Lectures_micro / Microeconomics_presentation_Chapter_20

.pdf

chapter:

20

>>Factor Markets and Distribution of Income

Krugman/Wells

Economics

©2009 Worth Publishers

WHAT YOU WILL LEARN IN THIS CHAPTER

How factors of production—resources like land, labor, and both physical and human capital—are traded in factor markets, determining the factor distribution of income

How the demand for factors leads to the marginal productivity theory of income distribution

An understanding of the sources of wage disparities and the role of discrimination

The way in which a worker’s decision about time allocation gives rise to labor supply

The Economy’s Factors of Production

The Economy’s Factors of Production

A factor of production is any resource that is used by firms to produce goods and services, items that are consumed by households.

Factors of production are bought and sold in factor markets, and the prices in factor markets are known as factor prices.

What are these factors of production, and why do factor prices matter?

The Factors of Production

The Factors of Production

Economists divide factors of production into four principal classes:

Land: a resource provided by nature Labor: the work done by human beings

Physical capital: which consists of manufactured resources such as buildings, equipment, tools and machines

Human capital: the improvement in labor created by education and knowledge that is embodied in the workforce

Why Factor Prices Matter: The Allocation

of Resources

Factor prices play a key role in the allocation of resources among producers due to two features that make these markets special:

Demand for the factor, which is derived from the firm’s output choice

Factor markets are where most of us get the largest shares of our income

Factor Incomes and the Distribution of Income

Factor Incomes and the Distribution of Income

The factor distribution of income is the division of total income among labor, land, and capital.

Factor prices, which are set in factor markets, determine the factor distribution of income.

Labor receives the bulk—more than 70 percent—of the income in the modern U.S. economy.

Although the exact share is not directly measurable, much of what is called compensation of employees is a return to human capital.

.S. in 2007

Interest

5.4%

Corporate profits 14.3%

Compensation of employees

70.4%

Rent  0.6%

0.6%

Proprietors’ income 9.3%

Proprietors’ income 9.3%

Marginal Productivity and Factor Demand

Marginal Productivity and Factor Demand

All economic decisions are about comparing costs and benefits. For a producer, it could be deciding whether to hire an additional worker.

But what is the marginal benefit of that worker?

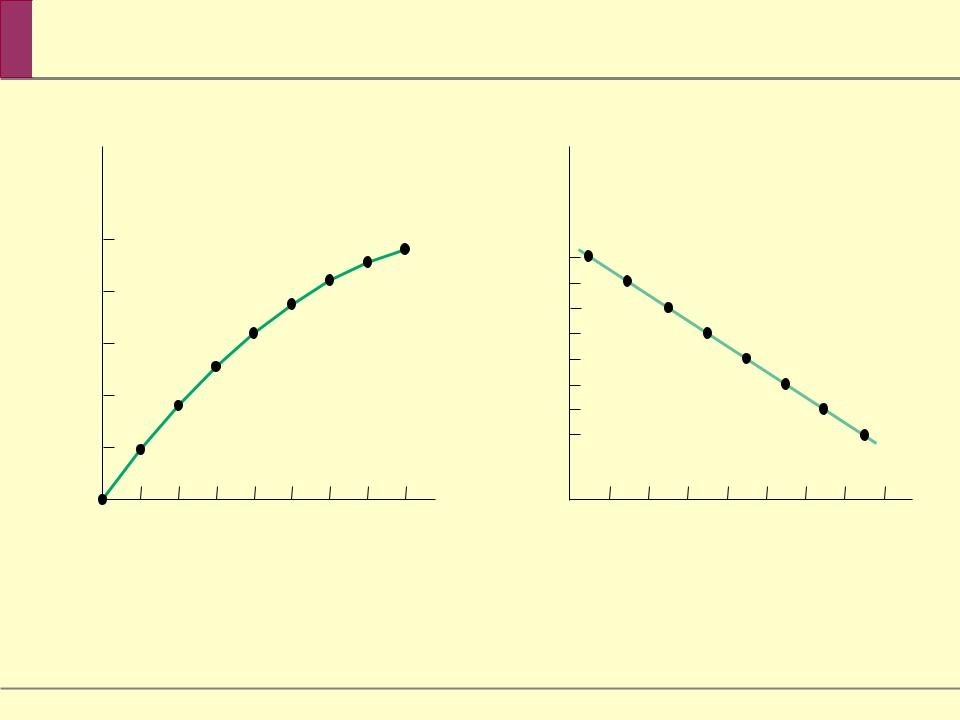

We will use the production function, which relates inputs to output to answer that question.

We will assume throughout this chapter that all producers are price-takers—they operate in a perfectly competitive industry.

The Production Function for George and Martha’s Farm

The Production Function for George and Martha’s Farm

Quantity of labor (workers)

Value of the Marginal Product

Value of the Marginal Product

As we know from earlier chapters, a price-taking firm’s profit is maximized by producing the quantity of output at which the marginal cost of the last unit produced is equal to the market price.

Once we determine the optimal quantity of output, we can go back to the production function and find the optimal number of workers.