Fin management materials / 4 P4AFM-Session06_j08

.pdf

SESSION 06 – ADVANCED INVESTMENT APPRAISAL

Tax relief on loan interest |

|

|

|

|

|

|

|

Gross value of loan |

|

= $(180,000 + 3,673) |

|

||||

|

|

= $183,673 |

|

|

|

||

Annual repayments |

|

= |

|

$183,673 |

|

|

|

|

|

3yr a.f.@10% |

|

||||

|

|

= |

|

$183,673 |

|

|

|

|

|

2.487 |

|

|

|

||

|

|

|

|

|

|

||

|

|

= $73,853 |

|

|

|

||

Loan schedule |

|

|

|

|

|

|

|

|

Opening |

Interest |

Repay- |

Closing |

|||

|

balance |

|

|

|

ment |

balance |

|

|

$ |

|

$ |

$ |

$ |

||

Year 1 |

183,673 |

18,367 |

73,853 |

128,187 |

|||

Year 2 |

128,187 |

12,819 |

73,853 |

67,153 |

|||

Year 3 |

67,153 |

6,715 |

73,853 |

15 |

|||

(difference due to rounding)

Tax relief at 35% on interest (one year’s delay)

|

Cash |

10% |

PV |

|

$ |

factor |

$ |

Year 2 |

6,428 |

0.826 |

5,309 |

Year 3 |

4,487 |

0.751 |

3,370 |

Year 4 |

2,350 |

0.683 |

1,605 |

|

|

|

_______ |

|

|

|

10,284 |

|

|

|

_______ |

Adjusted Present Value |

|

|

|

|

|

|

$ |

Base NPV |

|

|

20,552 |

Issue costs |

|

|

(12,193) |

Tax shield |

|

|

10,284 |

|

|

|

_______ |

Project APV |

|

|

18,643 |

|

|

|

_______ |

0621

SESSION 06 – ADVANCED INVESTMENT APPRAISAL

Solution 2

Let |

a be the proportion invested in project A. |

|||

|

|

b be the proportion invested in project B. |

||

Subject to the constraints: |

|

|

||

Year 0 |

20,000a + 40,000b |

≤ |

40,000 |

|

Year 1 |

40,000a + 20,000b |

≤ |

50,000 |

|

Year 2 |

60,000a |

≤ |

40,000 |

|

0 |

≤ a ≤ 1 |

|

|

|

0 |

≤ b ≤ 1 |

|

|

|

The objective function:

Maximise NPV = 44,280a + 31,940b (W )

WORKING

NPV of projects

Time |

DF @ 10% |

Project A |

|

Project B |

|

|

|

Cash flow |

PV |

Cash flow |

PV |

|

|

$ |

$ |

$ |

$ |

0 |

1.00 |

(20,000) |

(20,000) |

(40,000) |

(40,000) |

1 |

0.909 |

(40,000) |

(36,360) |

(20,000) |

(18,180) |

2 |

0.826 |

(60,000) |

(49,560) |

− |

− |

3 |

0.751 |

200,000 |

150,200 |

120,000 |

90,120 |

|

|

|

_______ |

|

_______ |

|

|

|

44,280 |

|

31,940 |

|

|

|

_______ |

|

_______ |

0622

|

|

|

SESSION 06 – ADVANCED INVESTMENT APPRAISAL |

|

|

|

|

||

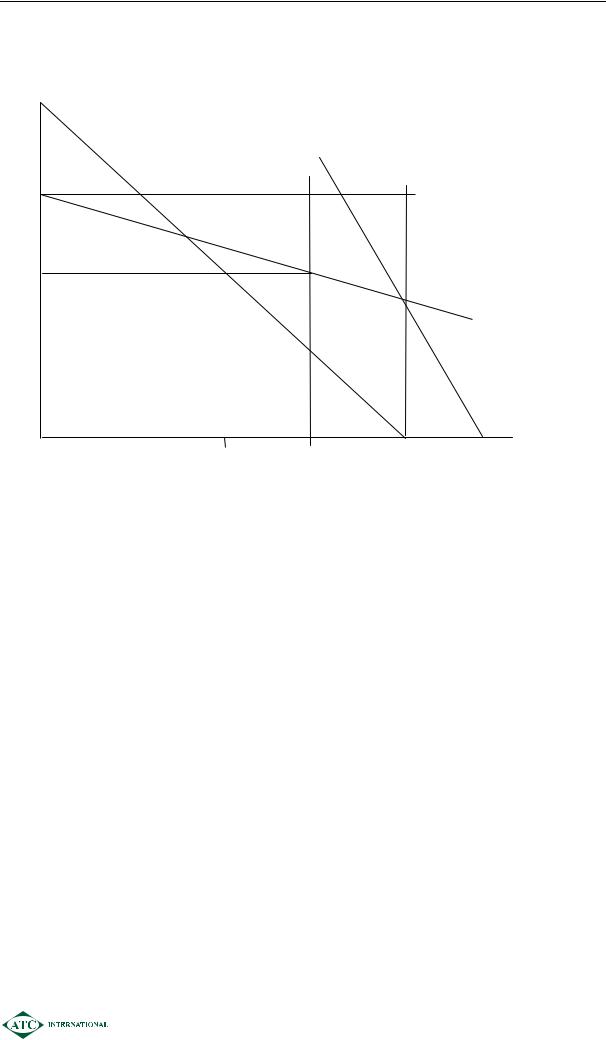

Graph |

|

|

||

|

x |

|

|

|

|

|

|

||

|

|

objective |

|

|

b |

|

|

40,000a + 20,000b ≤ 50,000 |

|

|

|

|||

1 |

x |

|

b = 1 |

|

20,000a + 40,000b = 40,000 |

||||

|

|

|||

|

|

|

O |

|

0.5 |

|

|

x a = 1 |

|

|

|

|

||

|

|

|

60,000a = 40,000 |

|

|

x |

|

x |

0.5 |

0.67 |

1 |

a |

To plot the objective function set it equal to (say) $44,280

44,280a + 31,940b = 44,280

when |

a = 0 |

b = 1.386 |

when |

b = 0 |

a = 1 |

Optimal solution

From the graph the objective function would appear to be maximised at point O. Reading off from the graph, this would comprise 2/3 of project A and 2/3 of project B.

0623

SESSION 06 – ADVANCED INVESTMENT APPRAISAL

Solution 3

T0 |

T1 |

T2 |

T3 |

T4 |

(34,000) |

7600 |

16,500 |

13,000 |

6,600 |

Future value of first year cash flow = 7600 × 1.083 = 9574

Future value of second year cash flow = 16500 × 1.082 = 19245

Future value of third year cash flow = 13000 × 1.08 = 14040

Total future value = 9574 + 19245 + 14040 + 6600 = 49459

MIRR = 4 3400049459 -1 = 9.82%

Solution 4

(a)

T0 |

T1 |

T2 |

T3 |

T4 |

|

(34,000) |

7600 |

16,500 |

13,000 |

6,600 |

|

Present Value |

7037 |

14146 |

10320 |

4851 |

|

Total present value of recovery phase = 36354 |

|

||||

Recovery = |

34000 |

× 4 = 3.73 years |

|

|

|

36354 |

|

|

|||

|

|

|

|

|

|

(b)

|

T1 |

T2 |

T3 |

T4 |

|

|

7600 |

16,500 |

13,000 |

6,600 |

|

Present Value |

7037 |

14146 |

10320 |

4851 |

Total = 36354 |

7037/36354 = |

0.194 |

0.389 |

0.284 |

0.133 |

Total = 1 |

Duration = (0.194) + (0.389×2) + (0.284×3) + (0.133×4)

= 2.356 years

0624

SESSION 06 – ADVANCED INVESTMENT APPRAISAL

Solution 5

(a)

The volatility attached to the NPV indicates that there are (z) standard deviations between the expected net present value and zero:

Z = |

1.964 |

- 0 |

= 1.9255 |

1.02 |

|

||

|

|

|

From the published tables this gives an area of approximately 0.473 i.e. a probability of 0.5- 0.475 = 2.7%

(b)

At the 95% confidence level z = 1.645.

VAR = 1.645 × 1.02 × √10 = $5.3m

VAR (99% confidence) = 2.33 × 1.02 × √10 = $7.51m

0625

SESSION 06 – ADVANCED INVESTMENT APPRAISAL

0626