- •HIGHLIGHTS

- •TABLE OF CONTENTS

- •Supply cushion insures against losses

- •DEMAND

- •Summary

- •Fundamentals

- •OECD

- •OECD Americas

- •OECD Europe

- •Europe disaffection for diesel accelerated in 2018

- •OECD Asia Oceania

- •Non-OECD

- •China

- •India

- •Other Non-OECD

- •SUPPLY

- •Summary

- •OPEC crude oil supply

- •Non-OPEC overview

- •REFINING

- •Summary

- •Margins

- •OECD refinery throughput

- •Non-OECD refinery throughput

- •STOCKS

- •Summary

- •Recent OECD industry stock changes

- •OECD Americas

- •OECD Europe

- •OECD Asia Oceania

- •Other stock developments

- •PRICES

- •Market overview

- •Futures markets

- •Spot crude oil prices

- •Spot product prices

- •Freight

- •TABLES

- •Table 1: World Oil Supply And Demand

- •State of the Markets

- •State of the Markets: Second Quarter 2019

- •State of the Markets: Second Quarter 2019

- •Fears of a Macro Slowdown Have Investors on Edge

- •Tech Rises to the Top

- •Nontraditional Industries Prime for Disruption

- •Beyond the Bay: Startups Extend to New Cities

- •Fundraising: Venture Dollars Climb from All Sides

- •VCs Raising More Capital with Each Trip Back to LPs

- •New Funds Move to Institutionalize Early Rounds

- •Diverse Pools of Capital Chase Innovation Returns

- •Next Wave of Capital Will Come After Lockups

- •M&A: Acquisitions Slow as Startups Aim for Growth

- •Opting for Growth Capital vs. an Early Exit

- •Across US, Valuations Climb for M&A

- •Bucking the Trend: Financial Acquisitions Mount

- •US Tech Looks To International Opportunities

- •Regulations: Potential New Hurdles for Exits

- •Tech Giants Spend Big but Now Face Scrutiny

- •Attractive Acquisition Values from Big 5 in Jeopardy

- •CFIUS Could Impact 20% of VC-Backed Acquisitions

- •Unicorns Rely on Capital Boosts From Abroad

- •A Steady Climb: Building Venture in Canada

- •Startup to Scale-Up: Canadians Face “Valley of Death”

- •As Foreign Capital Arrives, Toronto Cements Its Place

- •AI: An Opportunity for Canada to Lead the World

- •Appendix

- •Authors

- •Disclaimers

vk.com/id446425943

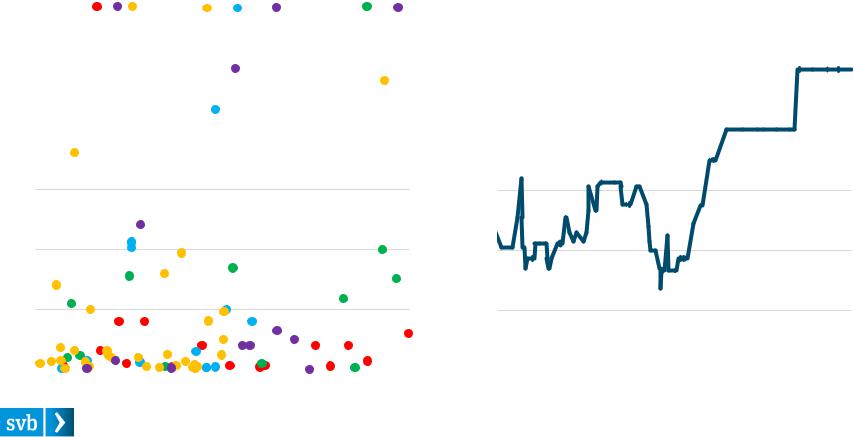

Attractive Acquisition Values from Big 5 in Jeopardy

As the Big 5 have grown, they are executing fewer but larger M&A transactions – the median deal value more than doubled this past decade. Again, this is an attractive exit for startups and investors, but political headwinds could block (or limit) this exit path.

Tech Big 5 Acquisitions of Venture-Backed |

Tech Big 5 Acquisitions of Venture-Backed |

||||

Tech Companies1 |

Tech Companies: Rolling 30-Deal Median |

||||

$3B + |

|

$0.3B |

|

||

|

|

|

|

||

|

|

|

|

$300M |

|

|

|

Alphabet |

|

|

|

|

|

Amazon |

|

|

|

|

|

Apple |

|

|

|

|

|

|

|

|

|

|

|

Microsoft |

|

|

|

$2B |

|

|

|

$0.2B |

|

|

|

|

|

||

|

|

|

|

$200M |

|

$1B |

$0.1B |

|

$100M |

$0B |

|

|

|

|

|

$0. B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

2010 |

2012 |

2014 |

2016 |

2018 |

$0M |

|

|

|

|

||

2010 |

2012 |

2014 |

2016 |

2018 |

|||||||

Source: PitchBook and SVB analysis. |

State of the Markets: Second Quarter 2019 |

21 |

vk.com/id446425943

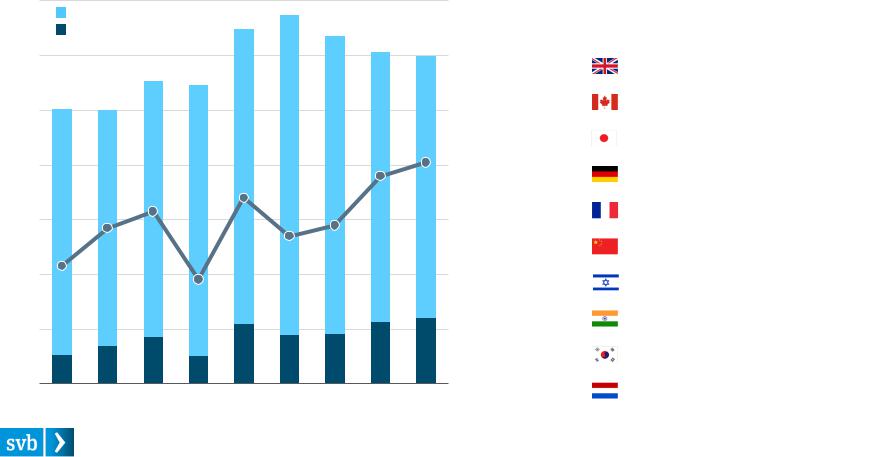

CFIUS Could Impact 20% of VC-Backed Acquisitions

As geopolitical tensions rise, the Committee on Foreign Investment in the United States (CFIUS) is paying close attention. This has the potential to limit foreign acquirers who have been buying a growing share of US start ups.

Strategic Acquisitions of US VC-Backed Tech Companies

700

Domestic Acquirer International Acquirer

600  % International

% International

500

400

300

200

100

0

2010 |

2012 |

2014 |

2016 |

2018 |

35%

30%

25%

20%

15%

10%

5%

0%

Most Acquisitions by Country: 2010–2018

|

Country |

Deal |

Deal |

|

Count |

Value |

|

|

|

||

|

|

|

|

#1 |

United Kingdom |

137 |

$15B |

|

|

|

|

#2 |

Canada |

116 |

$8B |

|

|

|

|

#3 |

Japan |

59 |

$22B |

|

|

|

|

#4 |

Germany |

58 |

$32B |

|

|

|

|

#5 |

France |

49 |

$8B |

|

|

|

|

#6 |

China |

43 |

$5B |

|

|

|

|

#7 |

Israel |

35 |

$1.3B |

|

|

|

|

#8 |

India |

31 |

$1.3B |

|

|

|

|

#9 |

South Korea |

28 |

$1.6B |

|

|

|

|

#10 |

Netherlands |

27 |

$24B |

|

|

|

|

Source: PitchBook and SVB analysis. |

State of the Markets: Second Quarter 2019 |

22 |

vk.com/id446425943

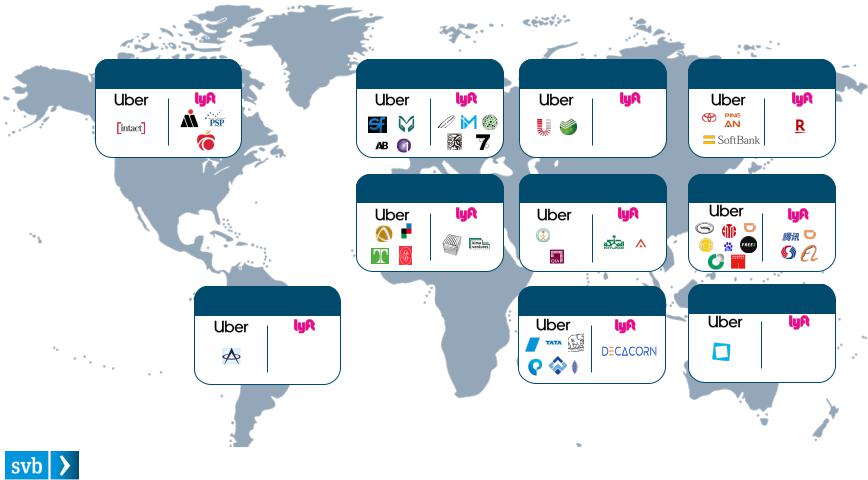

Unicorns Rely on Capital Boosts From Abroad

It takes a village. In the cases of Uber and Lyft, a global network of investors played significant roles in financing their growth from startups to giants. Regulators will need to weigh both the benefits and consequences to foreign investment in U.S. tech companies.

Uber & Lyft: International Investors by Country

Canada |

United Kingdom |

Russia |

Japan |

*

*

Rest of Europe |

Middle East |

China |

*

*

South America |

India & SE Asia |

Australia |

Notes: 1) * Represents beneficial ownership of more than 5% at IPO |

State of the Markets: Second Quarter 2019 |

23 |

Source: PitchBook and SVB analysis. |

vk.com/id446425943

Special Report:

Canadian Venture on the Rise

State of the Markets: Second Quarter 2019 |

24 |