- •Ministry of finance of ukraine

- •Preface

- •Unit 1 Why start a business?

- •Vocabulary

- •Why start a business?

- •2) What information do you think a business plan must represent? Reading

- •Contents of a business plan

- •What should be in the plan?

- •Business plan

- •Vocabulary

- •Text 3 Starting a new business

- •Vocabulary

- •Financial activities and their management

- •Vice – President for Finance

- •Vocabulary

- •Writing a summary (an abstract)1 of a text, a book, an academic paper etc. Steps in writing a summary

- •Here are a few tips for you about writing a summary and some useful expressions

- •Vocabulary

- •Can you answer the following questions?

- •Introduction to accounting

- •Vocabulary

- •Assets and liabilities

- •Current Fixed assets

- •Vehicles

- •Investments

- •Balance sheet

- •Financial statements

- •Value added statement

- •Vocabulary

- •Valuation of assets

- •Variable costs

- •Indirect costs

- •Imputed costs

- •Vocabulary

- •Costing methods

- •Vocabulary

- •The use of funds

- •Vocabulary

- •Sources of finance

- •Borrowing

- •Other sources of funds

- •Management of working capital

- •Vocabulary

- •Money and its functions

- •Nebraska

- •Florida

- •Bank credit

- •Тексти для самостійного читання у і семестрі3

- •Types and forms of business organization

- •Why are companies referred to as ltd., inc., gmbh, or s.A.?

- •The strategy of a company

- •Financial forecasting

- •Careers in finance

- •What is accounting?

- •Financial accounting

- •Business documents

- •Main streets store, inc

- •Main street store, inc Statement of Cash Flows For the Year Ended August 31, 20 XX

- •The ассоunt

- •Title of account Debit | Credit

- •Types of account

- •Тексти для самостійного читання у іі семестрі4

- •Classical economics

- •Keynesian economics (Part I)

- •Keynesian economics (Part II)

- •The importance of the rate of monetary growth

- •The basic propositions of monetarism (Part I)

- •The basic propositions of monetarism (Part II)

- •The monetary rule

- •The decline of monetarism

- •Supply-side economics (Part I)

- •(Part II) The Saving and Investment Effect

- •Supply - side economics (Part III) The Elimination of Productive Market Exchanges

- •Rational expectations theory

- •Government finance

- •Government Growth: Purchases and Transfers

- •Tax rates

- •Taxation

- •Types of taxes

- •Sources of federal revenue

- •Sources of State and Local Revenue

- •Tapescripts

- •Glossary

- •Indirect costs

- •Investment

Government finance

How large is the public sector? What are the main economic programs of Federal, state, and local governments? How are these programs financed?

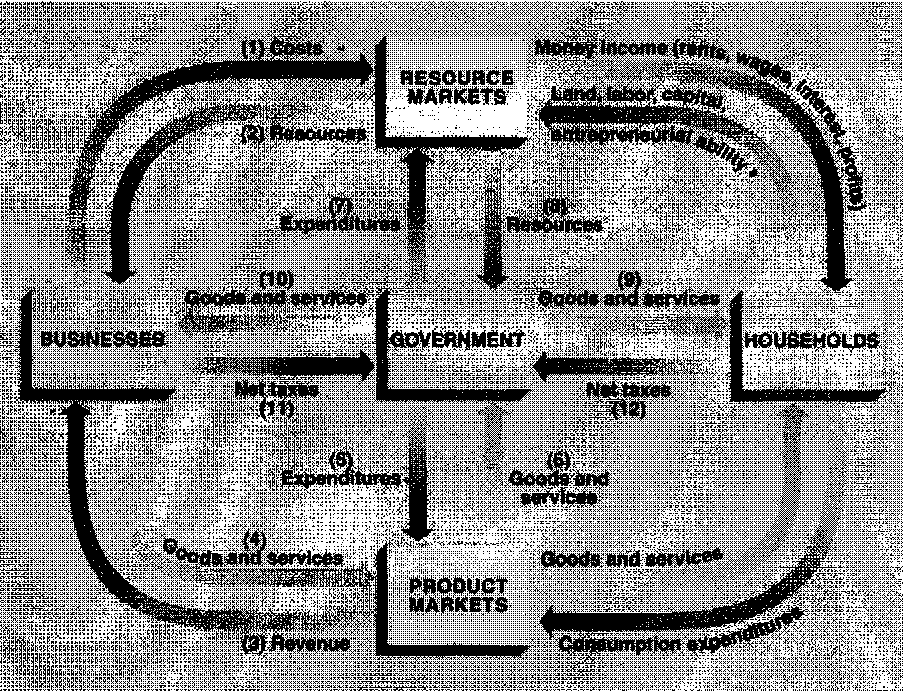

FIGURE 1 The circular flow and the public sector. Government expenditures, taxes, and transfer payments affect the distribution of income, the allocation of resources, and the level of economic activity.

Government Growth: Purchases and Transfers

We can get a general impression of the size and growth of government's economic role by examining government purchases of goods and services and government transfer payments. The distinction between these two kinds of outlays is significant.

1 Government purchases are "exhaustive"; they directly absorb or employ resources and the resulting production is part of the domestic output. For example, the purchase of a missile absorbs the labor of physicists and engineers along with steel, explosives, and a host of other inputs.

2 Transfer payments are "nonexhaustive"; they do not directly absorb resources or account for production. Social security benefits, welfare payments, veterans' benefits, and unemployment compensation are examples of transfer payments. Their key characteristic is that recipients make no current contribution to output in return for these payments.

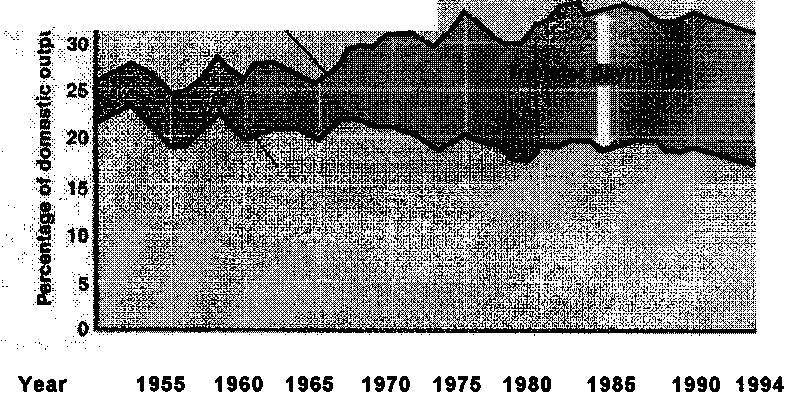

Figure 2 shows that government purchases of goods and services have been approximately 20 percent of domestic output over the past 45 years. Of course, domestic output has increased greatly during that time so that the absolute volume of government purchases has increased substantially. Government purchases were $75 billion in 1955 as compared to $1,175 billion in 1994.

But if we now look at transfer payments we get a different impression of government’s role and growth. As Figure 2 reveals, transfers have grown significantly since the 1960s, rising from 5 percent of domestic output in 1960 to over 14 percent in 1994. The net result is that tax revenues required to finance total government spending purchases plus transfers are equal to about one-third of domestic output. In 1994 the average taxpayer spent about 2 hours and 45 minutes of each 8-hour workday to pay taxes.

FIGURE 2 Government purchases, transfers, and total spending as a percentage of domestic output, 1950-1994. Government purchases have tightly fluctuated around 20 percent of domestic output since 1950. Transfer payments, however, have increased as a percentage of domestic output so that total government spending (purchases plus transfers) have grown and are now about one-third of domestic output.

19.2. Find in the text the English equivalents of the following words and word-combinations:

трансфертні платежі, переказні платежі

витрати, затрати, капіталовкладення

підприємницька здібність, здатність

споживчі витрати

вичерпний, виснажуючий

поглинати, покривати витрати

продуктивність, обсяг виробництва

ракета

фізики

вибух

безліч, численність

допомога по соціальному страхуванню

благодійні внески

допомога ветеранам війни

допомога по безробіттю

одержувач

внесок, збір

державні закупки

важкий, жорсткий

коливатися

19.3. Are these statements true or false? Correct the false ones.

a) Government purchases include raw materials and finished goods.

b) Government purchases are about 20 percent of the domestic output.

c) The addition of transfers increases government spending to almost one-third of domestic output.

19.4 Read the text again. Here are some answers about government finance. Write the questions.

a)______________________________________________________________

Government purchases of goods and services and government transfer payments.

b)

We get a different impression of government's role and growth.

c)______________________________________________________________

Social security benefits, welfare payments, veterans' benefits, and unemployment compensation.

d) ______________________________________________________________

During a few last years the average taxpayer spent about 2 hours and 45 minutes of each 8 hour workday.

20.1 Read text 24 and be ready to define:

the average tax rate;

the marginal tax rate

TEXT 24