of a listed company.

2.3Disadvantages of a listing

Time and cost spent preparing for floatation

Planning a floatation is a lengthy procedure (typically at least six months). Throughout this time a significant amount of management effort will need to be diverted into the floatation process.

In addition, advisers will be spending time and charging fees. These may be rolled up and only be payable if the floatation goes ahead, but at some time the cost will come through.

The cost of the floatation itself

The floatation process itself is very expensive, involving fees to advisers, the Stock Exchange and the underwriters and various other expenses.

The ongoing costs of maintaining a listing

These include the ongoing fees to be paid to the Stock Exchange and higher compliance costs e.g. to satisfy the UK Combined Code on Corporate Governance or (even more expensive) the US Sarbanes-Oxley Act. Furthermore significant management time will be spent communicating with investors and ensuring that the company is being marketed properly.

Satisfying the needs of external shareholders

The needs of external shareholders will depend on the nature of those investors – whether they want income or capital growth, whether they are pension funds, insurance companies, unit trusts/mutual funds or private investors. The company will need to identify their needs and tailor the strategy of the company to meet those requirements.

However the pressure to achieve short term results may damage the long term development of the business – a problem often referred to as “myopia”.

1004

SESSION 10 – EQUITY & DEBT ISSUES

Accountability

The requirement to have non-executive directors on the board and to justify performance, executive pay and other decisions to outside shareholders may be an interference to directors used to running the company their own way.

Lack of privacy

The disclosure requirements set by the Stock Exchange and the fact that the company is subject to the attention of analysts and the public in general, means that the company will not have the benefits of secrecy and discretion available to a private company.

The risk of takeover

If the directors do not perform satisfactorily, the company may be taken from them and sold to a (possibly hostile) predator. They may feel a great sense of loss if they had built up the company from start-up – although the pain may be cushioned by “golden parachutes”.

Different culture

The culture of the business is likely to change since the directors will be answerable to outside shareholders. Previously, the business may have been run as a “lifestyle” company, with generous benefits to the directors and their families. Such advantages may disappear on listing.

Tax planning for investors

The scope for tax planning is much wider in an unquoted company with a small group of shareholders and an uncertain market value.

1005

SESSION 10 – EQUITY & DEBT ISSUES

3CONDITIONS FOR A LISTING

¾The conditions for a listing on the London Stock Exchange are published by the UK Listing Authority (UKLA) – a department of the Financial Services Authority.

¾The conditions below are for the Main Market – less strict conditions apply to the AIM (Alternative Investment Market):

Public limited company

Private limited companies (Ltd’s) are not permitted to issue shares to the public. Therefore a private company will need to re-register as a public limited company (Plc) before it can apply for a listing. This means that it must have an issued share capital of a least £55,000, of which at least one quarter must be paid up.

Company history

It is important that there is evidence of a company’s stability and likely future success. The company must have published accounts for the three years prior to the application for a listing, except in exceptional circumstances (e.g. Eurotunnel). The accounts must have been audited, usually have an unqualified audit report and comply in all material respects with International Financial Reporting Standards.

The main business activity of the company should also have been carried on for the previous three years. In addition, there should have been continuity of management over the period.

Directors

The directors must collectively have appropriate experience to run the business. They must be free of conflicts of interest unless it can be demonstrated that these will be managed to avoid detriment to the company.

Working capital

The directors must confirm in writing that the company has sufficient working capital for its needs and will not become insolvent in the near future.

Controlling shareholder

A controlling shareholder is a person who owns 30% or more of the voting rights in the company or who controls the board of directors. Such a person would have great influence over the company and this could lead to conflicts of interest between them and other shareholders.

The company must demonstrate that all significant decisions are taken by directors independent of a controlling shareholder and that there are arrangements in place to avoid detriment to other shareholders.

1006

SESSION 10 – EQUITY & DEBT ISSUES

Transferability of securities

The shares must be freely transferable. This may mean that the company will have to change its articles of association. Many private companies will have a condition that shares may only be transferred with the approval of the board of directors.

Market value of securities to be listed

In order to ensure that securities to be listed for the first time are readily marketable, the minimum market value of shares to be listed is £700,000. The minimum value of any debt securities to be listed is £200,000.

These limits may be ignored if the Stock Exchange is satisfied that securities of a lower market value would be adequately marketable. However, given the problems that small company shares have in being traded anyway, it is unlikely that this will often be the case.

Public shareholders

A sufficient number of the shares must be in the hands of the public, to ensure that the secondary market for the shares is sufficiently liquid and the shares are marketable. This requirement will be satisfied where 25% of the shares are in public hands. A lower percentage than 25% may be permitted if the shares will nevertheless be sufficiently marketable.

4ROLE OF THE SPONSOR

4.1Written submissions to the Stock Exchange

¾The sponsor must make the following written confirmations to the Stock Exchange:

Written declaration

On application for listing, a declaration to confirm that in all cases the directors are aware of their responsibilities under the UKLA rules and that adequate financial reporting procedures are in place.

Working capital report

A confirmation that the sponsor has received a working capital report from the directors of the company and that in the sponsor’s view it has been prepared with due care.

1007

SESSION 10 – EQUITY & DEBT ISSUES

Profit forecast report

A confirmation that a profit forecast (if presented) has been prepared with due care.

Declaration of sponsor’s interests

A declaration of interests should be submitted at an early stage i.e. if the sponsor holds shares in the company.

4.2Other factors

¾In addition to the specific requirements highlighted by the UKLA, a sponsor will need to consider a number of other factors. These will include the following:

Product range and customer base

The company should not be over reliant on one product or one customer.

State of the market

The markets in which the company is operating should preferably be growing, but certainly not in steep decline.

Management quality

This will need to be of the highest quality and should not have any weaknesses in one particular area, such as finance or marketing.

Accounting and financial information

The company should have good financial records giving a well documented history of its performance. Accounting policies should be conservative and consistently applied.

Background of the directors

The directors’ backgrounds should show financial integrity and adequate experience to run a large company.

Litigation and other contingent liabilities

The company should not have any unresolved litigation or other factors which may result in a significant liability to the business.

1008

SESSION 10 – EQUITY & DEBT ISSUES

5SUMMARY TIMETABLE

The following table summarises the build up to a listing for a company:

Time before listing |

Action |

|

|

24 weeks |

Appoint advisers |

|

Commence the Long Form Report |

|

Consult Stock Exchange |

|

Planning |

|

|

8 to 12 weeks |

Draft documents prepared |

|

Drafts submitted to Stock Exchange |

|

Public relations campaign starts |

|

|

1 to 6 weeks |

Draft Listing Particulars (detailed documents about the securities |

|

to be listed and the company) |

|

Formal submission of documents to Stock Exchange |

|

|

Final week |

Approval of documents by Stock Exchange |

|

Completion meeting |

|

Underwriting agreement signed |

|

Investment presentations |

|

Allocation lists open and basis of share allocation is announced |

|

Application for listing |

|

Dealings commence |

|

|

1009

SESSION 10 – EQUITY & DEBT ISSUES

6MAIN METHODS OF ISSUING SHARES

6.1Companies with an existing listing

¾In the case of a company which already has a listing, the Stock Exchange is concerned to protect the interests of existing shareholders. It therefore requires that the company gives existing shareholders pre-emption rights i.e. the right to purchase new shares in the company in preference to other investors.

¾This means that the usual method of issuing shares for a company which already has a listing is the rights issue. However, the Stock Exchange permits other methods to be used in certain circumstances.

6.2New applicants for a listing

¾The objective of the Stock Exchange is to ensure the marketability of the shares when listed. The major methods which may be used are:

Offer for Subscription - the company sells new shares directly to the public.

Offer for Sale - new shares are sold to an intermediary who then sells to the general public.

Placing - new shares are sold to specific individuals (to obtain a listing there must be more than five individuals.)

Introduction - no new shares are issued, two market makers simply agree to trade existing shares. This method is often used when a company de-merges.

¾Whichever method is used, there must be a least two market makers willing to make a market in the securities, of which at least one must be independent of the sponsor or other advisers.

¾If the sponsor or any other adviser becomes interested in 3% or more of the shares this must be notified to the Stock Exchange before dealings in the securities commence.

1010