gordeeva_o_g_praktikum_po_perevodu_ekonomicheskih_tekstov_s

.pdfFigures showed a shock fall in jobs last month and triggered a wave of stock market declines, setting the stage for the Fed to cut interest rates by 50 basis points on September 18.

The Financial Times |

October 2007 |

Translate the text into Russian. |

№ 2.8 |

Euro-zone growth forecasts increase

Economists are raising their forecasts for 2007 growth and, in some cases, interest rates in the euro zone, after growth in the region accelerated unexpectedly in the three months ended in December.

Gross domestic product in the countries that use the euro currency grew 0.9% in the fourth quarter, fueled by strong showings across the region’s four largest economies – Germany, France, Italy and Spain – according to figures from Eurostat, the European Union’s statistics arm. That was well above expectations and the previous quarter’s 0.5% growth rate.

Economists said strong exports fueled by robust global growth were likely a prime factor behind the euro zone’s fourth-quarter sprint, though a detailed breakdown of the numbers wasn’t yet available.

“It’s very good news indeed, and very reassuring thing is that we now have shared momentum in the biggest countries of the euro zone,” said Gilles Moec, senior economist with Bank of America in London.

Still, the impact of domestic tax increases, the U.S.’s moderate slowdown and the European Central Bank’s six interest-rate increases since December 2005 are likely to combine to slow growth in the first quarter of this year. Economists say growth in 2007 is unlikely to match last year’s pace.

The Paris-based Organization for Economic Cooperation and Development, in a report also released yesterday, credited part of the recovery to continuing laborand product-market overhauls across the euro zone. But it warned governments against complacency in the face of a cyclical upswing and said further changes are needed to boost the region’s long-term growth rate.

The Wall Street Journal February 2007

42

Translate the text into Russian. |

№ 2.9 |

U.S. economic data signal a broad slowing of growth

Data indicated a broad slowing in the U.S. economy, as factory orders were flat in August and service-sector growth cooled in September as price pressures eased.

Factory-goods orders were flat in August, after two months of declines, as demand for autos and parts offset weakness in most other areas, the Commerce Department said. July orders were revised to a 1% fall after an original estimate of a 0.6% decline. The August figures were slightly stronger than the 0.2% decline Wall Street forecasters had predicted.

The government revised its estimates for August durable-goods orders to unchanged, from the 0.5% decline reported last week. A barometer of business-investment spending – nondefence capital-goods orders excluding aircraft – rose 0.4%, after a 0.6% rise in July.

Over the past three months, overall activity in the manufacturing sector appears to be slowing. This week the Institute for Supply Management indicated manufacturing cooled further in September. Measures of inflation and employment also fell.

The ISM said its nonmanufacturing index, based mostly on servicerelated companies, fell to 52.9 in September from 57 in August and 54.8 in July. It had been expected to come in at 56. Readings higher than 50 represent expanding activity.

In the report, the ISM said the inflationary forces faced by the service sector eased markedly, with the September price index falling to 56.7 from 72.4 in August. September has the lowest reading since the 51.8 recorded for August 2003.

The Wall Street Journal October 2006

43

Translate the text into English. |

№ 2.10 |

Основные экономические показатели

Как мы можем понять, что происходит в экономике? Экономисты пользуются специальными экономическими данными, чтобы отслеживать, прогнозировать и анализировать изменения в экономике вообще и в ее отдельных отраслях.

И з р а з л и ч н ы х э ко н о м и ч е с к и х д а н н ы х , п у бл и к у е м ы х государственными и другими учреждениями, экономисты интересуются теми, которые отражают текущее или будущее состояние экономики. Эти сводки называются экономическими показателями, потому что они отображают состояние экономики. Они могут помочь менеджеру управлять своей компанией в изменяющихся условиях.

Гд е м ож н о п о л у ч и т ь э ко н о м и ч е с к и е д а н н ы е ? К р о м е специализированных источников, вы можете найти их и их анализ в деловой прессе, особенно в национальных ежедневных деловых газетах («Ведомости», «Коммерсантъ»).

Вот ключевые экономические показатели: Уровень экономического роста Цены и инфляция Процентные ставки Безработица

Строительство и продажа жилья Розничная торговля и продажа новых автомобилей Рынок ценных бумаг

Крупнейший показатель: уровень экономического роста

Этот основной показатель отражает процент роста всей экономики, рассчитываемый по ВВП. Сам ВВП определяется как общий размер экономики. Данный показатель состоит из следующих слагаемых: потребительские расходы, инвестиции, государственные расходы и чистый экспорт (экспорт минус импорт).

Он публикуется ежемесячно. Но, к сожалению, его позднее пересматривают. Разница между первоначальными и конечными значениями может достигать одного-двух процентов для показателя, среднее значение которого составляет примерно три процента.

44

Рассмотрите отклонения от этого трехпроцентного уровня и найдите тренд. Тренд — это самый важный элемент. Если происходит сокращение экономического роста в течение нескольких месяцев или кварталов, то, возможно, условия существования многих видов бизнеса станут более трудными. В периоды снижения роста покупатели тратят меньше, следовательно, компании делают то же самое. Компании не желают производить и накапливать у себя продукцию, которая не находит сбыта, и сокращают производство. Если вы заметили, что ваш бизнес снижает обороты, было бы отличной идеей отследить поведение ваших покупателей и графики продаж, и, возможно, вам придется сократить производство, закупки сырья и количество принимаемых на работу. Не впадайте в панику, но будьте особенно внимательны во время такого замедления.

Если экономический рост ускоряется, потребители начинают тратить много денег. Люди чувствуют себя уверенно на своих рабочих местах и хотят совершать больше покупок и пользоваться кредитом. В такие времена большинство фирм пытаются «ковать железо, пока горячо», извлекая преимущества из создавшихся условий. Как и во время замедления темпов роста экономики, вы должны наблюдать за поведением ваших клиентов и отслеживать продажи. Избегайте чрезмерного развертывания деятельности, привлечения слишком большого количества работников и т.д. Для экономики как плохие времена, так и хорошие не продолжаются вечно.

Translate the text into Russian. |

№ 2.11 |

Chile’s economy

Stimulating

Cashing in the fruits of rigour

Long held up as a model of policymaking that others in Latin America and beyond should follow, Chile’s economy has recently seemed oddly lacklustre, with growth below the regional average and inflation stubbornly high. As a small, open economy it is uncomfortably exposed to the world recession—the price of copper, its main export, has

45

fallen by almost two-thirds since mid-2008. But virtue sometimes has its reward. More than any other government in the region, Chile’s is able to take action to stimulate the economy. Now it has done so.

Last month Andrés Velasco, the finance minister, unveiled fiscal measures worth $4 billion. Government spending will rise this year by 10.7%. On February 12th the independent Central Bank joined in, slashing its benchmark interest rate by a massive two-and-a-half percentage points, to 4.75%. These measures mean the economy may suffer only a mild downturn.

Mr Velasco’s package includes an extra $1 billion for Codelco, the state-owned copper company, to finance investment; $700m for infrastructure projects; extra benefits for poorer Chileans; and temporary tax cuts for small businesses. The measures are better designed than similar efforts in rich countries, says Eduardo Engel, a Chilean economist at Yale University. “There’s almost no pork.”

Mr Velasco himself says that the challenge is to get the bulldozers moving: “We looked for projects we can do quickly.” Much of the money will go on houses for the poor and road maintenance. He reckons these public works will create 70,000 new jobs directly. They follow an earlier, smaller fiscal stimulus last year.

The government forecasts this year’s fiscal deficit at 2.9% of GDP, but it can easily afford this. That is because it has stuck to a rigorous fiscal rule drawn up by its predecessor requiring it to save much of the revenue gained when the copper price rises. Not only is public debt minimal (4% of GDP in December), but the government has also piled up $20.3 billion (about 12% of GDP) in a sovereign wealth fund which it can now spend. That marks a contrast with neighbouring Argentina, whose government has financed an increase in spending by nationalising private pension funds, shredding investor confidence.

The fall in commodity prices has at least helped to cut Chile’s inflation rate, from 9.9% for the year to October to 7.1% in December. By the end of this year it should have fallen back within the Central Bank’s target range of 2-4%, reckons Rodrigo Valdés, the bank’s former chief economist who now works for Barclays Capital. He expects further substantial interest rate cuts in the course of the year.

Lower rates will not necessarily encourage Chile’s banks, some of which are foreign-owned, to lend. So officials are also trying to inject cash and confidence into the banking system. They have done this in two ways. The Central Bank, which has ample reserves, has auctioned dollars. And the government has given a $500m capital boost to

46

BancoEstado, a state-owned entity which is the third-biggest commercial bank, to allow it to expand lending, especially for mortgages and small businesses.

The government’s decision to save so much of the copper windfall was not popular at the time. But “being a Keynesian means being one in both parts of the cycle,” Mr. Velasco says. His approval ratings in opinion polls have leapt over the past few months, as have those of his boss, Michelle Bachelet, Chile’s president. The ruling centre-left Concertación coalition, which has been in power since 1990 and had been looking tired, now has a chance in a presidential election next December it had seemed certain to lose. Good policy can sometimes be good politics.

The Economist |

February 2009 |

|

Translate the text into Russian. |

№ 2.12 |

|

Economists see slump ending in September

Economists in the latest Wall Street Journal forecasting survey expect the recession to end in September, though most say it won’t be until the second half of 2010 that the economy recovers enough to bring down unemployment.

Gross domestic product was predicted to contract in the first and second quarters of this year by 5.0% and 1.8%, respectively, on a seasonally annualized rate. A return to growth – a modest 0.4% - isn’t expected until the third quarter. In the fourth quarter of 2008, the most recent period for which data are available, the economy contracted 6.3%.

“The end of the decline isn’t the beginning of the recovery,” said David Resler of Nomura Securities Inc. “It’s like a boxing match. Even if you win the fight, it’s not going to feel as good when you get out of the ring as when you went in.”

Indeed, economists’ prospects for the labor market remain bleak. Just 12% of the economists expect the unemployment rate to fall some time this year. More than a third of respondents expect the jobless rate to peak in the first half of 2010, while about half don’t see unemployment declining until the second half of 2010. By December of this year, the economists on average expect the unemployment rate to reach 9.5%, up from the 8.5% reported for March. They do see the rate of declining

47

slowing, forecasting 2.6 million job losses in the next 12 months, compared with the 4.8 million jobs lost in the previous period.

Even when the economy stops shedding jobs, the unemployment rate is likely to remain elevated for some time. “The unemployment rate isn’t going to recover, because you have to get back everything you lost and then some,” said Joseph Lavorgna of Deutsche Bank Securities Inc. He estimated that the economy would have to grow an average of about 4% for six years to get back to the sub-5% unemployment rates seen in 2007.

Despite the grim news for jobs, economists are seeing more signs of a recovery in the broader economy this year. On average, the 53 economists surveyed expect the recession to end in September, compared with the October forecast last month. It marked the first time since the recession began that the economists didn’t push the date of recovery further into the future. The survey was conducted April 3-6, before the release of trade data this week that led some forecasters to revise upward their outlook for the first quarter.

Several factors are raising hopes, chief among them businesses’ sharp cuts in production and inventory late last year. The economy may be reaching a point where even meeting subsistence demand requires an increase in output. Empty shelves need to be restocked, even if at lower levels than before.

Meanwhile, asked to name the biggest risk to their forecasts, economists singled out problems in the credit markets. “Once the virtuous cycle starts, the chief headwind will be credit availability,” said Kurt Karl of Swiss Re. The possibilities of a failure of a major financial institution and persistent reluctance of consumers to spend, both related to the credit markets, were tied for second place in the list of concerns.

The Wall Street Journal |

April 2009 |

Exercise 2

Translate the following into Russian:

Household spending; business confidence; manufactured goods; factory sector; fiscal deficit; index of leading indicators; economic performance; order books; interest rates; in real terms; wages and salary; a decade; public debt; commodity prices; domestic demand; deflation; foreign direct investment; turnaround.

48

UNIT III

GOVERNMENT DEFICIT AND

BALANCE OF PAYMENTS

№ 3.0

A. A budget deficit occurs when an entity spends more money than it takes in. The opposite of a budget deficit is a budget surplus. Debt is essentially an accumulated flow of deficits. In other words, a deficit is a flow, and debt is a stock.

An accumulated deficit over several years (or centuries) is referred to as the government debt. Government debt is usually financed by borrowing, although if a government's debt is denominated in its own currency it can print new currency to pay debts. Monetizing debts, however, can cause rapid inflation if done on a large scale. Governments can also sell assets to pay off debt. Most governments finance their debts by issuing long-term government bonds or shorter term notes and bills. Many governments use auctions to sell government bonds.

Governments usually must pay interest on what they have borrowed. Governments reduce debt when their revenues exceed their current expenditures and interest costs. Otherwise, government debt increases, requiring the issue of new government bonds or other means of financing debt, such as asset sales.

According to Keynesian economic theories, running a fiscal deficit and increasing government debt can stimulate economic activity when a country's output (GDP) is below its potential output. When an economy is running near or at its potential level of output, fiscal deficits can cause inflation.

B. Balance of payments

From Wikipedia, the free encyclopedia

In economics, the balance of payments, (or BOP) measures the payments that flow between any individual country and all other countries. It is used to summarize all international economic transactions for that country during a specific time period, usually a year. The BOP is determined by the country's exports and imports of goods, services, and financial capital, as well as financial transfers. It reflects all payments and liabilities to foreigners (debits) and all payments and obligations received from foreigners (credits). Balance of payments is one of the

49

major indicators of a country's status in international trade, with net capital outflow.

The balance, like other accounting statements, is prepared in a single currency, usually the domestic. Foreign assets and flows are valued at the exchange rate of the time of transaction.

C. Current account

The balance of trade is the difference between a nation's exports of goods and services and its imports of goods and services, if all financial transfers and investments and the like are ignored. A nation is said to have a trade deficit if it is importing more than it exports.

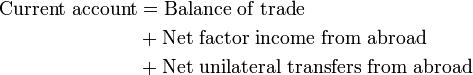

In economics, the current account is one of the two primary components of the balance of payments, the other being the capital account. It is the sum of the balance of trade (exports minus imports of goods and services), net factor income (such as interest and dividends) and net transfer payments (such as foreign aid).

The current account balance is one of two major metrics of the nature of a country's foreign trade (the other being the net capital outflow). A current account surplus increases a country's net foreign assets by the corresponding amount, and a current account deficit does the reverse. Both government and private payments are included in the calculation. It is called the current account because goods and services are generally consumed in the current period.

Positive net sales abroad generally contributes to a current account surplus; negative net sales abroad generally contributes to a current account deficit. Because exports generate positive net sales, and because the trade balance is typically the largest component of the current account, a current account surplus is usually associated with positive net exports.

The net factor income or income account, a sub-account of the current account, is usually presented under the headings income payments as outflows, and income receipts as inflows. Income refers not only to the money received from investments made abroad (note: investments are recorded in the capital account but income from investments is recorded in the current account) but also to the money sent by individuals working abroad, known as remittances, to their families back home. If the income account is negative, the country is

50

paying more than it is taking in interest, dividends, etc. For example, the United States' net income has been declining exponentially since it has allowed the dollar's price relative to other currencies to be determined by the market to a point where income payments and receipts are roughly equal. The difference between Canada's income payments and receipts have been declining exponentially as well since its central bank in 1998 began its strict policy not to intervene in the Canadian Dollar's foreign exchange. The various subcategories in the income account are linked to specific respective subcategories in the capital account, as income is often composed of factor payments from the ownership of capital (assets) or the negative capital (debts) abroad. From the capital account, economists and central banks determine implied rates of return on the different types of capital. The United States, for example, gleans a substantially larger rate of return from foreign capital than foreigners do from owning United States capital.

In the traditional accounting of balance of payments, the current account equals the change in net foreign assets. A current account deficit implies a paralleled reduction of the net foreign assets.

From Wikipedia, the free encyclopedia

51