DB European Pharmaceuticals 2019 Outlook_watermark

.pdf

vk.com/id446425943

Bank Deutsche |

DB strategists: overweight cyclicals - short term risk |

||

for EU Pharma |

|||

AG/London |

|

|

|

Rising US 10-year bond yields and a weakening USD to weigh on relative sector performance |

|||

|

|||

|

■ |

Our sector strategists are overweight cyclicals versus defensives. They see European cyclicals as 10% below the fair-value suggesting that the |

|

|

|

market is already priced for a further sharp growth slowdown. However, they believe such a slowdown is unlikely, as their PMI models project that |

|

|

|

Euro area and global PMI momentum are set to rebound into positive territory over the coming months. |

|

|

■ |

Underweight pharma suggesting short-term downside risk. Our strategists are underweight Pharma which has outperformed the market strongly |

|

|

|

since mid-June, leaving the sector’s price relative meaningfully above the level implied by the historical relationship with US bond yields. They expect |

|

|

|

a rebound in PMI momentum together with shrinking global central bank balance sheets to drive up US bond yields. Combined with their expectations |

|

|

|

for a weaker US$, this points to near-term downside risk for Pharma's relative performance. |

|

|

■ |

12 month market outlook more constructive for defensives but still risks for Pharma. Our strategy team expect the Stoxx 600 to end 2019 at 345, |

|

|

|

~5% below current levels. This view is based on their below consensus projected 2019 EPS growth of 1% (vs consensus 9%) with a target 12.0x |

|

|

|

PE (slightly down from current levels). They expect EPS growth to weaken due to increased headwinds from Euro strength and a slight softening in |

|

|

|

global PMIs. This 12 month outlook would be much more constructive for defensives, particularly given our expectations for EPS growth of ~6% in |

|

|

|

2019 (7% ex dilution from GSK's Tesaro acquisition). However, Euro strength and upward pressure on US bond yields represents the most significant |

|

|

|

risk to our more positive fundamental view. |

|

Figure 14 : Our strategists have a below consensus view on market EPS |

Figure 15 : European pharma's price relative tends to move inversely to |

||||||||||||||

growth |

|

|

|

|

US 10-year bond yields, but has become disconnected recently |

|

|||||||||

9% |

|

|

|

|

|

|

|

|

|

|

US 10-year bond yield (lhs) |

|

|

|

|

|

Factors behind move in Stoxx 600 12-month trailing EPS |

|

|

|

|

|

|

|

Strategy US 10-year bond yield forecast (lhs) |

|

|||||

8% |

from end-18 to end-19 |

1.1% |

|

|

|

-160 |

|

|

|

European pharma vs market (rhs) |

24% |

|

|||

|

|

-5.8% |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7% |

|

1.3% |

|

|

|

invyields,bondUSinchg6m(bps) |

-120 |

|

|

|

|

|

|

18% |

6mmarketvspharmaEuropeanchg (%) |

6% |

5.5% |

|

|

|

|

-80 |

|

|

|

|

|

|

12% |

||

|

|

|

|

|

|

|

|

|

|

|

|

||||

5% |

|

|

|

|

|

|

-40 |

|

|

|

|

|

|

6% |

|

4% |

|

|

|

|

|

|

0 |

|

|

|

|

|

|

0% |

|

3% |

|

|

|

|

|

|

40 |

|

|

|

|

|

|

-6% |

|

2% |

|

|

|

|

1.3% |

|

80 |

|

|

|

|

|

|

-12% |

|

1% |

|

|

|

|

|

|

120 |

|

|

|

|

|

|

-18% |

|

0% |

|

|

|

|

|

|

160 |

|

|

|

|

|

|

-24% |

|

|

Global growth |

Commodities |

Bund |

EUR TWI |

Overall |

|

2004 |

2006 |

2008 |

2010 |

2012 |

2014 |

2016 |

2018 |

|

11Page |

Source: Datastream, Haver, Deutsche Bank |

Source: Datastream, Deutsche Bank |

|

|

|||

|

|

|

|

2018 December 10 Pharmaceuticals Pharmaceuticals European

vk.com/id446425943

Page |

What’s changed for our 2019 outlook? |

12 |

|

|

|

|

Key forecast, recommendation and TP changes |

■Our large cap target prices are generally based on a blend of DCF and target PE. We now use a target PE of 16x our 2020 Core EPS forecasts (rolled forward from 2019).

■For detailed valuation & risk comments for each company please see Appendix B - Price targets and risks

Figure 16 : Summary of earnings estimates and target price changes

Company |

2018E |

2019E |

2020E |

2021E |

2022E |

New Rating |

Prev. Rating |

TP |

TP change |

Comments |

|

|

|

|

|

|

|

|

|

|

|

EU major Pharma |

|

|

|

|

|

|

|

|

|

|

AstraZeneca |

0.1% |

-1.4% |

-1.8% |

-1.4% |

-1.1% |

Buy |

Buy |

6,900 |

6.2% |

Dilution from Synagis deal & impact of Mystic failure; TP rolled forward |

Bayer |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

Buy |

Buy |

115 |

0.0% |

Forecast unchanged as these were updated post CMD |

GlaxoSmithKline |

0.0% |

-5.2% |

-7.7% |

-4.5% |

0.1% |

Hold |

Hold |

1,520 |

-0.3% |

Impact from Tesaro acquisition and Horlick's divestment |

Novartis |

-0.4% |

-1.2% |

-1.5% |

-1.9% |

-1.1% |

Hold |

Hold |

96 |

7.9% |

Modest forecast changes. TP roll forward. |

Novo Nordisk |

-0.1% |

-0.3% |

-0.3% |

-0.3% |

-0.3% |

Buy |

Buy |

355 |

0.0% |

Minimal forecast changes |

Roche |

2.1% |

2.2% |

2.8% |

3.2% |

4.7% |

Hold |

Hold |

255 |

6.3% |

Biosimilar erosion rates and assumed cost offsets from Esbriet patent expiry |

Sanofi |

0.9% |

0.5% |

0.5% |

0.5% |

0.6% |

Buy |

Buy |

93 |

6.9% |

Small uplift to BIVV001 forecasts. TP rolled forward |

EU mid-cap Pharma |

|

|

|

|

|

|

|

|

|

|

Evotec |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

Buy |

Buy |

22 |

0.0% |

|

Genmab |

-3.8% |

-21.4% |

-7.3% |

28.1% |

-1.8% |

Buy |

Hold |

1,250 |

2.5% |

Updated for milestone timing; minimal changes to Darzalex forecasts |

Grifols |

-0.8% |

-2.1% |

-2.9% |

-3.3% |

-2.3% |

Hold |

Hold |

25 |

8.7% |

Reduced near-term margins but increased LT sales growth on albumin/AMBAR |

Idorsia |

-4.0% |

-10.1% |

-12.8% |

-1.6% |

6.5% |

Buy |

Buy |

29 |

0.0% |

Adjusted cashburn spend timing; overall cash runway unchanged |

Lundbeck |

0.0% |

-2.1% |

-0.8% |

-0.4% |

-0.2% |

Sell |

Sell |

225 |

-6.3% |

Fx, Onfi erosion rate. DCF based TP rolled forward. |

Merck KGaA |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

Hold |

Hold |

93 |

0.0% |

|

Morphosys |

-4.5% |

3.3% |

-2.0% -30.0% 71.9% |

Buy |

Hold |

130 |

8.3% |

Updated for milestone timing, minimal underlying changes |

||

Polyphor |

0.0% |

0.0% |

0.0% |

0.0% |

-53.7% |

Buy |

Buy |

78 |

5.4% |

NPV rolled forward |

SOBI |

0.0% |

0.4% |

2.5% |

3.0% |

5.3% |

Buy |

Hold |

245 |

22.5% |

Increases to Gamifant forecasts post approval |

UCB |

-0.6% |

-4.0% |

0.6% |

1.4% |

7.4% |

Buy |

Hold |

95 |

26.7% |

Increases to long-term pipeline forecasts |

Vifor |

-0.2% |

-7.6% |

-7.0% |

-9.4% |

-10.8% |

Hold |

Hold |

135 |

-25.0% |

Reflecting a more cautious view on the uptake of Veltassa |

Source: Deutsche Bank

AG/London Bank Deutsche

2018 December 10 Pharmaceuticals Pharmaceuticals European

vk.com/id446425943

Bank Deutsche |

Pricing: Divided congress suggests more bark but |

||

little bite from US pricing in 2019 |

|||

AG/London |

|

|

|

Reform of Part B and elimination of rebates most impactful |

|||

|

|||

|

■ |

President Trump's drug pricing blueprint has led to easing fears over detrimental changes to US drug pricing for the industry. The Blueprint |

|

|

|

focused on e orts to reduce high drug list pricing and out of pocket costs by improving competition, negotiating power and reducing perverse |

|

|

|

incentives to maintain high list prices. More damaging measures such as direct government price negotiation in Medicare Part D seem o the table. |

|

|

|

The proposals increase our confidence that the US system is likely to remain supportive of innovation. |

|

|

■ |

Eliminating rebates could lead to disruption but likely neutral overall. The most dramatic proposals in Trump's Blueprint include the possibility of |

|

|

|

reforming the current rebating system, by either eliminating rebates altogether or making these available at the point of sale directly to the consumer. If |

|

|

|

successful we believe this would ultimately be broadly neutral to the Pharma sector. However, it would likely have negative implications for companies |

|

|

|

that have secured dominate positions in categories through aggressive rebating. It creates price transparency and in theory would allow drug utilisation |

|

|

|

decisions to be made on merits of added benefit vs price, aiding products in competitive categories that have previously been 'shut out' of uptake |

|

|

|

in markets due to high rebate barriers. |

|

|

■ |

Medicare Part B proposals suggest any changes are unlikely to be dramatic. High on the agenda for drug price control measures have been e orts |

|

|

|

to reform Medicare Part B which reimburses injectable in-o ce administered drugs. CMS proposals are seeking to test whether using a combination |

|

|

|

of three approaches: 1) an international drug price reference; 2) a change in physician reimbursement from a percentage to a flat fee; and 3) allowing |

|

|

|

private-sector vendors to negotiate will improve quality of care and reduce costs. However, this is planned to be implemented on a test basis which |

|

|

|

would be run in select geographies and phased in over a period of five years starting from Spring '20. The full proposal will be published in Spring '19. |

|

Figure 17 : The Trump administration has focused on the growing gap |

Figure 18 : Medicare Part B reform has also been a political focus |

|||||||||||

between list and net drug prices |

|

|

|

|

|

|

|

|

|

|

|

|

370 |

|

|

|

35% |

|

16% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

14% |

|

|

|

|

|

|

330 |

|

|

|

33% |

|

12% |

|

|

|

|

|

|

USDBN |

|

|

|

|

RevenueTotal |

|

|

|

|

|

|

|

|

|

|

|

10% |

|

|

|

|

|

|

||

290 |

|

|

|

31% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8% |

|

|

|

|

|

|

250 |

|

|

|

29% |

|

6% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

% |

4% |

|

|

|

|

|

|

210 |

|

|

|

27% |

|

2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0% |

|

|

|

|

|

|

170 |

|

|

|

25% |

|

Astra |

Bayer |

GSK |

Novartis |

Novo |

Roche |

Sanofi |

2013 |

2014 |

2015 |

2016 |

2017 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Medicare Part B (% Total Revenue) |

|

|

||

Page |

|

|

RETAIL GROSS |

|

RETAIL NET |

GROSS TO NET DISCOUNT (%) |

|

|

|

|

|

|

|

|

|

|

|

||||

Source: American Patients First. The Trump Administration Blueprint to Lower Drug Prices and Reduce Out-of-Pocket Costs; Medicine |

|

Source: Deutsche Bank, Company data |

|

|||||||

|

|

|||||||||

13 |

Use and Spending in the U.S.; A Review of 2017 and Outlook to 2022. April 19, 2018 |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2018 December 10 Pharmaceuticals Pharmaceuticals European

vk.com/id446425943

Page |

Biosimilars: uptake a key political target; Roche at |

14 |

risk but delays cannot be ruled out |

|

Biologic drugs make up 25% of global drug spend = $200bn

■Pressure on healthcare costs means biosimilar approvals and utilisation are a key political focus. The FDA has taken a pragmatic approach to biosimilar filings with multiple major approvals in place (Enbrel, Remicade, Avastin and Humira). The FDA also recently published its Biosimilar Action plan, which seeks to facilitate robust and timely market competition. In addition, the Trump administration's Pricing Blueprint highlights biosimilar adoption as a strategic priority. However, impact of biosimilars has been moderated in the US by ongoing legal battles over patents and di culty for new entrants to overcome existing rebate contracts.

■Driving biosimilar uptake in Medicare Part B and eliminating rebate trap key to savings. Thus far, US biosimilars that are reimbursed via Medicare Part D have been able to gain meaningful share. However, for drugs such as Remicade (primarily Medicare Part B) uptake has been muted. This likely reflects a 'rebate trap', with incumbents leveraging 'all or nothing' discount schemes that limit penetration of new competition. This is particularly pertinent for Remicade as physicians are unlikely to actively switch existing patients. This limits willingness of hospitals to stock biosimilars when there is uncertainty over likely volume use. We expect these barriers to biosimilar uptake to be a key focus for legislators during 2019.

■Roche has the largest uncertainties in 2019. With broad approvals for biosimilars of Herceptin, Avastin and soon expected Rituxan by the FDA, further pressures on Roche's oncology sales are imminent (patents expire in late '18 and mid '19). Biosimilar launches in Europe have thus far had a greater impact than initially anticipated. However, the impact of US launches remains a major uncertainty. In contrast to Remicade, Roche's cancer drugs are generally shorter duration treatments meaning higher patient turnover and thus lower economic barriers for payors to o er biosimilars. We note that Roche is also continuing to defend its patent estate covering each of the big three drugs. These legal cases could significantly delay erosion of these franchises relative to consensus forecasts.

Figure 19 : Biosimilar erosion to constrain Roche sales growth |

|

Figure 20 : EU company exposure to biosimilar risk (2018-2023) |

|

|

|

|

|

8 |

|

|

|

|

|

|

|

48 |

|

|

50% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

BankDeutsche |

salesProduct(CHFbn) |

7 |

|

|

|

|

|

|

|

46 |

groupTotalsales (CHFbn) |

of%2018E group sales |

40% |

|

|

|

|

|

|

1 |

|

|

|

Rituxan (consensus) |

|

|

34 |

|

|

|

|

|

|

|

|||||

|

|

6 |

|

|

|

|

|

|

|

44 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30% |

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

42 |

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

40 |

|

|

20% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

3 |

|

|

|

|

|

|

|

38 |

|

|

10% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

Avastin (consensus) |

|

|

36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Herceptin (consensus) |

|

|

|

|

|

0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AG/London |

|

|

|

|

|

Total pharma sales (DBe) |

|

|

|

|

Astra |

Bayer |

GSK |

Novartis |

Novo |

Roche |

Sanofi |

||

|

0 |

|

|

|

|

|

|

|

32 |

|

|

|

|

|

Sector Average |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

2015A |

2016A |

2017A |

2018E |

2019E |

2020E |

2021E |

2022E |

2023E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Source: Deutsche Bank, FactSet Consensus |

|

|

|

|

|

|

|

Source: Deutsche Bank |

|

|

|

|

|

|

||||

2018 December 10 Pharmaceuticals Pharmaceuticals European

vk.com/id446425943

Bank Deutsche |

Competitive categories: Limited new exclusions, |

||

more benign on insulins, HIV at risk? |

|||

AG/London |

|

|

|

Pricing in competitive categories in the US is here to stay |

|||

|

|||

|

■ |

Consolidation amongst US payors, slowing patent expiries and increasing new approvals have combined to put pressure on drug budgets and |

|

|

|

increase buyer purchasing power. As a result, payors have been increasing use of formulary exclusions and exclusive contracts to control cost |

|

|

|

inflation. This has led to increased pressure in categories with multiple competitors and low therapeutic di erentiation. However, total drug spend |

|

|

|

growth in the US has slowed from a peak in 2014, a fact we believe will continue to alleviate pressure to manage pricing. |

|

|

■ |

2019 will likely see minimal changes in excluded drug lists by major US formularies. Exclusion changes impacting our coverage include Eloctate |

|

|

|

(excluded from Express) and Symbicort (added back to Caremark) impacting Sanofi/AZN. |

|

|

■ |

Pressures on insulins to continue but more benign than expected. Basal insulin pricing pressure triggered by launch of Lilly's biosimilar Basaglar |

|

|

|

has been a major drag for both Sanofi and Novo in recent years. However, Merck recently terminated its Lantus biosimilar collaboration with Samsung |

|

|

|

Bioepis choosing not to launch its biosimilar, quoting the expected pricing and cost of production. While we expect continued price erosion in the |

|

|

|

segment the decision suggests pricing may be reaching somewhat of a floor and implies a more benign outlook than originally envisioned. |

|

|

■ |

More active management of costs a risk in HIV. Major pharmacy benefit manager Express Scripts recently announced it will exclude Gilead's HIV |

|

|

|

drug Atripla from its formulary in 2019 in favour of Mylan's generic formulation Symfi (efavirenz/3TC/TDF). In addition, UnitedHeallth has introduced |

|

|

|

a cost saving measure to encourage utilisation of Mylan's generic Cimduo. We believe these e orts could signal a trend of more active management |

|

|

|

of HIV costs and price pressure in the category, which may be negative for GSK's franchise in the long term. |

|

Figure 21 : EU company revenue exposure to competitive drug |

Figure 22 : Slowdown in total drug spend increases in the US market |

|

|||

categories |

|

|

|

|

|

|

100% |

|

500 |

20% |

|

|

90% |

|

450 |

15% |

|

|

80% |

|

|

||

2018Eofgroup sales |

Spending($bn) |

|

|

changeAnnual(%) |

|

30% |

|

|

|||

|

70% |

|

400 |

10% |

|

|

60% |

|

|

|

|

|

50% |

|

350 |

5% |

|

|

|

|

|

|

|

|

40% |

|

300 |

0% |

|

% |

20% |

|

250 |

-5% |

|

|

|

|

|

|

|

|

10% |

|

200 |

-10% |

|

|

|

|

|

||

|

0% |

|

|

2007A 2008A 2009A 2010A 2011A 2012A 2013A 2014A 2015A 2016A 2017A |

|

|

|

|

|

|

|

|

Astra |

Bayer |

GSK |

Novartis |

Novo |

Roche |

Sanofi |

|

|

|

|

Net Spending $bn (lhs) |

|

Gross to Net Discount $bn (lhs) |

|

|

|

|

|

|

|

||||||||||

|

|

|

|

Sector Average |

|

|

|

|

|

|

|

|

|||

Page |

|

|

|

|

|

|

|

|

|

|

Invoice Spending Growth % (rhs) |

|

Net Spending Growth % (rhs) |

||

|

|

|

|

|

|

|

|

|

|

|

|

||||

Source: Deutsche Bank estimates; Competitive categories defined as % of 2018E Group sales from at risk segments i.e. Diabetes, |

|

Source: IQVIA, National Sales Perspectives, Dec 2016; IQVIA Institute of Human Data Science |

|

||||||||||||

|

|

||||||||||||||

Respiratory, Cardio-metabolic, Haemophilia, HIV & genericised categories |

|

|

|

|

|

|

|

|

|

|

|

||||

15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2018 December 10 Pharmaceuticals Pharmaceuticals European

vk.com/id446425943

Page |

R&D productivity: Record year for new approvals but |

16 |

pace of innovation has a catch |

|

A record year expected for new drug approvals

■FDA approvals expected to reach a record high in 2018. Thus far the FDA has approved 55 NME/BLA’s. This is well above the 2000-2009 average of 19 and exceeds the previous record in 2017. With a further 5 novel agents still under review, the total could exceed the all time record year of 1996. We continue to believe the industry is in the middle of a super cycle of innovation driven by improved understanding of the biology of disease.

■EU Pharma approvals remain solid; outlook for '19 strong. Thus far in 2018, EU Pharma has had 9 new drug approvals that are expected to contribute close to $5bn to outer year sales, including AZN's Lumoxiti and Lokelma, Shire's Takhzyro, Roche's Xofluza and Novartis' Aimovig and Lutathera, and Bayer's Vitrakvi. In addition, major new approvals for AstraZeneca's Tagrisso (1L EGFRm lung cancer) and Imfinzi (unresectable stage III lung cancer) have added multi-blockbuster sales in new indications. We see potential for a further 15 major new drug approvals in late '18 or '19, including three blockbusters from Novartis including AVXS-101, siponimod and RTH258. In addition, we see an early approval of Novo's oral semaglutide as possible if it utilises its priority review voucher. These drugs contribute a total of >$15bn to outer year sales.

■Rapid pace of innovation has a catch: Lifecycles getting squeezed by fast followers and serial innovation. We maintain our positive view over the pace of sector innovation. However, we note a concentrated industry focus on limited drug classes. This is highlighted by the crowded nature of certain novel drug categories (such as PARP, PD-1/PD-L1, ALKi & CDKi). This and the fast pace of obsolescence through serial innovation is squeezing the lifecycles of new drugs in some circumstances, as evidenced by fast followers in the ALK inhibitor category. As such, increasing thought needs to be given to peak sales assumptions and terminal values for drugs in high research intensity categories.

Figure 23 : Another record year for new drug approvals |

|

Figure 24 : Onset of competition is rapid and truncates peak sales |

|

|

potential |

|

|

|

|

70 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,500 |

|

|

|

|

|

|

|

|

|

|

|

60 |

|

|

|

|

|

|

|

|

|

|

|

|

|

(USDm) |

3,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

48 |

59 |

2,500 |

|

|

|

|

|

|

|

|

|

|

|

|

50 |

|

|

|

|

|

|

|

|

|

35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

38 |

|

|

|

|

|

41 |

41 |

|

41 |

|

41 |

|

|

Sales |

2,000 |

|

|

|

|

|

|

|

|

|

|

|

|

35 |

|

36 |

|

|

|

36 |

|

45 |

|

46 |

|

|

|

|

|

|

|

|

|

|

|

|||

|

40 |

|

34 |

|

|

|

41 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

26 |

|

|

|

|

|

39 |

|

|

|

|

|

Worldwide |

1,500 |

|

|

|

|

|

|

|

|

|

|

|

Deutsche |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

30 |

|

|

|

|

23 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

30 |

|

|

|

|

|

|

|

|

1,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

27 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

20 |

|

|

24 |

26 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

22 |

|

|

21 |

|

|

|

|

|

22 |

|

|

|

500 |

|

|

|

|

|

|

|

|

|

|

||

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2013A |

2014A |

2015A |

2016A |

2017A |

2018E |

2019E |

2020E |

2021E |

2022E |

2023E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018* |

|

Xalkori (crizotinib) - Pfizer |

|

|

|

Zykadia (ceritinib) - Novartis |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

AG/London |

|

NME/new BLA Approvals |

|

NME/BLA Filings |

|

Average Approvals |

|

Alecensa (alectinib) - Roche/Chugai |

|

|

Alunbrig (brigatinib) - Takeda |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

(2005-2018) |

|

|

Lorbrena (lorlatinib) - Pfizer |

|

|

|

entrectinib - Roche/Chugai |

|

|||||||

|

Source: Deutsche Bank, FDA *DB estimate |

|

|

|

|

|

|

|

|

|

|

Source: Evaluate Pharma |

|

|

|

|

|

|

|

|

|

|

||||

2018 December 10 Pharmaceuticals Pharmaceuticals European

vk.com/id446425943

Bank Deutsche |

New launches in 2019 key for Novartis and Roche |

||||

|

|

|

|||

Drugs to be launched in '19 should add >$15bn to outer year sales |

|||||

AG/London |

|

specialty launches have continued to meet or beat expectations as highlighted by strong launches of AZN's Imfinzi, Tagrisso and Fasenra in key |

|||

|

■ |

Given a tougher US payor environment the pace of new drug launches has been a sector debate, with disappointing launches in cardiovascular |

|||

|

|

disease (Novarts’ Entresto; Sanofi’s Praluent) weighing on sentiment and impacting share prices in past years. However, oncology and innovative |

|||

|

|

indications during 2018. Even PD-1's/PD-L1's have beat initial expectations, but unfortunately not Roche's Tecentriq. |

|||

|

■ |

>12 major new drug launches expected in 2019, with potential to deliver >$15bn in peak sales. This rate of portfolio rejuvenation for the sector |

|||

|

|

is above the rate we believe is required for the sector to derive a positive rate of return on investment. New launches include AVXS-101 (spinal |

|||

|

|

muscular atrophy; Novartis), RTH258 (wet AMD; Novartis), siponimod (secondary progressive multiple sclerosis; Novartis), polatuzumab (DLBCL; |

|||

|

|

Roche), potentially risdiplam (spinal muscular atrophy; Roche) and oral-semaglutide (diabetes; Novo Nordisk). We expect these new drugs to go on |

|||

|

|

to deliver >$15bn in sales. We see Novartis as most sensitive to the performance of expected new launches in 2019. |

|||

|

■ |

New product sales underpin our expectations for an acceleration in EPS growth DBe '18-23E EPS CAGR of 7%. We expect new product sales to |

|||

|

|

drive a 5% CAGR in revenues over '18-23E, more than o setting relatively modest impact from patent expiries and erosion of legacy portfolios from |

|||

|

|

biosimilars over this period. |

|

|

|

|

■ |

~ 75% of new products sales from oncology/innovative/specialty segments. Importantly, only a minor proportion of forecasts for new product sales |

|||

|

|

within the sector are derived from segments where access is more challenging or where price competition is intense (cardiovascular/diabetes/primary |

|||

|

|

care/respiratory). |

|

|

|

|

|

|

|

|

|

|

Figure 25 : Key new drug launches in 2019 ($m) |

|

Figure 26 : New product launches in 2019 to add ~$14bn sales by |

||

|

|

|

|

2024E, all new launches since 2015 reaching >$70bn. |

|

|

|

|

|

|

|

Drug |

Indication |

Company |

DB 2024E |

Consensus |

|

90,000 |

|

|

|

|

|

|

|

|

45% |

|

|

|

($m) |

2024E ($m) |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

80,000 |

|

|

|

|

|

|

|

|

40% |

Oral semaglutide |

Diabetes |

Novo Nordisk |

4,587 |

2,600 |

|

70,000 |

|

|

|

|

|

|

|

|

35% |

Siponimod (BAF312) |

SPMS |

Novartis |

2,150 |

841 |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|||||

Brolucizumab (RTH258) |

wet AMD |

Novartis |

1,890 |

1,062 |

|

60,000 |

|

|

|

|

|

|

|

|

30% |

AVXS-101 |

SMA |

Novartis |

1,750 |

1,370 |

USDM |

50,000 |

|

|

|

|

|

|

|

|

25% |

Risdiplam |

SMA |

Roche |

900 |

151 |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|||||

Alpelisib |

PIK3Am breast cancer |

Novartis |

700 |

127 |

|

40,000 |

|

|

|

|

|

|

|

|

20% |

Polatuzumab |

DLBCL |

Roche |

630 |

458 |

|

30,000 |

|

|

|

|

|

|

|

|

15% |

Sotagliflozin |

Type I diabetes |

Sanofi |

592 |

767 |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|||||

Larotrectinib |

TRK/ROS1m lung cancer |

Bayer |

546 |

484 |

|

20,000 |

|

|

|

|

|

|

|

|

10% |

Isatuximab |

Multiple myeloma |

Sanofi |

531 |

479 |

|

10,000 |

|

|

|

|

|

|

|

|

5% |

Entrectinib |

TRK/ROS1m lung cancer |

Roche |

380 |

377 |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

0% |

|

|

|

|

|

|

2015A |

2016A |

2017A |

2018E |

2019E |

2020E |

2021E |

2022E |

2023E |

2024E |

|

|

|

|

|

|

LAUNCHES IN 2019 |

|

RECENT LAUNCHES |

|

AS % OF SECTOR REVENUES (RHS) |

|

|

|

|

|

|

|

|

|

||||

Source: Deutsche Bank |

|

Source: Deutsche Bank, Company data. Recent launches defined as product launches in 2015 - 2018. Sector revenues defined as |

|

||||||||

|

|

||||||||||

17Page |

|

Pharmaceuticals & Vaccines revenues for our European large cap coverage, excluding Shire. |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

2018 December 10 Pharmaceuticals Pharmaceuticals European

vk.com/id446425943

Page |

Consensus forecasts for growth products are |

18 |

favourable |

|

|

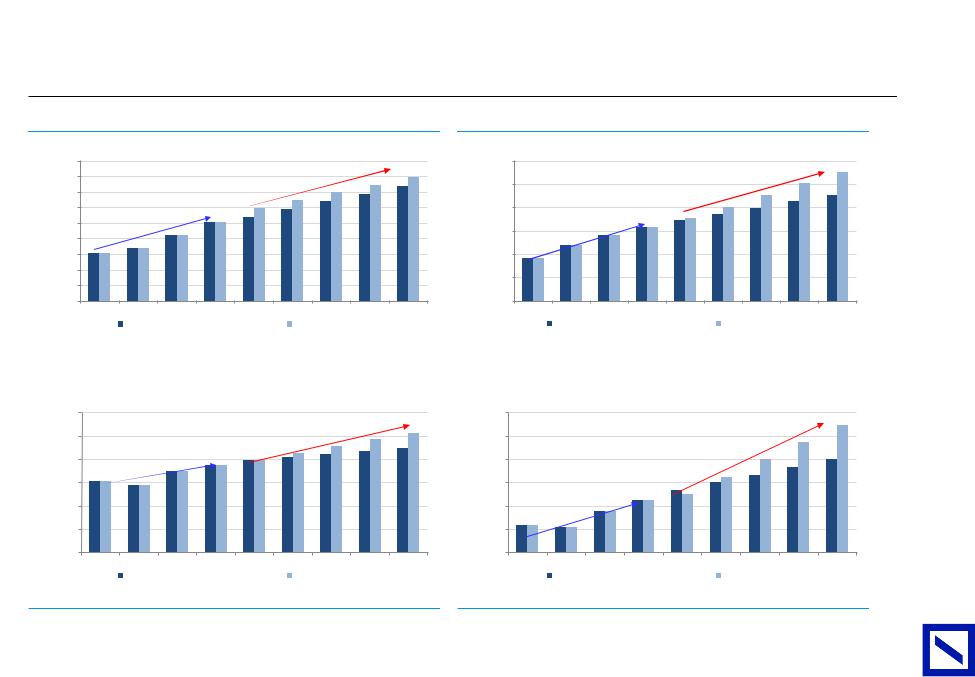

Key growth drivers have relatively undemanding consensus expectations |

|

|

|

|

|

|

|

||||||||||||||

|

Figure 27 : Tagrisso (AZN) |

|

|

|

|

|

|

Figure 28 : Ocrevus (Roche) |

|

|

|

|

|

|

||||||||

|

|

900 |

|

|

|

|

$50m/$50m per quarter |

|

|

|

1,200 |

|

|

|

|

CHF55m/CHF100m per |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

800 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

quarter required to meet |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

1,000 |

|

|

|

|

consensus/DB forecasts |

|

|

|||

|

|

700 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(USDm) |

600 |

$65m per quarter |

|

|

|

|

|

|

(CHFm) |

800 |

|

|

|

|

|

|

|

|

|

||

|

|

added to sales |

|

|

|

|

|

|

|

CHF80m per quarter |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

500 |

|

|

|

|

|

|

|

|

|

|

600 |

|

added to sales |

|

|

|

|

|

|

|

|

sales |

400 |

|

|

|

|

|

|

|

|

|

sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Global |

300 |

|

|

|

|

|

|

|

|

|

Global |

400 |

|

|

|

|

|

|

|

|

|

|

200 |

|

|

|

|

|

|

|

|

|

200 |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

4Q17A |

1Q18A |

2Q18A |

3Q18A |

4Q18E |

1Q19E |

2Q19E |

3Q19E |

4Q19E |

|

|

4Q17A |

1Q18A |

2Q18A |

3Q18A |

4Q18E |

1Q19E |

2Q19E |

3Q19E |

4Q19E |

|

|

|

|

Consensus (FactSet) |

|

|

Deutsche Bank |

|

|

|

|

|

Consensus (FactSet) |

|

Deutsche Bank |

|

|

|||||

|

Source: Deutsche Bank, FactSet |

|

|

|

|

|

|

|

Source: Deutsche Bank, FactSet |

|

|

|

|

|

|

|

||||||

|

Figure 29 : Cosentyx (Novartis) |

|

|

|

|

|

Figure 30 : Dupixent (Sanofi) |

|

|

|

|

|

|

|||||||||

|

|

1,200 |

|

|

|

|

$25m/$60m per quarter |

|

|

|

600 |

|

|

|

|

€30m/€75m per quarter |

|

|

||||

|

|

|

|

|

|

|

required to meet |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

1,000 |

|

|

|

|

consensus/DB forecasts |

|

|

|

500 |

|

|

|

|

required to meet |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

consensus/DB forecasts |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

(USDm)salesGlobal |

|

$50m per quarter |

|

|

|

|

|

|

(EURm)salesGlobal |

|

|

|

|

|

|

|

|

|

|

||

|

800 |

|

added to sales |

|

|

|

|

|

|

400 |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

600 |

|

|

|

|

|

|

|

|

|

|

300 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

€40m per quarter |

|

|

|

|

|

|

||

|

|

400 |

|

|

|

|

|

|

|

|

|

|

200 |

added to sales |

|

|

|

|

|

|

||

Deutsche |

|

200 |

|

|

|

|

|

|

|

|

|

|

100 |

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

4Q17A |

1Q18A |

2Q18A |

3Q18A |

4Q18E |

1Q19E |

2Q19E |

3Q19E |

4Q19E |

|

|

4Q17A |

1Q18A |

2Q18A |

3Q18A |

4Q18E |

1Q19E |

2Q19E |

3Q19E |

4Q19E |

|

|

|

|

Consensus (FactSet) |

|

|

Deutsche Bank |

|

|

|

|

|

Consensus (FactSet) |

|

Deutsche Bank |

|

|

|||||

AG/London Bank |

Source: Deutsche Bank, FactSet |

|

|

|

|

|

|

|

Source: Deutsche Bank, FactSet |

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2018 December 10 Pharmaceuticals Pharmaceuticals European

vk.com/id446425943

Bank Deutsche |

|

|

2019 large cap catalysts: most optionality at AZN & |

||||||||

|

|||||||||||

|

|

Novartis |

|

|

|

|

|

|

|||

AG/London |

|

|

|

|

|

|

|

|

|

|

|

|

|

Phase III readouts expected from ~18 major programmes in '19 |

|

|

|||||||

|

|

|

|

|

|||||||

|

|

|

■ |

$15bn in future new sales on the table in '19 Most upside optionality likely at AZN and Novartis. We expect Phase III de-risking data to report on |

|||||||

|

|

|

|

~18 major programmes during 2019. Collectively, these drugs could in theory deliver ~$15bn in future sales potential. We see greatest potential for |

|||||||

|

|

|

|

swings to investor expectations for AZN and Novartis. For AZN, focus will be on an integrated safety analysis of trials of roxadustat in 1Q19 and from |

|||||||

|

|

|

|

trials of Lynparza in new potential indications. For Novartis, results of subcut CD20 antibody ofatumumab in relapsing remitting multiple sclerosis |

|||||||

|

|

|

|

and trials of fevipiprant in severe asthma could open up a major opportunities. |

|

|

|||||

|

|

|

|

|

|

|

|

||||

|

|

|

Figure 31 : Key Phase III readouts in 2019 |

|

|

|

|

||||

|

|

|

Company |

Timing |

Sales |

Current DB |

Cons '23E |

Drug |

Indication |

DB comment |

|

|

|

|

|

|

potential* |

'23E |

(USDm) |

|

|

|

|

|

|

|

|

|

|

(USDm) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AZN |

2019 |

>$1bn |

$2,500m |

$2,134m |

Lynparza |

1L BRCAm pancreatic cancer (POLO-1), 1L |

Positive data fom PAOLO-1 in unselected ovarian cancer repesents a >$2bn |

|

|

|

|

|

|

|

|

|

|

ovarian cancer (PAOLA-1) and 2L prostate |

opportunity |

|

|

|

|

|

|

|

|

|

|

cancer (PROFOUND) |

|

|

|

|

|

AZN |

2019 |

>$1bn |

$3,204m |

$3,575m |

Imfinzi |

1L SCCHN (KESTREL), 1L SCLC (CASPIAN), 1L |

Smaller opportunities but potential to expand utility outside of core Stage III NSCLC |

|

|

|

|

|

|

|

|

|

|

bladder cancer (DANUBE) |

indication |

|

|

|

|

AZN |

1H19 |

$1-3bn |

$991m |

$704m |

Roxadustat |

Anaemia in kidney disease |

Cardiovascular outcomes analysis in 1Q19 is key to differentiation and market |

|

|

|

|

|

|

|

|

|

|

|

potential |

|

|

|

|

AZN |

1H19 |

$500m+ |

$2,041m |

$2,186m |

Brilinta |

THEMIS - type 2 diabetes with previous |

|

|

|

|

|

|

|

|

|

|

|

MI/stroke |

|

|

|

|

|

AZN |

2H19 |

>$1bn |

$1,482m |

$1,232m |

Calquence |

Chronic lymphocytic leukaemia |

Positive data would enable potential approval in the multi-blockbuster CLL |

|

|

|

|

|

|

|

|

|

|

|

indication. However, data from head-to-head trials with Imbruvica will likely be |

|

|

|

|

|

|

|

|

|

|

|

required to achieve meaningful market share. |

|

|

|

|

Bayer |

1Q19 |

$500m |

$136m |

$271m |

Aliqopa |

2L+ Non-Hodgkin's lymphoma |

|

|

|

|

|

Bayer |

1H19 |

>$1bn |

$376m |

$450m |

Daralutamide |

Castration resistant prostate cancer |

Presentation of detailed data in 1H19 could be share price moving if it demonstrates |

|

|

|

|

|

|

|

|

|

|

|

an efficacy advantage or clear safety benefit vs already launched competitors |

|

|

|

|

GSK |

1H19 |

<$500m |

$1,079m |

$953m |

Trelegy |

Asthma |

Incremental opportunity (<$500m) given modest current use of LAMAs in asthma |

|

|

|

|

|

|

|

|

|

|

|

treatment |

|

|

|

|

GSK |

1H19 |

$500m |

$489m |

$250m |

BCMA-ADC |

4L r/r multiple myeloma (P2 pivotal) |

GSK's most promising pipeline asset but likely to be entering a competitive field of |

|

|

|

|

|

|

|

|

|

|

|

BCMA targetting therapies and in an initially limited 4L setting. |

|

|

|

|

Novartis |

2H19 |

>$1bn |

$1,200m |

$900m |

Ofatumumab |

Multiple sclerosis |

Potential to compete with Roche's blockbuster Ocrevus with the advantage of |

|

|

|

|

|

|

|

|

|

subcut |

|

monthly subcut dosing and faster immune reconstitution |

|

|

|

|

Novartis |

2H19 |

>$1bn |

$500m |

$405m |

Fevipiprant |

Moderate/severe asthma |

Efficacy profile requires characterisation in Phase III trials to evaluate positioning in |

|

|

|

|

|

|

|

|

|

|

|

the treatment paradigm |

|

|

|

|

Novartis |

2H19 |

$500m |

$0m |

$150m |

Spartalizumab |

1L metastatic melanoma, combo with Tafinlar & Launching in a competitive field of PD-1 inhibitors |

||

|

|

|

|

|

|

|

|

|

Mekinist |

|

|

|

|

|

Roche |

1H19 |

$600m |

$2,275m |

$3,854m |

Tecentriq |

1L TNBC combo with paclitaxel (IMpassion131), TNBC represents a ~$600m opportunity but data from Merck's Keynote-355 trial of |

||

|

|

|

|

|

|

|

|

|

1L neo-adj breast cancer combo with nab-pac |

pembrolizumab in a similar setting is expected in 2019 |

|

|

|

|

|

|

|

|

|

|

(IMpassion031) |

|

|

|

|

|

Roche |

2H19 |

$500m |

$1,425m |

$1,297m |

Kadcyla |

KAITLIN - operable HER2+ breast cancer |

|

|

|

|

|

Sanofi |

1Q19 |

$500m |

$393m |

$0m |

Isatuximab |

ICARIA - r/r multiple myeloma |

First Phase III data of Darzalex fast follower |

|

Page |

|

|

Sanofi |

2H19 |

>$1bn |

$0m |

$0m |

Fitusiran |

Haemophilia A & B with/without inhibitors |

Favourable safety profile required to allay concerns over pro-thrombotic risks |

|

|

|

Source: Deutsche Bank, * - peak sales potential includes sales across all indications |

|

|

|

||||||

|

|

|

|

|

|||||||

19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2018 December 10 Pharmaceuticals Pharmaceuticals European

vk.com/id446425943

Page |

Mid cap coverage: More Bullish on mid cap catalysts |

20 |

in 2019 |

|

We are more bullish on the pipelines of our mid cap coverage in 2019

■We have previously been cautious on much of our mid cap coverage. This reflected both high valuations and structural challenges with immature pipelines. However, valuation appear more reasonable in 2019 and we expect to see Genmab's early stage pipeline begin to mature and key Phase III readouts from Idorsia (clazosentan/ponesimod), UCB (bimekizumab) and Genmab/Novartis (subcut ofatumumab).

■Detailed Phase II data for UCB's FcRn inhibitor rozanolixizumab at American Academy of Neurology should increase confidence in blockbuster potential. Early clinical data suggest FcRn inhibition is e ective in reducing pathogenic IgG levels and thus improving disease outcomes in various autoantibody driven autoimmune diseases. We see strong proof-of-concept and mechanistic rationale in the treatment of myasthenia gravis (MG), immune thrombocytopenia (ITP) and pemphigus vulgaris (PV). We believe these settings have ~$3bn in sales potential, with upside to $7bn if planned Phase II trials in chronic inflammatory demyelinating polyneuropathy (CIDP) report positively in 2020. We expect data from UCB's Phase II trial to be presented at the AAN conference in May to confirm its competitiveness in this potential multi-blockbuster class.

|

Figure 32 : Mid-cap catalysts 2019 |

|

Figure 33 : FcRn drug class market potential |

|

|||

|

Company |

Drug |

Timing |

Description |

|

|

|

|

Genmab |

Darzalex |

Mid-19 |

Approval for 1L MM based on MAIA data |

Pemphigus |

|

|

|

Genmab |

Ofatumumab |

2H19 |

Phase III data in multiple sclerosis |

|

||

|

504 |

Myasthenia Gravis |

|||||

|

Genmab |

Tisotumab vedotin |

2019 |

Data from Phase I/II trials in multiple solid tumours |

|||

|

|

1188 |

|||||

|

|

|

|

|

|

|

|

|

Genmab |

DuoBody-CD3xCD20 |

2019 |

First clinical data from Phase I/II study in B-cell cancer |

|

|

|

|

Genmab |

HexaBody DR5/DR5 |

2019 |

First clinical data from Phase I/II study in solid tumors |

|

|

|

|

Genmab |

HuMax-AXL-ADC |

2019 |

First clinical data from Phase I/II study in solid tumors |

|

|

|

|

Idorsia |

Clazosentan |

1Q19 |

Results of Phase III in SAH in Japan |

|

|

|

|

Idorsia |

Ponesimod |

Mid-19 |

Phase III data in multiple sclerosis |

|

|

|

|

Lundbeck |

Rexulti |

1H19 |

Phase III data in bipolar disorder |

|

|

|

|

Lundbeck |

Foliglurax |

1H19 |

Results of Phase II AMBLED study in Parkinson's |

|

ITP |

|

|

SOBI |

Gamifant |

2019 |

Performance of US launch |

|

||

|

|

1197.504 |

|||||

|

UCB |

Evenity |

1H19 |

FDA approval decision in osteoporosis |

|

||

|

|

|

|||||

|

UCB |

Rozanolixizumab |

May-19 |

Publication of data at AAN conf. from Phase II trial in MG |

|

|

|

|

UCB |

Bimekizumab |

2H19 |

Phase III data from psoriasis programme |

|

|

|

|

|

|

|

|

|

CIDP |

|

|

|

|

|

|

|

4032 |

|

AG/LondonBankDeutsche |

Source: Deutsche Bank |

|

|

|

Source: Deutsche Bank |

|

|

|

|

|

|

||||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

2018 December 10 Pharmaceuticals Pharmaceuticals European