Fin management materials / 4 P4AFM-Session06_j08

.pdf

SESSION 06 – ADVANCED INVESTMENT APPRAISAL

OVERVIEW

Objective

¾To use Adjusted Present Value to evaluate a project whose financing package disturbs the firm’s existing capital structure.

¾To appreciate the approach of Real Options Pricing Theory.

¾To formulate a linear programming model to deal with multi-period capital rationing.

¾To calculate Modified Internal Rate of Return.

¾To calculate measures of project liquidity and project risk.

ADVANCED

INVESTMENT

APPRAISAL

|

|

|

|

|

|

|

|

ADJUSTED |

|

|

|

RISK ANALYSIS |

|

|

PRESENT VALUE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REAL OPTIONS |

|

|

|

LIQUIDITY |

|

|

PRICING THEORY |

|

|

|

MEASURES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CAPITAL |

|

|

|

MODIFIED IRR |

|

|

RATIONING |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0601

SESSION 06 – ADVANCED INVESTMENT APPRAISAL

1ADJUSTED PRESENT VALUE (APV)

¾An alternative approach to appraising new investments where a project changes both the firm’s level of operating risk and its capital structure i.e. business risk and financial risk.

¾It is often described as the “divide and conquer” approach in that it separates the “base” benefits of the project from its “side-effects”.

¾APV is calculated as

APV |

= Project value if all + |

Present value of |

+ |

Present value of |

|

equity financed |

the tax shield |

/- |

other side effects |

|

|

from any debt |

|

|

Approach

(a)Calculate the operational value of the project as if it were being financed only by equity − “Base Case NPV”.

The operating cash flows are discounted at a cost of equity ungeared representing the project’s level of business risk.

(b)Calculate the present value of the “side-effects” e.g.

present value of tax shield from interest on any debt used to finance the project.

present value of issue costs from raising finance.

The financing side effects are discounted at the pre-tax cost of debt (or the risk-free rate if it is believed that such cash flows are absolutely without risk)

A project should be accepted if the APV is positive

0602

SESSION 06 – ADVANCED INVESTMENT APPRAISAL

Example 1

Blades plc is considering diversifying its operations away from its main area of business (food manufacturing) into the plastics business. It wishes to evaluate an investment project which involves the purchase of a moulding machine costing $450,000. The project is expected to produce net annual operating cash flows of $220,000 for each of the three years of its life. At the end of this time its scrap value will be zero.

The assets of the project will support debt finance of 40% of its initial cost (including issue costs). The loan is to be repaid in three equal annual instalments. The balance of finance will be provided by a placing of new equity. Issue costs will be 5% of funds raised for the equity placing and 2% for the loan. Issue costs are allowable for corporation tax.

The plastics industry has an average equity beta of 1.356 and an average debt: equity ratio of 1:5 at market values. Blades’ current equity beta is 1.8 and 20% of its long-term capital is represented by debt which is generally regarded to be risk-free.

The risk-free rate is 10% pa and the expected return on the market portfolio is 15%. Corporation tax is at 35%, payable one year in arrears. The machine will attract a 70% capital allowance; the balance is to be written off over the three years and is allowable against tax. The firm is certain that it will earn sufficient profits against which to offset these allowances.

Appraise the investment project using.

(a)the current WACC

(b)a WACC adjusted for business and financial risk

(c)Adjusted Present Value.

0603

SESSION 06 – ADVANCED INVESTMENT APPRAISAL

Solution

(a)

(b)

0604

SESSION 06 – ADVANCED INVESTMENT APPRAISAL

(c)

0605

SESSION 06 – ADVANCED INVESTMENT APPRAISAL

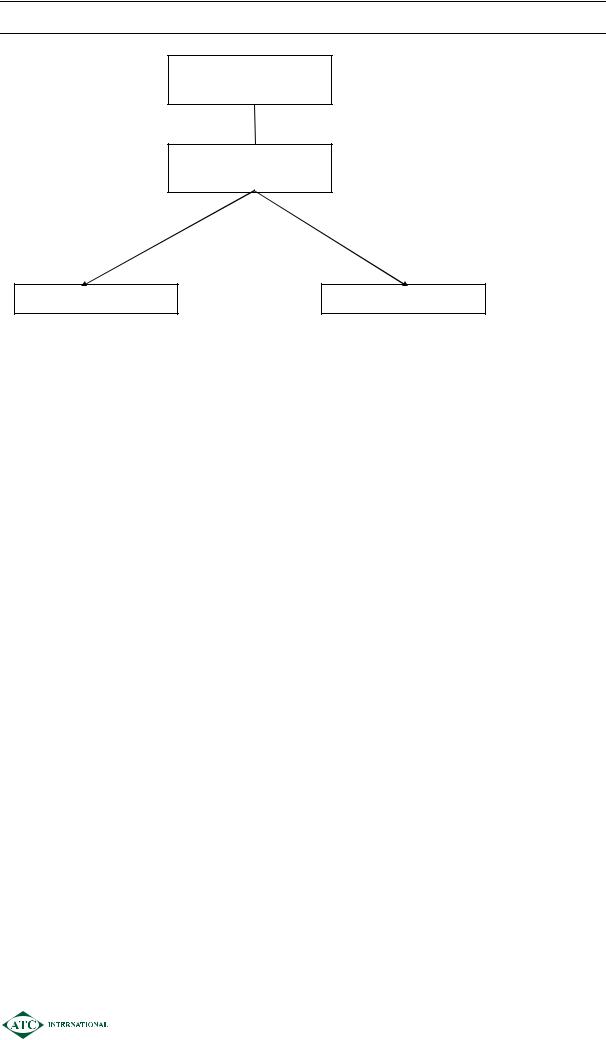

Comparison of NPV and APV

NPV

Firstly prepare cash flow.

Take βe of company in target industry and degear. Gives βa.

Regear βa to take account of project gearing.

This gives βe which reflects project finance and project risk.

Use βe in CAPM to calculate Ke geared.

Calculate post-tax cost of debt.

Calculate WACC.

Discount cash flows.

Accept project if positive NPV.

APV

Firstly prepare cash flow.

Stage 1 Base Case NPV

Take βe of company in target industry and degear. This give βa.

Put βa into CAPM, gives Ke ungeared.

Discount operating cash flows at Ke ungeared.

Total of discounted cash flow is “base case” NPV.

Stage 2 PV of tax shield

Discount tax savings on debt interest at the pre-tax cost of debt.

Stage 3 PV of issue costs

Discount issue costs at the pre-tax cost of debt.

APV is the sum of Stages 1, 2 and 3. If positive accept project.

Commentary

APV is based on Modigliani and Miller. At Stage 1 we are using M&M’s original model without tax. Ignoring tax there is no reason to regear the asset beta because WACC = Ke ungeared.

Stages 2 & 3 simply correct imperfections in M&M’s original model. Stage 2 brings in M&M’s model with tax and adds the value of the tax shield. M&M assumed issue costs don’t exist. They do in practice so we must take account of this in stage 3.

Stages 2 & 3 are not necessary for traditional NPV as all financing implications are included in the WACC.

0606

SESSION 06 – ADVANCED INVESTMENT APPRAISAL

2REAL OPTIONS PRICING THEORY

Real Options Pricing Theory (ROPT) tries to measure the value of managerial flexibility to adapt decisions in response to unexpected market developments.

Companies create shareholder value by identifying, managing and exercising real options associated with their investment portfolio.

The real options method applies options valuation models to quantify the value of management flexibility in a world of uncertainty.

Traditional methods of project appraisal (e.g. Net Present Value) fail to accurately capture the economic value of investments in an environment of widespread uncertainty and rapid change.

The real options method represents the new approach for the valuation and management of strategic investments.

A real option is easier to describe than to define. A financial option is a contract that grants to the holder the right but not the obligation to buy or sell an asset at a fixed price within a fixed period (or on a fixed date). Real options theory attempts to extend the valuation techniques of financial option pricing (e.g. the Black Scholes model) to the valuation of non – financial assets e.g. projects.

Instead of viewing an asset or project as a single set of expected cash flows (as in NPV), the asset is viewed as a series of compound options that, if exercised, generate another option and a cash flow. These are sometimes referred to as options “embedded” within a project.

True NPV = traditional NPV + value of embedded options.

Examples of business situations that can be modelled as real options:

¾“Waiting to invest options”- as in the case of a trade-off between immediate plant expansion (and possible losses from decreased demand) and delayed expansion (and possible lost revenues)

¾“Growth options” - as in the decision to invest in entry into a new market

¾“Flexibility options” - as in the choice between building a single centrally located facility or building two facilities in different locations

¾“Exit options”- as in the decision to develop a new product in an uncertain market

¾“Learning options” - as in a staged investment in advertising.

Supporters of ROPT argue that a focus on the value of flexibility provides a better measure of projects that would otherwise appear uneconomical using NPV.

0607

SESSION 06 – ADVANCED INVESTMENT APPRAISAL

3CAPITAL RATIONING

3.1Definition

A situation where there is not enough finance available to undertake all available positive NPV projects.

¾Hard capital rationing – where the capital markets impose limits on the amount of finance available e.g. due to high perceived risk of the company.

¾Soft rationing – where the company itself sets internal limits on finance availability e.g. to encourage divisions to compete for funds.

¾Single-period capital rationing - where capital is in short supply in only one period.

¾Multi-period - where capital is rationed in two or more periods.

3.2Single-period capital rationing

¾If projects are divisible i.e. any portion of a project may be undertaken, the correct method is to calculate a profitability index for each project and then to rank them according to this measure.

¾ Profitability index |

= |

NetPresentValue |

|

CapitalInvested |

|||

|

|

¾If projects are non-divisible there is no need to calculate the index above – the optimal investment plan can only be found using trial and error i.e. trying different combinations of projects until the maximum possible NPV is found.

3.3Multi-period capital rationing

¾If investment funds are expected to be restricted in more than one period then neither the profitability index nor trial and error approaches can be used, as they do not take into account the restriction on finance in future periods.

¾If projects are divisible then a linear programming model must be formulated and solved. If there are only two projects the solution can be found graphically. Three of more variables require a computer solution.

0608

SESSION 06 – ADVANCED INVESTMENT APPRAISAL

MULTI-PERIOD

CAPITAL RATIONING

Linear programming approach

NPV formulation

Aim

To maximise NPVs of projects

Method

Let a, b etc be proportion of projects A, B undertaken

Objective function

PV of dividends

To maximise present value of dividends

Let a, b, c be the proportions of projects A, B, C undertaken, and d0, d1, d2 be the dividend paid at t0, t1, t2 etc

Maximise (a × NPVA) + (b × NPVB)

Constraints

(a x outflow A) + (b x outflow B) ≤ Period 1 capital constraint and inflows.

(a x outflow A) + (b x outflow B) ≤ Period 2 capital constraints and inflows etc

a,b .................... |

≤ 1 |

a,b .................... |

≥ 0 |

Maximise d0 + |

d1 |

+ |

d2 |

|

(1+ r) |

(1+ r)2 |

|||

|

|

where r = cost of capital

(a × outflow A) + (b × outflow B) + d1 ≤ Period 1 constraint and inflows.

(a x outflow A) + (b × outflow B) + d2 ≤ Period 2 constraints and inflows etc

a,b |

................................ ≤ 1 |

a,b.......... |

d 0 ,. d 1 ,. d 2 ..... ≥ 0 |

Assumes

All surplus cash is distributed as dividends

¾If projects are non-divisible the mathematics become even more complex and would not be required in the examination.

0609

SESSION 06 – ADVANCED INVESTMENT APPRAISAL

Example 2

A company is considering investment in two projects both of which are divisible. However, neither project can be deferred.

The cash flows of the two projects are:

Year |

Project A |

Project B |

0 |

(20,000) |

(40,000) |

1 |

(40,000) |

(20,000) |

2 |

(60,000) |

− |

3 |

200,000 |

120,000 |

The company’s cost of capital is 10%.

The funds available to the company are restricted as follows:

Year

0$40,000

1 $50,000

2$40,000

Required:

Determine the company’s optimum investment policy to maximise NPV.

Solution

0610