Lectures_micro / Microeconomics_presentation_Chapter_21

.pdf

The Demand for Insurance

The Demand for Insurance

The Insurance Market

The Insurance Market

The Power of Diversification

The Power of Diversification

How were the British merchants able to survive the risky routes they took?

One important way was reducing their risks by not putting all their eggs in one basket: by sending different ships to different destinations, they could reduce the probability that all their ships would be lost.

A strategy of investing in such a way as to reduce the probability of severe losses is known as diversification.

As we’ll now see, diversification can often make some of the economy’s risk disappear.

The Power of Diversification

The Power of Diversification

Diversification

Diversification

A strong form of diversification, relevant especially to insurance companies, is pooling.

In pooling, an individual takes a small share in many independent events.

This produces a payoff with very little total overall risk.

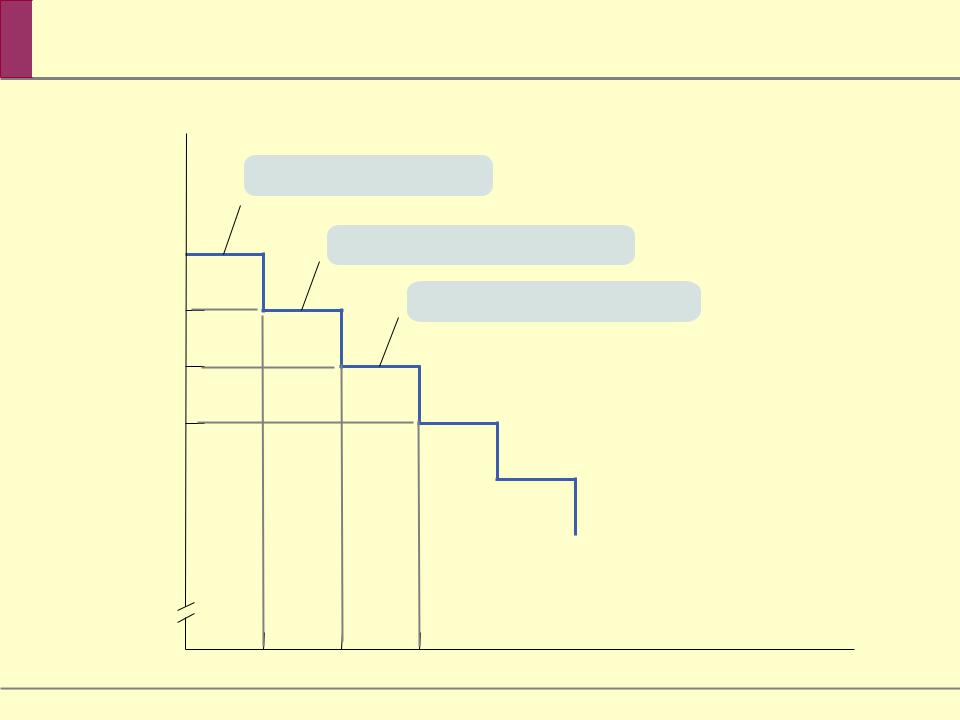

Limits of Diversification

Limits of Diversification

Events are positively correlated if each of them is more likely to occur if the other one also occurs.

When events are positively correlated, there is a core risk that will not go away no matter how much individuals diversify.

Here are some of the positively-correlated financial risks that investors in the modern world face:

Severe weather Political events Business cycles

Private Information

Private Information

Markets do very well dealing with risk due to uncertainty: situations in which nobody knows what is going to happen, whose house will be flooded, or who will get sick.

However, markets have much more trouble with situations in which some people know things that other people don’t know—situations of private information.

Private Information

Private Information

Why should such differences in who knows what be a problem?

It turns out that there are two distinct sources of trouble:

Adverse selection Moral hazard

Adverse Selection

Adverse Selection

Adverse selection occurs when an individual knows more about the way things are than other people do. Private information leads buyers to expect hidden problems in items offered for sale, leading to low prices and the best items being kept off the market (e.g. used car market).

Adverse selection can be reduced through screening: using observable information about people to make inferences about their private information.

Adverse Selection

Adverse Selection

Aside from screening, adverse selection can be reduced by revealing private information through signaling, or by cultivating a long-term reputation.

A long-term reputation allows an individual to reassure others that he or she isn’t concealing adverse information.