Fin management materials / 11 P4AFM-Session05_j08

.pdf

SESSION 05 – BASIC INVESTMENT APPRAISAL

¾This method is known as “linear interpolation”.

Illustration 4

The NPVs of a project with uneven cash flows are as follows.

Discount rate |

NPV |

|

$ |

10% |

64,237 |

20% |

(5,213) |

Estimate the IRR of the investment.

Solution |

|

|

|

|

NA |

|

|

IRR ~ A + NA −NB (B – A) |

|

|

|

IRR ~ 10% + |

64,237 |

(20 – 10)% |

|

64,237 −(−5,213) |

|

||

IRR ~ 19% |

|

|

|

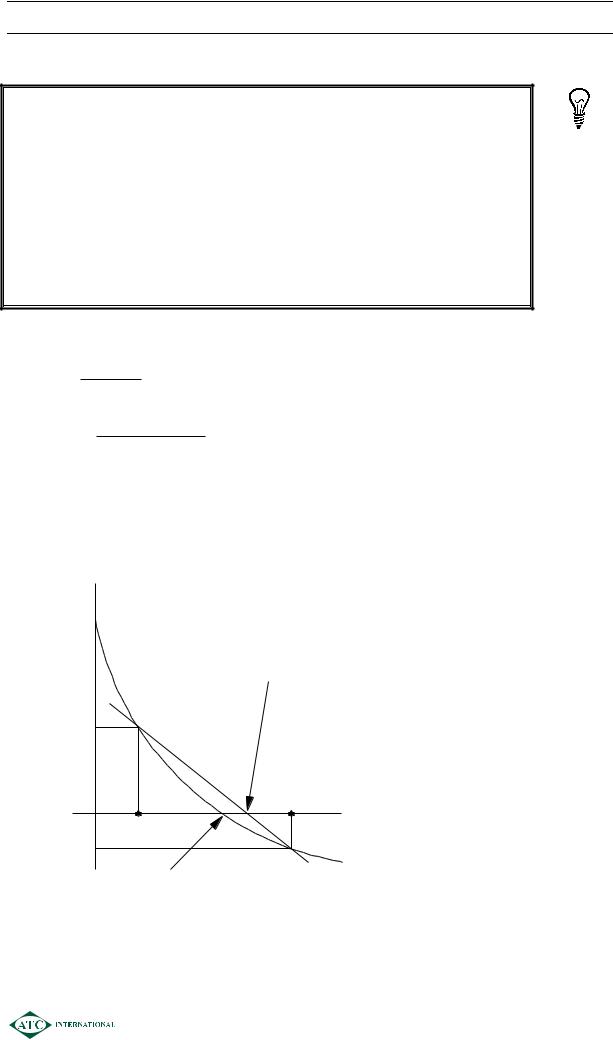

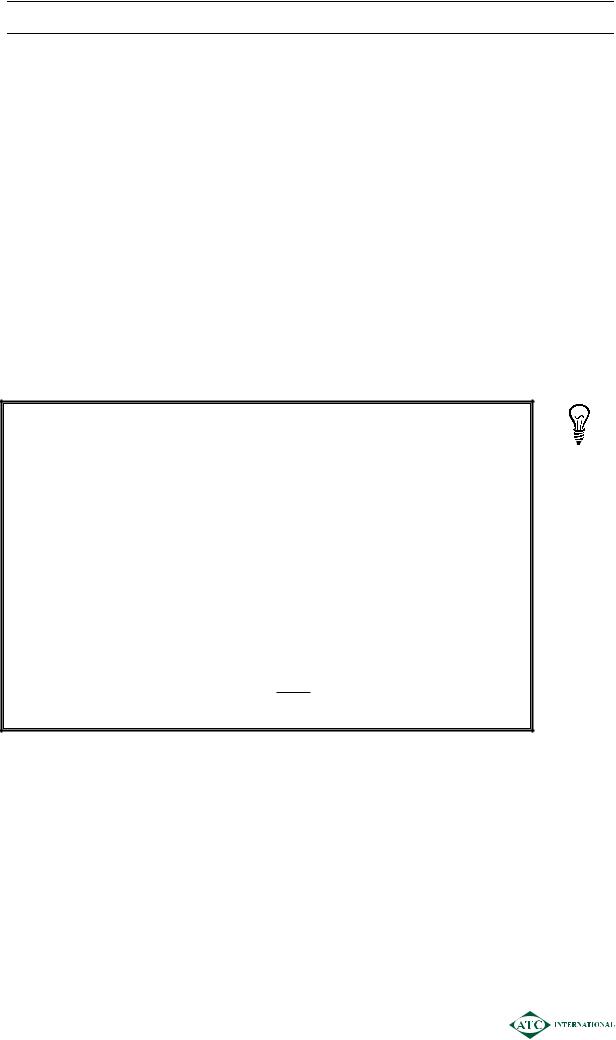

Graphically |

|

|

|

NPV |

|

|

|

|

IRR using formula |

|

|

|

|

(interpolated) |

|

NA |

|

|

|

|

A |

B |

Discount rate |

|

|

||

NB |

|

|

Actual NPV as |

|

Actual IRR |

|

discount rate varies |

|

|

|

|

0511

SESSION 05 – BASIC INVESTMENT APPRAISAL

Example 3

An investment opportunity with uneven cash flows has the following net present values

|

$ |

At 10% |

71,530 |

At 15% |

4,370 |

Required:

Estimate the IRR of the investment.

Solution

Formula

IRR ~ A + |

NA |

(B – A) |

NA −NB |

||

IRR ~ |

|

|

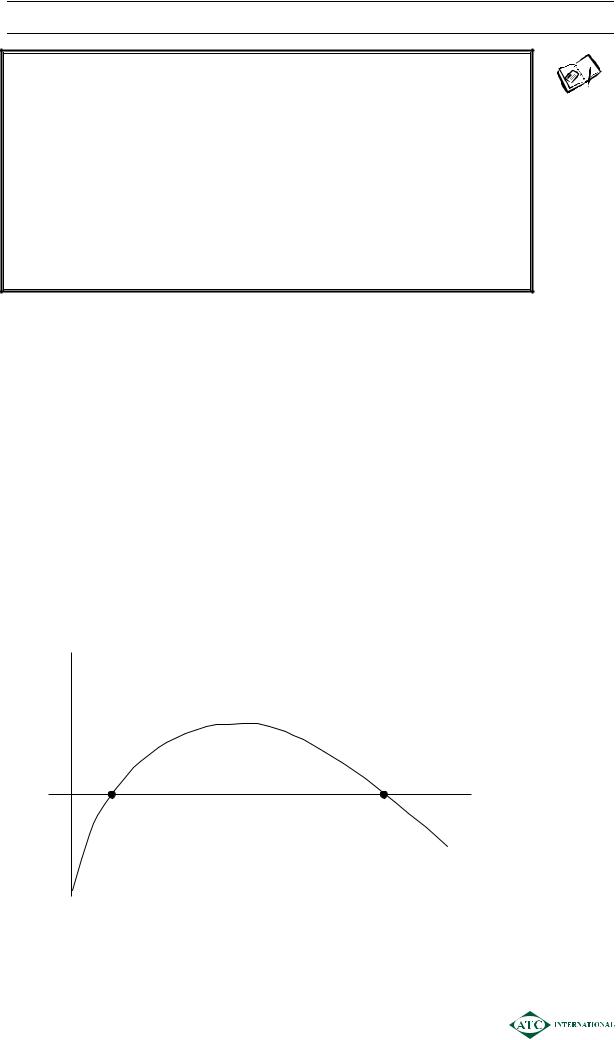

4.3Unconventional cash flows

¾If there are cash outflows, followed by inflows are then more outflows the situation of “multiple IRR” may arise:

NPV |

|

|

|

Actual NPV as |

|

|

discount rate varies |

|

IRR1 |

IRR2 |

Discount rate |

Actual IRR |

|

|

I

¾The project appears to have two different IRR’s – in this case IRR is not a reliable method of decision making.

0512

SESSION 05 – BASIC INVESTMENT APPRAISAL

5NPV VS. IRR

NPV

¾An absolute measure ($)

¾If NPV ≥ 0 ,accept

¾If NPV ≤ 0, reject

¾Shows $ change in value of company/wealth of shareholders

¾A unique solution i.e. a project has only one NPV

¾Always reliable for decision making

IRR

¾A relative measure (%)

¾If IRR ≥ target %, accept

¾If IRR ≤ target %, reject

¾Does not show absolute change in wealth

¾May be a multiple solution

¾Assumes that project cash flows can be reinvested at the IRR

¾Not always reliable

6RELEVANT CASH FLOWS FOR DISCOUNTING

6.1General rule

Include only those costs and revenues which are affected by the decision. This means using only future, incremental, operating cash flows.

Operating cash flows means the cash flows generated from operating the project e.g. cash from sales, operating costs such as materials and labour.

Do not include financing cash flows because the cost of finance is measured in the cost of capital/discount rate - finance costs are taken into account by the discounting process itself.

Specifically, exclude:

¾sunk costs – money already spent;

¾historic costs – e.g. of an asset;

¾non-cash flows – e.g. depreciation;

¾book values – e.g. FIFO/LIFO inventory values;

¾unavoidable costs – money already committed, apportioned fixed costs;

¾finance costs – e.g. interest (discounting the operating cash flows already deals with this). The cost of capital is the finance cost - never include interest payments in a DCF calculation or the finance cost will be double counted.

0513

SESSION 05 – BASIC INVESTMENT APPRAISAL

Specifically, include:

¾all opportunity costs and revenues e.g. “cannibalisation”; where the launch of a new product will reduce the sales of an exiting product the lost contribution is an opportunity cost and should be shown as a cash outflow.

6.2Effect of UK tax system

Taxation has two effects in investment appraisal

NEGATIVE |

|

|

POSITIVE |

|

|

EFFECT |

|

|

EFFECT |

|

|

|

|

|

|

|

|

Tax charged |

|

Tax relief given |

|||

on non-current assets |

|||||

on operating |

|

via |

|||

results |

|

|

|

|

|

|

|

|

|

|

|

|

|

WRITING DOWN |

|

||

|

|

ALLOWANCES |

|

||

|

|

|

|

|

|

¾Operating results = revenues – operating costs

¾Any tax relief on finance costs is taken into account in the discount rate/cost of capital.

¾Depreciation expense from the financial statements is not a tax allowable deduction in the UK

¾Instead companies can claim Writing Down Allowances (WDA’s), also called Capital Allowances (CA’s)

¾Details:

Often given at 25% reducing balance

– but exam question will tell you the policy.

no WDA in year of sale; balancing allowance/charge given instead, representing a tax loss/gain on disposal.

0514

SESSION 05 – BASIC INVESTMENT APPRAISAL

Timing

The timing of tax cash flows is complex. Some exam questions will tell you that tax is paid in the year of taxable profits, other questions will tell you tax is paid "one year in arrears” i.e. in the following year,

T0 |

Year 1 |

T1 |

T2 |

¾Assume net revenues (revenues minus operating costs) are received at the end of year 1 (T1)

Tax assessed at T1

Tax paid T2 (assuming tax is paid one year in arrears)

¾If asset bought at start of year 1

First WDA received at T1 (date of next tax assessment) Reduces tax payment at T2

¾However if the asset is bought on the last day of the previous year i.e. on the date of a tax assessment, the first WDA would be received immediately i.e. at T0 , which reduces the tax payment at T1

Illustration 5

An asset is bought for $5,000 at the start of an accounting period. It is sold at the end of the third accounting period for $1,000.

Corporation tax is 30% and paid one year in arrears. Writing down allowances are available at 25% reducing balance.

What are the tax savings available and when do they arise?

Solution

|

|

Tax saving |

Timing |

|

|

@ 30% |

|

|

$ |

$ |

$ |

Cost |

5,000 |

|

|

Year 1 WDA 25% |

(1,250) |

375 |

T2 |

|

______ |

|

|

WDV c/f |

3,750 |

|

|

Year 2 WDA 25% |

(938) |

281 |

T3 |

|

______ |

|

|

WDV c/f |

2,812 |

|

|

Year 3 Disposal |

(1,000) |

|

|

|

______ |

|

|

Balancing allowance |

1,812 |

544 |

T4 |

|

______ |

|

|

0515

SESSION 05 – BASIC INVESTMENT APPRAISAL

Other assumptions

¾Tax rate is constant.

¾Sufficient taxable profits are available to use all tax deductions in full

¾Working capital flows have no tax effects e.g. if the level of accounts receivable rises this does not change the tax situation as tax is charged when revenues are recorded rather than when the cash is received.

6.3Inflation

Real and money (or nominal) interest rates

¾Real rate of interest reflects the rate of interest that would be required in the absence of inflation.

¾Money (or nominal) rate of interest reflects the real rate of interest adjusted for the effect of general inflation (measured by the CPI – the Consumer Price Index).

Illustration 6

Suppose you invest $100 today for one year and, in the absence of inflation, you require a return of 5%. The CPI is expected to rise by 10% over the coming year.

In one year, in the absence of inflation, you require

$100 × 1.05 = $105

To maintain the purchasing power of your investment, i.e. to cover inflation you require

$105 × 1.1 = $115.50

You therefore require a money return of 15100.50 = 15.5% over the year.

¾ Money rates, real rates and general inflation (CPI) are linked by the Fisher formula:

(1+money rate) = (1+real rate) (1+general inflation rate)

(1+i) = (1+r) (1+h)

i = nominal/money interest rate

r= real interest rate

h= general inflation rate

0516

SESSION 05 – BASIC INVESTMENT APPRAISAL

In the example above

(1 + i) = (1.05) (1.1) = 1.155

i = 15.5%

General and specific inflation rates

¾A specific inflation rate is the rate of inflation on an individual item e.g. wage inflation, materials price inflation.

¾The general inflation rate is a weighted average of many specific inflation rates, e.g. CPI

Cash flow forecasts

If there is inflation in the economy there are three ways in which the cash flow forecast for project appraisal can be performed:

Current cash flows

¾Cash flows expressed at today’s prices i.e. before the effects of inflation.

Money (or nominal) cash flows

¾Cash flows are inflated to future price levels using the specific inflation rate for each type of revenue/cost.

¾This produces a forecast of the physical amount of money that will move in/out of the company.

Real cash flows

¾Money cash flows with the effect of general inflation removed.

Discounting

There are three methods of discounting if there is inflation. Each method results in the same NPV.

Money method

¾Adjust individual cash flows for specific inflation to convert to money cash flows.

¾Discount using money discount rate.

Real method

¾Remove the effects of general inflation from money cash flows to generate real cash flows.

¾Discount using real discount rate.

0517

SESSION 05 – BASIC INVESTMENT APPRAISAL

Effective method

¾Express each type of cash flow in current terms i.e. at t0 prices.

¾Discount at the effective rate for that cash flow:

(1+money rate) = (1+effective rate) (1+specific inflation rate)

Illustration 7

One year project

Outlay at T0 = $5m

Sales for the year are expected to be $10m in current terms, with an expected specific inflation rate of 5%

Costs for the year are expected to be $3m in current terms, with an expected specific inflation rate of 3%

CPI expected to rise by 4%

Nominal cost of capital = 6%

Solutions

Money method

|

|

T0 |

T1 |

|

|

Outlay |

|

(5) |

|

|

|

Sales |

|

|

10 × 1.05 |

= |

10.5 |

Costs |

|

___ |

(3) × 1.03 |

= |

(3.09) |

|

|

|

|

_____ |

|

Money flows |

(5) |

|

|

7.41 |

|

|

|

7.41 |

|

|

|

NPV |

= (5) + 1.06 |

= $1.99m |

|

|

|

0518

|

|

|

|

|

SESSION 05 – BASIC INVESTMENT APPRAISAL |

|

|

|

|

|

|

|

|

Real method |

|

|

|

|

|

|

|

|

|

|

T0 |

T1 |

|

Money cash flow |

(5) |

7.41 |

||||

CPI 4% |

|

|

|

|

7.41 |

|

|

|

|

|

1.04 |

||

|

|

|

|

|

||

Real cash flow |

|

(5) |

7.125 |

|||

(1 + i) |

= |

(1 + r) (1 + h) |

|

|||

(1.06) |

= |

(1 + r) (1.04) |

|

|||

r |

= 1.92307% |

|

||||

NPV |

= (5) + |

|

7.125 |

= $1.99m |

||

1.0192307 |

||||||

|

|

|

|

|||

Commentary

As money flows are needed to do this, the money method might just as well be used – it gives the same result.

Net cash flow expressed in current terms ($7m) is not the same as real cash flow ($7.125m), because sales and costs are not changing at CPI.

Effective method

¾Effective discount rates:

for sales: |

|

(1.06) |

= (1 + e) (1.05) |

e |

= 0.95238% |

for costs (1.06) |

= (1 + e) (1.03) |

e |

= 2.91262% |

¾Technique

Discount cash flows expressed in current terms at effective rates

NPV = (5) + |

10 |

+ |

(3) |

= $1.99m |

|

1.0095238 |

1.0921262 |

||||

|

|

|

as before

¾Effective method can be useful where an annuity is given in today’s prices.

0519

SESSION 05 – BASIC INVESTMENT APPRAISAL

6.4Working Capital

Movements in working capital need to be incorporated into investment appraisals. Cash flows are derived as follows:

¾Increase in net working capital = cash outflow;

¾Decrease in net working capital = cash inflow.

¾Unless the question tells you otherwise assume that working capital is “released” at the end of a project i.e. the investment in working capital falls to zero, creating a cash inflow.

¾Assume that changes in the level of working capital have no tax effects. This is a realistic assumption because tax will be charged when net revenues accrue rather than when the cash is received.

0520