- •Contents

- •Investment summary

- •Organic store openings should slow with M&A becoming more important

- •Magnit can once again take traffic from X5

- •Competition from specialists and Magnit in Moscow will weigh on X5’s earnings

- •Magnit is better positioned than X5 to realise headcount savings

- •Lenta’s outlook is challenging but we see value

- •Financials and valuation

- •Disclosures appendix

vk.com/id446425943

Competition from specialists and Magnit in Moscow will weigh on X5’s earnings

Moscow is an important profit generator for X5 and returns are declining

X5 is the leading food retailer in Moscow and, for the company, Moscow is its most important revenue and profit generator. On our estimates, Moscow and region currently account for c. 30% of the company’s sales and more importantly have contributed disproportionately to earnings growth over the past couple of years with we estimate EBITDA profitability exceeding 11%. Given the ongoing rise of speciality retail in the capital as well as Magnit’s potential push into the region, we believe X5’s Moscow margin is unsustainable and RoIC in the capital has actually been declining for several years.

Renaissance Capital

21 January 2019

Russian retail

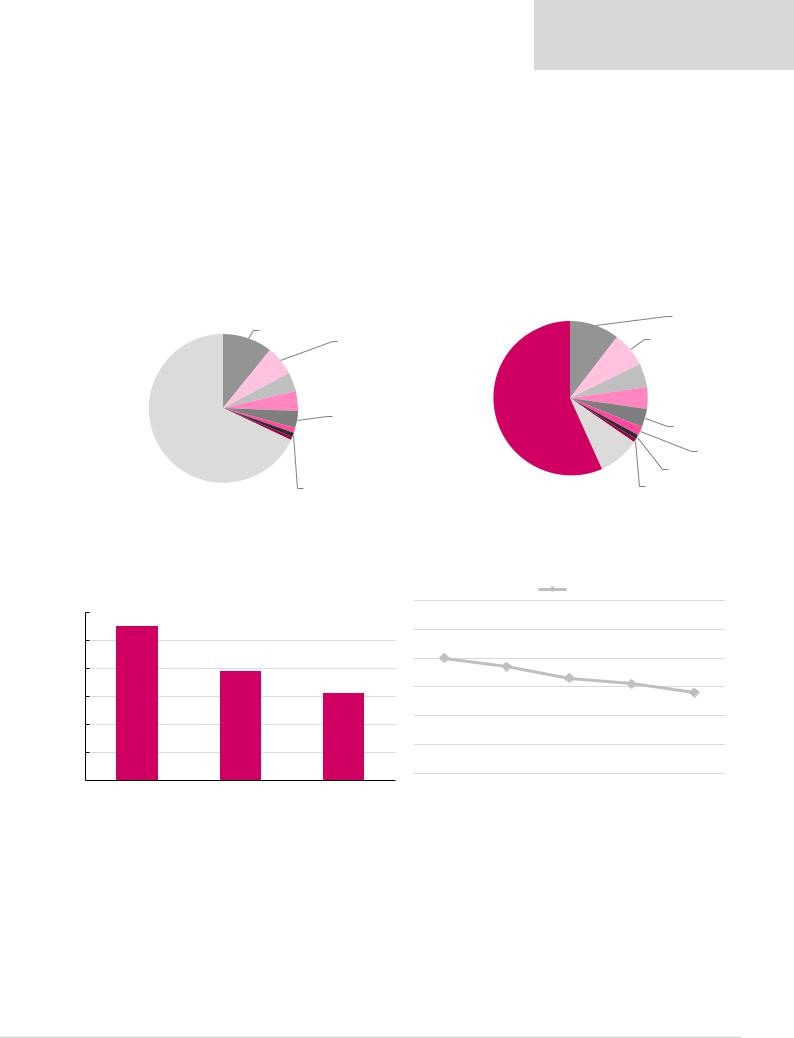

Figure 31: X5 is the dominant player in Moscow and region in terms of presence…

Share of modern selling space in Moscow and region, %

Pyaterochka |

|

||

11% |

|

Auchan |

|

|

|

|

6% |

|

Dixy |

|

|

|

|

4% |

|

|

|

Magnit |

|

|

|

4% |

Perekrestok |

|

|

|

|

|

|

|

4% |

Others |

Karusel |

|

|

68% |

|

1% |

|

|

|

|

|

|

|

|

|

Victoria |

Azbuka Vkusa |

||

1% |

|

1% |

|

Figure 32: …and market share

Moscow and region market shares, %

|

Pyaterochka |

|

|

10% |

|

|

Auchan |

|

|

7% |

|

|

Dixy |

|

|

5% |

|

|

Perekrestok |

|

Others |

4% |

|

Magnit |

|

|

57% |

|

|

4% |

|

|

|

|

|

|

Azbuka |

|

|

Karusel |

Vkusa |

Open |

2% |

|

markets Victoria 1% |

|

|

9% |

1% |

|

*Data for 2017 |

|

*Data for 2017 |

|

Source: Rosstat, Company data, Companies' websites. Renaissance Capital estimates |

|

|

Source: Fedstat, Company data, Companies' websites. Renaissance Capital estimates |

|

|

|

Figure 33: We estimate Moscow EBITDA profitability is considerably above the X5 Group average …

Adj. EBITDA margin, % (2017)

12% |

|

11%+ |

10%

7.8%

8%

Up to 6%

6%

4%

2%

0%

Moscow and region |

X5 group average |

Rest of X5 average |

|

|

Source: Renaissance Capital estimates |

Figure 34: …and Pyaterochka’s RoIC in the capital has been declining

Actual

2Q17

3Q17

4Q17 1Q18

2Q18

Source: Company data

20

vk.com/id446425943

Renaissance Capital

21 January 2019

Russian retail

Specialist retailers are growing rapidly in Moscow

The past five-to-seven years have seen various speciality retailers expand fast, primarily in Moscow and the region, with the most notable examples being Vkusvill, Myasnov and Azbuka Vkusa. We believe X5 has the most to lose from speciality retail over the long term:

1.Speciality retailers will remain niche and relatively small compared with the leading federal chains

More developed markets show that there is room for niche players in the long term, and despite their scale advantages large players are unable to force specialists out of the market. In the US the largest organic food retailers, Wholefoods and Trader Joe’s, have only around 1.5% market share each (growing slowly). In the UK Holland & Barrett (bought by Mikhail Friedman) is almost the only national health food retailer and has c. 0.5% market share. However, despite being niche these chains have existed for a long time.

2.In Russia speciality retailers can put pressure on larger chains, especially X5

In our view, an important difference between Russia and western examples is that in the UK and US speciality retailers have not really disrupted the market leaders which have 20-40% market shares. In Russia, however, X5 and Magnit have 10% share each, and given the wide presence of specialists in Moscow and the region’s high concentration in X5’s results, specialists can be meaningful disruptors to X5’s financials, in our view.

3.Larger players will adjust their assortment, but some traffic loss is inevitable; M&A is possible but not a top priority

Speciality retailers will never become mass-market but with a high-quality proposition can be relevant and profitable. Larger players will need to respond in terms of assortment

(and that’s happening with X5 offering Vkusvill’s assortment in its Moscow stores, and it’s common to see ‘farmer’s corners’ in standard supermarkets) but the incumbents will inevitably lose some traffic given their high market share, with the net result being pressure on sales densities and profitability.

Figure 35: Competition from specialist retailers has been growing rapidly, primarily in Moscow

|

|

|

|

Number of stores |

|

|

|

||||

800 |

|

750 |

|

2012 |

|

2016 |

|

2018 |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|||

700 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

600 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

400 |

|

|

|

|

|

|

|

|

|

|

|

300 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

300 |

|

|

|

|

|

|

|

|

|

|

|

|

190 |

229 |

|

|

|

|

|

|

|

||

|

|

|

|

|

172 |

|

|

|

|||

200 |

|

140 |

|

|

|

|

|

|

|

||

|

|

|

|

|

107 |

|

|

71 |

|||

|

|

|

|

|

|

|

|

|

|||

100 |

|

|

|

|

|

|

49 |

33 |

46 |

||

4 |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

Vkusvill |

Myasnov |

|

|

|

Azbuka Vkusa |

|

Miratorg |

|

|||

|

|

|

|

|

|

||||||

Note: Vkusvill excludes Izbenka stores.

Source: Company data, press reports

21

vk.com/id446425943

Renaissance Capital

21 January 2019

Russian retail

Figure 36: In Moscow several specialist players are comparable in presence to the federal chains

Number of stores in Moscow and region

3,000

2,500

2,000

1,500

1,000

500

0

Krasnoe & Beloe |

Fix Price |

Vkusvill |

Magnit |

Dixy |

Pyaterochka |

Source: Companies' websites, Renaissance Capital estimates

Profiles of the largest Russian speciality retailers

Vkusvill

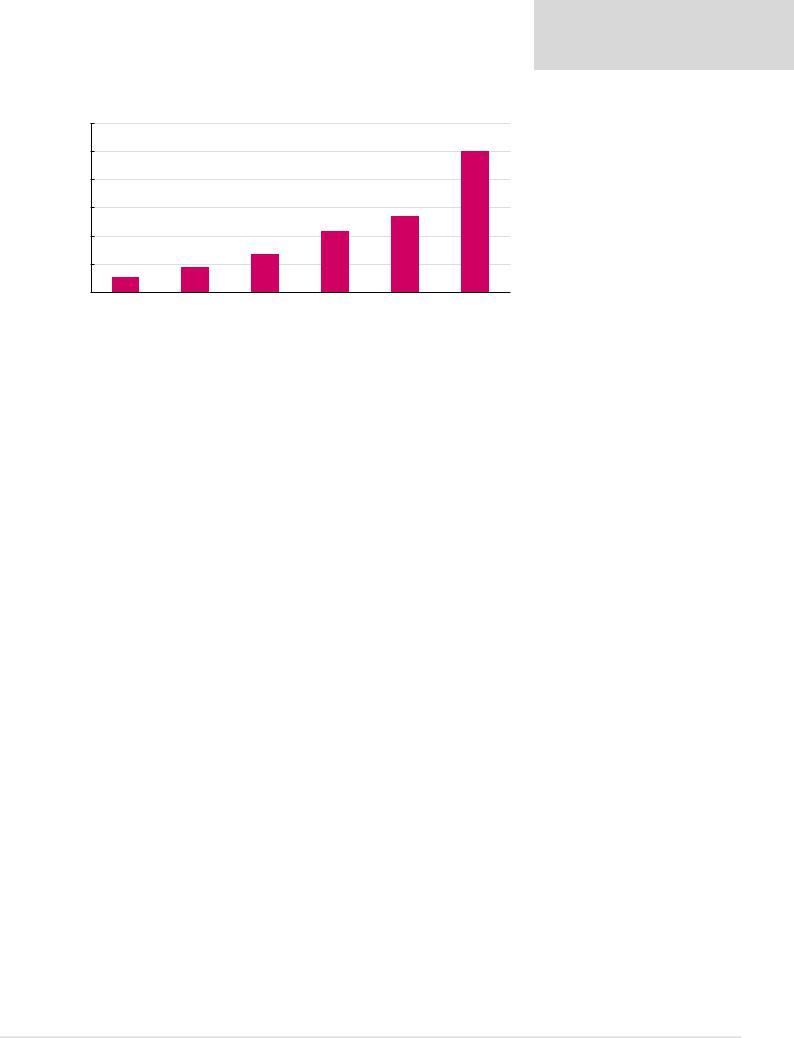

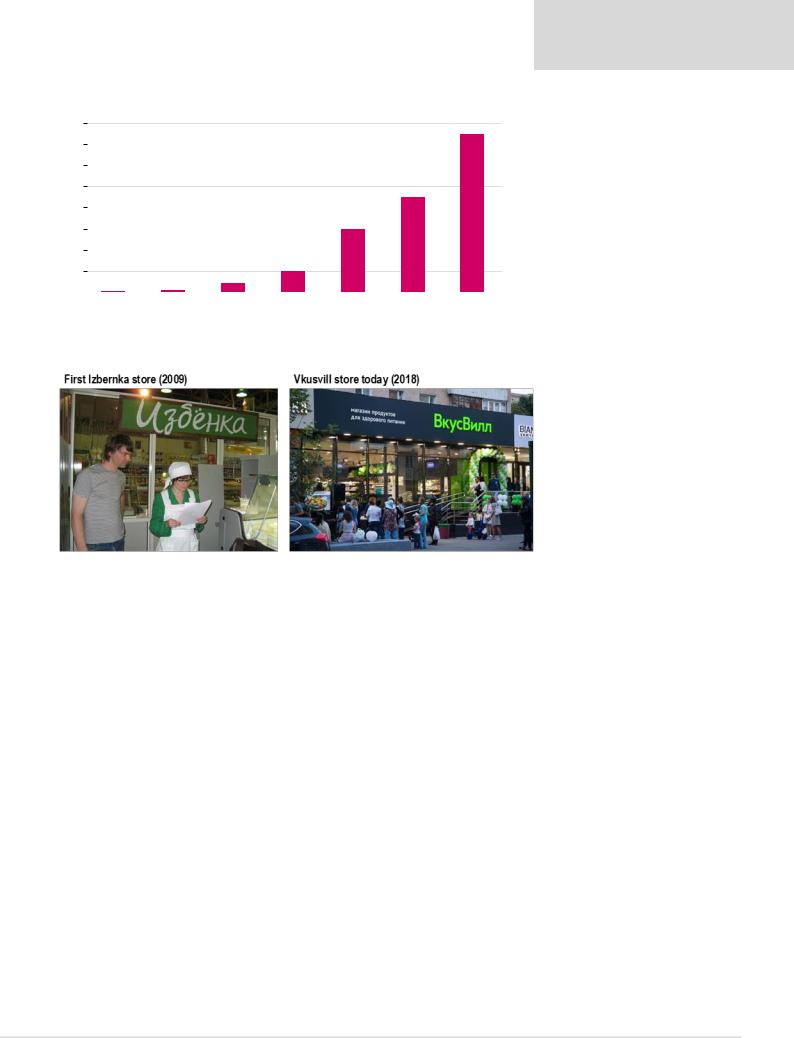

Vkusvill is the largest health food chain in Russia operating under ‘Vkusvill’ and ‘Izbenka’ brands. The company sources its assortment from Russian farmers and tests its ingredients to guarantee the natural origin of products. The business started in 2009 with four Izbenka stores selling only dairy products. In 2012 the first Vkusvill stores were opened, with assortment including non-dairy goods, and over time the store mix has shifted from Izbernka to Vkusvill.

In 2017 Vkusvill’s revenue almost doubled to RUB39bn and in 2018 the company accelerated its pace of expansion, opening c. 300 store openings. Today it operates around 750 Vkusvill stores, with most of them in Moscow and the region. Not only has the business scaled quickly but in recent years it has significantly expanded its assortment.

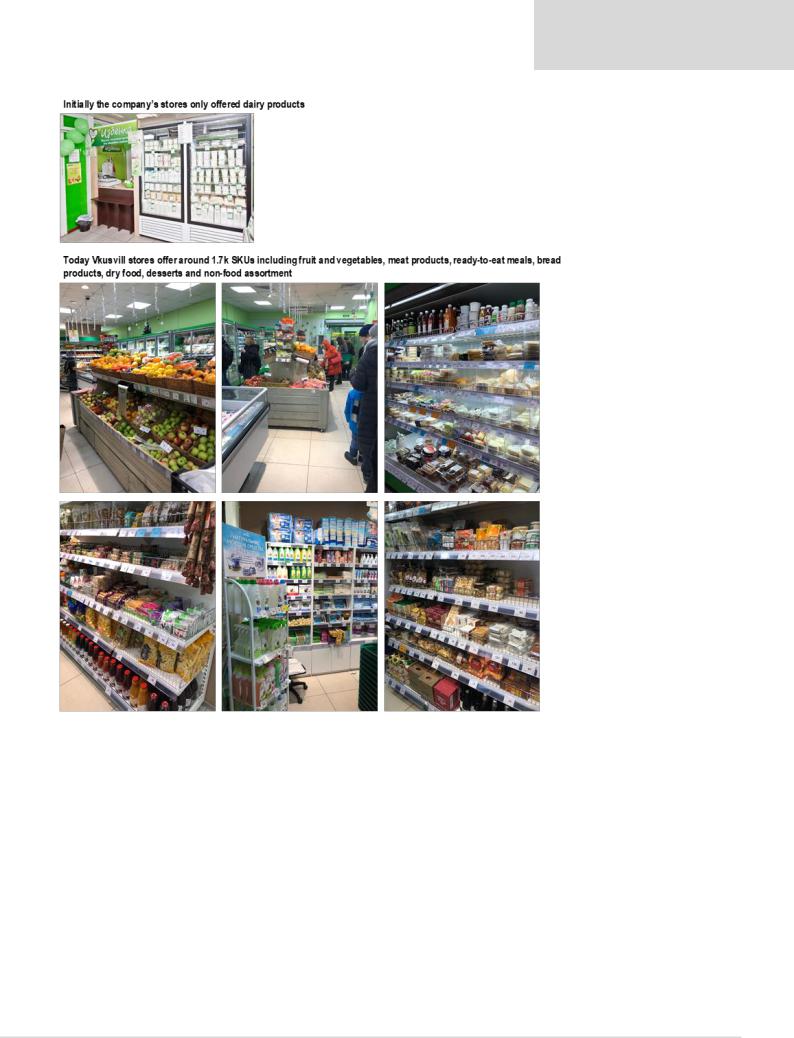

Currently Vkusvill’s assortment includes c. 1.7k SKUs vs 700-800 two years ago, and average store size has also increased. As a result, it has become increasingly possible for customers to purchase a greater share of their basket at Vkusvill. In the case of X5 it recently started to offer products from Vkusvill’s suppliers in Perekrestok and Pyaterochka stores in Moscow. However, X5’s and Magnit’s problem is that they’re too big to be able to source goods from small suppliers. In terms of prices, Vkusvill’s lower-end is higher vs federal chains; however, the prices are broadly in line for goods of comparable quality, in our view.

Vkusvill is owned by founders Evgeny Lisitsin and Andrey Krivenko (CEO), with 12% held by Baring Vostok. We think the acquisition of Vkusvill by one of the federal players is unlikely, as its specific brand would make it hard to integrate and extract synergies.

22

vk.com/id446425943

Renaissance Capital

21 January 2019

Russian retail

Figure 37: Vkusvill has been expanding aggressively, with most of its stores located in Moscow and region

|

|

|

Number of Vkusvill stores |

|

|

|

||

800 |

|

|

|

|

|

|

750 |

|

|

|

|

|

|

|

|||

700 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

600 |

|

|

|

|

|

|

|

|

|

|

|

|

|

451 |

|

||

500 |

|

|

|

|

|

|

||

400 |

|

|

|

|

|

|

|

|

|

|

|

|

300 |

|

|

||

|

|

|

|

|

|

|

||

300 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

200 |

|

|

|

|

|

|

|

|

|

|

|

100 |

|

|

|

||

|

|

|

|

|

|

|

||

100 |

4 |

8 |

40 |

|

|

|

|

|

|

|

|

|

|

|

|||

0 |

|

|

|

|

|

|

|

|

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

||

|

||||||||

Source: Company data

Figure 38: Vkusvill’s store development

Source: Company website

23

vk.com/id446425943

Renaissance Capital

21 January 2019

Russian retail

Figure 39: Vkusvill has significantly expanded its assortment which now includes around 1.7k SKUs

Source: Renaissance Capital

Myasnov

Myasnov is a Russian retail chain specialising in fresh meat products. The first store was opened in 2003 and today there are 229 stores located primarily in Moscow region. The company has been continually expanding its assortment which now includes dairy products, pastry and bakery. Moreover, most Myasnov’s are located next to Otdokhni stores offering alcohol and other goods for barbecue, which broadens the appeal.

Similarly to Vkusvill, Myasnov’s key competitive advantage vs federal players is its high quality assortment, the bulk of which is produced by the company or its partners. That includes over 150 SKUs produced by the ‘Myasnov’ meat factory as well as dairy goods made by the Myasnov Khlevnoe milk factory in partnership with Family Farms. Average prices at Myasnov are meaningfully higher vs Magnit or Pyaterochka, we believe, however its high-quality fresh assortment justifies the premium. Although Myasnov has

24

vk.com/id446425943

Renaissance Capital

21 January 2019

Russian retail

not been expanding as rapidly as Vkusvill, its relatively wide presence in Moscow makes it a strong competitor for some of X5’s customers, in our view.

The business is owned by Vladlen Altshuller, the major shareholder of Otdokhni, and

Sergey Mikhailov, CEO of Cherkizovo Group.

Figure 40: Myasnov and Otdokhni stores offer a relatively wide product range, with Myasnov’s focus on quality of assortment being the key competitive advantage vs larger players

Source: Renaissance Capital

Miratorg

Miratorg is the leading producer and supplier of meat on the Russian market. The company started to open stores in 2010 reaching around 90 by 2014 but then closed over 50 loss-making locations. In 2016 Miratorg refreshed its retail concept and spent around RUB600mn to re-accelerate expansion. Currently Miratorg operates 69 supermarkets, two hypers as well as small meat stores, mainly in Moscow and the region. Miratorg stores offer a good shopping experience and in our view are very similar to refurbished Perekrestok stores, with the main difference being a wider offering of meat products (including over 300 SKUs produced by Miratorg) and imported goods. Miratorg is owned by Alexander and Victor Linnik.

25

vk.com/id446425943

Renaissance Capital

21 January 2019

Russian retail

Figure 41: We believe Miratorg stores compete mainly with Perekrestok, with the main difference being a wider offering of meat products and imported goods

Source: Renaissance Capital

Azbuka Vkusa

Azbuka Vkusa is the largest Russian food retailer in the high-end segment. Founded in 1997 today it operates over 170 stores with most of them located in Moscow and the region and 12 stores in St Petersburg. The core format is Azbuka Vkusa supermarkets with over 700 m2 average selling space and around 15k SKUs. In addition to basic assortment available in other supermarkets, Azbuka has a wide offering of unique SKUs, including imported, private label and own produced goods; in total these account for over 30% of sales. The company is well-known for its superior level of service (personnel costs account for a significantly higher share of revenue vs public players) and high-quality fresh assortment (c. 60% of sales) including ready-to-eat meals.

26

vk.com/id446425943

Renaissance Capital

21 January 2019

Russian retail

In the past five years the company has accelerated its expansion, with the number of stores having almost tripled vs 2013. It currently expands primarily via AV Daily, convenience stores with c. 200 m2 selling space, 6k SKUs and high focus on ready-made meals. The number of AV Daily stores grew from 18 in early-2017 to around 60 currently.

Although Azbuka claims to have average market prices for basic assortment, its target customer is very different from that of Pyaterochka and even Perekrestok. That said, while Azbuka is not a direct competitor to X5’s core format, it is another example of how the Moscow market continues to get more competitive, with consumers enjoying an increasingly wide choice of where to shop. Azbuka is owned by founders (46.3%), Roman Abramovich (36.9%), former owners of Expobank – Andrey Vdovin, Pavel Maslovsky and Peter Hambro (11.9%), and management (5%).

Figure 42: Azbuka Vkusa accelerated expansion in 2017… |

|

|

Figure 43: …and now generates over RUB50bn revenue |

|

|

|

|

|

||||||||||||||||||

|

|

Number of Azbuka Vkusa stores |

|

|

|

|

|

|

Azbuka Vkusa revenue, RUBbn |

|

|

|

|

|

Growth, % |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

200 |

|

|

|

|

|

|

|

|

60.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

35.0% |

180 |

|

|

|

|

|

|

|

|

50.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

160 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25.0% |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

140 |

|

|

|

|

|

|

|

|

40.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

120 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100 |

|

|

|

|

|

|

|

|

30.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

80 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

60 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

40 |

|

|

|

|

|

|

|

|

10.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

0.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

|

2013 |

2014 |

2015 |

2016 |

|

2017 |

|

||||||||||||

|

|

|

|

|

|

Source: Company data, press reports |

|

|

|

|

|

|

|

|

|

|

|

|

|

Source: Company data, press reports |

||||||

Figure 44: Azbuka Vkusa provides goods of superior quality with prices above average

Source: Renaissance Capital

27

vk.com/id446425943

Renaissance Capital

21 January 2019

Russian retail

Fix Price

Founded in 2007 Fix Price is the largest Russian ‘dollar-store’ chain. The business has grown rapidly and today operates almost 3k stores in 74 Russian regions. In 2016 the company also expanded abroad, launching its stores in Kazakhstan, Belarus, Georgia and Latvia via franchising. Each store offers about 1,750 SKUs, including household goods and food products, at five different price points ranging between RUB50-199. Fix Price is constantly updating its assortment with for example, in 2016 expansion into the children’s goods category and in 2017 it was among the top-seven importers of children’s goods in Russia (top three by volume after Detsky Mir and Gloria Jeans).

Although the assortment overlap between Fix Price and X5 / Magnit is limited, it is a good example of consumer choice proliferating. With only c. 15% of stores located in Moscow, Fix Price also demonstrated that the competition from specialist players is a theme in Russian regions as well and given the difficult consumer environment we believe the company’s low-price proposition is appealing to a significant part of the market.

Beneficiaries of Meridian Management, which owns Fix Price, are unknown, however it has been reported that Dmitry Kirsanov (CEO), management and VTB Group (less than

7% stake) are among the company’s shareholders. In 2017 Fix Price’s revenue reportedly grew by 6% to RUB62bn.

Figure 45: Number of Fix Price stores grew significantly over the past five years

Number of Fix Price stores

3,500

3,000

2,500

2,000

1,500

1,000

500

0

2012 2013 2014 2015 2016 2017 2018

Source: Company data

28

vk.com/id446425943

Renaissance Capital

21 January 2019

Russian retail

Figure 46:Fix Price stores offer a wide assortment for consumers

Source: Renaissance Capital

Alcohol stores

Competition from alcohol-specialised retailers has grown substantially over the past five years. The largest players are Krasnoe & Beloe (over 6k stores), Bristol (3k stores) and Winlab (430 stores), and all three are growing fast. In 2017 Krasnoe & Beloe’s revenue grew by 48% YoY to RUB215bn; Bristol showed a 60% sales growth to RUB67.4bn;

Winlab’s number of stores increased from 136 in 2016 to over 400 currently.

The above chains have limited presence in Moscow but put material competitive pressure on both Magnit and X5 in the regions, where a wide offering of alcohol at competitive prices is a strong footfall generator. Alcohol stores also offer grocery assortment which, although limited vs Magnit / Pyaterochka, allows them to compete for a higher share of consumer basket.

Krasnoe & Beloe is owned by its founder Sergei Studennikov, Bristol belongs to the major owner of Dixy, Igor Kesaev and Sergey Katsiev, founders of Mercury group of companies, and Winlab is a part of Beluga Group.

29

vk.com/id446425943

Renaissance Capital

21 January 2019

Russian retail

Figure 47:Alcohol stores can compete with Magnit and Pyaterochka in alcohol and complementary goods offering

Source: Renaissance Capital

30