Chapter 3

.pdf

CHAPTER 3 Intermediaries |

71 |

B ox 3 . 1 The Most Expensive Seat in Town

On August 23, 1999, a seat on the NYSE sold for $2.65 million, the highest price ever paid. The last three seats sold during 2000 went for $2 million each. Owning one of the 1,366 NYSE seats is the admission ticket to trading on the world's largest stock exchange. Membership gives the hold-

ers the right to trade stocks and vote at exchange meetings. As expensive as a seat on the exchange is, consider this: It doesn't even include a chair. If you want to sit down, you have to bring in your own stool.

and are engaged principally in the buying and selling of securities on behalf of their clients. The fees charged by full-service brokerage firms are naturally higher than those charged by discount brokerage firms. If you know which securities you want to purchase, you may save by using a discount broker.

Regardless of which type brokerage firm you choose, both will hold seats on the major exchanges and have NASDAQ computer links. Suppose that you place an order for 100 shares of IBM with your local Merrill Lynch office. Your broker sends an electronic message to the Merrill Lynch traders who work on the floor of the NYSE to buy 100 shares of IBM in your name. Merrill Lynch has purchased a number of "seats" on the exchange for its traders, as discussed in Box 3.1. On the floor of the NYSE are circular work areas for specialists in each security traded on the exchange. Each specialist is responsible for several different stocks. The Merrill Lynch floor trader knows where the IBM specialist is and approaches him or her to fill your buy order. Confirmation of the purchase is then communicated back to your local broker, who informs you that the trade has been completed.

The two most common types of orders are the market order and the limit order. In the example above you placed a market order, which instructs your broker to buy or sell the security at the current market price. When you place a market order, there is a risk that the price of the security has changed significantly from what it was when you made your investment decision. If you are buying a stock and the price falls, no harm is done, but if the price goes up, you may regret your purchase.

An alternative to the market order is the limit order. Here, buy orders specify a maximum acceptable price and sell orders specify a minimum acceptable price. For example, you could place a limit order to sell your 100 shares of IBM at $120. If the current market price of IBM is less than $120, the order will not be filled. Unfilled limit orders are reported to the stock specialist who keeps track of them. When the stock price moves in such a way that limit orders are activated, the stock specialist initiates the trade. If at all possible, the specialist fills new orders that come in from limit orders that are waiting. If no limit orders are activated, then the specialist trades from inventory. Knowing the status of unfilled limit orders helps the specialist judge the market and to move the bid and ask prices appropriately. An example of working a limit-order book is provided in Box 3.2.

72 |

PART I Markets and Institutions |

Investment Companies

Investment companies manage pooled funds, commonly called mutual funds, and invest in a variety of securities. Investment companies offer small investors the opportunity to own securities that would be unavailable otherwise. For example, commercial paper is seldom sold in denominations of less than $500,000. Few individual investors are able to put this much into a single investment. By pooling funds, investment companies can purchase these high-priced securities.

A second important advantage investment companies offer to the individual investor is the ability to diversify even when only small sums of money are available for investment. Suppose an investor has $1,000 to invest. It would be impossible to buy enough different stocks to properly diversify. By pooling small sums from many investors, diversification is possible.

ClosedVersus Open-End Funds

Investment companies are organized as either closed-end funds or open-end funds. Closed-end funds operate much like other corporations. The company sells shares to the public. The funds raised are used to purchase various securities. The shares give the

B o x 3 . 2 Using the Limit-Order Book

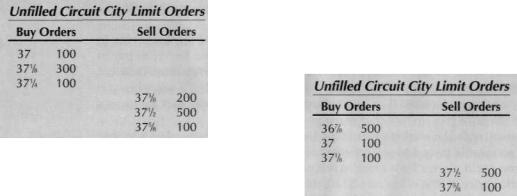

Suppose a trader on the NYSE is a specialist responsible for Circuit City stock. The limit-order book might look like the following:

Listed under Buy Orders are the highest prices investors are willing to pay to buy the stock. Listed under Sell Orders are the lowest prices investors holding Circuit City are willing to accept to sell. Currently, no transactions occur because there is no crossover or common prices. In other words, there is currently no one willing to sell Circuit City at a price anyone is willing to pay.

Now suppose the specialist receives a new 200-share market order to buy, an order to be filled at the best market price currently available. The specialist consults the Sell Orders column and fills the order at $37.37.

Next, the specialist receives a 300-share limit order to sell at $37.12. Again, the specialist consults the book, but this time looks under the Buy Orders column. The limit order is filled with 100 shares at $37.25 and 200 shares at $37.12.

Next suppose that a limit order to buy 500 shares at $37.87 is received. Because there is no sell order for this amount, the order is added to the book, which now looks like this:

Your broker can help you buy or sell securities that trade on other exchanges or over-the-counter as well. These important intermediaries offer a broad spectrum of investments such as bonds, annuities, limited partnerships, and shares in real estate investment trusts. Full-service brokers help their clients find the investments that best suit their risk and return requirements.

CHAPTER 3 Intermediaries |

73 |

holder an ownership right in the assets of the company. If the value of the securities held by the company rises, the value of the shares also should rise.

Theoretically, the aggregate value of the outstanding mutual fund shares should exactly equal the value of the securities purchased by the investment company. Often, however, the value of the shares drifts above or below this theoretical value based on the market's perception of how the management of the funds is expected to perform in the future. At times, if the market value of the shares falls far below the theoretical value of the investment company, the company liquidates the closed-end fund by selling all of the assets held by the funds and distributing the proceeds to the investors.

An alternative to the closed-end fund is an open-end fund. Open-end funds are also called mutual funds. Open-end funds offer shares at the current net asset value (NAV) of their portfolios and redeem outstanding shares at this same price. Unlike closed-end funds, open-end funds can accept new money at any time. The number of shares in openend funds is not fixed, but is increased to accommodate increased demand by investors. This new money simply is invested in new securities on behalf of the shareholders. Openend funds tend to be more popular than closed-end funds and account for much of the rapid growth of investment companies. When you invest in an open-end fund you buy shares at the NAV (adjusted for any fees), which fluctuates as the values of the underlying assets change. Box 3.3 discusses how the NAV is computed.

B o x 3 . 3 Calculation of Mutual Fund NAV

If you invest in a mutual fund, you will receive periodic statements summarizing the activity in your account. The statement shows funds that were added to your investment balance, funds that were withdrawn, and any earnings that have accrued. One term on the statement that is critical to understanding the investment's performance is the net asset value (NAV), The NAV is the total value of the mutual fund's stocks, bonds, cash, and other assets minus any liabilities such as accrued fees, divided by the number of shares outstanding. An example will make this clear.

Suppose a mutual fund has the following assets and liabilities:

Stock (at current market value) |

$20,000,000 |

Bonds (at current market value) |

10,000,000 |

Cash |

500,000 |

Total value of assets |

$30,500,000 |

Liabilities |

$ 300,000 |

Net worth |

$30,200,000 |

The net asset value is computed by dividing the net worth by the number of shares outstanding. If 10 million shares are outstanding, the net asset value is $3.02 ($30,200,000/10,000,000 = $3.02).

The net asset value rises and falls as the values of the underlying assets change. For example, suppose the value of the stock portfolio held by the mutual fund rises by 10% and the value of the bond portfolio falls by 2% over the course of a year. If the cash and liabilities are unchanged, the new net asset value is calculated as follows:

Stock (at current market value) |

$22,000,000 |

Bonds (at current market value) |

9,800,000 |

Cash |

500,000 |

Total value of assets |

$32,300,000 |

Liabilities |

$ 300,000 |

Net worth |

32,000,000 |

NAV = $32,000,000/10,000,000 = $3.20

The yield on your investment in the mutual fund is

then

When you buy and sell shares in the mutual fund, you do so at the current NAV.

74 |

PART I Markets and Institutions |

Load Versus No-Load Funds

Many mutual funds are sold by salespeople, who earn a commission for marketing the fund. These salespeople may work for brokerage houses, insurance companies, or banks, or as private investment counselors. Because these commissions are paid when the mutual fund is sold, a fee must be charged the buyer. This one-time fee is called a load. A fund that charges a load is a load fund. Loads vary between 0.5% and 8% of the amount invested.

Funds that are sold directly to the public without a fee are called no-load funds. However, even no-load funds are subject to service charges. The managers of both load and no-load funds deduct a percentage of the fund's assets each year to cover their costs. One of the secrets to choosing a good mutual fund is to review the fees charged and to pick one that has provided high returns with low costs.

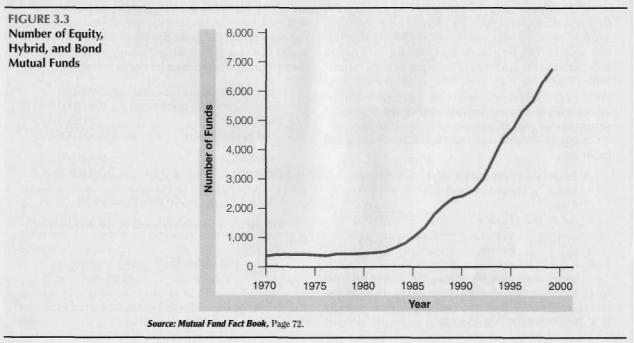

Most mutual funds specialize in a particular type of security. One fund may invest in stock whereas another invests only in bonds. Even among funds that invest only in a particular type of security, there is additional specialization. Some stock mutual funds invest only in small firms; others invest only in growth stock. With over 6,700 different mutual funds available, investors can find one that closely suits their needs and preferences.

Figure 3.3 shows how rapidly mutual funds have grown since the early 1980s.

Money Market Mutual Funds

One particular type of mutual fund deserves special notice. The money market mutual fund can be credited with initiating major changes in the structure of the financial

CHAPTER 3 Intermediaries |

75 |

system. Money market mutual funds are open-end funds that invest in short-term, low-risk securities. These funds were first introduced in the early 1970s by brokerage houses as a way to simplify investment. Customers of the brokerage house could deposit money into the mutual fund. When the investor wanted to buy or sell a security, the broker would either withdraw funds or deposit funds into this account. The mutual fund account saved the expense and inconvenience of writing and mailing checks.

As discussed earlier, interest rates rose dramatically in 1978. Regulation Q limited banks and S&Ls to paying low rates on deposits. Depositors could earn market rates by putting their money into mutual funds. Massive amounts of money were moved out of banks and S&Ls during 1978-1980. Earlier in this chapter we discussed how this disintermediation led to the failure of many S&Ls, large government losses, and a greatly restructured regulatory environment.

Money market mutual funds pay investors the return earned on short-term investments such as Treasury bills. Money market mutual funds continue to be a popular alternative to bank savings accounts. However, the current low rates have stifled any rapid growth.

The distinction between brokerage houses and investment companies can be confusing because you can buy shares in mutual funds by contacting both directly. Brokerage firms offer access to many different mutual funds offered by many different investment companies, including some sponsored by the brokerage company itself. Some investment companies offer mutual funds that are sold only by brokerage firms. The mutual funds sold by brokers typically have higher fees so that brokers can be compensated for their time selling the fund. Other investment companies accept funds directly from the public and, because these funds do not pay commissions, the fees can be much lower. For example, the annual fee on a typical index fund offered by one brokerage house is about 1.5% of the amount invested. A similar fund that investors can contact directly has an annual fee of about 0.2%.

Pension Funds

A pension fund is an asset pool that accumulates over the working years of an individual and is paid out during the nonworking years.

Types of Pension Plans

There are both public and private pension plans, although in many cases there is very little difference between the two. When a government body sponsors a plan, it is a public plan. Plans sponsored by employers, groups, and individuals are private plans.

Public Plans The largest public plan is the Federal Old Age and Disability Insurance Program (often simply called Social Security). This pension plan was established in 1935 and is a pay-as-you-go system. This means the money that workers contribute today pays benefits to current retirees. Future generations will be called on to pay benefits to those now contributing. Many people fear that the fund will be unable to meet its obligations by the time they retire. This fear is based on problems the fund encountered in the 1970s.

76 |

PART I Markets and Institutions |

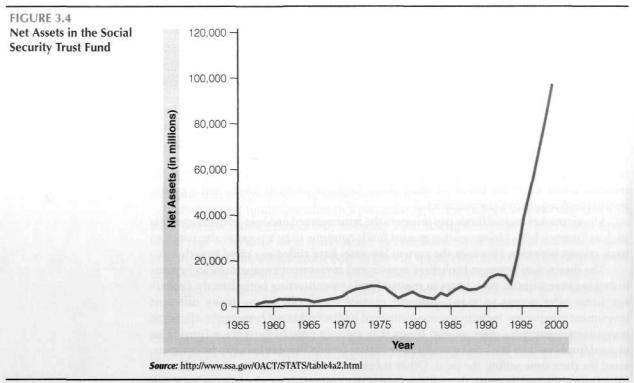

Figure 3.4 shows that in the mid-1970s the net assets held by the Social Security Trust Fund fell. The total assets in the fund decreased at the same time as the number of insured people was increasing. During the mid-1980s and into the 1990s, adjustments were made to strengthen the fund. These adjustments included raising the program's contributions and reducing the program's benefits. The fund has also been bolstered by the strength of the economy during the 1990s and by the unexpected surge in new immigrant workers who contribute to it. Currently, the fund has sufficient assets and cash flows to pay retirees. However, most analysts are concerned that as the average age of the U.S. population increases, fewer people will be paying into the system and more will be receiving benefits. Despite the rapid increase in trust fund assets, projections still show that by the year 2037 the fund balance will fall to zero. The question of whether the Social Security system will be there when current workers retire is a critical element of retirement planning. It is likely that the system will require some adjustment, such as benefits starting a year or two later than they do currently. The benefit payments also are adjusted for inflation. Economists argue that the inflation adjustment has been larger than the true rate of inflation, so a task force has been appointed to determine whether there is a more accurate way of computing inflation. In the future, beneficiaries of Social Security will probably see smaller increases in their year-to-year payments. Economists and politicians note that small adjustments to the system, such as those discussed here, can keep it solvent.

CHAPTER 3 Intermediaries |

77 |

Over the next several years, Social Security is likely to get a great deal of attention. It was a major issue of debate in the 2000 presidential election. One issue to watch is President Bush's proposal to invest a portion of Social Security in stocks and bonds.

The next largest group of public plans is state and local employee plans. Currently, these plans cover over 17 million government workers. The Federal Civilian Employees plan covers over 5.5 million federal employees. The Railroad Retirement plan covers 1.1 million workers.

Private Plans Private plans may be administered by private corporations or by insurance companies. Over 30% of the total number of people covered by a pension plan are covered by a private plan. There has been a dramatic increase in the popularity of private pension plans. Nearly 50 million people have enrolled in private plans administered by insurance companies. There are several reasons for this growth. First, people expect to live longer and to retire earlier than in the past. This leads to better retirement planning. Second, many investors are more sophisticated than those of past generations. This leads them to capture the tax advantages of being enrolled in approved pension plans. Money contributed to an approved retirement plan is not subject to taxes until it is withdrawn during retirement. Finally, as noted above, many people are not confident that Social Security will be there when they retire. This motivates them to provide for retirement themselves.

Private Pension Fund Assets In the past, private pension funds invested mostly in government securities and corporate bonds. These are still important pension fund assets, but corporate stocks, mortgages, and time deposits have a significant role. Private pension funds are now the largest institutional investor in the stock market. This makes pension fund managers a potentially powerful force if they choose to exercise control over firm management.

Employee Retirement Income Security Act

The most important and comprehensive legislation affecting pension funds is the Employee Retirement Income Security Act (ERISA), passed in 1974. This act set certain standards that must be followed by all pension funds. Failure to follow the provisions of the act may cause the plan to lose its advantageous tax status. The motivation for the act was that many workers who had contributed to plans for many years were losing their benefits when plans failed. The principal features of the act are that it:

•Established minimum guidelines for funds to be qualified

•Provided that employees switching jobs may transfer their credits from one employer plan to the next

•Required that plans provide minimum vesting requirements

•Established the Pension Benefit Guarantee Corporation, which guarantees workers against the failure of private plans

•Increased the disclosure requirements for pension plans

Despite ERISA, many plans still remain dangerously underfunded.

78 |

PART I Markets and Institutions |

Self-Test Review Questions*

1.Why do people buy insurance even though it costs more than the average expected loss?

2.What is the difference in the investment portfolios between life insurance companies and property and casualty insurance companies?

3.What is a load fund?

4.Why does the Social Security system run the risk of running out of money?

CHAPTER SUMMARY

This chapter introduced the major institutions that make up the financial system. Depository institutions take in funds and make them immediately available to the depositor. Alternatively, nondepository institutions hold investor funds for longer periods of time.

The major depository institutions are commercial banks and S&Ls. The Federal Deposit Insurance Corporation insures commercial bank deposits against loss. This insurance is critical to instilling confidence in depositors. Without this confidence, banks are subject to failure.

In the late 1970s banks began to feel the effects of competition from nonbank institutions such as brokerage houses. To help banks compete, Congress passed new regulations that permitted them to engage in more activities and to pay more competitive interest rates. Additionally, recent regulatory changes have permitted banks to expand across state lines. This has led to a period of rapid consolidation within the industry.

The S&L industry is responsible for major losses to the government and represents a case study in how not to deregulate an industry. S&Ls were suffering losses when interest rates rose in the late 1970s. Congress attempted to help by deregulating the industry. Unfortunately, Congress did not see the need to increase supervision over the industry. Deposit insurance removed any motivation depositors might have felt

to monitor risk taking by S&L managers, so the managers could use cheap, risk-free deposits to invest in high-risk loans. The results were many S&L failures, for which the government was required to pay depositors. The industry was reregulated in 1989.

Credit unions were established by Congress to provide a way for consumers to borrow money for nonmortgage loans. They are usually small because of the common bond membership rule. They enjoy tax advantages, employer support, and an extensive array of trade associations that allow them to offer lower interest rates on loans and lower account service fees than other depository institutions. Credit union growth is expected to continue in the future.

Nondepository institutions include insurance companies, investment companies, and pension funds. Insurance companies are important in that they provide long-term funds that are used by corporations. Insurance companies take on risk for a fee.

Investment companies offer investment advice and administer investment funds. There are closed-end funds and open-end funds, with the former limiting the amount of new investment whereas the latter can accept new deposits at any time. These funds may be no-load or load funds depending on whether a fee is charged for making deposits or withdrawals.

KEY WORDS

bank notes 52 certainty equivalent 69 closed-end fund 72 common bond 66

depository institutions 51 dual banking system 56 Federal Deposit

Insurance Corporation (FDIC) 53

Federal Savings and Loan Insurance Corporation (FSLIC) 62

holding company 56 interstate banking 58 investment banking 53 investment companies 72 life insurance 67

limit order 71

CHAPTER 3 Intermediaries |

79 |

load fund 74 market order 71 money market

mutual fund 75 mutual ownership 62 net asset value (NAV) 73 no-load fund 74 open-end fund 73 pay-as-you-go system 75

pension fund 75 property and

casualty insurance 67 reciprocal interstate

banking 58 risk averse 69 self-insuring 68 Social Security 75 thrifts 55

DISCUSSION QUESTIONS

1.Define the term depository institution.

2.What are reserve requirements? Who sets the reserve requirement?

3.What events led to the Glass-Steagall Act? What are the responsibilities of the Federal Deposit Insurance Corpo ration?

4.List and explain the principal provisions of the DIDMCA.

5.Why did many states limit bank branching?

6.What has prompted the rapid increase in mergers and acquisitions among banks?

7.What is one important difference between S&Ls and commercial banks?

8.What caused trouble for the S&Ls in the 1970s?

9.Why was the Financial Institutions Reform, Recovery and Enforcement Act passed in 1989?

10.Why might it be reasonable to eliminate S&L charters?

11.What lessons can we learn from the S&L crisis?

12.List and define three types of nondepository institutions.

13.Define the following terms:

a.Closedand open-end funds

b.Load and no-load funds

с Limit order and market order

d.Money market mutual funds

14.Describe how an order to buy stock is filled by a broker.

15.What is a pay-as-you-go pension plan? Why do experts fear that the Social Security system will have problems meeting its obligations in the next 30 to 40 years?

PROBLEMS

1.What is the expected value of a loss if the probability of an auto accident is 5% and the amount of a loss, if it occurs, is $10,000? If an insurance company wanted to earn a 15% profit, how much would it charge in insurance premiums?

2.Suppose that your house is valued at $250,000. What would be the insurance premium if each year there

is a one in 1,000 chance that the house will burn down?

3.You are considering buying mutual funds and have decided to buy from a private investment counselor who sells load funds. The load is 1.5% and you are investing $150,000. What would be the counselor's commission?

WEB EXPLORATION

1. Morningstar is a well-known company that specializes in analysis and review of mutual funds. There are a num ber of Web sites that report Morningstar's results. Go to www.quicken.com/investments/mutualfunds/ finder/. Perform the EasyStep Search according to your own preferences for investment. Can you find funds that provide the return you want with the expense ratio you are willing to pay?

2.The Internet has many calculators available to help con sumers estimate their needs for various financial services. However, when using these tools you should keep in mind that they are usually sponsored by financial intermediaries that also hope to sell you products. Visit one such site at www.finaid.org/calculators/lifeinsuranceneeds.phtml and calculate how much life insurance you need. Are you the beneficiary of any life insurance policies? Use the calcu lator to see if that policy is large enough.

80 |

PART I Markets and Institutions |

MINI CASE

Jenny Cabycar, a mutual fund manager for a number of years, has recently been moved into the financial institutions research division. In her first meeting with her boss, Ernie, she learns that the company plans to aggressively purchase the stock of small banks that may be the target of takeover attempts by larger banks. Ernie is aware that takeover targets often experience large increases in price as a result of the acquiring firm buying shares. This particular investment strategy is inspired by the rapid consolidation that has been taking place in the banking industry. Ernie asked Jenny to prepare a one-page report outlining the viability of this plan and making a few tentative suggestions for how to

proceed in the selection of banks for me new portfolio.

1. Discuss whether the trend toward consolidation will continue. Will the number of banks decrease due to failure or due to acquisition by another bank?

2.Discuss what features may make a bank a good target for a larger bank to attempt to buy it.

3.Identify sources of information about banks on the Web. You may choose to look at the following for help: www.fdic.gov/, www.bog.frb.fed.us/, www2.fdic.gov/ qbp/cool.cfm?report=%2F, and www.fdic.gov/bank/ statistical/statistics/index.html. Is there sufficient data available to prepare reports about individual banks and their competitors?

4.Conclude your report by identifying a strategy that uses the available data to select target banks and state an opinion as to whether the plan is viable.