- •Lecture 1. The subject and the method of Microeconomics

- •Microeconomics as a part of economic theory.

- •Scarce resources and necessity of choice.

- •Tools of microeconomic analysis.

- •Lecture 2. Market structure: essence and classification

- •When to produce?

- •Lecture 3. Wants, goods and utility

- •Topic 4. Supply and demand in market mechanism

- •Individual Demand Function

- •Income Elasticity of Demand

Lecture 1. The subject and the method of Microeconomics

Microeconomics as a part of economic theory.

Scarce resources and necessity of choice.

Tools of microeconomic analysis.

-1-

Political economy which we studied last year was based on classical economic tradition. By contrast modern economic theory which we are going to study this year is based on neoclassical economic tradition and received a name “Economics”. For the first time it was introduced by Prof. A. Marshall in 1890 in his book “Principles of Economics”

Economics is divided into two parts: microeconomics and macroeconomics.

Microeconomics is a part of economic theory which studies individual behavior of economic actors (units) – their individual choice, and how that choice is influenced by economic forces.

Microeconomics deals with small components of the national economy, such as: a particular consumer, a particular household or a particular firm.

As Prof. Samuelson said: “In microeconomics we examine the trees not the forest.”

Macroeconomics is a part of economic theory which study economy as a whole. Macroeconomics studies the behavior of all particular units combined together.

It examines the cyclical movements and trends in economy, such as total production, total consumption, total savings, total investment, unemployment, inflation, economic growth, money supply and demand, budget deficits, exchange rates and so on.

Microeconomics and Macroeconomics are complementary to each other. In fact, they are so interdependent that neither approach is complete without the other. In the words of Prof. Samuelson, “There is really no opposition between microeconomics and macroeconomics. Both are absolutely vital. You are less than half educated if you understand the one while being ignorant of the other.

So, the area of our study is Microeconomics.

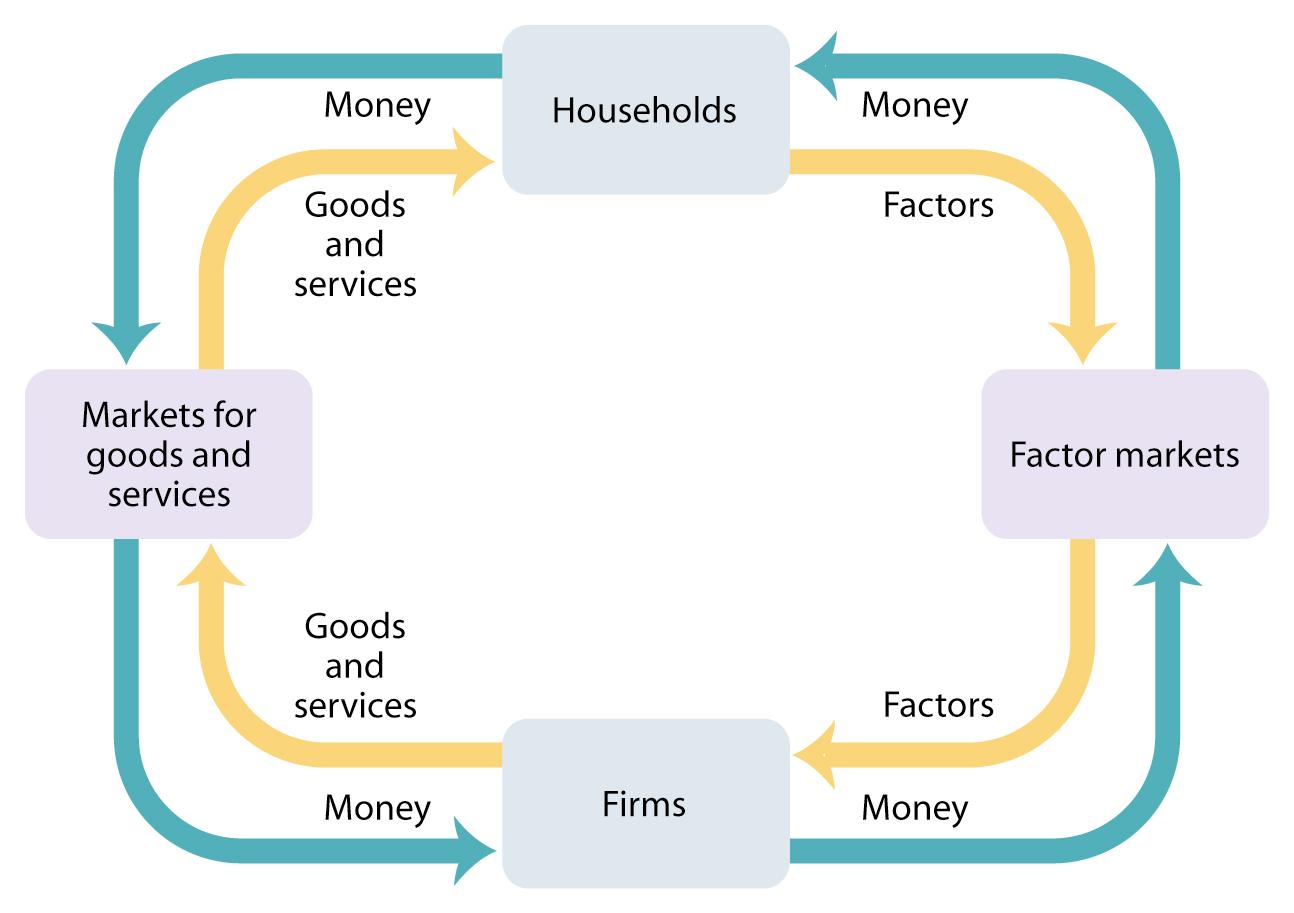

It studies decision making by households and firms and the interaction between them in the marketplace.

It considers households from two sides: from one side as suppliers of factors of production and from the next side as ultimate consumers of final goods and services.

It also analyzes firms from two sides: from one side as suppliers of goods and services and from another side as demanders of factors of production.

A household (consumer) is a person or a group of people that share their income or produces all the items they consume.

A firm is an organization that produces goods and services for sale.

The interrelations between firms, markets and householders can be showed on such diagram.

Firms sell goods and services that they produce to households in markets for goods and services.

Firms buy the resources they need to produce—factors of production—in factor markets.

On internal circle (yellow) we can see the flow of factors, goods and services. On external circle (blue) we can see the flow of money.

Factors of production (resources) are material and human resources which are used in the process of goods and services production. They can be classified into two groups: typical and alternative.

Typical factors of production or inputs: land, labour, capital entrepreneurial ability.

Alternative factors of production: energy, matter, time & technology [knowledge].

Land is natural resources which are considered as a “gift of Nature”.

Some natural resources are:

Flow [sunlight];

Renewable [fish, trees, rivers, resources that can be renewed];

Stock or exhaustible [fossil fuels].

Return to land is “rent”.

Labour is any human effort used to produce goods and services: manual and mental. Return to labour includes “wages, salaries, bonuses, commissions”, etc. Education and training is often referred to as “human capital”.

Capital is the buildings, equipment, tools, etc. that humans create to use in the further production of goods and services. The concept of capital was added during the early years of the industrial revolution. The return to capital is “interest”.

Entrepreneurial activity is the creation or innovation process in an economy which is connected with a risk. Entrepreneurial activity is used to explain the appearance of a “surplus” in production. The return to the entrepreneur is “profit”. The last factor of production added by Richard Cantillon (1680-1734) and popularized by J.B. Say (1776-1832)].

-2-

Both firms and householders function in the world of finite (limited) resources (inputs of factors of production, time, budget, information, knowledge, technology) and unlimited wants.

It means that wants of society are unlimited and have a tendency to increase but resources are finite. But resources that they use to satisfy these wants (inputs of factors of production, time, budget, information, knowledge, technology) are limited. That is why a problem of relative scarcity appears.

Scarcity has relative character. It means that impossible to meet all want of all people at the same time.

From this point of view individuals and society, householders and firms have to make choices. All choices in a finite world have “opportunity costs”– costs in foregone opportunities.

Opportunity cost is the value of the highest-valued alternative that must be forgone when a choice is made.

To illustrate opportunity cost a production possibility curve is used

A production possibility curve shows alternative outputs we can achieve with our inputs.

Output –is a result of an activity.

Input –is what you what we put into a production process to achieve an output.

A production possibility curve also shows us productive efficiency – achieving as much output as possible from a given amount of inputs or resources. By contrast inefficiency – getting less output from inputs which, if devoted to some other activity, would produce more output.

So, to build PPC we should use such assumptions (conditions):

Only 2 goods are produced in economics.

All resources are limited and their quantity is constant.

The technology is also constant.

All resources are used effectively.

Conclusions:

If all resources are spent to production of commodity X –Xmax can be produced and on the contrary.

Any point on PPC (A and B) shows effective output.

Any point inside the PPC (C) represents inefficiency.

Any point outside the PPC can’t be reached with set assumptions.

All of these conditions can change over time. According to this PPC can shift. Any shift inside means economic decrease. And shift outside means economic increase or growth.

PPC shows increase of opportunity costs.

There are two types of opportunity costs: total and marginal.

Total opportunity costs – is amount of particular goods which we have to lose for producing of any amount of other goods.

Marginal opportunity costs – is amount of particular goods which we have to lose for producing of additional unit of other goods.

The principle of increasing marginal opportunity cost states that opportunity costs increase the more you concentrate on an activity. In order to get more of something, one must give up ever-increasing quantities of something else.

It can be explained in such way: some resources are better suited for the production of some goods than to the production of other goods.

So, economics is a social science that studies human behavior and institutional arrangements in societies that influence the processes by which relatively scarce resources are allocated to alternative uses

-3-

To reach its goal microeconomics uses such tools:

Deduction is a method of reasoning in which one deduces a theory based on a set of almost self-evident principles.

Induction is a method of reasoning in which one develops general principles by looking for patterns in the data.

Abduction is the combination of deduction and induction

Analysis is a process of mentally breaking down of a whole into its constituent parts

Synthesis is a process reconstituting a whole from its parts.

Theories are too abstract to apply in specific cases and are often embodied in economic models and principles.

An economic model is a framework that places the generalized insights of the theory in a more specific contextual setting.

An economic principle is a commonly held insight stated as a law or general assumption.

Marginal analysis. Using economic reasoning, decisions are often made by comparing marginal costs and marginal benefits.

Marginal cost [MC] is the additional cost over and above costs already incurred. MC is the same as opportunity cost

Marginal benefit [MB] is the additional benefit above and beyond what has already accrued.

Individuals optimize welfare when MB = MC

Neoclassical economics holds that when each individual maximizes their utility, the utility of society is also maximized.

The economic decision rule:

If the marginal benefits of doing something exceed the marginal costs, do it.

If the marginal costs of doing something exceed the marginal benefits, don’t do it.

Positive economics is the study of what is. Objective policy analysis keeps value judgments separate from the analysis

Normative economics is the study of what should be. Subjective policy analysis reflects the analyst’s views of how things should be

Art of economics is using the knowledge of positive economics to achieve the goals determined in normative economics. Economic policies are actions (or inactions) taken by the government to influence economic actions