Экзамен зачет учебный год 2023 / Class_11

.pdf

the yale law journal |

1 1 5 : 2 2 0 0 5 |

over the independent directors’ objections, and then voting the deal through at the shareholder level without a MOM condition.244 This kind of threat should continue to be impermissible under Lynch (meaning that the controller should have the burden to demonstrate fairness) because it strips the SC of its veto power, leaving no further check on the controller’s actions.

The guiding principle for treating unilateral threats differently continues to be the arms-length standard. In the arms-length context, a threat to go around the target board still requires the approval of a majority of target shareholders in the proxy contest—that is, there is no way for the buyer to unilaterally acquire the target. Likewise, a threat to go around the SC in the freezeout context must still be subjected to shareholder approval through the tender offer route.

This refinement would complement the change on MOM conditions proposed in the previous Subsection. If merger freezeouts will be increasingly subjected to MOM conditions, because of the benefit of business judgment review, then courts should be less determined to provide SCs with absolute veto power. Taken together, the proposed approach to merger freezeouts increases the procedural protection provided by MOM conditions and reduces (slightly) the procedural protection provided by SC approval. The combination more closely emulates the procedural protections that are inherent in the armslength merger process.

Bolstering the tender offer threat in merger freezeouts would not drive prices in freezeout merger negotiations down toward market prices, as described in Subsection II.B.1.b. The reason is that the threatened tender offer would be subject to entire fairness review, due to the absence of SC approval. Entire fairness review detaches the price paid from market prices, which, in turn, reduces the incentives for inefficient opportunistic behavior by the controller. Therefore, the threat of a tender offer provides a controller a second opinion against an intransigent SC but would not allow the controller to pay a lower price.

D. Synthesis

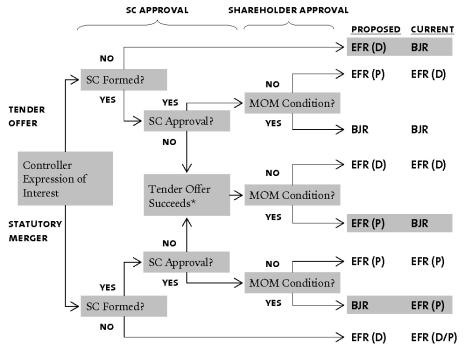

Figure 1 summarizes the standards of judicial review that would apply according to the transaction structure and procedural protections that are included in the deal. The most important departures from existing doctrine in the application of entire fairness review (EFR) and business judgment review

244.For an example of this kind of threat, see American General Corp. v. Texas Air Corp., Nos. Civ. A. 8390 et al., 1987 WL 6337 (Del. Ch. Feb. 5, 1987), which involved the freezeout of Continental Airlines’s minority shareholders by Frank Lorenzo’s Texas Air.

62

fixing freezeouts

(BJR) are shaded on the right side of the chart. For fairness review, the party that has the burden of proof is indicated in parentheses.

Figure 1.

proposed standards of judicial review for freezeouts

*Without a successful tender offer at this stage there is no transaction to be examined by the courts.

While the details are somewhat complicated, the proposal can be summarized with two simple points. First, a point on SC bargaining power: While SCs should have meaningful bargaining power against the controller, this bargaining power should be subject to the controller’s right to proceed directly to minority shareholders through a tender offer freezeout (overruling aspects of Lynch). The controller should bear a cost, in terms of standards of review, from going around the SC, but this cost should not be prohibitive.

Second, a point on standards of judicial review: SC approval and a MOM condition should lead to business judgment review rather than entire fairness (again, overruling aspects of Lynch); SC approval or a MOM condition should shift the burden on entire fairness to the plaintiffs (following aspects of Lynch

63