- •Content

- •Introduction

- •1 Theoretical basis of formation and management of second tier banks’ resources

- •1.1The concept, structure and management of the bank’s own capital

- •1.2 Essence, classification and role of deposits.

- •1.3 Bonds and syndicated loans as the main sources of non-deposit funds

- •Underwritten deal.

- •1.4 Assets Liability Management

- •2.1 Analysis of the formation, management and evaluation of the capital adequacy of jsc Kazkommertsbank

- •Note - Compiled by the author according to the data of websitewww.Kkb.Kz

- •Table 1 Changes in Equity for 2010-2012 (mln.Kzt)

- •Shareholders' equity decreased over the period from 413.746 to 353.466 million kzt that is decreased for 60, 294 million kzt or 14,6 %.

- •2.3 Analysis of non-deposits sources of funding in Kazkommertsbank rk

- •2.4 Analysis of assets and liabilities management of jsc Kazkommertsbank

- •3. The ways of improvement in funding of banking operations and asset management of the bank.

- •3.1 The implementation of Basel III

- •3.2 The implementation of certificate of deposit

- •Conclusion

- •Shareholders' equity decreased over the period from 413.746 to 353.466 million tenge that is decreased for 60, 294 million tenge.

- •List of used literature

- •Interest rates of banks on attracted deposits (by maturity and types of currency) % for the month

- •Instruments of jsc Kazkommertsbank

2.1 Analysis of the formation, management and evaluation of the capital adequacy of jsc Kazkommertsbank

JSC Kazkommertsbank is one of the largest private banks in CIS and the market leader by total assets in Kazakhstan. The Bank provides a wide range of banking and other financial services to corporate and retail clients across the region.

Headquartered in Almaty, the Bank serves its retail clients through a network of branches in 45 cities all over Kazakhstan under the KAZKOM logo. In addition, Kazkommertsbank has international banking subsidiaries in Kyrgyzstan, Tajikistan and the Russian Federation.

Kazkommertsbank is in operation since 1991, and it is the dominant provider of banking services and other financial products to large and medium-sized corporations across all sectors of the Kazakh economy. The Bank’s employees across the region are devoted to the task of maintaining the Bank’s position as the premier financial services company in Kazakhstan based on superior understanding of our clients' financial needs and the ability to meet these through the highest quality of service.

Kazkommertsbank is focused on working with its existing clientele and on asset quality of its loan portfolio. The Bank concentrates its efforts on problem loans on case-by-case basis in line with cooperation with clients to help them improve their operations and increase the recovery rate.

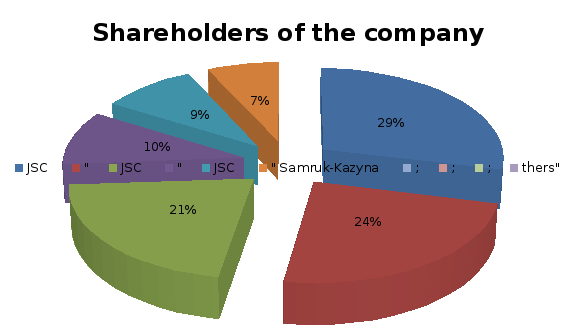

Shareholder structure

Kazkommertsbank is a public company, with a proportion of its shares, including most of the free float, listed in GDR form on the London Stock Exchange. Kazkommertsbank is committed to high standards of transparency and corporate governance and regularly announces its shareholder structure to the Kazakhstan and London stock exchanges.

Kazkommertsbank’s shareholding structure as at 01 January 2013

JSC "Alnair Capital Holding" - 28,76%;

JSC "Central Asian Investment Company" - 23.83%;

JSC "National Welfare Fund" Samruk-Kazyna "- 21.26%;

The European Bank for Reconstruction and Development, 9.77%;

Subkhanberdin N.S. - 9.32%;

Other shareholders -7.06% .

Note - Compiled by the author according to the data of websitewww.Kkb.Kz

Figure 4.Kazkommertsbank’s shareholding structure at January 1, 2013

Table 1 Changes in Equity for 2010-2012 (mln.Kzt)

|

Equity: |

31.12.2012 |

31.12.2011 |

31.12.2010 |

Changes for 2010-2012 in (%) |

|

Authorized capital |

9,008 |

9,023 |

9,031 |

-0,25 |

|

Share premium |

178,099 |

194,924 |

195,024 |

-8,7 |

|

Property revaluation reserve |

5,774 |

5,488 |

5,508 |

4,83 |

|

Retained earnings |

90,799 |

55,568 |

204,007 |

-55,5 |

|

Other provisions |

66,521 |

170,517 |

-898 |

7508 |

|

Total |

350,216 |

435,520 |

412,672 |

-15,13 |

|

Minority share |

3,250 |

1,112 |

1,074 |

202,6 |

|

Total equity |

353,466 |

436,632 |

413,746 |

-14,6 |

|

Note - source website www.afn.kz | ||||

The share of capital in total equity of the bank shows the extent of forming its own capital through equity. The share capital as compared to 2010 decreased, but not by much: in the period 2010-2012, its share has decreased by 0.25%.

Analyzing the dynamics of the bank's own funds it can be concluded that the observed downward trend of total equity by reducing the share premium (16,925 mln.tg) and retained earnings (113,208 mln.tg).

Other provisions in 2012 compared with 2010 have a positive trend and increased by 7508%. However, the increase of this indicator is negative and may be associated with increased risks of banking (credit risk, interest rate risk).