economics_of_money_banking__financial_markets

.pdf

124 P A R T I I Financial Markets

ratings below Baa (or BBB) have higher default risk and have been aptly dubbed speculative-grade or junk bonds. Because these bonds always have higher interest rates than investment-grade securities, they are also referred to as high-yield bonds.

Next letÕs look back at Figure 1 and see if we can explain the relationship between interest rates on corporate and U.S. Treasury bonds. Corporate bonds always have higher interest rates than U.S. Treasury bonds because they always have some risk of default, whereas U.S. Treasury bonds do not. Because Baa-rated corporate bonds have a greater default risk than the higher-rated Aaa bonds, their risk premium is greater, and the Baa rate therefore always exceeds the Aaa rate. We can use the same analysis to explain the huge jump in the risk premium on Baa corporate bond rates during the Great Depression years 1930Ð1933 and the rise in the risk premium after 1970 (see Figure 1). The depression period saw a very high rate of business failures and defaults. As we would expect, these factors led to a substantial increase in default risk for bonds issued by vulnerable corporations, and the risk premium for Baa bonds reached unprecedentedly high levels. Since 1970, we have again seen higher levels of business failures and defaults, although they were still well below Great Depression levels. Again, as expected, default risks and risk premiums for corporate bonds rose, widening the spread between interest rates on corporate bonds and Treasury bonds.

Application |

The Enron Bankruptcy and the Baa-Aaa Spread |

In December 2001, the Enron Corporation, a firm specializing in trading in the energy market, and once the seventh-largest corporation in the United States, was forced to declare bankruptcy after it became clear that it had used shady accounting to hide its financial problems. (The Enron bankruptcy, the largest ever in the United States, will be discussed further in Chapter 8.) Because of the scale of the bankruptcy and the questions it raised about the quality of the information in accounting statements, the Enron collapse had a major impact on the corporate bond market. LetÕs see how our supply and demand analysis explains the behavior of the spread between interest rates on lower quality (Baa-rated) and highest quality (Aaa-rated) corporate bonds in the aftermath of the Enron failure.

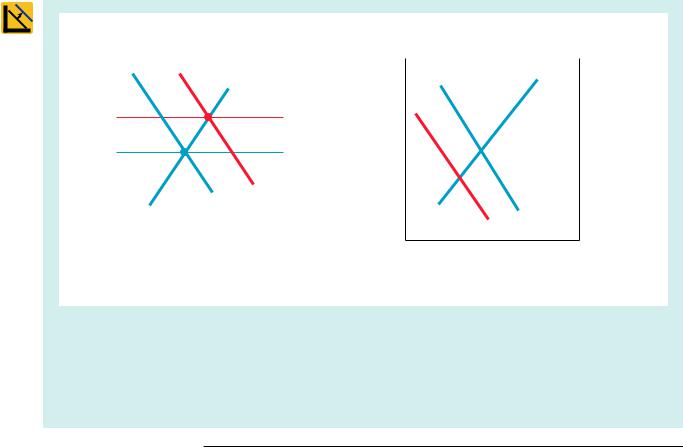

As a consequence of the Enron bankruptcy, many investors began to doubt the financial health of corporations with lower credit ratings such as Baa. The increase in default risk for Baa bonds made them less desirable at any given interest rate, decreased the quantity demanded, and shifted the demand curve for Baa bonds to the left. As shown in panel (a) of Figure 2, the interest rate on Baa bonds should have risen, which is indeed what happened. Interest rates on Baa bonds rose by 24 basis points (0.24 percentage points) from 7.81% in November 2001 to 8.05% in December 2001. But the increase in the perceived default risk for Baa bonds after the Enron bankruptcy made the highest quality (Aaa) bonds relatively more attractive and shifted the demand curve for these securities to the rightÑan outcome described by some analysts as a Òflight to quality.Ó Just as our analysis predicts in Figure 2, interest rates on Aaa bonds fell by 20 basis points, from 6.97% in November to 6.77% in December. The overall outcome was that the spread between interest rates on Baa and Aaa bonds rose by 44 basis points from 0.84% before the bankruptcy to 1.28% afterward.

Liquidity

Income Tax

Considerations

C H A P T E R 6 The Risk and Term Structure of Interest Rates |

125 |

Another attribute of a bond that influences its interest rate is its liquidity. As we learned in Chapter 4, a liquid asset is one that can be quickly and cheaply converted into cash if the need arises. The more liquid an asset is, the more desirable it is (holding everything else constant). U.S. Treasury bonds are the most liquid of all long-term bonds, because they are so widely traded that they are the easiest to sell quickly and the cost of selling them is low. Corporate bonds are not as liquid, because fewer bonds for any one corporation are traded; thus it can be costly to sell these bonds in an emergency, because it might be hard to find buyers quickly.

How does the reduced liquidity of the corporate bonds affect their interest rates relative to the interest rate on Treasury bonds? We can use supply and demand analysis with the same figure that was used to analyze the effect of default risk, Figure 2, to show that the lower liquidity of corporate bonds relative to Treasury bonds increases the spread between the interest rates on these two bonds. Let us start the analysis by assuming that initially corporate and Treasury bonds are equally liquid and all their other attributes are the same. As shown in Figure 2, their equilibrium prices and interest rates will initially be equal: P c1 P T1 and i c1 i T1. If the corporate bond becomes less liquid than the Treasury bond because it is less widely traded, then (as the theory of asset demand indicates) its demand will fall, shifting its demand curve from D c1 to D c2 as in panel (a). The Treasury bond now becomes relatively more liquid in comparison with the corporate bond, so its demand curve shifts rightward from D T1 to D T2 as in panel (b). The shifts in the curves in Figure 2 show that the price of the less liquid corporate bond falls and its interest rate rises, while the price of the more liquid Treasury bond rises and its interest rate falls.

The result is that the spread between the interest rates on the two bond types has risen. Therefore, the differences between interest rates on corporate bonds and Treasury bonds (that is, the risk premiums) reflect not only the corporate bondÕs default risk but its liquidity, too. This is why a risk premium is more accurately a Òrisk and liquidity premium,Ó but convention dictates that it is called a risk premium.

Returning to Figure 1, we are still left with one puzzleÑthe behavior of municipal bond rates. Municipal bonds are certainly not default-free: State and local governments have defaulted on the municipal bonds they have issued in the past, particularly during the Great Depression and even more recently in the case of Orange County, California, in 1994 (more on this in Chapter 13). Also, municipal bonds are not as liquid as U.S. Treasury bonds.

Why is it, then, that these bonds have had lower interest rates than U.S. Treasury bonds for at least 40 years, as indicated in Figure 1? The explanation lies in the fact that interest payments on municipal bonds are exempt from federal income taxes, a factor that has the same effect on the demand for municipal bonds as an increase in their expected return.

Let us imagine that you have a high enough income to put you in the 35% income tax bracket, where for every extra dollar of income you have to pay 35 cents to the government. If you own a $1,000-face-value U.S. Treasury bond that sells for $1,000 and has a coupon payment of $100, you get to keep only $65 of the payment after taxes. Although the bond has a 10% interest rate, you actually earn only 6.5% after taxes.

Suppose, however, that you put your savings into a $1,000-face-value municipal bond that sells for $1,000 and pays only $80 in coupon payments. Its interest rate is only 8%, but because it is a tax-exempt security, you pay no taxes on the $80 coupon payment, so you earn 8% after taxes. Clearly, you earn more on the municipal bond

126 P A R T I I Financial Markets

after taxes, so you are willing to hold the riskier and less liquid municipal bond even though it has a lower interest rate than the U.S. Treasury bond. (This was not true before World War II, when the tax-exempt status of municipal bonds did not convey much of an advantage because income tax rates were extremely low.)

Another way of understanding why municipal bonds have lower interest rates than Treasury bonds is to use the supply and demand analysis displayed in Figure 3. We assume that municipal and Treasury bonds have identical attributes and so have the same bond prices and interest rates as drawn in the figure: P m1 P T1 and i m1 i T1. Once the municipal bonds are given a tax advantage that raises their after-tax expected return relative to Treasury bonds and makes them more desirable, demand for them rises, and their demand curve shifts to the right, from D m1 to D m2. The result is that their equilibrium bond price rises from Pm1 to P m2, and their equilibrium interest rate falls from i m1 to i m2. By contrast, Treasury bonds have now become less desirable relative to municipal bonds; demand for Treasury bonds decreases, and D T1 shifts to D T2. The Treasury bond price falls from P T1 to P T2, and the interest rate rises from i T1 to i T2. The resulting lower interest rates for municipal bonds and higher interest rates for Treasury bonds explains why municipal bonds can have interest rates below those of Treasury bonds.2

Price of Bonds, P |

Interest Rate, i |

||

(P increases ↑) |

(i increases ↑ ) |

||

|

|

S m |

|

P m |

|

|

i m |

2 |

|

|

2 |

P m |

|

|

i m |

1 |

|

|

1 |

|

D m |

D m |

|

|

2 |

|

|

|

1 |

|

|

|

|

|

|

Quantity of Municipal Bonds

(a) Market for municipal bonds

F I G U R E 3 Interest Rates on Municipal and Treasury Bonds

Price of Bonds, P |

Interest Rate, i |

(P increases ↑) |

(i increases↑ ) |

|

S T |

P T1  i T1

i T1

P T2  i T2

i T2

DT

DT2 1

Quantity of Treasury Bonds

(b) Market for Treasury bonds

When the municipal bond is given tax-free status, demand for the municipal bond shifts rightward from Dm1 to D m2 and demand for the Treasury bond shifts leftward from DT1 to DT2. The equilibrium price of the municipal bond (left axis) rises from P m1 to P m2, so its interest rate (right axis) falls from im1 to im2, while the equilibrium price of the Treasury bond falls from PT1 to PT2 and its interest rate rises from iT1 to iT2. The result is that municipal bonds end up with lower interest rates than those on Treasury bonds. (Note: P and i increase in opposite directions. P on the left vertical axis increases as we go up the axis, while i on the right vertical axis increases as we go down the axis.)

2In contrast to corporate bonds, Treasury bonds are exempt from state and local income taxes. Using the analysis in the text, you should be able to show that this feature of Treasury bonds provides an additional reason why interest rates on corporate bonds are higher than those on Treasury bonds.

Summary

C H A P T E R 6 The Risk and Term Structure of Interest Rates |

127 |

The risk structure of interest rates (the relationship among interest rates on bonds with the same maturity) is explained by three factors: default risk, liquidity, and the income tax treatment of the bondÕs interest payments. As a bondÕs default risk increases, the risk premium on that bond (the spread between its interest rate and the interest rate on a default-free Treasury bond) rises. The greater liquidity of Treasury bonds also explains why their interest rates are lower than interest rates on less liquid bonds. If a bond has a favorable tax treatment, as do municipal bonds, whose interest payments are exempt from federal income taxes, its interest rate will be lower.

Application |

Effects of the Bush Tax Cut on Bond Interest Rates |

|

The Bush tax cut passed in 2001 scheduled a reduction of the top income tax |

|

bracket from 39% to 35% over a ten-year period. What is the effect of this |

|

income tax decrease on interest rates in the municipal bond market relative |

|

to those in the Treasury bond market? |

|

Our supply and demand analysis provides the answer. A decreased income |

|

tax rate for rich people means that the after-tax expected return on tax-free |

|

municipal bonds relative to that on Treasury bonds is lower, because the |

|

interest on Treasury bonds is now taxed at a lower rate. Because municipal |

|

bonds now become less desirable, their demand decreases, shifting the |

|

demand curve to the left, which lowers their price and raises their interest |

|

rate. Conversely, the lower income tax rate makes Treasury bonds more desir- |

|

able; this change shifts their demand curve to the right, raises their price, and |

|

lowers their interest rates. |

|

Our analysis thus shows that the Bush tax cut raises the interest rates on |

|

municipal bonds relative to interest rates on Treasury bonds. |

Term Structure of Interest Rates

We have seen how risk, liquidity, and tax considerations (collectively embedded in the risk structure) can influence interest rates. Another factor that influences the interest rate on a bond is its term to maturity: Bonds with identical risk, liquidity, and tax characteristics may have different interest rates because the time remaining to maturity is different. A plot of the yields on bonds with differing terms to maturity but the same risk, liquidity, and tax considerations is called a yield curve, and it describes the term structure of interest rates for particular types of bonds, such as government bonds. The ÒFollowing the Financial NewsÓ box shows several yield curves for Treasury securities that were published in the Wall Street Journal. Yield curves can be classified as upward-sloping, flat, and downward-sloping (the last sort is often referred to as an inverted yield curve). When yield curves slope upward, as in the ÒFollowing the Financial NewsÓ box, the long-term interest rates are above the shortterm interest rates; when yield curves are flat, shortand long-term interest rates are the same; and when yield curves are inverted, long-term interest rates are below short-term interest rates. Yield curves can also have more complicated shapes in which they first slope up and then down, or vice versa. Why do we usually see

128 P A R T I I Financial Markets

Following the Financial News

Yield Curves

The Wall Street Journal publishes a daily plot of the yield curves for Treasury securities, an example of which is presented here. It is typically found on page 2 of the ÒMoney and InvestingÓ section.

The numbers on the vertical axis indicate the interest rate for the Treasury security, with the maturity given by the numbers on the horizontal axis. For example, the yield curve marked ÒYesterdayÓ indicates that the interest rate on the three-month Treasury bill yesterday was 1.25%, while the one-year bill had an interest rate of 1.35% and the ten-year bond had an interest rate of 4.0%. As you can see, the yield curves in the plot have the typical upward slope.

Source: Wall Street Journal, Wednesday, January 22, 2003, p. C2.

Treasury Yield Curve

Yield to maturity of current bills, notes and bonds.

5.0%

Yesterday

1 month ago

1 year ago

4.0

3.0

2.0

1.0

1 |

3 |

6 |

2 |

5 |

10 |

30 |

mos. |

|

|

yrs. |

|

maturity |

|

Source: Reuters

www.ratecurve.com/yc2.html

Check out todayÕs yield curve.

upward slopes of the yield curve as in the ÒFollowing the Financial NewsÓ box but sometimes other shapes?

Besides explaining why yield curves take on different shapes at different times, a good theory of the term structure of interest rates must explain the following three important empirical facts:

1.As we see in Figure 4, interest rates on bonds of different maturities move together over time.

2.When short-term interest rates are low, yield curves are more likely to have an upward slope; when short-term interest rates are high, yield curves are more likely to slope downward and be inverted.

3.Yield curves almost always slope upward, as in the ÒFollowing the Financial NewsÓ box.

Three theories have been put forward to explain the term structure of interest rates; that is, the relationship among interest rates on bonds of different maturities reflected in yield curve patterns: (1) the expectations theory, (2) the segmented markets theory, and (3) the liquidity premium theory, each of which is described in the following sections. The expectations theory does a good job of explaining the first two facts on our list, but not the third. The segmented markets theory can explain fact 3 but not the other two facts, which are well explained by the expectations theory. Because each theory explains facts that the other cannot, a natural way to seek a better understanding of the term structure is to combine features of both theories, which leads us to the liquidity premium theory, which can explain all three facts.

If the liquidity premium theory does a better job of explaining the facts and is hence the most widely accepted theory, why do we spend time discussing the other two theories? There are two reasons. First, the ideas in these two theories provide the

C H A P T E R 6 The Risk and Term Structure of Interest Rates |

129 |

Interest |

|

|

|

|

|

|

|

|

|

|

Rate (%) |

|

|

|

|

|

|

|

|

|

|

16 |

|

|

|

|

|

|

|

|

|

|

14 |

|

|

|

|

|

|

|

|

|

|

12 |

|

|

|

Three-to |

|

|

|

|

|

|

|

|

|

Five-Year |

|

|

|

|

|

||

|

|

|

|

Averages |

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|

8 |

|

20-Year Bond |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

6 |

|

Averages |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

Three-Month Bills |

|

|

|

||

|

|

|

|

(Short-Term) |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

0 |

|

|

|

|

|

|

|

|

|

|

1950 |

1955 |

1960 |

1965 |

1970 |

1975 |

1980 |

1985 |

1990 |

1995 |

2000 |

F I G U R E 4 Movements over Time of Interest Rates on U.S. Government Bonds with Different Maturities

Sources: Board of Governors of the Federal Reserve System, Banking and Monetary Statistics, 1941Ð1970; Federal Reserve: www.federalreserve.gov/releases/h15 /data.htm#top.

Expectations

Theory

groundwork for the liquidity premium theory. Second, it is important to see how economists modify theories to improve them when they find that the predicted results are inconsistent with the empirical evidence.

The expectations theory of the term structure states the following commonsense proposition: The interest rate on a long-term bond will equal an average of short-term interest rates that people expect to occur over the life of the long-term bond. For example, if people expect that short-term interest rates will be 10% on average over the coming five years, the expectations theory predicts that the interest rate on bonds with five years to maturity will be 10% too. If short-term interest rates were expected to rise even higher after this five-year period so that the average short-term interest rate over the coming 20 years is 11%, then the interest rate on 20-year bonds would equal 11% and would be higher than the interest rate on five-year bonds. We can see that the explanation provided by the expectations theory for why interest rates on bonds of different maturities differ is that short-term interest rates are expected to have different values at future dates.

The key assumption behind this theory is that buyers of bonds do not prefer bonds of one maturity over another, so they will not hold any quantity of a bond if its expected return is less than that of another bond with a different maturity. Bonds that have this characteristic are said to be perfect substitutes. What this means in practice is that if bonds with different maturities are perfect substitutes, the expected return on these bonds must be equal.

130 P A R T I I Financial Markets

To see how the assumption that bonds with different maturities are perfect substitutes leads to the expectations theory, let us consider the following two investment strategies:

1.Purchase a one-year bond, and when it matures in one year, purchase another one-year bond.

2.Purchase a two-year bond and hold it until maturity.

Because both strategies must have the same expected return if people are holding both oneand two-year bonds, the interest rate on the two-year bond must equal the average of the two one-year interest rates. For example, letÕs say that the current interest rate on the one-year bond is 9% and you expect the interest rate on the one-year bond next year to be 11%. If you pursue the first strategy of buying the two one-year bonds, the expected return over the two years will average out to be (9% 11%)/2 10% per year. You will be willing to hold both the oneand two-year bonds only if the expected return per year of the two-year bond equals this. Therefore, the interest rate on the twoyear bond must equal 10%, the average interest rate on the two one-year bonds.

We can make this argument more general. For an investment of $1, consider the choice of holding, for two periods, a two-period bond or two one-period bonds. Using the definitions

it |

todayÕs (time t) interest rate on a one-period bond |

i et 1 |

interest rate on a one-period bond expected for next period (time t 1) |

i2t |

todayÕs (time t) interest rate on the two-period bond |

the expected return over the two periods from investing $1 in the two-period bond and holding it for the two periods can be calculated as:

(1 i2t )(1 i2t ) 1 1 2i2t (i2t )2 1 = 2i2t (i2t )2

After the second period, the $1 investment is worth (1 i2 t )(1 i2 t ). Subtracting the $1 initial investment from this amount and dividing by the initial $1 investment gives the rate of return calculated in the previous equation. Because (i2 t )2 is extremely smallÑif i2 t 10% 0.10, then (i2 t )2 0.01Ñwe can simplify the expected return for holding the two-period bond for the two periods to

2i2t

With the other strategy, in which one-period bonds are bought, the expected return on the $1 investment over the two periods is:

(1 i )(1 i e ) 1 1 i i e i (i e ) 1 i i e i (i e )

t t 1 t t 1 t t 1 t t t t 1

This calculation is derived by recognizing that after the first period, the $1 investment becomes 1 it , and this is reinvested in the one-period bond for the next period, yielding an amount (1 it )(1 i et 1). Then subtracting the $1 initial investment from this amount and dividing by the initial investment of $1 gives the expected return for the strategy of holding one-period bonds for the two periods. Because

it(i et 1) is also extremely smallÑif it i et 1 0.10, then it(i et 1) 0.01Ñwe can simplify this to:

i |

i e |

t |

t 1 |

Both bonds will be held only if these expected returns are equal; that is, when:

2i |

i |

i e |

2t |

t |

t 1 |