- •Definition of economics

- •Modern definition of the subject

- •1.3 Scarcity

- •1.4.Microeconomics and Macroeconomics

- •2.1.Types of industry

- •2.2. Sectors of business

- •2.3. Classification of business

- •2.4. Forms of business

- •Forms of business

- •6.1. Field Research

- •6.2.Desk Research

- •Price of market balance: p – price, q - quantity of good, s – supply,

- •5 P rule

- •The purpose of tight fiscal policy is:

- •Side Effects of Tight Fiscal Policy

- •21.1. Law of comparative advantage

- •21.2. Absolute Advantage

- •Origin of the theory

- •Example

- •Unit 20 Balance of payments

- •Bookkeeping system

- •Foreign Exchange

- •Unit 24 Underground Economy

- •Unit 25 Preferred and Common Stocks

- •Unit 26 Economic Functions of Government

- •Unit 39 Factors of Production

- •Intrinsic

- •Need of venture capital

- •Main alternatives to venture capital

- •Basic roles

- •[Edit]Management skills

- •[Edit]Formation of the business policy

- •Levels of management

- •[Edit]Top-level managers

- •[Edit]Middle-level managers

- •[Edit]low-level managers

- •International trade

- •U nited States

U nited States

"Outsourcing" became a popular political issue in the United States during the 2004 U.S. presidential election. The political debate centered on outsourcing's consequences for the domestic U.S. workforce. Democratic U.S. presidential candidate John Kerry criticized U.S. firms that outsource jobs abroad or that incorporate overseas in tax havens to avoid paying their "fair share" of U.S. taxes during his 2004 campaign, calling such firms "Benedict Arnold corporations".[28]

Criticism of outsourcing, from the perspective of U.S. citizens, generally revolves around the costs associated with transferring control of the labor process to an external entity in another country. A Zogby International poll conducted in August 2004 found that 71% of American voters believed that “outsourcing jobs overseas” hurt the economy while another 62% believed that the U.S. government should impose some legislative action against companies that transfer domestic jobs overseas, possibly in the form of increased taxes on companies that outsource.

UNIT 61 AUDIT

Audit is an evaluation of a person, organization, system, process, enterprise, project or product.

It refers to audits in:

Accounting

Project management,

Quality management,

Energy conservation

Accounting

Audits are performed:

to ascertain the validity and reliability of information;

to provide an assessment of a system's internal control.

Audits were associated with gaining information about financial systems and the financial records of a company or a business

Now auditing includes non-financial subject areas, such as:

Safety

Security

Information systems performance

Environmental concerns.

With nonprofit organizations and government agencies, there has been an increasing need for performance audits, examining their success in satisfying mission objectives. As a result, there are now audit professionals who specialize in security audits, information systems audits, and environmental audits.

Project Management

- Regular Health Check Audits(The aim is to understand the current state of a project in order to increase project success)

- Regulatory Audits (The aim of a regulatory audit is to verify that a project is compliant with regulations and standards)

Energy Audit - is an inspection, survey and analysis of energy flows for energy conservation in a building, process or system to reduce the amount of energy input into the system without negatively affecting the output(s).

AUDITORS:

Internal auditors are employed by the organization they audit. They perform various audit procedures related to procedures over the effectiveness of the company's internal controls over financial reporting.

External auditor / Statutory auditor is an independent firm engaged by the client subject to the audit, to express an opinion on whether the company's financial statements are free of material misstatements, whether due to fraud or error.

Consultant auditors are external personnel contracted by the firm to perform an audit following the firm's auditing standards. This differs from the external auditor, who follows their own auditing standards

Quality auditors may be consultants or employed by the organization.

UNIT 62 Price ceiling and floor

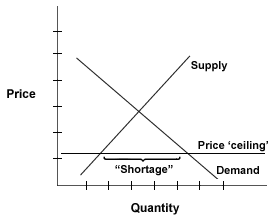

Price Ceilings If the price ceiling is above the market price, then there is no direct effect. If the price ceiling is set below the market price, then a "shortage" is created; the quantity demanded will exceed the quantity supplied. The shortage may be resolved in many ways. One way is "queuing"; people have to wait in line for the product, and only those willing to wait in line for the product will actually get it. Sellers might provide the product only to family and friends, or those willing to pay extra "under the table". Another effect may be that sellers will lower the quality of the goods sold. "Black markets" tend to be created by price ceilings. Effect of Price Ceilings

|

The graph above illustrates the shortage that occurs when a price ceiling is imposed on suppliers. Consumers demand QD while Suppliers are only willing to supply QS. If the price ceiling is set above the equilibrium, consumers would demand a smaller quantity than suppliers are producing. Economic Efficiency: Black Vs. Legal Markets Legal systems provide various benefits to economic systems. Economic efficiency may be said to occur when an action creates more benefits than costs. Legal systems help economic systems become more efficient by reducing risks to economics participants. Risk represents a cost that must be compensated for by higher charges. One risk reduced by government regulation is theft. Government protects the property rights of owners so that they can benefit from the assets they own and use them in an efficient, economic manner. Participants in a "black market system" face a high risk of theft in their transactions as well as exposure to other forms of violence. Governments often also provide a regulatory framework for the safety of products. In a market operating within a legal system, purchasers of drugs have a reasonable expectation about the quality of the drugs and the expected benefits of the drugs. Participants in a black market for drugs will have incomplete information about the quality of drugs purchased and, therefore, appropriate decisions are more difficult to make.

Price Floors When a "price floor" is set, a certain minimum amount must be paid for a good or service. If the price floor is below a market price, no direct effect occurs. If the market price is lower than the price floor, then a surplus will be generated. Minimum wage laws are good examples of price floors. In many states, the U.S. minimum wage law has no effect, as market wage rates for low-skilled workers are above the U.S. minimum wage rate. In states where the minimum wage is above the market wage rate, the law will increase unemployment for low-skilled workers. Although some low-skilled workers will get higher pay, others will lose their jobs.

UNIT 63 INTERNATIONAL MONETARY ECONOMICS

Monetary economics is a branch of economics that historically prefigured and remains integrally linked to macroeconomics.[1] Monetary economics provides a framework for analyzing money in its functions as a medium of exchange, store of value, and unit of account. It considers how money, for example fiat currency, can gain acceptance purely because of its convenience as a public good.[2] It examines the effects of monetary systems, including regulation of money and associated financial institutions[3] and international aspects.[4]

Modern analysis has attempted to provide a micro-based formulation of the demand for money[5] and to distinguish valid nominal and real monetary relationships for micro or macro uses, including their influence on the aggregate demand for output.[6] Its methods include deriving and testing the implications of money as a substitute for other assets[7] and as based on explicit frictions.[8]

Research areas have included:

empirical determinants and measurement of the money supply, whether narrowly-, broadly-, or index-aggregated, in relation to economic activity[9]

debt-deflation and balance-sheet theories, which hypothesize that over-extension of credit associated with a subsequent asset-price fall generate business fluctuations through the wealth effect on net worth.[10] and the relationship between the demand for output and the demand for money[11]

monetary implications of the asset-price/macroeconomic relation[12]

the importance and stability of the relation between the money supply and interest rates, the price level, and nominal and real output of an economy.[13]

monetary impacts on interest rates and the term structure of interest rates[14]

lessons of monetary/financial history[15]

transmission mechanisms of monetary policy as to the macroeconomy[16]

the monetary/fiscal policy relationship to macroeconomic stability[17]

neutrality of money vs. money illusion as to a change in the money supply, price level, or inflation on output[18]

tests and testability of rational-expectations theory as to changes in output or inflation from monetary policy[19]

monetary implications of imperfect and asymmetric information[20] and fraudulent finance[21]

game theory as a modeling paradigm for monetary and financial institutions[22]

the political economy of financial regulation and monetary policy[23]

possible advantages of following a monetary-policy rule to avoid inefficiencies of time inconsistency from discretionary policy[24]

"anything that central bankers should be interested in."[25]

UNIT 64 INTERNATIONAL STANDARDS OF FINANCIAL REPORTING

International Financial Reporting Standards (IFRS) are principles-based standards, interpretations and the framework (1989)[1] adopted by the International Accounting Standards Board (IASB).

Many of the standards forming part of IFRS are known by the older name of International Accounting Standards (IAS). IAS were issued between 1973 and 2001 by the Board of the International Accounting Standards Committee (IASC).

Objective of financial statements

A financial statement should reflect true and fair view of the business affairs of the organization. As these statements are used by various constituents of the society / regulators, they need to reflect true view of the financial position of the organization. and it is very helpful to check the financial position of the business for a specific period.

Qualitative characteristics of financial statements include: Understandability, Reliability, Relevance, Comparability

Elements of financial statements:

* The financial position of an enterprise is primarily provided in the Statement of Financial Position. The elements include:

- Asset: An asset is a resource controlled by the enterprise as a result of past events from which future economic benefits are expected to flow to the enterprise.

- Liability: A liability is a present obligation of the enterprise arising from the past events, the settlement of which is expected to result in an outflow from the enterprise' resources, i.e., assets.

- Equity: Equity is the residual interest in the assets of the enterprise after deducting all the liabilities under the Historical Cost Accounting model. Equity is also known as owner's equity. Under the units of constant purchasing power model equity is the constant real value of shareholders´ equity.

* The financial performance of an enterprise is primarily provided in the Statement of Comprehensive Income (income statement or profit and loss account). The elements of an income statement or the elements that measure the financial performance are as follows:

- Revenues: increases in economic benefit during an accounting period in the form of inflows or enhancements of assets, or decrease of liabilities that result in increases in equity. However, it does not include the contributions made by the equity participants, i.e., proprietor, partners and shareholders.

- Expenses: decreases in economic benefits during an accounting period in the form of outflows, or depletions of assets or incurrences of liabilities that result in decreases in equity.

The list of International Financial Reporting Standards (IFRS):

International Financial Reporting Standards (IFRS) issued after 2001

International Accounting Standards (IAS) issued before 2001

Interpretations originated from the International Financial Reporting Interpretations Committee (IFRIC) issued after 2001

Standing Interpretations Committee (SIC) issued before 2001

Conceptual Framework for the Preparation and Presentation of Financial Statements (2010)

UNIT 65 Recession

In economics, a Recession is a business cycle contraction, a general slowdown in economic activity. During recessions, many macroeconomic indicators vary in a similar way. Production, as measured by gross domestic product (GDP), employment, investment spending, capacity utilization, household incomes, business profits, and inflation all fall, while bankruptcies and the unemployment rate rise.

Recessions generally occur when there is a widespread drop in spending, often following an adverse supply shock or the bursting of an economic bubble. Governments usually respond to recessions by adopting expansionary macroeconomic policies, such as increasing money supply, increasing government spending and decreasing taxation.

Recession shapes are used by economists to describe different types of recessions. There is no specific academic theory or classification system for recession shapes; rather the terminology is used as an informal shorthand to characterize recessions and their recoveries. The most commonly used terms are V-shaped, U-shaped, W-shaped, and L-shaped recessions.

In a V-shaped recession, the economy suffers a sharp but brief period of economic decline with a clearly defined trough, followed by a strong recovery

A U-shaped recession is longer than a V-shaped recession, and has a less-clearly defined trough. GDP may shrink for several quarters, and only slowly return to trend growth.

A W-shaped recession, occurs when the economy has a recession, emerges from the recession with a short period of growth, but quickly falls back into recession.

An L-shaped recession occurs when an economy has a severe recession and does not return to trend line growth for many years, if ever. The steep drop, followed by a flat line makes the shape of an L. This is the most severe of the different shapes of recession. Alternative terms for long periods of underperformance include "depression" and lost decade; compare also "malaise".

In the United States, the unofficial beginning and ending dates of national recessions have been defined by an American private nonprofit research organization known as the National Bureau of Economic Research (NBER).

There have been as many as 47 recessions in the United States since 1790 (although economists and historians dispute certain 19th-century recessions

UNIT 66 UNEMPLOYMENT

UNIT 67 MORTGAGE

A mortgage loan is a loan secured by real property through the use of a mortgage note which evidences the existence of the loan and the encumbrance of that realty through the granting of a mortgage which secures the loan. However, the word mortgage alone, in everyday usage, is most often used to mean mortgage loan.

The word mortgage is a Law French term meaning "death contract," meaning that the pledge ends (dies) when either the obligation is fulfilled or the property is taken through foreclosure.[1]

A home buyer or builder can obtain financing (a loan) either to purchase or secure against the property from a financial institution, such as a bank, either directly or indirectly through intermediaries. Features of mortgage loans such as the size of the loan, maturity of the loan, interest rate, method of paying off the loan, and other characteristics can vary considerably.

In many jurisdictions, though not all (Bali, Indonesia being one exception[2]), it is normal for home purchases to be funded by a mortgage loan. Few individuals have enough savings or liquid funds to enable them to purchase property outright. In countries where the demand for home ownership is highest, strong domestic markets have developed.

Mortgage types:

There are many types of mortgages used worldwide, but several factors broadly define the characteristics of the mortgage. All of these may be subject to local regulation and legal requirements.

Interest: interest may be fixed for the life of the loan or variable, and change at certain pre-defined periods; the interest rate can also, of course, be higher or lower.

Term: mortgage loans generally have a maximum term, that is, the number of years after which an amortizing loan will be repaid. Some mortgage loans may have no amortization, or require full repayment of any remaining balance at a certain date, or even negative amortization.

Payment amount and frequency: the amount paid per period and the frequency of payments; in some cases, the amount paid per period may change or the borrower may have the option to increase or decrease the amount paid.

Prepayment: some types of mortgages may limit or restrict prepayment of all or a portion of the loan, or require payment of a penalty to the lender for prepayment.

The two basic types of amortized loans are the fixed rate mortgage (FRM) and adjustable-rate mortgage (ARM) (also known as a floating rate or variable rate mortgage). In many countries (such as the United States), floating rate mortgages are the norm and will simply be referred to as mortgages. Combinations of fixed and floating rate are also common, whereby a mortgage loan will have a fixed rate for some period, and vary after the end of that period.

In a fixed rate mortgage, the interest rate, and hence periodic payment, remains fixed for the life (or term) of the loan. Therefore the payment is fixed, although ancillary costs (such as property taxes and insurance) can and do change. For a fixed rate mortgage, payments for principal and interest should not change over the life of the loan,

In an adjustable rate mortgage, the interest rate is generally fixed for a period of time, after which it will periodically (for example, annually or monthly) adjust up or down to some market index. Adjustable rates transfer part of the interest rate risk from the lender to the borrower, and thus are widely used where fixed rate funding is difficult to obtain or prohibitively expensive. Since the risk is transferred to the borrower, the initial interest rate may be from 0.5% to 2% lower than the average 30-year fixed rate; the size of the price differential will be related to debt market conditions, including the yield curve.

Mortgage industry in the United Kingdom

The Mortgage industry of the United Kingdom has traditionally been dominated by building societies, but from the 1970s the share of the new mortgage loans market held by building societies has declined substantially. Between 1977 and 1987, the share fell drastically from 96% to 66% while that of banks and other institutions rose from 3% to 36%. There are currently over 200 significant separate financial organizations supplying mortgage loans to house buyers in Britain. The major lenders include building societies, banks, specialized mortgage corporations, insurance companies, and pension funds.

In the UK variable-rate mortgages are more common, unlike the fixed-rate mortgage common in the United States.[1][2] Home ownership rates are comparable to the United States, but overall default rates are lower.[1] Mortgage loan financing relies less on securitized assets and more on deposits, since funds raised by building societies must be at least 50% deposits.[1][2] Prepayment penalties are still common, whilst the United States has discouraged their use.[1] Like Europe and the rest of the world, but unlike most of the United States, mortgages loans are usually not nonrecourse debt, meaning debtors are liable for any loan deficiencies after foreclosure.

Types of mortgage in the UK

The UK mortgage market is one of the most innovative and competitive in the world. There is little intervention in the market by the state or state funded entities and virtually all borrowing is funded by either mutual organisations (building societies and credit unions) or proprietary lenders (typically banks). Since 1982, when the market was substantially deregulated, there has been substantial innovation and diversification of strategies employed by lenders to attract borrowers. This has led to a wide range of mortgage types.

As lenders derive their funds either from the money markets or from deposits, most mortgages revert to a variable rate, either the lender's standard variable rate or a tracker rate, which will tend to be linked to the underlying Bank of England (BoE) repo rate (or sometimes LIBOR). Initially they will tend to offer an incentive deal to attract new borrowers. This may be:

A fixed rate; where the interest rate remains constant for a set period; typically for 2, 3, 4, 5 or 10 years. Longer term fixed rates (over 5 years) whilst available, tend to be more expensive and/or have more onerous early repayment charges and are therefore less popular than shorter term fixed rates.

A capped rate; where similar to a fixed rate, the interest rate cannot rise above the cap but can vary beneath the cap. Sometimes there is a collar associated with this type of rate which imposes a minimum rate. Capped rate are often offered over periods similar to fixed rates, e.g. 2, 3, 4 or 5 years.

A discount rate; where there is set margin reduction in the standard variable rate (e.g. a 2% discount) for a set period; typically 1 to 5 years. Sometimes the discount is expressed as a margin over the base rate (e.g. BoE base rate plus 0.5% for 2 years) and sometimes the rate is stepped (e.g. 3% in year 1, 2% in year 2, 1% in year three).

A cashback mortgage; where a lump sum is provided (typically) as a percentage of the advance e.g. 5% of the loan.

100% mortgages - Normally when a bank lends a customer money they want to protect their money as much as possible; they do this by asking the borrower to fund a certain percentage of the property purchase in the form of a deposit.

100% mortgages are mortgages that require no deposit (100% loan to value). These are sometimes offered to first time buyers, but almost always carry a higher interest rate on the loan.

UK lenders usually charge a valuation fee, which pays for a chartered surveyor to visit the property and ensure it is worth enough to cover the mortgage amount. This is not a full survey so it may not identify all the defects that a house buyer needs to know about. Also, it does not usually form a contract between the surveyor and the buyer, so the buyer has no right to sue in contract if the survey fails to detect a major problem. For an extra fee, the surveyor can usually carry out a building survey or a (cheaper) "homebuyers survey" at the same time. However, the buyer may have a remedy against the surveyor in tort.

UNIT 68 LOANS

A loan is a type of debt. Like all debt instruments, a loan entails the redistribution of financial assets over time, between the lender and the borrower.

In a loan, the borrower initially receives or borrows an amount of money, called the principal, from the lender, and is obligated to pay back or repay an equal amount of money to the lender at a later time. Typically, the money is paid back in regular installments, or partial repayments; in an annuity, each installment is the same amount.

The loan is generally provided at a cost, referred to as interest on the debt, which provides an incentive for the lender to engage in the loan. In a legal loan, each of these obligations and restrictions is enforced by contract, which can also place the borrower under additional restrictions known as loan covenants. Although this article focuses on monetary loans, in practice any material object might be lent.

Acting as a provider of loans is one of the principal tasks for financial institutions. For other institutions, issuing of debt contracts such as bonds is a typical source of funding.

A secured loan is a loan in which the borrower pledges some asset (e.g. a car or property) as collateral.

A mortgage loan is a very common type of debt instrument, used by many individuals to purchase housing. In this arrangement, the money is used to purchase the property. The financial institution, however, is given security — a lien on the title to the house — until the mortgage is paid off in full. If the borrower defaults on the loan, the bank would have the legal right to repossess the house and sell it, to recover sums owing to it.

In some instances, a loan taken out to purchase a new or used car may be secured by the car, in much the same way as a mortgage is secured by housing. The duration of the loan period is considerably shorter — often corresponding to the useful life of the car. There are two types of auto loans, direct and indirect. A direct auto loan is where a bank gives the loan directly to a consumer. An indirect auto loan is where a car dealership acts as an intermediary between the bank or financial institution and the consumer.

Unsecured loans are monetary loans that are not secured against the borrower's assets. These may be available from financial institutions under many different guises or marketing packages:

credit card debt

personal loans

bank overdrafts

credit facilities or lines of credit

corporate bonds (may be secured or unsecured)

The interest rates applicable to these different forms may vary depending on the lender and the borrower. These may or may not be regulated by law. In the United Kingdom, when applied to individuals, these may come under the Consumer Credit Act 1974.

Interest rates on unsecured loans are nearly always higher than for secured loans, because an unsecured lender's options for recourse against the borrower in the event of default are severely limited. An unsecured lender must sue the borrower, obtain a money judgment for breach of contract, and then pursue execution of the judgment against the borrower's unencumbered assets (that is, the ones not already pledged to secured lenders). In insolvency proceedings, secured lenders traditionally have priority over unsecured lenders when a court divides up the borrower's assets. Thus, a higher interest rate reflects the additional risk that in the event of insolvency, the debt may be uncollectible.

Demand loans are short term loans (typically no more than 180 days)[1] that are atypical in that they do not have fixed dates for repayment and carry a floating interest rate which varies according to the prime rate. They can be "called" for repayment by the lending institution at any time. Demand loans may be unsecured or secured.

A subsidized loan is a loan on which the interest is reduced by an explicit or hidden subsidy. In the context of college loans in the United States, it refers to a loan on which no interest is accrued while a student remains enrolled in education.[2] Otherwise, it may refer to a loan on which an artificially low rate of interest (or none at all) is charged to the borrower.

An unsubsidized loan is a loan that gains interest at a market rate from the date of disbursement.

UNIT 69 PERSONAL FINANCE

Personal finance is the application of the principles of finance to the monetary decisions of an individual or family unit. It addresses the ways in which individuals or families obtain, budget, save, and spend monetary resources over time, taking into account various financial risks and future life events. Components of personal finance might include checking and savings accounts, credit cards and consumer loans, investments in the stock market, retirement plans, social security benefits, insurance policies, and income tax management.

A key component of personal finance is financial planning, which is a dynamic process that requires regular monitoring and reevaluation. In general, it has five steps:

Assessment: One's personal financial situation can be assessed by compiling simplified versions of financial balance sheets and income statements. A personal balance sheet lists the values of personal assets (e.g., car, house, clothes, stocks, bank account), along with personal liabilities (e.g., credit card debt, bank loan, mortgage). A personal income statement lists personal income and expenses.

Setting goals: Two examples are "1. Retire at age 65 with a personal net worth of $1,000,000," and, "2. Buy a house in 3 years while paying a monthly mortgage servicing cost that is no more than 25% of my gross income." Having multiple goals is common, including a mix of short term and long term goals. Setting financial goals helps to direct financial planning. Goal setting is done with an objective to meet certain financial requirements.

Creating a plan: The financial plan details how to accomplish your goals. It could include, for example, reducing unnecessary expenses, increasing one's employment income, or investing in the stock market.

Execution: Execution of one's personal financial plan often requires discipline and perseverance. Many people obtain assistance from professionals such as accountants, financial planners, investment advisers, and lawyers.

Monitoring and reassessment: As time passes, one's personal financial plan must be monitored for possible adjustments or reassessments.

The six key areas of personal financial planning:

Financial position: this area is concerned with understanding the personal resources available by examining net worth and household cash flow. Net worth is a person's balance sheet, calculated by adding up all assets under that person's control, minus all liabilities of the household, at one point in time. Household cash flow totals up all the expected sources of income within a year, minus all expected expenses within the same year. From this analysis, the financial planner can determine to what degree and in what time the personal goals can be accomplished.

Adequate protection: the analysis of how to protect a household from unforeseen risks. These risks can be divided into liability, property, death, disability, health and long term care. Some of these risks may be self-insurable, while most will require the purchase of an insurance contract. Determining how much insurance to get, at the most cost effective terms requires knowledge of the market for personal insurance. Business owners, professionals, athletes and entertainers require specialized insurance professionals to adequately protect themselves. Since insurance also enjoys some tax benefits, utilizing insurance investment products may be a critical piece of the overall investment planning.

Tax planning: typically the income tax is the single largest expense in a household. Managing taxes is not a question of if you will pay taxes, but when and how much. Government gives many incentives in the form of tax deductions and credits, which can be used to reduce the lifetime tax burden. Most modern governments use a progressive tax. Typically, as your income grows, you pay a higher marginal rate of tax. Understanding how to take advantage of the myriad tax breaks when planning your personal finances can make a significant impact upon your success.

Investment and Accumulation Goals: planning how to accumulate enough money to acquire items with a high price is what most people consider to be financial planning. The major reasons to accumulate assets is for the following:

purchasing a house

purchasing a car

starting a business

paying for education expenses

accumulating money for retirement, to generate a stream of income to cover lifestyle expenses.

Achieving these goals requires projecting what they will cost, and when you need to withdraw funds. A major risk to the household in achieving their accumulation goal is the rate of price increases over time, or inflation. Using net present value calculators, the financial planner will suggest a combination of asset earmarking and regular savings to be invested in a variety of investments. In order to overcome the rate of inflation, the investment portfolio has to get a higher rate of return, which typically will subject the portfolio to a number of risks. Managing these portfolio risks is most often accomplished using asset allocation, which seeks to diversify investment risk and opportunity. This asset allocation will prescribe a percentage allocation to be invested in stocks, bonds, cash and alternative investments. The allocation should also take into consideration the personal risk profile of every investor, since risk attitudes vary from person to person.

Retirement Planning: retirement planning is the process of understanding how much it costs to live at retirement, and coming up with a plan to distribute assets to meet any income shortfall.

Estate Planning: involves planning for the disposition of your asset when you die. Typically, there is a tax due to the state or federal government at your death. Avoiding these taxes means that more of your assets will be distributed to your heirs. You can leave your assets to family, friends or charitable groups.

иски о возмещении вреда, причиненного повреждением здоровья, и иски об отобрании детей и передаче их на воспитание от одного родителя к другому, являясь по своей процессуальной классификации исками о присуждении, в то же время отличаются друг от друга по составу участников спора, особенностям судебного доказывают и составу судебных доказательств, сущности решения и особенностям его исполнения.