- •Contents

- •Investment summary

- •Organic store openings should slow with M&A becoming more important

- •Magnit can once again take traffic from X5

- •Competition from specialists and Magnit in Moscow will weigh on X5’s earnings

- •Magnit is better positioned than X5 to realise headcount savings

- •Lenta’s outlook is challenging but we see value

- •Financials and valuation

- •Disclosures appendix

vk.com/id446425943

Magnit can once again take traffic from X5

Product offering matters more than ever and Magnit’s CVP has visibly improved

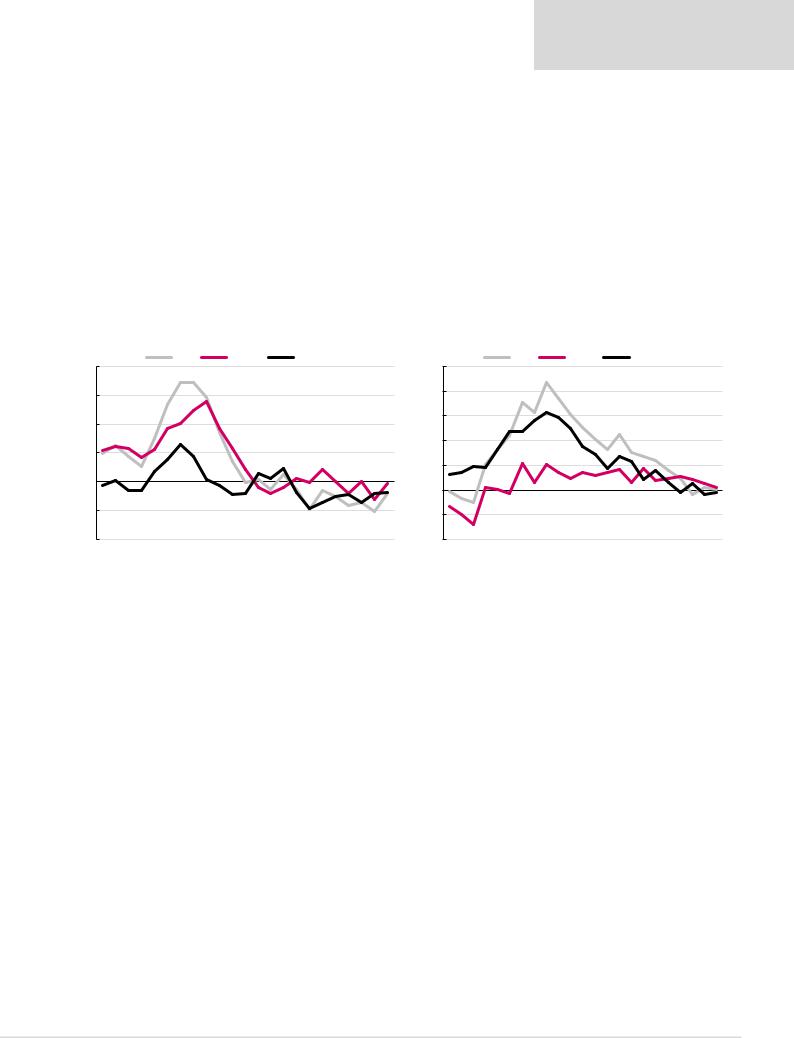

Over the past few years X5 has materially outperformed Magnit in terms of LfL growth. The former demonstrated solid traffic gains on the back of its refurbishment programmes at Pyaterochka and Perekrestok as well as struggling competition (e.g. Dixy), while Magnit with its weaker product offering lost relative share.

However, we think the situation is changing now. X5’s LfL growth has also slowed to around zero with the refurbishment programme at Pyaterochka ending more than 12 months ago. At the same time, Magnit’s consumer value proposition (CVP) is improving and we think this is important because assuming less aggressive openings by the largest players and a shift towards non-organic expansion top-line performance will increasingly depend on who offers the best consumer proposition.

Renaissance Capital

21 January 2019

Russian retail

Figure 12: Magnit – LfL growth dynamics, YoY |

Figure 13: X5 – LfL growth dynamics, YoY |

LFL |

Basket |

Traffic |

20.0% |

|

25.0% |

15.0% |

|

20.0% |

|

|

|

10.0% |

|

15.0% |

|

|

|

|

|

10.0% |

5.0% |

|

|

|

|

5.0% |

0.0% |

|

0.0% |

|

|

|

-5.0% |

|

-5.0% |

|

|

|

-10.0% |

|

-10.0% |

1Q13 3Q13 1Q14 3Q14 1Q15 3Q15 1Q16 3Q16 1Q17 3Q17 1Q18 3Q18 |

||

Source: Company data

LFL |

Traffic |

Basket |

1Q13 3Q13 1Q14 3Q14 1Q15 3Q15 1Q16 3Q16 1Q17 3Q17 1Q18 3Q18 |

||

Source: Company data

Magnit’s CVP has visibly improved

In our view, Magnit’s offering started to improve a while ago, even before Sergey Galitsky left the company. We believe the positive trend continued after the management reshuffle and note the following key changes:

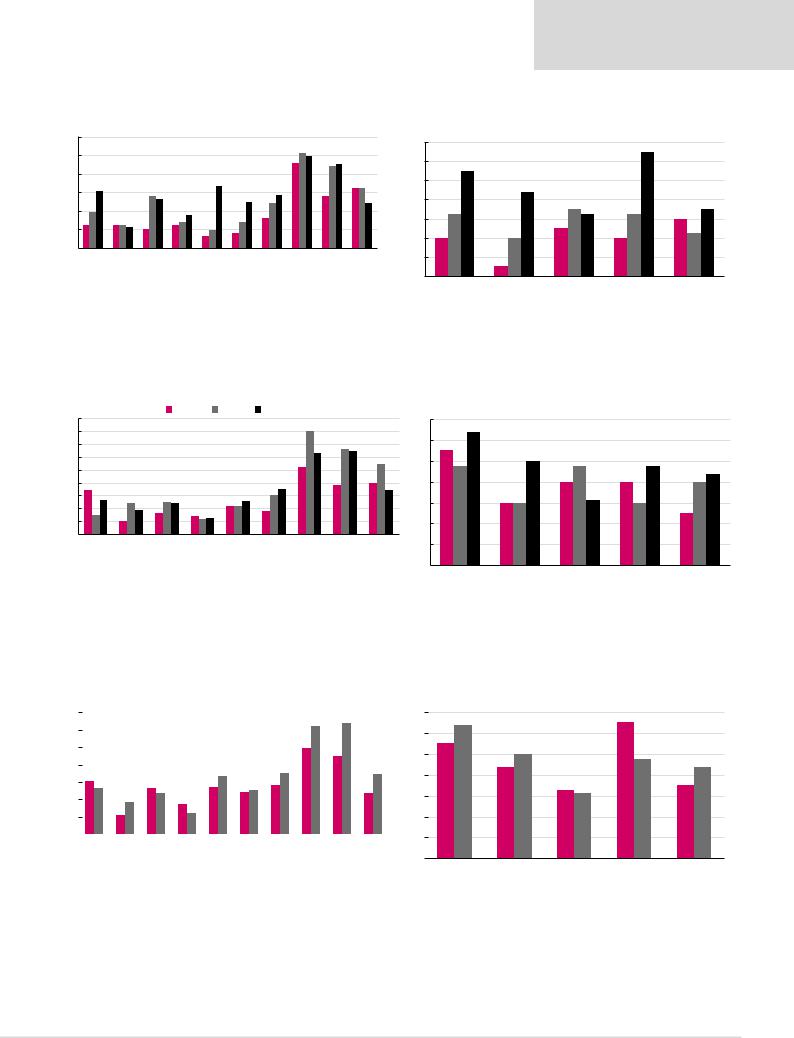

▪Assortment continues to expand, and we observe improvements in both width and depth in most of the key categories, with materially more choice in fruit and other fresh categories.

▪Pyaterochka’s assortment has also been expanding, however Magnit’s is now more comparable with X5’s in terms of choice.

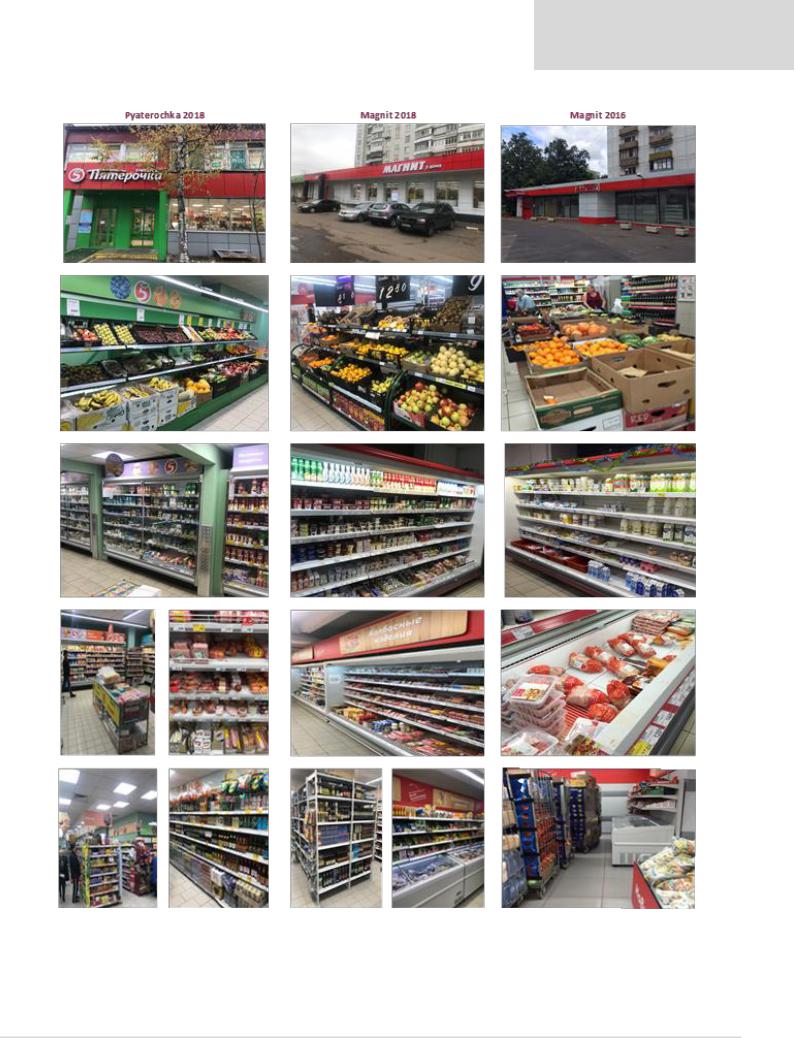

▪Look and feel has improved a lot at Magnit – many features of fit-out, navigation and communication to a large extent have been copied from Pyaterochka but at the same time X5’s stores that were refurbished several years ago now look less attractive than new Magnit’s.

12

vk.com/id446425943

Renaissance Capital

21 January 2019

Russian retail

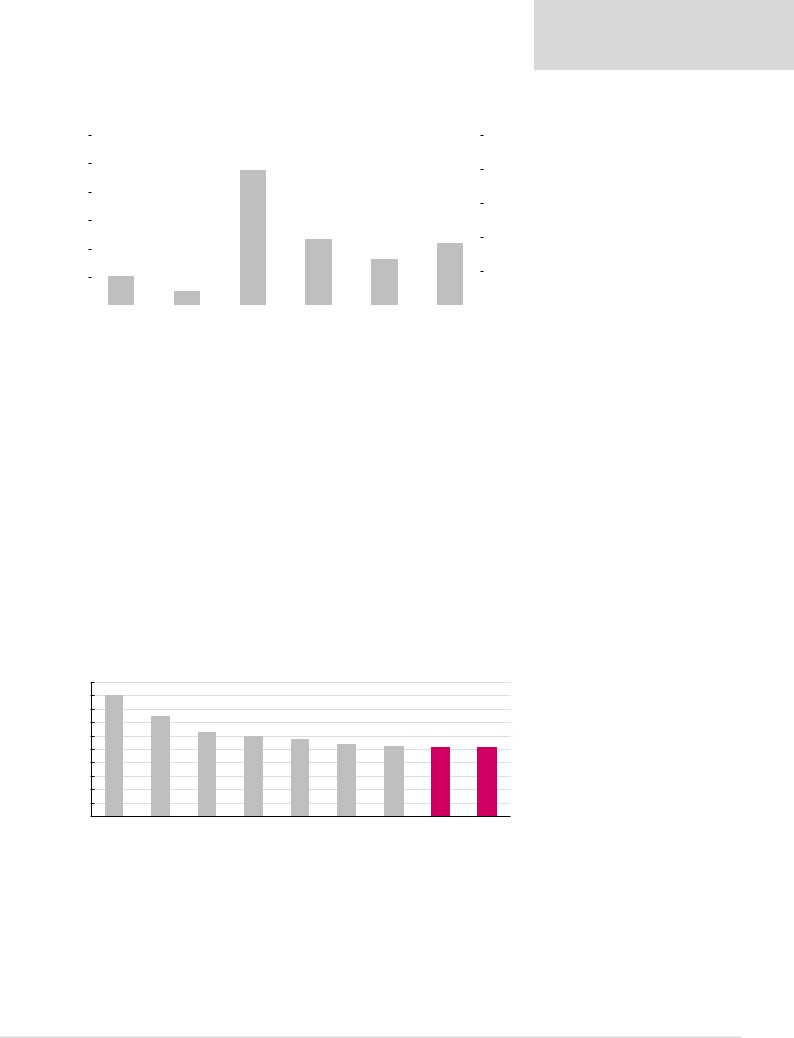

Figure 14: Magnit’s assortment continues to expand in terms of both width…

Number of brands in selected categories

|

May-17 |

|

Jan-18 |

|

Oct-18 |

|

|

|

|||

|

|

|

30

25

20

15

10

5

0

Milk |

Sour cream |

Yougurt |

Eggs |

Cheese (price tags, '0s) |

Pasta |

Juice |

Bottle beer |

Can beer |

Champagne |

Figure 15: …and depth

Number of flavours of selected products

|

May-17 |

|

Jan-18 |

|

Oct-18 |

|

|

|

|||

|

|

|

14

12

10

8

6

4

2

0

Danissimo |

Activia curd |

Activia yogurt Greenfield tea |

Lays |

yogurt |

yogurt |

drink |

|

*Based on the sample of selected stores in Moscow |

*Based on the sample of selected stores in Moscow |

Source: Renaissance Capital |

Source: Renaissance Capital |

Figure 16: Pyaterochka’s assortment has expanded too…

Number of brands in selected categories

May-17 Jan-18 Oct-18

45

40

35

30

25

20

15

10

5

0

Milk |

Sour cream |

Yougurt |

Eggs |

Pasta |

Juice |

Bottle beer |

Can beer |

Champagne |

Figure 17: …but not as significantly

Number of flavours of selected products

|

May-17 |

|

Jan-18 |

|

Oct-18 |

|

|

|

|||

|

|

|

14

12

10

8

6

4

2

0

Danissimo |

Activia curd |

Activia yogurt Greenfield tea |

Lays |

yogurt |

yogurt |

drink |

|

*Based on the sample of selected stores in Moscow |

*Based on the sample of selected stores in Moscow |

Source: Renaissance Capital |

Source: Renaissance Capital |

Figure 18: We believe assortment in renovated Magnit stores is now |

Figure 19: ...and depth… |

comparable to that of Pyaterochka in terms of width… |

|

|

|

Number of brands in selected categories |

|

|

|

|

|

|

|

Number of flavours of selected products |

||||||||||

35 |

|

|

|

|

Magnit |

|

|

Pyaterochka |

|

|

|

|

14 |

|

|

|

Magnit |

|

Pyaterochka |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

Milk |

Sourcream |

Yougurt |

|

Eggs |

Cheese |

|

Pasta |

Juice |

Bottlebeer |

Can beer |

Champaigne |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

0 |

yougurt |

yougurt |

drink |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Danissimo |

Activia curd Activia yougurt Greenfield tea |

||||

*Based on the sample of selected stores in Moscow |

|

|

|

|

|

|

|

|

*Based on the sample of selected stores in Moscow |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

Source: Renaissance Capital |

|

|

|

|

|

|

|

||

Lays

Source: Renaissance Capital

13

vk.com/id446425943

Renaissance Capital

21 January 2019

Russian retail

Figure 20: …and importantly this is also true in the fruit category (number of SKUs)

8 |

|

|

|

|

|

|

|

|

Magnit |

|

Pyaterochka |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Apples |

Pears |

Bananas |

Oranges |

Grapes |

Garnets |

Grapefruits |

|

Mandarins |

Lemons |

Pineapples |

Watermelons |

Melons |

Plums |

Kiwi |

Persimmon |

Pomelo |

Mango |

||

|

|

||||||||||||||||||

*Based on the sample of selected stores in Moscow

Source: Renaissance Capital

14

vk.com/id446425943

Renaissance Capital

21 January 2019

Russian retail

Figure 21: Magnit’s refurbished stores are now comparable to Pyaterochka’s in terms of look & feel, with some of Pyaterochka’s older refurbishments looking less attractive to us

Source: Renaissance Capital

15

vk.com/id446425943

Renaissance Capital

21 January 2019

Russian retail

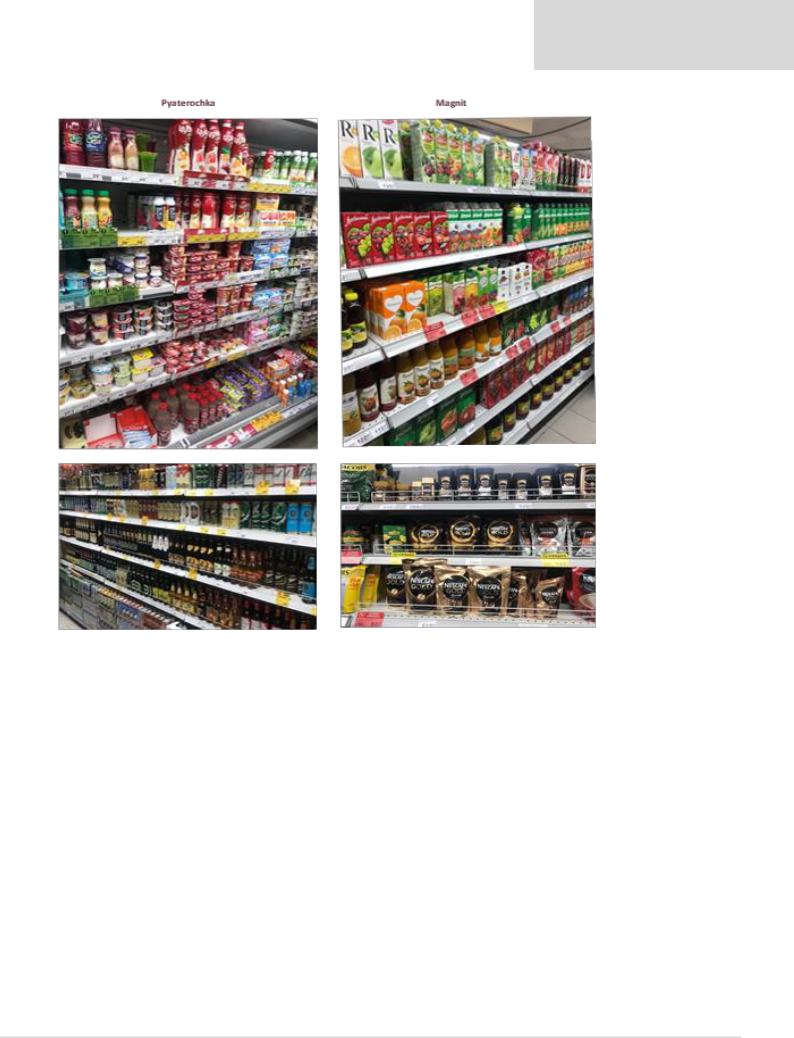

Figure 22: Many features at Magnit look similar to Pyaterochka’s, in our view, including marketing communication

Source: Renaissance Capital

There’s still room for improvement at Magnit but further rollout of existing initiatives should lead to traffic regains

We do not think that Magnit stores are ideal and dramatically better than Pyaterochka’s.

For example, we still observe serious availability issues at some of Magnit’s stores, which is an important offset to all the positive changes achieved over the past couple of years. Magnit also has a lower share of private label goods and appears to be less active in promo (Figure 25) although the end-prices are broadly the same, with both retailers being cheaper than most of smaller competitors.

16

vk.com/id446425943

Renaissance Capital

21 January 2019

Russian retail

Figure 23: There are still serious availability issues at some Magnit stores

Source: Renaissance Capital

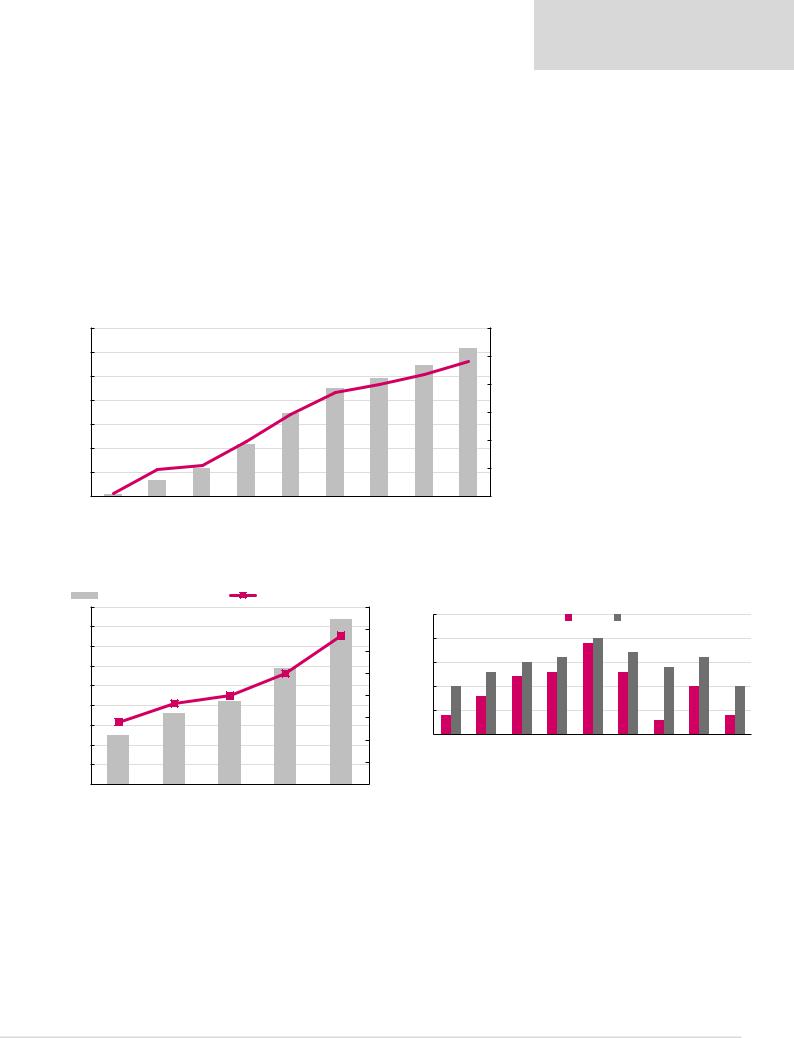

Figure 24: Both retailers have scope to increase the number of private labels in total sales

Share of private label 2017

|

Pyaterochka |

|

Magnit |

|

|

||

|

|

18%

16%

14%

12%

10%

8%

6%

4%

2%

0%

2015 |

2016 |

2017 |

Source: Company data

17

vk.com/id446425943

Renaissance Capital

21 January 2019

Russian retail

Figure 25: Pyaterochka is a leader in terms of share of SKUs on promo, while Magnit is significantly less active in promo…

|

|

|

|

|

|

|

SKUs on promo |

|

Share of total SKUs |

|||||||||

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|||||||||||

3000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

2500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

1000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Lenta |

Magnit |

Karusel |

Perekrestok |

Dixy |

Pyaterochka |

|

|

|

|

|

Note: Average data for Moscow, St. Petersburg, Kazan' and Novosibirsk used where available. |

|

|

|

|

|

|

|

|||

|

|

|

|

|

Source: Edadil, Renaissance Capital estimates |

|

|

|

||

Figure 26: …however, the end-prices are similar at Magnit and Pyaterochka (pricing in selected stores in Moscow/Moscow region, RUB) |

|

|||||||||

|

Magnit |

Pyaterochka |

Dixy |

Verny |

Yarche |

Magnolia |

Azbuka Vkusa* |

Vkuss Vill* |

Masnov* |

Krasnoe & Beloe |

Juice "Dobry" |

89.9 (152) |

81.59 (119.99) |

89.9 (144) |

82 (148) |

79.9 (89.9) |

87.9 (149.9) |

132 |

98 |

135 |

95.14* |

Bananas |

57 |

56 |

56 |

51 |

50 |

70 |

396 |

61 |

58 |

52 |

Cucumbers |

29 |

33 |

75 |

35 |

66 |

95 |

158 |

95 |

110 |

90 |

Tomatoes |

67 |

66 |

65 |

50 |

60 |

90 |

158 |

115 |

85 |

108 |

Bread |

13 |

13 |

13 |

13 |

15 |

20 |

42 |

20 |

26 |

|

Milk "Domik v derevne" |

65 |

65 |

na |

87 |

na |

85 |

86 |

55 |

52 |

61 |

Coca Cola |

60 |

55 |

56 |

55 |

38 |

60 |

57 |

na |

52 |

39 |

Sausages "Ostankino" |

121 |

120 |

155 |

150 |

121 |

na |

198 |

172 |

131 |

|

Chocolate "Alenka" |

74 |

70 |

80 |

74 |

na |

80 |

89 |

150 |

225 |

59 |

Lays |

52 |

53 |

56 |

53 |

42 |

53 |

52 |

na |

82 |

42 |

Tea "Greenfield" |

190 |

190 |

na |

na |

na |

na |

na |

na |

na |

|

Coffee "Nescafe" |

219 |

224 |

229 |

235 |

na |

229 |

241 |

190 |

340 |

|

Total |

1036 |

1027 |

1150 |

1074 |

1050 |

1192 |

1799 |

1251 |

1486 |

|

*Only bananas, cucumbers, tomatoes and bread are LfL; the rest is analogues.

Note: Number in brackets and with * is a two-litre pack of juice. An average of 3 stores is used for both Magnit and Pyaterochka.

Source: Renaissance Capital

Figure 27: …however, the end-prices are similar at Magnit and Pyaterochka (pricing in selected stores in

Moscow/Moscow region, RUB)

Average basket price, RUB

2,000

1,800

1,600

1,400

1,200

1,000

800

600

400

200

0

Azbuka Vkussa |

Myasnov |

Vkuss Vill |

Magnolia |

Dixy |

Verny |

Yarche |

Magnit |

Pyaterochka |

Note: Basket consists of 12 SKUs. An average of 3 stores is used for both Magnit and Pyaterochka.

Source: Renaissance Capital

Nevertheless, overall we think Magnit has made significant progress improving its product and becoming more competitive with X5. As such, we expect Magnit to at least partially regain traffic lost to nearby Pyaterochka stores over the past few years. We believe it is

18

vk.com/id446425943

important to realise that given Magnit’s often superior locations in regions, many of its stores do not need to be significantly better than X5’s in order to return part of traffic; being comparable should be enough, in our view.

Currently around 50% of Magnit stores are in a renovated format, with about 10% of those the latest ‘Redesign 2.1’ type. In the past X5 said that refurbishments become visible in financial results once more than half of store base is in the new format. Thus, we expect to see the improved operating trends at Magnit over the next 12 months and given its high overlap with Pyaterochka and planned focus on expansion in Moscow we believe X5 will feel more competitive pressure from Magnit and its new CVP than has been the case in recent years.

Figure 28: Magnit has renovated around 50% of its store base, which should be enough to impact overall trading, in our view

|

Total number of stores in new format |

|

as % of total convience stores |

|

|

7,000 |

|

|

|

|

|

|

|

60% |

6,000 |

|

|

|

|

|

|

|

50% |

|

|

|

|

|

|

|

|

|

5,000 |

|

|

|

|

|

|

|

40% |

|

|

|

|

|

|

|

|

|

4,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30% |

3,000 |

|

|

|

|

|

|

|

|

2,000 |

|

|

|

|

|

|

|

20% |

|

|

|

|

|

|

|

|

|

1,000 |

|

|

|

|

|

|

|

10% |

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

0% |

3Q16 |

4Q16 |

1Q17 |

2Q17 |

3Q17 |

4Q17 |

1Q18 |

2Q18 |

3Q18 |

Source: Company data

Renaissance Capital

21 January 2019

Russian retail

Figure 29: Overlap between Magnit Convenience and Pyaterochka stores has been increasing fast

Figure 30: Magnit aims to increase its market share to 15% by 2023 (vs 9% in 2017), with expansion focus on Moscow, St Petersburg, Volga Region and Siberia

Magnit / Pyaterochka overlaps |

As a share of Magnit's store base |

|

|

|

|

Market share by regions |

|

|

|

||||||

9,000 |

|

|

|

80% |

|

|

|

|

|

|

|

||||

|

|

|

25% |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

2018 |

2023 |

|

|

|

|

8,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

70% |

20% |

|

|

|

|

|

19%20% |

17% |

|

|

|

|

7,000 |

|

|

|

|

|

|

|

|

16% |

|

|

16% |

|

||

|

|

|

|

|

|

|

15% |

|

|

|

|||||

|

|

|

60% |

|

|

|

|

|

14% |

|

|||||

|

|

|

|

|

|

13% |

13% |

|

13% |

|

|

||||

|

|

|

|

|

15% |

|

12% |

|

|

|

|

||||

6,000 |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

50% |

|

10% |

|

|

|

|

|

|

10% |

10% |

||

|

|

|

|

|

8% |

|

|

|

|

|

|

||||

5,000 |

|

|

|

40% |

10% |

|

|

|

|

|

|

|

|

|

|

4,000 |

|

|

|

|

4% |

|

|

|

|

|

|

|

|

4% |

|

|

|

|

|

5% |

|

|

|

|

|

|

3% |

|

|||

|

|

|

|

30% |

|

|

|

|

|

|

|

|

|

||

3,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20% |

Moscow |

StPete |

Volga |

|

Central |

South |

NorthWest |

Siberia |

Ural |

NorthCaucasus |

|

2,000 |

|

|

|

|

|

||||||||||

Jun-16 |

Dec-16 |

Oct-17 |

Jun-18* |

|

|

||||||||||

Jun-15 |

|

|

|||||||||||||

1,000 |

|

|

|

10% |

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

0% |

|

|

|

|

|

|

|

|

|

|

|

*Including overlaps between Magnit Convenience and federal competitors |

Source: Company data |

Source: Company data

19