Hulley v. Russia 2014

.pdf

1789. In order to determine the value of Yukos on each of the two valuation dates, the Tribunal will now adjust Yukos’ value as of 21 November 2007 (USD 61.076 billion) by multiplying it by a factor that reflects the change in the RTS Oil and Gas index between 21 November 2007 and each of the two valuation dates. This adjustment factor is calculated and applied for each of the two valuation dates in subections 5(a) and 5(b) below.

1790. Having explained the Tribunal’s methodology in respect of the first head of damage (the valuation of Yukos on each of the valuation dates), the Tribunal will now explain the basis on which it has determined the value of “lost” dividends, namely the dividends that would likely have been paid to Claimants, in the “but for” scenario, prior to each of the valuation dates.

(b)Valuation of Lost Dividends

1791. A second element of the damages suffered by Claimants as a result of Respondent’s expropriation of their investment is the loss of dividends that would otherwise have been paid to them as Yukos shareholders. For each valuation calculated as of the two valuation dates, the Tribunal must determine the value of the lost dividends up to each date, since the value of Yukos as of that date, while it captures the expectations of future profit, does not capture any of the past profit that the company would likely have generated.

1792. The Tribunal recalls that the two valuation dates are the date of the YNG auction (19 December 2004) and the date of this Award (deemed to be 30 June 2014 for valuation purposes). For the first valuation date, the Tribunal must therefore determine the value of the lost dividends up to 19 December 2004; for the second valuation date, the Tribunal must determine the value of the lost dividends up to 30 June 2014.

1793. The starting point for the Tribunal’s analysis are the “Yukos lost cash flows” (i.e., free cash flow to equity) that Claimants’ expert calculated with respect to his valuation of Claimants’ damages. In his first report, Mr. Kaczmarek values Yukos as of 21 November 2007 only, and therefore produces a model of “lost cash flows” that does not extend beyond that date.2384 The “lost cash flows” between 2004 and 21 November 2007 are presented as being based on actual historical information, as opposed to the cash flows included in Mr. Kaczmarek’s DCF model

2384 |

First Kaczmarek Report, Appendix J.1. |

|

- 553 -

for the period 21 November 2007 through the end of 2015, which are based on forecasts and projections built up from information available prior to the period.2385

1794. In his second report, Mr. Kaczmarek updates his valuation of Yukos as of November 2007 (including his presentation of “lost cash flows” to that date),2386 but also presents, for the first time, a valuation of Yukos as of 1 January 2012 (as a proxy for the valuation of Yukos as of the date of the Award).2387 For purposes of the valuation as of 1 January 2012, Mr. Kaczmarek produces a model of “lost cash flows” that extends from 2004 through to the end of 2011.2388 The “lost cash flows” between 2004 and 2011 are presented as being based on actual historical information, as opposed to the cash flows included in Mr. Kaczmarek’s DCF model for the period 2012 through the end of 2019, which are based on forecasts and projections built up from information available prior to the period.2389

1795. The Tribunal observes that no free cash flow to equity figures are provided by Claimants’ expert for the years 2012 to 2014. While Claimants offered to update their damages calculations at a date closer to the Award,2390 the Tribunal has been able to establish the relevant figures on the basis of Mr. Kaczmarek’s methodology, using data provided elsewhere in Mr. Kaczmarek’s reports. The Tribunal’s calculations are set out in Tables T4 to T6, attached to the Award, and explained in greater detail in the following paragraphs.

1796. To calculate Yukos’ free cash flow to equity, Mr. Kaczmarek uses the following formula: Free cash flow to equity = Free cash flow to the firm – Tax-adjusted interest payments + Change in net debt + 20 percent of Sibneft dividends.2391 Mr. Kaczmarek provides figures regarding the free cash flow to the firm and the tax-adjusted interest payments for the relevant time period in Appendix AJ.2 to his second report.2392 In addition, in note (5) to Appendix AJ.1 to his second report, Mr. Kaczmarek defines Yukos’ annual change in net debt as the annual change in

2385

2386

2387

2388

2389

2390

2391

2392

Ibid., Appendix J.2.

Second Kaczmarek Report, Appendix J.1–updated. Ibid. ¶ 155.

Ibid., Appendix AJ.1.

Ibid., Appendix AJ.2.

Reply ¶ 946; Second Kaczmarek Report ¶ 155. Second Kaczmarek Report, Appendix AJ.1. Tables T4 and T5 attached to the Award.

- 554 -

Yukos’ long-term debt plus its short-term debt less its cash.2393 Mr. Kaczmarek provides these figures in Appendix AJ.4 to his second report.2394 With regard to the Sibneft dividends, Mr. Kaczmarek provides figures for years 2004 through 2011 in Appendix AJ.1 to his second report.2395 For the years 2012 through 2014, the Tribunal has assumed that the Sibneft dividends would have been equal to those paid in 2010, the last year for which Mr. Kaczmarek has provided an annual figure (his figure for 2011 being based on annualized third quarter figures).

1797. With these additional numbers calculated by the Tribunal, on the basis of data and formulas set out in Mr. Kaczmarek’s reports, the Tribunal is able to arrive at numbers for Yukos’ “lost cash flows” (i.e., free cash flows to equity) for the entire period extending from 2004 through 2014. The Tribunal then, in principle, has the input it needs in order to determine the lost dividends for each of the valuation dates: for the first valuation date (the date of the YNG auction), the Tribunal can therefore arrive at a value (based on Mr. Kaczmarek’s model) for the lost dividends up to 19 December 2004; and for the second valuation date (the date of the Award), the Tribunal can also arrive at a value (based on Mr. Kaczmarek’s model) of the lost dividends up to 30 June 2014. The Tribunal notes that the total amount of lost dividends, based on Mr. Kaczmarek’s model, for the period from 2004 to 30 June 2014, is USD 67.213 billion.2396

1798. As mentioned earlier, however, Claimants’ calculation of Yukos’ lost cash flows is merely a starting point for the Tribunal’s determination of what it views as the correct estimate of the dividends that Claimants would have earned from Yukos in the “but for” scenario. As explained in the following paragraphs, several fundamental considerations lead the Tribunal to modify the calculations of Claimants’ expert.

1799. Firstly, although Yukos’ lost cash flows determined by Mr. Kaczmarek are based in part on actual historical information (i.e., largely information about the performance of Yukos’ former assets disclosed by Rosneft in its financial reports),2397 the Tribunal is unable to dissociate them

2393

2394

2395

2396

2397

Table T5 attached to the Award. Table T6 attached to the Award.

Second Kaczmarek Report, Appendix AJ.1.

The relevant calculations with regard to both dividends and interest are set out in Table T3 attached to this Award.

See e.g., Second Kaczmarek Report, Appendix AJ.8, nn.6–8 (which indicate that actual tariff rates and tax expenses, as reported by Rosneft, are used for the 2004–2011 period). See also Second Kaczmarek Report, Appendix AJ.9, n.2 (which indicates that “[f]or the period 2004–2011, the crude sales percentages are based on actual crude sales as reported by Rosneft and Lukoil”).

- 555 -

from Claimants’ DCF model, which was convincingly criticized by Respondent’s expert and its counsel.

1800. In his second report, Professor Dow identifies and explains a “series of errors” embedded in Claimants’ DCF valuation of Yukos.2398 His “corrections” of those errors result in a very substantial reduction (51 percent) in the valuation of Yukos generated by the DCF model. Although not all of those “corrections” apply to the cash flows discussed above, which are based in part on actual historical information (and thus are not plagued by some of the errors associated with forecasts and projections), some of the “corrections”―notably those related to the interpretation of the historical information―in the view of the Tribunal, do impact the cash flows.

1801. For example, the Tribunal accepts Professor Dow’s opinion that Claimants have underestimated Yukos’ transportation costs (by implicitly assuming that, in the “but for” scenario, “Yukos would have been able to capture the efficiencies of Rosneft’s proprietary pipeline network”).2399 The Tribunal also accepts Professor Dow’s opinion that Claimants’ model overlooks certain operating expenses of Yukos, thus evidencing a “basic flaw” in Claimants’ DCF model, namely that there is “no systematic attempt” to ensure that all of Yukos’ costs have been accounted for.2400

1802. Although, for the reasons stated above, the Tribunal does not consider it appropriate to accept all of Professor Dow’s “corrections” for purposes of the valuation of the dividends, the Tribunal notes that the spreadsheets submitted by Respondent’s expert with his Second Report allow the Tribunal to calculate “corrected” free cash flow to equity figures for the relevant years.2401 While Respondent’s expert has not explicitly endorsed this “corrected” version as representing his views with regard to Yukos’ free cash flow to equity, it is evident to the Tribunal that it represents a figure that is more in line with his views. According to this “corrected” methodology, Yukos’ dividends in 2004 would have been USD 3.218 billion

2398

2399

2400

2401

Second Dow Report ¶¶ 237–317. Ibid. ¶ 256.

Ibid. ¶ 277.

Second Dow Report, Appendix 1 (in Excel format). The results obtained by switching the values in the “Corrected?” column on the first sheet of Appendix 1 (Appendix 1.1) from 0 to 1 (meaning that the corrections are applied) in sheets 2 and 3 (Appendix J.1 and Appendix J.2) are reproduced in Annex A1 to this Award.

- 556 -

(instead of USD 3.645 billion), and the sum of Yukos’ dividends over the period from 2004 through the first half of 2014 would have been USD 49.293 billion (instead of USD 67.213).2402

1803. The Tribunal has formed the view that Professor Dow’s corrections, however, do not take into account all the risks that Yukos would have had to contend with in carrying on business during the period 2004 through to the present if the company had not been expropriated. The Tribunal agrees with Respondent that “an expropriation relieves the owner not only of the value of the asset on the date of expropriation, but also of the risk associated with owning it.”2403 Accordingly, in any model of the cash flows that would have been generated by Yukos had it not been expropriated (i.e., the cash flows in a “but for” scenario), it is necessary to take into account the risks to those cash flows that were eliminated by the expropriation. Those risks must be factored back into the cash flow model in the “but for” scenario.

1804. The Tribunal observes that Mr. Kaczmarek’s cash flow model does not factor in those risks in his calculations. To the contrary, Mr. Kaczmarek models Yukos’ financial performance after the date of expropriation based, in large measure, on the results achieved by Yukos’ assets in the hands of Rosneft.2404 As Respondent rightly submits, “Mr. Kaczmarek effectively valued Yukos as if it were a State-owned strategic enterprise, which it never was.”2405

1805. The first significant risk that, in the Tribunal’s view, is not adequately accounted for in the cash flow models of either expert is the real risk of substantially higher taxes. Since taxes other than income taxes (also referred to as “non-income taxes”) consistently account for well over 50 percent of Yukos’ net income from year to year,2406 Yukos’ cash flows could be significantly affected by any increases in the tariffs and rates relating to the non-income taxes.2407 In Mr. Kaczmarek’s model, the taxes that are established annually by legislation (such as the export customs duty and domestic excise tax for refined products) are based on actual historical data (if available) and, for the forecast period, are based on the prior year’s tax rate plus an adjustment to account for annual inflation.2408 In other words, there is no accounting for the

2402

2403

2404

2405

2406

2407

2408

The relevant calculations with regard to both dividends and interest are set out in Table T3 attached to this Award. Respondent’s Post-Hearing Brief ¶ 239.

Second Kaczmarek Report, Appendix AJ and related Appendices. Respondent’s Post-Hearing Brief ¶ 242.

See line items for “taxes other than income tax” and “net income” in Second Kaczmarek Report, Appendix AJ.3.

See breakdown of Yukos’ non-income taxes (including crude oil unified mineral extraction tax, export customs duties, and various excise taxes) and associated tariffs and rates. Second Kaczmarek Report, Appendix AJ.8.

First Kaczmarek Report ¶ 259.

- 557 -

possibility―even likelihood―that had Yukos remained in private hands, the State would have increased taxes, perhaps even substantially, in order to capture a greater share of the rent earned from the exploitation of Russia’s natural resources. Yet, the record shows that this is precisely what the Russian Federation did in 2002 and 2003, when Yukos was still in private hands. In paragraph 188 of his first report, for example, Mr. Kaczmarek explains that large tax increases in 2002 and 2003 caused surging profits at Yukos to level off during that period.2409

1806. In this connection, the Tribunal notes that Yukos, in its 2002 Annual Report, disclosed the following concerns about taxation:

We are subject to numerous taxes that have had a significant effect on our results of operations. Russian tax legislation is and has been subject to varying interpretations and frequent changes. 2410

. . .

In the context of the significant regulatory changes related to Russia’s transition from a centrally planned to a market economy over the past 10 years and the general instability of the new market institutions introduced in connection with this transition, taxes, tax rates and implementation of taxation in Russia have experienced numerous changes. Although there are signs of improved political stability in Russia, further changes to the tax system may be introduced which may adversely affect the financial performance of our Company. In addition, uncertainty related to Russian tax laws exposes us to enforcement measures and the risk of significant fines and could result in a greater than expected tax burden.2411

1807. The 2002 Annual Report also alerted the Yukos shareholders to risks related to the Company’s dividend policy:

Reserves available for distribution to shareholders are based on the statutory accounting reports of YUKOS Oil Company, which are prepared in accordance with Regulations on Accounting and Reporting of the Russian Federation and which differ from U.S. GAAP. Russian legislation identifies the basis of distribution as net income. For 2002, the current year statutory net income for YUKOS Oil Company as reported in the annual statutory accounting reports was RR 40,701 million. However, current legislation and other statutory laws and regulations dealing with distribution rights are open to legal interpretation and, consequently, actual distributable reserves may differ from the amount disclosed.2412

1808. Finally, and perhaps most significantly, there are the risks associated with the complex and opaque structure set up by Claimants, or by others on their behalf, in order to transfer money earned by Yukos out of the Russian Federation through a vast offshore structure. This structure

2409

2410

2411

2412

First Kaczmarek Report ¶ 188.

Yukos Annual Report, 2002, p. 81, Exh. C-26. Ibid., p. 84.

Ibid., p. 58.

- 558 -

is well documented in the reports of Professor Lys. An organizational chart attached as an appendix to a letter from PwC Cyprus to PwC Moscow dated 10 April 2003 shows the complexity of the structure as of that date, and the fact that Yukos’ control over it was established by means of call options.2413 With this structure, Yukos was able to consolidate the profits of the trading companies and offshore holding companies (entities within its “consolidation perimeter”) into its results while remaining “free to segregate these profits from minority shareholder claims whenever it served the majority shareholders’ or management’s interests.”2414

1809. As Respondent rightly points out, Yukos’ claim of corporate governance reforms, Western standards of transparency and protection of minority interests, which Mr. Kaczmarek highlighted in his first report2415 (and which was a recurring theme heard from Claimants in this case), “was a façade.”2416 Notably, even the company’s President, Mr. Theede, testified that they had no knowledge that Yukos was using offshore structures that it did not own.2417

1810. The Tribunal notes that even after the tax assessments at issue in the present arbitration were issued, Claimants and their owners were able to divert money earned by Yukos out of Yukos, and into the two Stichtings,2418 and therefore away from the tax authorities. The Tribunal cannot exclude the possibility that, but for the expropriation, the very same mechanism would have been resorted to by Claimants under different circumstances to divert some of the money earned by Yukos.

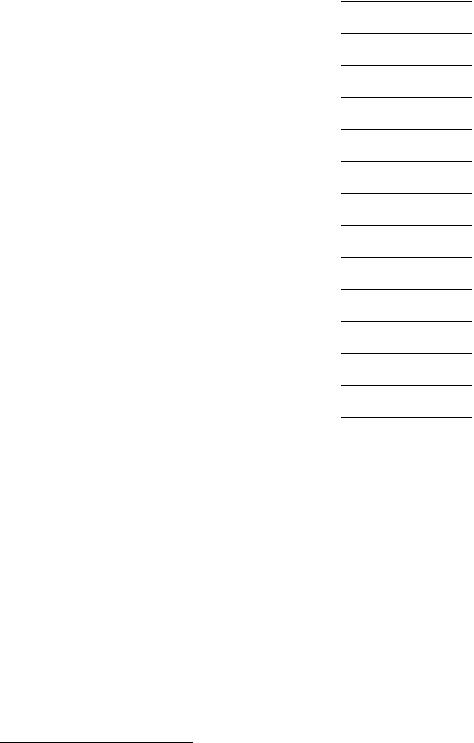

1811. In light of all the circumstances, and taking into account: (a) the figures based on Mr. Kaczmarek’s calculations; (b) the figures based on Professor Dow’s “corrections”; and

(c) the additional risks described above, which the Tribunal finds must be factored into its damages analysis, the Tribunal, in the exercise of its discretion, concludes that it is appropriate to determine and fix the dividend payments that it assumes Yukos would have paid to its

2413

2414

2415

2416

2417

2418

Exh. R-3165, p. 5. The Tribunal has included a copy of the chart in Annex A2 to this Award. See also Second Lys Report, Appendix F.

Respondent’s Post-Hearing Brief ¶ 258. First Kaczmarek Report ¶ 156. Respondent’s Post-Hearing Brief ¶ 260.

Transcript, Day 11 at 59. The Tribunal notes that Mr. Kosciusko-Morizet, the Chairman of the Board’s Audit Committee, acknowledged that he had no opinion, and had made no enquries, as to whether Yukos owned the low tax region entities (see Transcript, Day 4 at 60–61).

Respondent’s Counter-Memorial ¶¶ 528–39. The Tribunal recalls that Claimants do not dispute that money was transferred into the Stichtings. See above at ¶¶ 1054–60, 1124.

- 559 -

shareholders in the “but for” scenario in the amounts set out in the far right column of the following table (in USD billion):

Year |

Kaczmarek |

Dow |

Tribunal |

|

|

|

|

2004 |

3.645 |

3.218 |

2.5 |

|

|

|

|

2005 |

4.796 |

4.489 |

3.5 |

|

|

|

|

2006 |

4.677 |

4.396 |

3.5 |

|

|

|

|

2007 |

8.484 |

7.670 |

6 |

|

|

|

|

2008 |

7.819 |

6.749 |

6 |

|

|

|

|

2009 |

7.642 |

5.463 |

5 |

|

|

|

|

2010 |

4.254 |

4.842 |

3.5 |

|

|

|

|

2011 |

6.285 |

4.283 |

4 |

|

|

|

|

2012 |

8.395 |

3.724 |

5 |

|

|

|

|

2013 |

7.628 |

3.148 |

4 |

|

|

|

|

2014 (first half) |

3.586 |

1.310 |

2 |

|

|

|

|

Total |

67.213 |

49.293 |

45 |

|

|

|

|

1812. Accordingly, the Tribunal concludes that Yukos’ dividends in 2004 would have been USD 2.5 billion, and the sum of Yukos’ dividends over the period from 2004 through the first half of 2014 would have been USD 45 billion.2419

5.Application of the Methodology Followed by the Tribunal

1813. The Tribunal, applying the methodology outlined above to the two valuation dates of 19 December 2004 and 30 June 2014, can now proceed to the valuation of the expropriated company as of those two dates.2420

2419

2420

The relevant calculations with regard to both dividends and interest are set out in Table T3 attached to this Award. See Table T1 annexed to this Award.

- 560 -

(a)Calculations Based on 19 December 2004 Valuation Date

1814. The damages suffered by Claimants based on a valuation date of 19 December 2004 are determined as follows.

i.Valuation of Shares in Yukos

1815. As explained earlier, the Tribunal will determine the equity value of Yukos as of 19 December 2004 by adjusting what it considers, based on the Parties’ submissions, to be the best available estimate of this value as of 21 November 2007, i.e., an amount of USD 61.076 billion, with a factor that reflects the development of the RTS Oil and Gas index between 19 December 2004 and 21 November 2007. The value of the RTS Oil and Gas index on 19 December 2004 was 92.85, whereas on 21 November 2007 it had a value of 267.8. The adjustment factor to be applied to determine Yukos’ value as of the earlier date is therefore x=92.85/267.8=0.3467. By applying this factor to the amount of USD 61.076 billion, the Tribunal arrives at an equity value of Yukos as of 19 December 2004 in the amount of USD 21.176 billion.2421

1816. The value of Claimants’ 70.5 percent share in Yukos, calculated as a pro rata share of this amount, corresponds to USD (70.5/100)*21.176=14.929 billion.

ii.Dividends

1817. According to the Tribunal’s methodology outlined above, the dividends that would have been paid to Yukos’ shareholders throughout 2004 will be assumed to be USD 2.5 billion. Since the valuation date is 19 December 2004, there are 12 days missing for the full year which must be taken into consideration. Accordingly, this amount must be multiplied by a factor x=(365–12)/365, corresponding to approximately 97 percent. This gives a total amount of

free cash flow to |

equity based on |

a |

valuation date |

of 19 December 2004 |

of |

USD 2.418 billion. |

Claimants’ share |

of |

this amount |

corresponds to dividends |

of |

USD (70.5/100)*2.418=1.705 billion. |

|

|

|

|

|

2421 |

See Table T2 annexed to this Award. |

|

- 561 -

iii.Interest

1818. By applying an annual interest rate of 3.389 percent,2422 the total amount of interest payable on the equity value of Yukos and the dividends that would have been paid to its shareholders from 1 January 2005 to 30 June 2014 is 7.596 billion.2423 The total amount of interest payable to Claimants on this basis is 70.5 percent of this figure, i.e., USD 5.355 billion.

iv.Total Damages Suffered by Claimants

1819. The damages suffered by Claimants due to the breach by Respondent of Article 13 of the ECT based on a 19 December 2004 valuation date is the sum of the Claimants’ share of these components calculated above, i.e., 70.5 percent of (21.176 + 2.418 + 7.596), which amounts to USD 21.988 billion.2424

(b)Calculations Based on 2014 Valuation Date

1820. The damages suffered by Claimants based on a valuation date of 30 June 2014 are determined as follows.

i.Valuation of Claimants’ Share in Yukos

1821. As for the calculations based on the date of the expropriation, the Tribunal will determine the equity value of Yukos as of 30 June 2014 by adjusting what it considers, based on the Parties’ submissions, the best available estimate of this value as of 21 November 2007, i.e., the amount of USD 61.076 billion, with a factor that reflects the development of the RTS Oil and Gas index between 21 November 2007 and 30 June 2014. For practical purposes, and in order to eliminate the effects of random fluctuations of the index on the amount to be awarded, the

2422

2423

2424

See Part XI. The Tribunal has assumed that dividends would have been paid in each case at the end of the relevant year and that interest would have started accruing at the determined pre-award interest rate from 1 January of the year thereafter.

To avoid unnecessarily complicating the calculations, this figure does not take into account interest for the period from 19 to 31 December 2004. Adding this interest would not affect the Tribunal’s conclusions.

See Table T1 annexed to this Award. Claimants’ shareholdings in Yukos, as percentages of Yukos Issued Shares, were 48.72 percent, 2.25 percent and 10 percent for Hulley, YUL and VPL, respectively. Interim Awards ¶ 419 (Hulley); ¶ 419 (YUL); ¶ 419 (VPL). In absolute numbers, out of a total number of 2,236,964,578 Issued Shares, Hulley held 1,090,043,968 shares, YUL held 50,340,995 shares and VPL held 223,699,175 shares, while 302,000,000 shares were Treasury Shares. First Kaczmarek Report, Appendix C.5.b. This translates into a total number of 1,934,964,578 Outstanding Shares, of which 56.33405 percent, 2.60165 percent and 11.56089 percent were held by Hulley, YUL and VPL, respectively. The exact combined share of Claimants in Yukos Outstanding Shares was 70.49659 percent.

- 562 -