- •Investment Case 11

- •Valuation summary 37

- •Investment case 53

- •Investment Case

- •Companies Compared Stock data

- •Key metrics

- •Per ha comparison

- •Management credibility

- •Market Overview Summary

- •Ukraine in global context Ukraine produces 2-3% of world soft commodities

- •Sunflower oil, corn, wheat, barley and rapeseed are Ukraine’s key soft commodities to export

- •Ukraine is 8th in arable land globally

- •Key inputs used in crop farming Ukraine`s climate favorable for low-cost agriculture

- •Soil fertility map

- •Machinery use far below developed countries

- •Land trade moratorium makes more benefits

- •Fertilizer use

- •Inputs prices: lease cost is Ukraine’s key cost advantage

- •Case study: Production costs in Ukraine vs. Brazil for corn and soybean

- •Farming Efficiency Ukrainian crop yields lag the eu and us, on par with Argentina and Brazil, above Russia’s

- •5Y average yields, t/ha and their respective 10y cagRs

- •Yields at a premium in Ukraine on the company level

- •Growth Growth should come from yield improvement, crop structure reshuffle and acreage increase

- •Crop structure is gradually shifting to more profitable cultures

- •Combined crop structure of listed companies

- •Ukraine`s 2012 harvest outlook

- •Valuation

- •Valuation summary

- •Valuation summary

- •Asset-based approach

- •Asset-based valuation

- •Valuation premium/discount summary

- •Location matters: Value of land by region

- •Yields efficiency comparing to benchmark region

- •Cost efficiency

- •Adding supplementary businesses

- •Valuation summary for other assets

- •Cost of equity assumptions

- •Model assumptions

- •Landbank growth capped at 30%

- •Crop structure

- •Biological revaluation (ias 41) excluded

- •Land ownership

- •Company Profiles Agroton a high cost producer

- •Investment case

- •Valuation

- •Operating assumptions

- •Financials

- •Income statement*, usd mln

- •Agroton in six charts

- •Operati

- •Industrial Milk Company Corn story

- •Investment case

- •A focus on the corn explains high margins

- •Location favourable for corn

- •Well on track with ipo proceeds

- •Weak ebitda margin in 2012 explained by non-cash items

- •Valuation

- •Valuation

- •Operating assumptions

- •Financials

- •Income statement*, usd mln

- •Ksg Agro On the road to space/Not ready to be public

- •Investment Case

- •A 5x yoy boost in total assets looks strange to us

- •Valuation

- •Operating assumptions

- •Financials

- •Income statement*, usd mln

- •Ksg Agro in six charts

- •Mcb Agricole Acquisition target with lack of positives for minorities

- •Investment Case

- •Inventories balance, usd mln

- •Overview of acquisitions of public farming companies in Ukraine

- •Valuation

- •Operating assumptions

- •Financials

- •Income statement, usd mln

- •Mcb Agricole in six charts

- •Mriya Too sweet to be true

- •Investment Case

- •Valuation

- •Operating assumptions

- •Financials

- •Income statement*, usd mln

- •Mriya in six charts

- •Sintal Agriculture

- •Investment Case

- •25% Yoy cost reduction in 2011 should improve margins

- •Irrigation is a growth option

- •Inventory balance, usd mln

- •Valuation

- •Valuation

- •Operating assumptions

- •Financials

- •Income statement*, usd mln

- •Sintal Agriculture in six charts

- •Astarta Sugar maker

- •Kernel Grain trader actively integrating upstream

- •Poultry producer

- •Appendices Land value

- •Current landowner income capitalization model

- •Farmer income capitalization model

- •Normative value

- •Biological asset revaluation

- •How do we adjust the income statement to be on a cost basis?

- •Ias 41 application summary

- •Appendix: Crop production schedule Crop schedule, based on 2012 harvesting year

- •Investment ratings

- •Contacts

Farmer income capitalization model

Listed Ukrainian companies earn on average USD 280/ha –ON/FROM WHAT EXACTLY?, a figure that we believe somewhat underestimates their earnings potential but that we are comfortable with using at the current stage of market development. Should the farmer own the land, the figure grows by the size of current lease payments, USD 75/ha on average.

We arrive at a USD 2,536/ha fair value after applying a 3% long-term growth rate and 17% discount rate (100% equity, sum of the current 9% Ukraine Eurobond yield, 6% equity risk premium and 2% sector-specific premium that we apply to farming businesses).

Farmland value = Income * (1+ growth rate) / (discount rate – growth rate) =

(USD 280 + USD 75)*(1+3%) / (17%-3%) = USD 2,612/ha

Normative value

We use the normative value of land currently set by the government as our third reference. While the figure varies by plot, the average value is known to be around UAH 20,000/ha or USD 2,500/ha.

As a reality check, below we provide land value in other countries and EV/ha multiples for listed companies.

Land value by country, USD/ha |

|

Listed farming companies, EV/ha owned, USD |

|

|

|

Sources: FAO, Margenes Agropecuarious, CARD, Black Rock, SLC Agricola, Brasilagro, Cresud, Adecoagro |

|

Source: Concorde Capital estimates

|

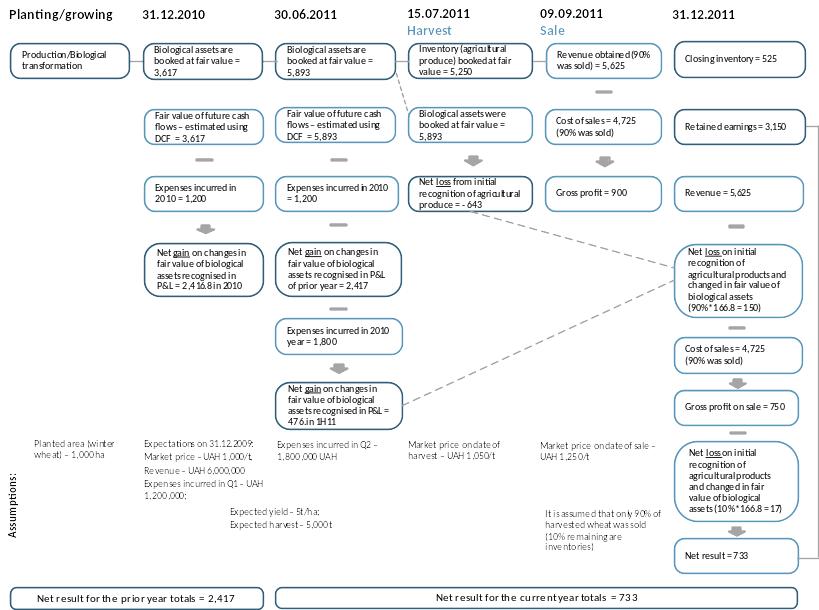

Biological asset revaluation

IAS 41 standard, effective since 2003 for all agricultural companies reporting under IFRS, requires companies to book agricultural produce and biological assets at “fair value less estimated cost of sell”, not at cost. Resulting revaluation gains or losses are recognized on the income statement; affecting all lines starting from COGS. Given that IFRS allows for a significant amount of freedom in estimating fair value and its amount could exceed total sales for farmers, we believe elimination of the revaluation components (effectively adjusting accounting to a cost-basis) is required for (1) assessment of true operating performance and (2) cross-company comparison.

How do we adjust the income statement to be on a cost basis?

To restate the income statement on a cost basis, we deduct two elements from the gross profit line:

(1) net change in fair value of biological assets and agricultural produce. Reported on the income statement just below revenues.

(2) the difference between fair value of agricultural produce sold and cash costs incurred during the production of agricultural produce. This is the revaluation part of the COGS line and could be either reported in COGS composition in the notes or not reported on the financial statements at all. If not reported, we requested the figure from management.

Where does revaluation come from?

Ukrainian farmers’ typical biological assets include crops in the ground and living animals. Typical agricultural produce are harvested crops.

Ias 41 application summary

Timing |

Assets |

Income statement |

Notes on revaluation |

Quarterly revaluation |

Prior “significant transformation occurred” |

Sowing costs are booked as inventories |

No effect |

At cost |

|

When “significant transformation of the biological asset has occurred” |

Inventories reclassified to biological assets with revaluation to the fair value less estimated cost to sell |

Fair value less estimated cost to sell is recognized as the net change in the fair value of biological assets and agricultural produce in the income statement just below the revenue line. It is included in the gross profit line and all subsequent lines |

Fair value is estimated using a cash flow model. Management decides: (1) when transformation is significant and (2) expected yields, costs, and discount rate Current market prices for crops are taken from a third-party |

Revalued quarterly with the change in the fair value less estimated cost to sell appearing in the same income statement line |

Harvesting |

Biological assets revalued and reclassified to agricultural produce at the moment of harvesting |

The net effect from revaluation is recognised in the income statement’s line usually named the net change in fair value of biological assets and agricultural produce |

Actual yields and production costs are used. Market prices at the moment of harvesting are used, selling costs are estimated |

Agricultural produce is not revalued |

Sale |

Inventory sold is deducted from the agricultural produce line in the asset part of the balance sheet |

(1) Actual revenue reported as revenue (2) The value of agricultural produce sold is recognised in COGS |

COGS includes both (1) cash production costs and (2) the difference between fair value of agricultural produce and cash costs |

n/a |

Note: See Appendix TT for crop production schedule for different crops

Source: Concorde Capital

Below we present an example of application of IAS 41 to winter wheat (sown in the second half of the year) and semi-annual reporting, based on a case provided by Mriya:

|

|

Source: Mriya |

How can earnings be manipulated because of IAS 41?

Though use of the IAS 41 standard does not change earnings itself, if measured over the long-term, its application results in profits shifting from one period to another. Below, we present a list of actions management might undertake in order to increase profits in a previous period at the cost of a future period:

Increase the assumption of future crop yields

Underestimate costs to be incurred in the future

Use a lower discount rate

Increase the share of winter crops (for annual reporting, assuming management expects winter crops to be profitable)

Does revaluation make up a significant part of earnings? Yes

We find that biological asset revaluation comprised from TT% to TT% of total revenues for farming companies in this report. On the EBITDA line, IAS 41 revaluation was responsible for from TT% to TT% of the total and its impact was even more significant on the bottom line XYZ.

Charts

Are companies` approaches to revaluation identical? No

We also find that companies in this report have different approaches to biological asset revaluation, which makes us believe cross-company comparison is meaningless on unadjusted figures. Though companies are not required to disclose all assumptions used in estimating the fair value of biological assets, many of them disclose fair value structure per crop and hectares sown.

Book value of one hectare at yearend, USD/ha Wheat |

|

All winter crops |

|

|

|

Source: Concorde Capital estimates |

|

Source: Concorde Capital estimates |

We also look at the relative size of biological assets to total assets, which basically shows how management estimates the value of winter crops in the ground as a percentage of total assets. For all companies except Agroton, IMC and Kernel, the value of winter crops in the ground represents a significant part of total assets, with the share varying significantly among companies.

Biological assets (winter crops) as a % of total assets, end-2010 vs. share of winter crops in the total harvest structure of the next year |

|

Note: Bold marks those companies that use revaluation aggressively, in our view. MHP was excluded from this dataset as the company does not provide asset figures for its agriculture operations separately Source: Concorde Capital estimates |