- •Definition of economics

- •Modern definition of the subject

- •1.3 Scarcity

- •1.4.Microeconomics and Macroeconomics

- •2.1.Types of industry

- •2.2. Sectors of business

- •2.3. Classification of business

- •2.4. Forms of business

- •Forms of business

- •6.1. Field Research

- •6.2.Desk Research

- •Price of market balance: p – price, q - quantity of good, s – supply,

- •5 P rule

- •The purpose of tight fiscal policy is:

- •Side Effects of Tight Fiscal Policy

- •21.1. Law of comparative advantage

- •21.2. Absolute Advantage

- •Origin of the theory

- •Example

- •Unit 20 Balance of payments

- •Bookkeeping system

- •Foreign Exchange

- •Unit 24 Underground Economy

- •Unit 25 Preferred and Common Stocks

- •Unit 26 Economic Functions of Government

- •Unit 39 Factors of Production

- •Intrinsic

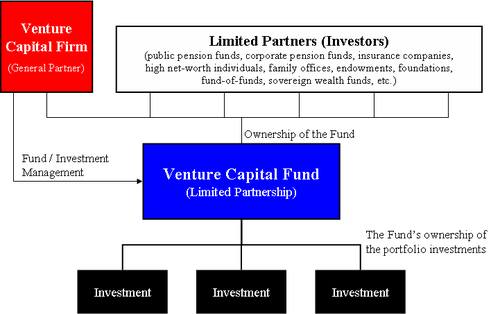

- •Need of venture capital

- •Main alternatives to venture capital

- •Basic roles

- •[Edit]Management skills

- •[Edit]Formation of the business policy

- •Levels of management

- •[Edit]Top-level managers

- •[Edit]Middle-level managers

- •[Edit]low-level managers

- •International trade

- •U nited States

ExtrinsicIntrinsic

refers

to the performance of an activity in order to attain

an

outcome, which then contradicts intrinsic motivation

refers

to motivation that is driven by an interest or enjoyment in the task

itself, and exists within the individual rather than relying on any

external pressure.

Students who are intrinsically motivated are more likely to engage in the task willingly as well as work to improve their skills, which will increase their capabilities

Students are likely to be intrinsically motivated if they:

a

ttribute

their educational results to factors under their own control, also

known as autonomy,

ttribute

their educational results to factors under their own control, also

known as autonomy,

believe they have the skill that will allow them to be effective agents in reaching desired goals (i.e. the results are not determined by luck),

are interested in mastering a topic, rather than just rote-learning to achieve good grades.

Extrinsic motivation comes from outside of the individual. Common extrinsic motivations are rewards like money and grades, threat of punishment. Competition is in general extrinsic because it encourages the performer to win and beat others, not to enjoy the intrinsic rewards of the activity. A crowd cheering on the individual and trophies are also extrinsic incentives.

For those who received no extrinsic reward, Self-determination theory proposes that extrinsic motivation can be internalised by the individual if the task fits with their values and beliefs and therefore helps to fulfill their basic psychological needs.

At lower levels of Maslow's hierarchy of needs money is a motivator, however it tends to have a motivating effect on staff that lasts only for a short period

At higher levels of the hierarchy, praise, respect, recognition are far more powerful motivators than money (Abraham Maslow's theory of motivation and Douglas McGregor's theory X and theory Y ). McGregor places money in his Theory X category and feels it is a poor motivator. Praise and recognition are placed in the Theory Y category and are considered stronger motivators than money.

Motivated employees always look for better ways to do a job.

Motivated employees are more quality oriented.

Motivated workers are more productive.

M otivation

by threat is a dead-end strategy, and naturally staff are more

attracted to the opportunity side of the motivation curve than the

threat side.

otivation

by threat is a dead-end strategy, and naturally staff are more

attracted to the opportunity side of the motivation curve than the

threat side.

In Essentials of Organizational Behavior, five principles that contribute to the success of an employee incentive program are identified:

Recognition of employees' individual differences, and clear identification of behavior deemed worthy of recognition

Allowing employees to participate

Linking rewards to performance

Rewarding of nominators

Visibility of the recognition process

Questions to unit 9

U NIT

53 INTERNATIONAL FINANCE

NIT

53 INTERNATIONAL FINANCE

International finance (also referred to as international monetary economics or international macroeconomics) is the branch of financial economics broadly concerned with monetary and macroeconomic interrelations between two or more countries.

Monetary economics provides a framework for analyzing money in its functions as a medium, store of value, and unit of account. It considers how money, for example fiat currency, can gain acceptance purely because of its convenience as a public good. It examines the effects of monetary systems, including regulation of money and associated financial institutions and international aspects.

The global financial system (GFS) is the financial system consisting of institutions and regulators that act on the international level, as opposed to those that act on a national or regional level. The main players are the global institutions, such as International Monetary Fund and Bank for International Settlements, national agencies and government departments, e.g., central banks and finance ministries, private institutions acting on the global scale, e.g., banks and hedge funds, and regional institutions, e.g., the Eurozone.

I nternational

finance examines the dynamics of the global

financial system,

international

monetary systems,

balance

of payments, exchange

rates,

foreign

direct investment, and how

these topics relate to international

trade.

nternational

finance examines the dynamics of the global

financial system,

international

monetary systems,

balance

of payments, exchange

rates,

foreign

direct investment, and how

these topics relate to international

trade.

Sometimes referred to as multinational finance, international finance is additionally concerned with matters of international financial management. Investors and multinational corporations must assess and manage international risks such as risk and exchange rate risk, including transaction exposure, economic exposure, and translation exposure.

Some examples of key concepts within international finance are the Mundell-Fleming model, the optimum currency area theory, purchasing power parity, interest rate parity, and the international Fisher effect. Whereas the study of international trade makes use of mostly microeconomic concepts, international finance research investigates predominantly macroeconomic concepts.

Questions to Unit

J

J

J

J

UNIT 54 VENTURE CAPITAL

Venture

capital (VC)

is financial

capital provided

to early-stage, high-potential, high risk, growth startup

companies. The venture

capital fund makes

money by owning equity in

the companies it invests in, which and usually have a novel

technology or business

model in

high technology industries, such as biotechnology, IT, software,

etc. The typical venture capital investment occurs after the seed

funding round

as growth funding round (also referred to as Series

A round) in the interest of

generating a return through an eventual realization event, such as

an IPO or trade

sale of

the company. Venture capital is a subset of private

equity. Therefore, all

venture capital is private equity, but not all private equity is

venture capital.[1]

Venture

capital (VC)

is financial

capital provided

to early-stage, high-potential, high risk, growth startup

companies. The venture

capital fund makes

money by owning equity in

the companies it invests in, which and usually have a novel

technology or business

model in

high technology industries, such as biotechnology, IT, software,

etc. The typical venture capital investment occurs after the seed

funding round

as growth funding round (also referred to as Series

A round) in the interest of

generating a return through an eventual realization event, such as

an IPO or trade

sale of

the company. Venture capital is a subset of private

equity. Therefore, all

venture capital is private equity, but not all private equity is

venture capital.[1]

In addition to angel investing and other seed funding options, venture capital is attractive for new companies with limited operating history that are too small to raise capital in the public markets and have not reached the point where they are able to secure a bank loan or complete a debt offering. In exchange for the high risk that venture capitalists assume by investing in smaller and less mature companies, venture capitalists usually get significant control over company decisions, in addition to a significant portion of the company's ownership (and consequently value).

Venture

capital is also associated with job creation (accounting for 2% of US

GDP),[2] the knowledge

economy, and used as a proxy

measure of innovation within

an economic sector or geography. Every year, there are nearly 2

million businesses created in the USA, and only 600–800 get venture

capital funding. According to the National

Venture Capital Association,

11% of private sector jobs come from venture backed companies and

venture backed revenue a ccounts

for 21% of US GDP.[3]

ccounts

for 21% of US GDP.[3]

It is also a way in which public and private actors can construct an institution that systematically creates networks for the new firms and industries, so that they can progress. This institution helps in identifying and combining pieces of companies, like finance, technical expertise, know-hows of marketing and business models. Once integrated, these enterprises succeed by becoming nodes in the search networks for designing and building products in their domain.