- •Word List:

- •Exercises to the text:

- •Price Versus Value

- •Word List:

- •Exercises to the text:

- •Approaches to Value

- •Word List:

- •Exercises to the text:

- •Cost Approach

- •Word List:

- •Exercises to the text:

- •Problematic, others, valuation, fairly, methodological, appraisal, embedded, comparison

- •The Sales Comparison Approach

- •Word List:

- •Exercises to the text:

- •Income Approach

- •Word List:

- •Exercises to the text:

- •Appraisers and Assessors

- •Word List:

- •Exercises to the text:

- •Perspective predominately assessors surrounding properties independent valuing assess

- •The Work of Appraisers and Assessors

- •Word List:

- •Exercises to the text:

- •Real Estate Appraisal

- •Word List:

- •Exercises to the text:

- •Report compared appraiser infrequently client property process

- •House Appraisals

- •Identification

- •Word List:

- •Exercises to the text:

- •What Is Included in a House Appraisal?

- •Word List:

- •Exercises to the text:

- •What Does a House Appraisal Entail?

- •Pricing a Home

- •Word List:

- •Exercises to the text:

- •Appraisal Value for a Home

- •Word List:

- •Exercises to the text:

- •Appraisal Fee for Buying a House?

- •Exercises to the text:

- •Getting a Damage Appraisal

- •Exercises to the text:

- •What is the Meaning of the Appraisal Value of a Home?

- •Influencing Factors

- •Exercises to the text:

- •Claims Adjuster

Income Approach

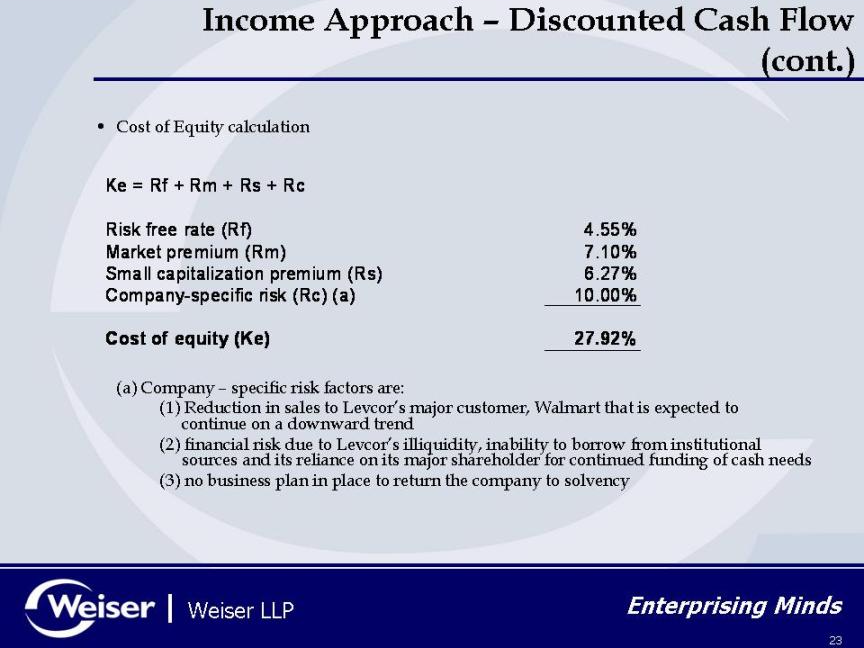

The income capitalization approach (often referred to simply as the "income approach") is used to value commercial and investment properties. Because it is intended to directly reflect or model the expectations and behaviors of typical market participants, this approach is generally considered the most applicable valuation technique for income-producing properties, where sufficient market data exists.

In a commercial income-producing property this approach capitalizes an income stream into a value indication. This can be done using revenue multipliers or capitalization rates applied to a Net Operating Income (NOI). Usually, an NOI has been stabilized so as not place too much weight on a very recent event. An example of this is an unleased building which, technically, has no NOI. A stabilized NOI would assume that the building is leased at a normal rate, and to usual occupancy levels. The Net Operating Income (NOI) is gross potential income (GPI), less vacancy and collection loss (= Effective Gross Income) less operating expenses (but excluding debt service, income taxes, and/or

Черкаський політехнічний технікум Для студентів III курсу, група ОД

Text № 6. Викладач Кособокова А.В.

depreciation charges applied by accountants). Alternatively, multiple years of net operating income can be valued by a discounted cash flow analysis (DCF) model. The DCF model is widely used to value larger and more expensive income-producing properties, such as large office towers or major shopping centres. This technique applies market-supported yields (or discount rates) to projected future cash flows (such as annual income figures and typically a lump reversion from the eventual sale of the property) to arrive at a present value indication.

Word List:

1. |

the income approach |

|

|

2. |

to value |

|

|

3. |

expectation |

|

|

4. |

applicable |

|

|

5. |

valuation |

|

|

6. |

sufficient |

|

|

7. |

a value indication |

|

|

8. |

revenue |

|

|

9. |

an unleased building |

|

|

10. |

to assume |

|

|

11. |

to be leased |

|

|

12. |

occupancy level |

|

|

13. |

debt service |

|

|

14. |

income taxes |

|

|

15. |

depreciation charge |

|

|

16. |

alternatively |

|

|

17. |

discounted cash flow |

|

|

18. |

technique apply |

|

|

19. |

lump reversion |

|

|

20. |

value indication |

|

|

Черкаський політехнічний технікум Для студентів III курсу, група ОД

Text № 6. Викладач Кособокова А.В.