Fin management materials / 11 P4AFM-Session14_j08

.pdf

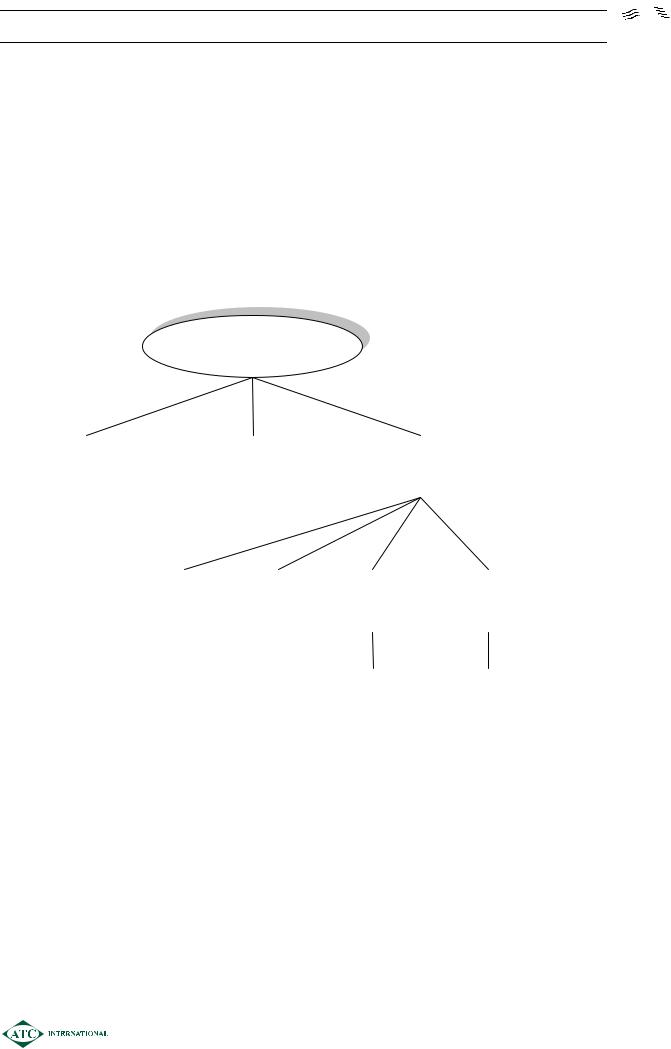

SESSION 14 – INTEREST RATE RISK MANAGEMENT

OVERVIEW

Objective

¾To appreciate the nature of interest rate risk.

¾To describe internal methods of hedging interest rate exposure.

¾To implement and evaluate external hedging strategies.

INTEREST RATE RISK

MANAGEMENT

|

|

|

|

|

|

|

|

|

|

|

|

TYPES OF RISK |

|

|

|

INTERNAL |

|

|

|

EXTERNAL |

|

|

|

|

|

HEDGES |

|

|

|

HEDGES |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FRA‘S |

|

|

|

OTC |

|

|

|

FUTURES |

|

|

|

|

|

SWAPS |

|

|

|

|

|

|

|

OPTIONS |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPTIONS |

|

|

|

SWAPTIONS |

|

|

|||

|

|

|

|

|

|

|

|

|

ON |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

FUTURES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1401

SESSION 14 – INTEREST RATE RISK MANAGEMENT

1NATURE OF INTEREST RATE RISK

1.1Exposure to rising interest rates

¾There are two main situations where a company may fear rising interest rates:

a company which has a significant proportion of floating interest rate debt it will fear a rise in interest rates as this obviously leads to lower profits. However higher interest expense also leads to higher financial risk i.e. more volatile future profits due to a larger block of committed interest expense to be covered. An extreme interest rate rise could even cause financial distress risk i.e. bankruptcy.

a company which has a significant amount of surplus cash invested in fixed interest rate securities e.g. government bonds – if market interest rates rise then bond prices fall.

1.2Exposure to falling interest rates

¾There are two main situations where a company may fear falling interest rates:

a company which has a significant proportion of fixed interest rate debt and therefore does not participate in the benefits of falling rates.

company with significant floating rate investments e.g. money market investments.

1.3Other types of interest rate risk

¾Basis Risk – even if a company has floating rate assets and floating rate liabilities of similar size, they may be linked to different reference rates which may change at different times and/or by different amounts. This can be referred to as basis risk (which is also used to describe the risk of an unexpected change in the level of basis in a futures contract).

¾Gap Exposure - if a company has floating rate assets and floating rate liabilities of similar size that are all linked to the same reference rate e.g. LIBOR (London Interbank Offered Rate), it can still face risk. It is possible that the interest rate is reset at different intervals on assets and liabilities e.g. every 6 months on assets but every 3 months on liabilities.

1.4Management of Interest Rate Risk

¾For some companies it may be practical to use internal methods of hedging against interest rate risk e.g.

Smoothing – maintaining a balance between fixed rate and floating rate borrowing.

Matching – attempting to have a common interest rate for both assets and liabilities. This is more practical for financial institutions than for trading companies.

1402

SESSION 14 – INTEREST RATE RISK MANAGEMENT

¾However it may be necessary to also consider external hedging techniques. The following are mentioned in the syllabus and will be considered in detail:

Forward Rate Agreements (FRA’s)

OTC options – caps, floors and collars

Interest rate futures contracts

Options on interest rate futures

Interest rate swaps and swaptions

2FORWARD RATE AGREEMENTS

Definition

An agreement by a bank to enter into a notional loan or accept a notional deposit from a customer for a specified period of time. The contract is settled based upon the difference between the interest rate agreed when the contract is signed and the rate prevailing when the notional loan/deposit is deemed to start.

¾FRAs allow companies to fix, in advance, either a future borrowing rate or a future deposit rate, based on a notional principal amount, over a given period.

¾FRAs are settled in advance i.e. when the notional loan/deposit is deemed to start, The settlement is based upon the difference on settlement date between:

the rate fixed in the contract

the reference interest rate e.g. LIBOR

¾FRA’s are therefore cash settled rather than requiring physical delivery i.e. a company cannot actually borrow or invest money using an FRA – but can use it to hedge the interest rate on underlying physical positions.

¾The maximum maturity period for an FRA is usually around two years.

¾FRA’s are customised agreement with a bank i.e. OTC.

¾No premium is paid for an FRA and no margin needs to be posted.

¾Although no money changes hands when an FRA is signed, the words “buy” and “sell” are still used:

Buying an FRA – represents taking a notional loan from the bank at a fixed borrowing rate. Hence a company would buy an FRA to hedge against rising interest rates.

Selling an FRA – represents making a notional deposit at the bank at a fixed rate. A company would sell an FRA to hedge against falling rates.

1403

SESSION 14 – INTEREST RATE RISK MANAGEMENT

¾If the company buys an FRA it will be offered a higher rate than if it sells an FRA i.e. the bank makes its profit by applying a spread to the rates; and this is where the cost of hedging for the company is “hidden”.

Illustration 1

A company plans to borrow $20 million in 3 months time for a period of 6 months. The interest rate on the loan will be set at LIBOR + 0.5%. The company fears that LIBOR may rise above 5%during the next 3 months.

It can buy an FRA from a bank at an agreed rate of 5% on a notional principal of $20 million, starting in 3 months from today, ending 9 months from today and referenced to LIBOR. This is known as a 3v9 FRA.

¾if LIBOR is higher than 5% in 3 month’s time then the bank pays the company the difference between 5% and LIBOR i.e. cash settlement is made at the start of the FRA period. The compensation would be calculated as the present value of the interest rate difference on a $20m 6 month loan (discounted at LIBOR)

¾if actual interest rates are lower than 5% then the company pays the bank the difference.

Therefore whatever happens to LIBOR during the next 3 months the company will pay interest at a rate of 5% (plus 0.5%) on the underlying $20 million loan.

No premium is paid for the FRA. There is also no reason why the company must use the same bank for the FRA and the underlying loan

1404

SESSION 14 – INTEREST RATE RISK MANAGEMENT

3OTC OPTIONS

Various OTC interest rate options can be purchased from financial institutions and tailormade to meet company requirements. The major types are:

3.1Cap

Definition

An interest rate cap is an agreement by the seller of the cap to pay the buyer the excess of the reference interest rate over the agreed cap rate, based on a notional principal amount.

¾Caps are usually written/sold by financial institutions and purchased by companies.

¾If the reference interest rate rises above a pre-determined level, the financial institution pays the difference to the company, based upon an agreed notional principal and time period. This puts a cap or ceiling on the interest rate paid by the company. If the reference rate stays below the pre-determined rate the cap will not be exercised.

¾An interest rate cap is an option which allows the buyer, for the cost of the premium, to limit the interest that it pays to a maximum amount whilst being able to take advantage of possible falls in interest rates.

Illustration 2

Co A has $1 million of debt in issue and it pays interest on this debt at the rate of LIBOR+0.5%. Interest is due every 3 months and Co A’s treasury manager is concerned about a possible rise in interest rates during the next 6 months above the current LIBOR of 5%.

Co A buys a 6 month interest rate cap based upon a notional principal of $1 million with a cap rate of 7%. The cap is reset every 3 months.

LIBOR at the end of the first three month period is 8%. This means that under the cap agreement the seller of the cap must pay Co A:

1% × $1,000,000 × 3/12 |

= |

$2,500 |

being the difference between the reference interest rate (8%) and the cap rate (7%) based upon the notional principal amount for a three month period.

LIBOR at the end of the next three month period is 4%

Co A simply pays 4.5% interest on its debt and the cap option is not exercised.

1405

SESSION 14 – INTEREST RATE RISK MANAGEMENT

3.2Floor

Definition

An interest rate floor is an agreement by the seller of the floor to pay the buyer the excess of the agreed floor rate over the reference interest rate based upon a notional principal amount.

¾Floors are usually written by financial institutions and purchased by companies.

¾If the reference interest rate falls below a pre-determined level, the financial institution pays the difference to the company. This would be relevant for a company with floating rate investment income that wishes to guarantee a minimum return.

Illustration 3

Co B has investments of $2m producing income of LIBOR which is currently 5%. Interest is received every 3 months. The company does not wish to see this income decline during the next 6 months.

Co B therefore purchases a 6 month floor at 5% based upon a notional principal of $2 million and referenced to LIBOR every 3 months.

LIBOR at the end of the first three month period is 4%

Seller of floor pays Co B 1% × $2,000,000 × 3/12 |

= |

$5,000 |

LIBOR at the end of the next three month period is 7%

Co B receives 7% on its investments and the floor option is not exercised.

1406

SESSION 14 – INTEREST RATE RISK MANAGEMENT

3.3Collar

Definition

A low-cost cap or interest rate collar is a combination of a purchased cap and a written/sold floor agreement. It protects against rising interest rates but limits participation in falling rates.

¾Buying an interest rate cap can be expensive in terms of the premium cost. Therefore by simultaneously selling a floor a premium can also be received to reduce the net cost of the hedge.

¾The effect of the collar is to create both a maximum and a minimum interest rate. The benefit is the reduced cost of establishing the hedge but the disadvantage is that it restricts the possible gains from drops in interest rates compared to simply buying a cap.

¾Building a collar is also known as a constructing a “lowcost cap”.

Illustration 4

Co A has floating rate debt. The treasury manager believes that LIBOR might rise above 7% but he is fairly confident that it will not fall below 5%.

Therefore Co A – |

buys a cap from a bank at 7% |

– |

sells a floor at 5% |

If LIBOR rises to 8% – bank pays 1% difference to Co A

If LIBOR falls to 3% – Co A pays 2% difference to the buyer of the floor

Co A has created an interest band of 5% - 7%.

¾Another variation on the collar is the “low-cost floor” i.e. buy a floor/sell a cap. This may be considered by a company with floating rate investments that wants to protect against falling interest rates but is discouraged by the cost of just buying a floor. By also selling a cap the cost of the hedge falls but so does the participation in rising interest income.

1407

SESSION 14 – INTEREST RATE RISK MANAGEMENT

4INTEREST RATE FUTURES

Definition

Interest rate futures (IRF’s) are traded forward interest rate agreements

4.1Characteristics of IRF’s

¾The nature and terminology of interest rate futures is very similar to that of currency futures, as are the principles of hedging.

¾The most common futures contract to use for interest rate hedging is a “three-month” contract. This contract is referenced to short-term interest rates e.g. three month LIBOR. In London these are traded on LIFFE (now part of NYSE Euronext) and are also referred to as “short sterling futures”.

¾The key to hedging with these contracts is familiarity with the pricing convention: Contract price = 100 – implied forward interest rate

Illustration 5

3 month sterling interest rate futures |

£500,000 contract size |

LIFFE prices on 4 February: |

|

Mar |

93.65 |

June |

93.42 |

Sep |

93.21 |

Dec |

93.03 |

Assume the delivery date is the end of the relevant month (in practice it is the third Wednesday)

Consider the March futures:

On the 4 February the forward interest rate for the end of March = 100-93.65 = 6.35%. If LIBOR on 4 February is 6% then the basis in March futures = 0.35%. Between 4 Feb and the end of March the level of basis in the contract must fall to zero.

If, by chance, LIBOR is still 6% on the delivery date the contract price would be 100-6 = 94.00

1408

SESSION 14 – INTEREST RATE RISK MANAGEMENT

¾In effect the “seller” of the contract agrees to issue, at a price agreed today, a 3 month sterling discount bill on the delivery date with a face value of £500,000. The “buyer” agrees to buy this bill on the delivery date, and to pay the agreed price.

¾The implied interest rate in a futures contract is a therefore a forward interest rate i.e. the interest rate that applies on the delivery date of the contract.

¾Physical delivery will not occur as most participants will use “offset” before the delivery date. Even if the contracts are held until their delivery date they are cash settled rather than by physical delivery i.e. the seller does not actually issue a discount bill to the buyer, each party simply takes an equal and opposite gain or loss depending on the price change of the contracts. Gains/losses accrue daily using the mark to market system.

¾Therefore a company cannot physically borrow or invest money using 3-month interest rate futures. However the contracts can be used to hedge interest rate risk on an underlying physical loan or deposit.

4.2Hedging with IRF’s

¾If a company wishes to hedge against rising interest rates it should use futures as follows:

Today sell interest rate futures

Wait for interest rates to rise

If interest rates rise, the price of futures should fall

“Close out” the futures position by buying the same contracts that were originally sold.

There should be a gain on futures (as we sold high and bought low) to cover higher interest expense on company debts. The gain can be calculated using the tick system:

− |

tick size |

= 0.01% |

− |

tick value |

= 0.0001 × £500,000 × 3/12 (3 month’s notional interest) = £12.50 |

However the hedge is not likely to be perfectly efficient as futures prices rarely move the same amount as LIBOR due to the fall in basis over the life of the contract.

¾Note above that we first sold futures and later bought them. This is called taking a “short position” and is possible in all futures markets because of the ability to close out positions before contracts reach their delivery date.

1409

SESSION 14 – INTEREST RATE RISK MANAGEMENT

5OPTIONS ON FUTURES CONTRACTS

5.1LIFFE short sterling options

¾LIFFE short sterling option contracts involve an option on interest rate futures contracts.

¾It is convenient for both speculators and risk managers that the options are on futures rather than on underlying discount bills as futures do not require physical delivery.

Illustration 6

LIFFE short sterling options £500,000 contract size (4 February)

|

|

CALLS |

|

|

PUTS |

|

Strike price: |

Mar |

Jun |

Sep |

Mar |

Jun |

Sep |

9350 |

0.18 |

0.13 |

0.13 |

0.03 |

0.21 |

0.42 |

9375 |

0.03 |

0.05 |

0.06 |

0.13 |

0.38 |

0.60 |

9400 |

0 |

0.01 |

0.02 |

0.35 |

0.59 |

0.81 |

Strike price represents the price at which the underlying interest rate futures contract can be bought or sold at. There is a convention that the decimal point is removed i.e. 9350 = 93.50

The holder of calls has the right to buy futures contracts at the chosen strike price on or before the chosen expiry date (traded options are American style)

The numbers below the month columns represent the price of each option i.e. the premium. The premium is expressed as a percentage cost on £500,000 for 3 months (the specification of the notional bill in the futures contract) but can be easily calculated in total using the tick system.

5.2Hedging with options on futures contracts

¾Interest rate cap – to protect against rising interest rates the company should buy puts on interest rate futures. If interest rates rise the price of futures will fall. The company can then buy futures at the lower market price, exercise the puts to sell the futures at the strike price and take a gain.

¾Interest rate floor – to protect against falling interest rates the company should buy calls. If rates fall then futures prices will rise. The company can then exercise the calls to buy futures at the strike price, sell them at the higher market price and take a gain.

¾Low cost cap/collar – a combination of the above i.e. buy puts and simultaneously sell calls.

¾Low cost floor/collar – buy calls/sell puts.

1410