Fin management materials / 11 P4AFM-Session05_j08

.pdf

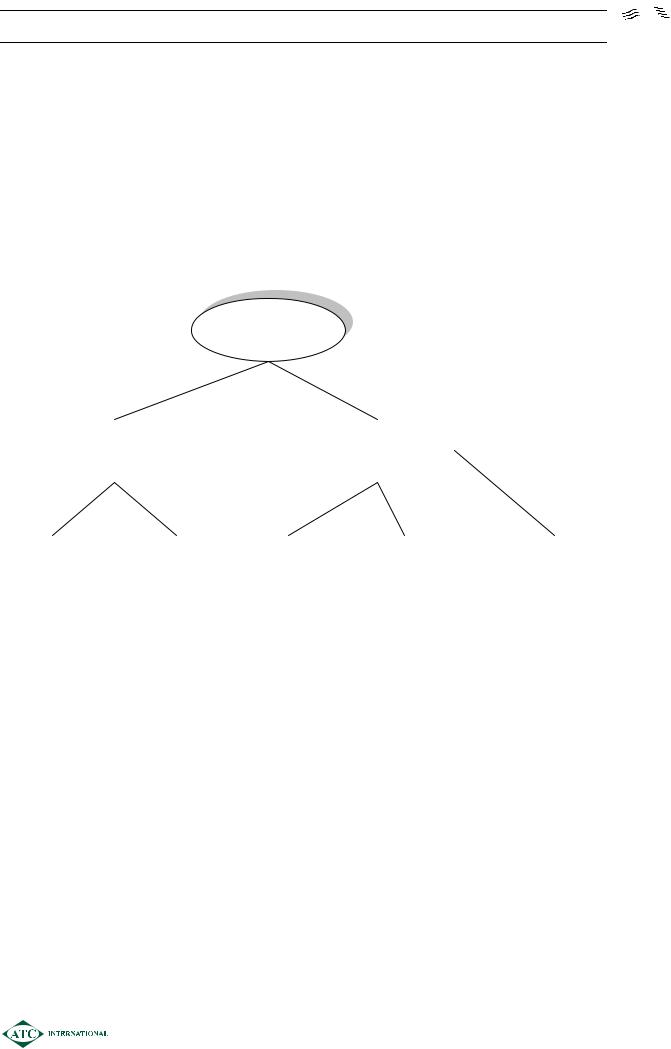

SESSION 05 – BASIC INVESTMENT APPRAISAL

OVERVIEW

Objective

¾To revise profit and payback based measures of investment appraisal and discounted cash flow (DCF) methods.

INVESTMENT

APPRAISAL

|

|

|

|

|

|

|

|

NON DCF |

|

|

|

DCF |

|

|

METHODS |

|

|

|

METHODS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PAYBACK |

|

|

|

ARR |

|

|

|

NPV |

|

|

|

IRR |

|

|

|

RELEVANT CASH |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FLOWS |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0501

SESSION 05 – BASIC INVESTMENT APPRAISAL

1NON DCF METHODS OF INVESTMENT APPRAISAL

1.1Purpose of investment appraisal

The purpose of investment appraisal is to determine whether an investment project gives an adequate financial return. This return can be measured in a variety of ways but the most common are either by measuring the profitability of the investment or the cash flows from the investment.

Profits can be distorted by selection of different accounting policies and therefore methods based upon cash flows are preferable.

1.2Payback Period

The time it takes for the operating cash flows from a project to pay back the initial investment.

Decision rule

If payback period < target ACCEPT

If payback period > target REJECT

Illustration 1

Investment |

$1.4m |

Annual operating cash flow |

$0.3m |

Project life |

10 yrs |

Solution

Payback period = 10..43 = 4.7 years

(or five years if cash flows are assumed to arise at year ends.)

0502

SESSION 05 – BASIC INVESTMENT APPRAISAL

Advantages of payback

9

9

9

Simple to calculate.

Easy to understand.

Concentrates on earlier flows:

more certain;

more important if firm has liquidity concerns.

Disadvantages of payback

8Ignores cash flows after payback period;

8Target period is subjective;

8Gives little information about change in shareholder wealth;

8Ignores the time value of money (although using discounted payback deals with this).

1.3Accounting Rate of Return (ARR)

The earnings of a project expressed as a percentage of the capital outlay or average investment.

¾Also referred to as Return on Capital Employed (ROCE) or Return on Investment (ROI).

¾This is a financial accounting measure based on the income statement and statement of financial position (balance sheet).

¾It includes:

Sunk costs (money already spent);

Net book values of assets;

Depreciation and amortisation;

Allocated fixed overheads.

¾Calculated as

|

Average annual operating profit |

× 100 |

|

Initial investment |

|

|

|

|

OR |

Average annual operating profit |

× 100 |

|

Average investment |

|

|

|

0503

SESSION 05 – BASIC INVESTMENT APPRAISAL

Decision rule

If ARR > target ACCEPT

If ARR < target REJECT

Example 1

Initial investment |

|

$200m |

Scrap value at end |

$20m |

|

Cash flows |

Year 1 |

$100m |

|

Year 2 |

$50m |

|

Year 3 |

$50m |

|

Year 4 |

$50m |

Required:

Calculate ARR on

(i) Initial investment (ii) Average investment

Solution

0504

SESSION 05 – BASIC INVESTMENT APPRAISAL

Advantages

9Uses readily available accounting information;

9Simple to calculate and understand;

9Often used by financial analysts to appraise performance.

Disadvantages

8Different methods of calculation may cause confusion;

8Based on profits rather than cash. Profits are easily manipulated by accounting policy.

8Ignores time value of money;

8Target rate is subjective;

8A relative measure (%) – gives little information about the absolute change in shareholders’ wealth.

2DISCOUNTED CASH FLOW TECHNIQUES

2.1Time value of money

¾Investors prefer to receive $1 today rather than $1 in one year.

¾This concept is referred to as the “time value of money”

¾There are several possible causes:

Liquidity preference – if money is received today it can either be spent or reinvested to earn more in future. Hence investors have a preference for having cash/liquidity today.

Risk – cash received today is safe, future cash receipts may be uncertain.

Inflation – cash today can be spent at today’s prices but the value of future cash flows may be eroded by inflation

DCF techniques take account of the time value of money by restating each future cash flow in terms of its equivalent value today.

0505

SESSION 05 – BASIC INVESTMENT APPRAISAL

¾Two traditional DCF methods are available:

NET PRESENT |

|

INTERNAL RATE |

VALUE |

|

OF RETURN |

|

|

|

2.2Discount factors

¾Single cash flow

1 n =discount factor (1+r)

Discount factors are provided in the exam for discount rates from 1% to 20% for up to 15 years. The formula above is also given in the at the top of the tables in the alternative format of (1 + r)–n

¾Annuities

Annuities are equal annual cash flows each year for a number of years. The first cash flow is assumed to start at T1

The present value of $1 received each year from T1 to Tn discounted at interest rate r

=$1 ×

=$1 ×

|

1 |

+ |

1 |

+ |

1 |

+ •• |

1 |

|

|

|

|

|

|

|

|

||||

(1+r) |

(1+r)2 |

(1+r)3 |

(1+r)n |

||||||

|

|

|

|

|

1−(1+r)−n

r

The formula above and annuity factors calculated for discount rates of 1% to 20% for up to 15 years are provided in the exam.

In some instances the annuity will not start until some period after time 1.

The tables cannot be used directly here as they assume that the first cash flow is at time 1.

Two methods are possible:

0506

SESSION 05 – BASIC INVESTMENT APPRAISAL

Illustration 2

Suppose that an equal annual amount is to be received for each of 10 years starting at time 3 with a discount rate of 10% per annum.

Method 1 |

|

|

|

10 year 10% annuity factor |

× |

2 year 10% discount factor |

|

6.145 |

|

× |

0.826 |

= |

5.076 |

|

|

OR |

|

|

|

Method 2 |

|

|

|

12 year 10% annuity factor |

− |

2 year 10% annuity factor |

|

6.814 |

|

− |

1.736 |

=5.078 (difference due to rounding)

A further complication is that an annuity may begin at Time 0, i.e. today. This simply means that there is an additional cash flow at Time 0 which will always have a discount factor of 1. Therefore 1 should be added to the annuity factor taken from the tables.

¾Perpetuities

Equal annual cash flow to infinity.

1r =perpetuity factor

¾Change of discount rates

Normally for discounting purposes the annual discount rate is assumed to be constant each year. However it is possible for rates to change in which case discount factors must be calculated from first principles.

0507

SESSION 05 – BASIC INVESTMENT APPRAISAL

Illustration 3

Interest rates for year 1 are anticipated to be 10% and to be 11% in year 2.

Discount factor for Time 1 cash flow |

= |

|

1 |

|

|

1.10 |

|

||||

|

|

|

|||

|

= |

0.909 |

|||

Discount factor for Time 2 cash flow |

= |

|

1 |

||

1.10×1.11 |

|||||

|

|

||||

|

= |

0.819 |

|||

¾Non-annual cash flows

DCF questions normally assume that cash flows occur at each year end however this may not always be the case. If cash flows occur at anything other than annual time periods then a matching non-annual discount rate must be calculated using the following formula:

1 + r |

= |

n 1 + R |

|

where |

r |

= |

periodic discount rate |

|

R |

= |

annual discount rate |

|

n |

= |

number of periods per annum |

Example 2

A cash flow is to occur in 3 months time and the annual interest rate is 10%.

What discount factor should be applied to this cash flow?

Solution

0508

SESSION 05 – BASIC INVESTMENT APPRAISAL

3NET PRESENT VALUE (NPV)

3.1Procedure

¾Forecast the relevant cash flows from the project.

¾Estimate the required return of investors i.e. the discount rate. The required return of investors represents the company’s cost of finance, also referred to as its cost of capital.

¾Discount each cash flow (receipt or payment) to its present value (PV).

¾Sum present values to give the NPV of the project.

¾If NPV is positive then accept the project as it provides a higher return than required by investors.

3.2Meaning

¾NPV shows the theoretical change in the $ value of the company due to the project.

¾It therefore shows the change in shareholders’ wealth due to the project.

¾The assumed key objective of financial management is to maximise shareholder wealth.

¾Therefore NPV must be considered the key technique in business decision making.

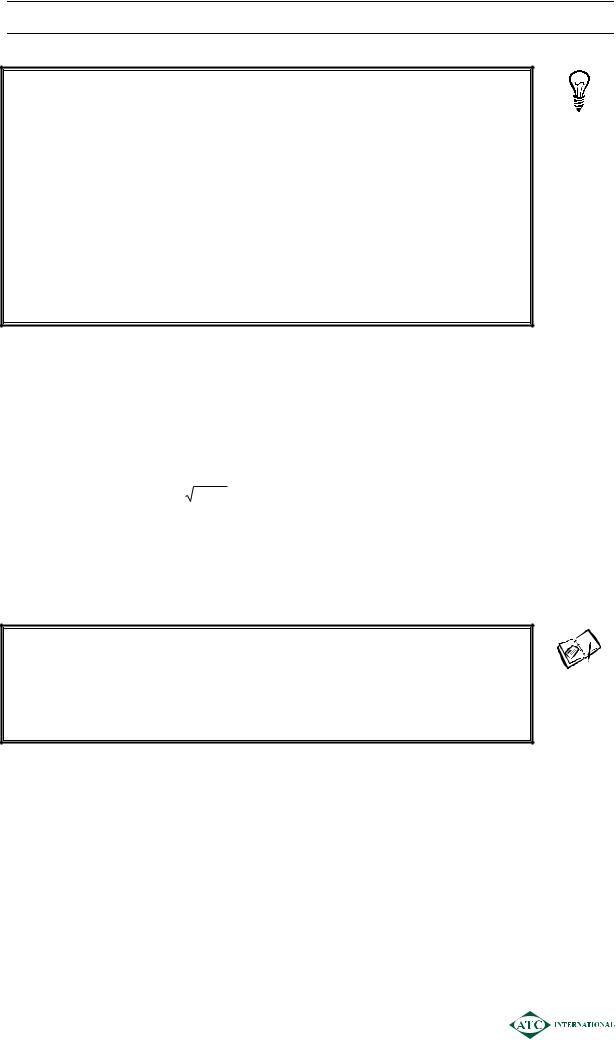

3.3Cash budget pro forma

Time |

0 |

1 |

2 |

3 |

||

|

$000 |

$000 |

$000 |

$000 |

||

Capital expenditure |

(X) |

– |

|

– |

|

X |

Cash from sales |

– |

X |

|

X |

|

X |

Materials |

(X) |

(X) |

|

(X) |

|

(X) |

Labour |

– |

(X) |

|

(X) |

|

(X) |

Overheads |

– |

(X) |

|

(X) |

|

(X) |

Advertising |

(X) |

– |

|

(X) |

|

– |

Grant |

– |

X |

|

– |

|

– |

|

___ |

___ |

___ |

___ |

||

Net cash flow |

(X) |

X |

|

X |

|

X |

|

___ |

___ |

___ |

___ |

||

r% discount factor |

1 |

1 |

1 |

1 |

||

|

|

1 + r |

|

(1 + r)2 |

|

(1 + r)3 |

Present value |

(X) |

X |

|

X |

|

X |

NPV = X |

|

|

|

|

|

|

0509

SESSION 05 – BASIC INVESTMENT APPRAISAL

3.4Tabular layout

|

|

|

Discount |

Present |

Time |

|

Cash flow |

factor |

value |

|

|

$000 |

@ r% |

$000 |

0 |

CAPEX |

(X) |

1 |

(X) |

1–10 |

Cash from sales |

X |

x |

X |

0–9 |

Materials |

(X) |

x |

(X) |

1–10 |

Labour and overheads |

(X) |

x |

(X) |

0 |

Advertising |

(X) |

x |

(X) |

2 |

Advertising |

(X) |

x |

(X) |

1 |

Grant |

X |

x |

X |

10 |

Scrap value |

X |

x |

X |

|

|

|

|

___ |

Net present value |

|

|

X |

|

|

|

|

|

___ |

4INTERNAL RATE OF RETURN (IRR)

4.1Definition and decision rule

¾IRR is the discount rate where NPV = 0

¾IRR represents the average annual % return from a project.

¾It therefore shows the highest finance cost that be accepted for the project.

¾If IRR > cost of capital, accept project.

¾If IRR < cost of capital, reject project.

4.2Method

¾Calculate the NPV of the project at a chosen discount rate.

¾If NPV is positive, recalculate NPV at a higher discount rate (i.e. to get closer to IRR).

¾If NPV is negative, recalculate at a lower discount rate.

IRR ~A + |

NA |

NA −NB |

Where A =

B=

NA |

= |

NB |

= |

(B −A)

Lower discount rate Higher discount rate NPV at rate A NPV at rate B

0510