- •Tax residence

- •Tax residence in Germany

- •History

- •Cases of Schedule d

- •Relief for expenses

- •Case I of Schedule d and Schedule a

- •Tax depreciation

- •Cfc charge

- •Itemized deductions: Those who choose to claim actual itemized deductions may deduct the following, subject to many conditions and limitations:

- •Income tax for year 2012:

- •Items producing future benefits,

- •Internal Revenue Code (irc) (legislative authority, written by the United States Congress through legislation)

- •Capital gains tax

- •Individuals who are residents or ordinarily residents in the United Kingdom (and trustees of various trusts) are subject to an 18% capital gains tax.

- •Installment Sale - Defer capital gains by taking payments from a buyer over a period of years. No protection from buyer default.

- •In the United States, the term "double taxation" is also used by critics to describe dividend taxation and capital gains taxation.[6]

Tier 1

United States Constitution

Internal Revenue Code (irc) (legislative authority, written by the United States Congress through legislation)

Treasury regulations

Federal court opinions (judicial authority, written by courts as interpretation of legislation)

Treaties (executive authority, written in conjunction with other countries)

Tier 2

Agency interpretative regulations (executive authority, written by the Internal Revenue Service (IRS) and Department of the Treasury), including:

Final, Temporary and Proposed Regulations promulgated under IRC § 7805;

Treasury Notices and Announcements;

Public Administrative Rulings (IRS Revenue Rulings, which provide informal guidance on specific questions and are binding on all taxpayers)

Tier 3

Legislative History

Private Administrative Rulings (private parties may approach the IRS directly and ask for a Private Letter Ruling on a specific issue – these rulings are binding only on the requesting taxpayer).

Where conflicts exist between various sources of tax authority, an authority in Tier 1 outweighs an authority in Tier 2 or 3. Similarly, an authority in Tier 2 outweighs an authority in Tier 3.[43] Where conflicts exist between two authorities in the same tier, the "last-in-time rule" is applied. As the name implies, the "last-in-time rule" states that the authority that was issued later in time is controlling.[44]

Regulations and case law serve to interpret the statutes. Additionally, various sources of law attempt to do the same thing. Revenue Rulings, for example, serves as an interpretation of how the statutes apply to a very specific set of facts. Treaties serve in an international realm.

[edit]The complexity of the U.S. income tax laws

United States tax law attempts to define a comprehensive system of measuring income in a complex economy. Many provisions defining income or granting or removing benefits require significant definition of terms. Further, many state income tax laws do not conform with federal tax law in material respects. These factors and others have resulted in substantial complexity. Even venerable legal scholars like Judge Learned Hand have expressed amazement and frustration with the complexity of the U.S. income tax laws. In the article, Thomas Walter Swan, 57 Yale Law JournalNo. 2, 167, 169 (December 1947), Judge Hand wrote:

In my own case the words of such an act as the Income Tax… merely dance before my eyes in a meaningless procession: cross-reference to cross-reference, exception upon exception—couched in abstract terms that offer [me] no handle to seize hold of [and that] leave in my mind only a confused sense of some vitally important, but successfully concealed, purport, which it is my duty to extract, but which is within my power, if at all, only after the most inordinate expenditure of time. I know that these monsters are the result of fabulous industry and ingenuity, plugging up this hole and casting out that net, against all possible evasion; yet at times I cannot help recalling a saying of William James about certain passages of Hegel: that they were no doubt written with a passion of rationality; but that one cannot help wondering whether to the reader they have any significance save that the words are strung together with syntactical correctness.

Complexity is a separate issue from flatness of rate structures. Also, in the United States, income tax laws are often used by legislatures as policy instruments for encouraging numerous undertakings deemed socially useful — including the buying of life insurance, the funding of employee health care and pensions, the raising of children, home ownership, development of alternative energy sources and increased investment in conventional energy. Special tax provisions granted for any purpose increase complexity, irrespective of the system's flatness or lack thereof.

[edit]State, local and territorial income taxes

Main article: State income tax

Map of USA showing states with no state individual income tax in red, and states that tax individuals only interest and dividend income in yellow.

Income tax is also levied by most U.S. states and many localities on individuals, corporations, estates, and trusts. These taxes are in addition to federal income tax and are deductible for federal tax purposes. State and local income tax rates vary from 1% to 16% of taxable income.[45] Some state and local income tax rates are flat (single rate) and some are graduated. State and local definitions of what income is taxable vary highly. Some states incorporate the federal definitions by reference. Taxable income is defined separately and differently for individuals and corporations in some jurisdictions. Some states impose alternative or additional taxes based a second measure of income or capital.

States and localities tend to tax all income of residents. States and localities only tax nonresidents on income allocated or apportioned to the jurisdiction. Generally, nonresident individuals are taxed on wages earned in the state based on the portion of days worked in the state. Many states require partnerships to pay tax for nonresident partners.

Tax returns are filed separately for states and localities imposing income tax, and may be due on dates that differ from federal due dates. Some states permit related corporations to file combined or consolidated returns. Most states and localities imposing income tax require estimated payments where tax exceeds certain thresholds, and require withholding tax on payment of wages.

Puerto Rico is treated as a separate taxing entity from the USA; its income tax rates are set independently, and only some residents there pay federal income taxes[46] (though everyone must pay all other federal taxes).[47] The unincorporated territories Guam, American Samoa, and the Virgin Islands also impose income tax separately, under a "mirror" tax law based on federal income tax law.

[edit]Controversies

-

The neutrality of this section is disputed. Please do not remove this message until the dispute is resolved. (November 2011)

[edit]Simplification movement in the 2000s

In 2005, the President's Advisory Panel for Federal Tax Reform criticized the tax system as being extremely complex, requiring detailed record-keeping, lengthy instructions, and complicated schedules, worksheets, and forms. They stated that it penalizes work, discourages saving andinvestment, and hinders the competitiveness of American business. "The tax code is commonly riddled with provisions that treat similarly situated taxpayers differently and create perceptions of unfairness."[48] The panel's major reform push was for the removal of the Alternative Minimum Tax, which is not indexed for inflation.

Several organizations and individuals are working for tax reform in the United States including Americans for Tax Reform, Citizens for an Alternative Tax System, Americans For Fair Taxation, and FreedomWorks. Various proposals have been put forth for tax simplification in Congress including the Fair Tax Act and various Flat tax plans.

[edit]Alternatives

Proponents of a consumption tax argue that the income tax system creates perverse incentives by encouraging taxpayers to spend rather than save: a taxpayer is only taxed once on income spent immediately, while any interest earned on saved income is itself taxed.[49] To the extent that this is considered unjust, it may be remedied in a variety of ways, e.g. excluding investment income from taxable income, making investments deductible and therefore only taxing them when gains are realized, or replacing the income tax by other forms of tax, such as a sales tax.[50]

[edit]Tax as theft

Libertarians believe in a natural right to property (money being a representation of a person's property), and taken to its most logical extent, individuals including institutions composed of individuals, can not take another individual's property involuntarily without stealing it. Such individuals may view taxation as equivalent to theft. Some[who?] believe income taxation offers the federal government a technique to diminish the power of the states, because the federal government is then able to distribute funding to states with conditions attached, often giving the states no choice but to submit to federal demands. Libertarian philosophy in general favors less federal tax and more local solutions, with the goal of fostering greater personal responsibility instead of a one size fits all approach that fosters entitlement mentalities.[citation needed]

[edit]Tax protestors

Numerous tax protester arguments have been raised asserting that the federal income tax is unconstitutional, including discredited claims that the Sixteenth Amendment was not properly ratified. All such claims have been repeatedly rejected by the federal courts as frivolous.[51]

[edit]Distribution

Further information: Progressivity in United States income tax

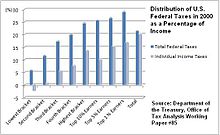

Distribution of U.S. federal taxes for 2000 as a percentage of income among the family income quintiles.

In the United States, a progressive tax system is employed which equates to higher income earners paying a larger percentage of their income in taxes. According to the IRS, the top 1% of income earners for 2008 paid 38% of income tax revenue, while earning 20% of the income reported.[52]

The top 5% of income earners paid 59% of the total income tax revenue, while earning 35% of the income reported.[52] The top 10% paid 70%, earning 46% and the top 25% paid 86%, earning 67%. The top 50% paid 97%, earning 87% and leaving the bottom 50% paying 3% of the taxes collected and earning 13% of the income reported.[52]

A 2008 OECD study ranked 24 OECD nations by progressiveness of taxes and separately by progressiveness of cash transfers, which include pensions, unemployment and other benefits. The United States had the highest concentration coefficient in income tax, a measure of progressiveness, before adjusting for income inequality. The United States was not at the top of either measure for cash transfers. Adjusting for income inequality, Ireland had the highest concentration coefficient for income taxes. Overall income tax rates for the US are below the OECD average.[53]