- •State of the Markets

- •State of the Markets: Second Quarter 2019

- •State of the Markets: Second Quarter 2019

- •Fears of a Macro Slowdown Have Investors on Edge

- •Tech Rises to the Top

- •Nontraditional Industries Prime for Disruption

- •Beyond the Bay: Startups Extend to New Cities

- •Fundraising: Venture Dollars Climb from All Sides

- •VCs Raising More Capital with Each Trip Back to LPs

- •New Funds Move to Institutionalize Early Rounds

- •Diverse Pools of Capital Chase Innovation Returns

- •Next Wave of Capital Will Come After Lockups

- •M&A: Acquisitions Slow as Startups Aim for Growth

- •Opting for Growth Capital vs. an Early Exit

- •Across US, Valuations Climb for M&A

- •Bucking the Trend: Financial Acquisitions Mount

- •US Tech Looks To International Opportunities

- •Regulations: Potential New Hurdles for Exits

- •Tech Giants Spend Big but Now Face Scrutiny

- •Attractive Acquisition Values from Big 5 in Jeopardy

- •CFIUS Could Impact 20% of VC-Backed Acquisitions

- •Unicorns Rely on Capital Boosts From Abroad

- •A Steady Climb: Building Venture in Canada

- •Startup to Scale-Up: Canadians Face “Valley of Death”

- •As Foreign Capital Arrives, Toronto Cements Its Place

- •AI: An Opportunity for Canada to Lead the World

- •Appendix

- •Authors

- •Disclaimers

vk.com/id446425943

Bucking the Trend: Financial Acquisitions Mount

As financial buyers grow more comfortable with tech, particularly companies with recurring revenue, they’re increasingly stepping in to purchase those startups. Financial buyers also are filling a void – buying companies that may be unable to attract soaring venture rounds.

US VC-Backed M&A: Strategic vs. Financial Activity |

Financial Acquisitions: % of Total M&A Activity |

|||||||||||||

800 |

|

|

|

|

|

|

|

|

40% |

|

|

|

|

|

|

|

Strategic Acquisitions |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

700 |

|

|

Financial Acquisitions |

|

|

|

|

35% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

600 |

|

|

|

|

|

|

|

|

30% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

500 |

|

|

|

|

|

|

|

|

25% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

400 |

|

|

|

|

|

|

|

|

20% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

300 |

|

|

|

|

|

|

|

|

15% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

200 |

|

|

|

|

|

|

|

|

10% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

100 |

|

|

|

|

|

|

|

|

5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

0 |

|

|

|

|

|

|

|

|

0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

2010 |

2012 |

2014 |

2016 |

2018 |

|

2010 |

2012 |

2014 |

2016 |

2018 |

||||

Source: PitchBook and SVB analysis. |

State of the Markets: Second Quarter 2019 |

17 |

vk.com/id446425943

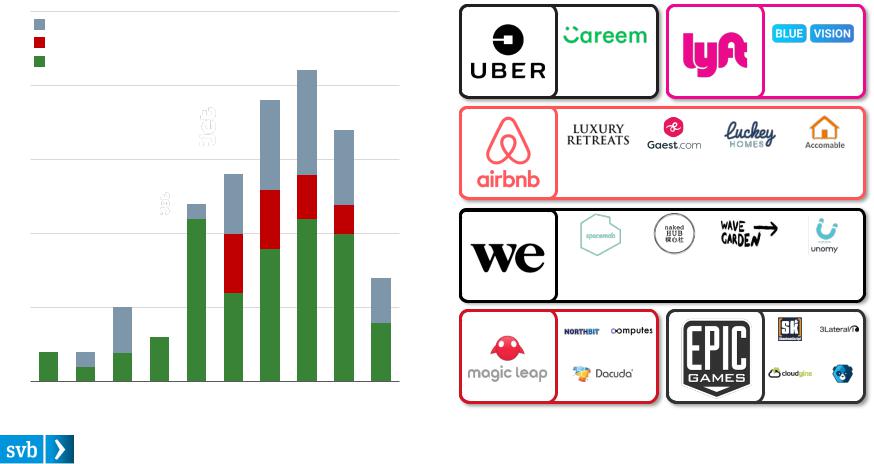

US Tech Looks To International Opportunities

The innovation economy’s best and brightest are putting their abundant capital to work abroad, with 20% of their acquisitions taking place outside of the US. On the back of a strong dollar, their capital is going even further for expansion overseas.

International Acquisitions by US Tech Unicorns

25

Rest of World

Asia

Europe

20

15

10

5

0

2010 |

2013 |

2016 |

2019 |

Notable Int’l Acquisitions by US Tech Decacorns

UAE |

|

|

|

United Kingdom |

|

$3.1B Acquisition |

|

|

$72M Acquisition |

||

March 2019 |

|

|

Oct.2018 |

||

Canada |

|

Demark |

France |

United Kingdom |

|

$300M Acq. |

Acquisition |

Acquisition |

Acquisition |

||

Feb. 2017 |

|

Jan. 2019 |

Dec. 2018 |

Nov. 2017 |

|

Singapore |

|

China |

Spain |

|

Israel |

$500M Acq. |

$400M Acq. |

Acquisition |

Acquisition |

||

Aug. 2017 |

|

Apr. 2018 |

Nov. 2017 |

Aug. 2017 |

|

Israel |

Italy |

|

Canada |

Serbia |

|

Switzerland |

|

|

UK |

Finland |

|

Source: PitchBook, company websites and SVB analysis. |

State of the Markets: Second Quarter 2019 |

18 |

vk.com/id446425943

Regulations: Potential New Hurdles for Exits

State of the Markets: Second Quarter 2019 |

19 |

vk.com/id446425943

Tech Giants Spend Big but Now Face Scrutiny

The Big 5 US tech giants have gone unchecked despite their growing influence. Now, as they outspend the entire tech venture ecosystem in R&D dollars alone, they are facing increasing political scrutiny. Are their innovations a true benefit to society?

R&D Expenditure by Big 5 US Tech Companies vs. US Tech Venture Capital Invested

$100B

$80B

$60B

$40B

$20B

$0B

V e n t u r e

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

Source: PitchBook, S&P Capital IQ and SVB analysis. |

State of the Markets: Second Quarter 2019 |

20 |