- •Mass choirs will open Houston service; guests arriving

- •Euro leaders 'optimistic' Greek deal can be approved Monday

- •In the euro zone

- •Pictured: Limbless motivational speaker enjoys honeymoon on the beach a week after marrying the love of his life

- •More...

- •Taxpayers bank on better returns at Lloyds and Royal Bank of Scotland

- •Bp oil spill partner moex Offshore first to settle with us a minority partner in bp's ill-fated Macondo well has become the first company involved in the disaster to settle with the us government.

- •Think Tank: Brands still need words to get the message across Slogans can animate a company and its employees, not just shape what consumers might think about its brand.

- •Pancake power

- •Politics

- •Audit Chamber head says Putin’s proposed privatization fee is doable

- •Not all about the mouse

- •Yandex.Dengi expands bankcard services

- •Business

Pictured: Limbless motivational speaker enjoys honeymoon on the beach a week after marrying the love of his life

These incredible pictures show motivational speaker Nick Vujicic and his new wife on the beach in Hawaii, frolicking like any other couple on their honeymoon.

Vujicic was born with no limbs, a crippling disability that meant he had little hope of ever living a normal life.

Tetra-amelia syndrome is a rare disorder characterised by the absence of both arms and legs.

Stunning scene: Nick Vujicic was spotted honeymooning in Hawaii with his new bride Kanae Miyahara. The couple married in California on February 10

Vujicic was born to Serbian immigrants in Melbourne, Australia, but the couple now live in California.

Now a best-selling author, as a child Vujicic suffered from depression as a child, but as he got older he eventually began to embrace his disability.

The teen mastered life’s daily tasks and went on to show that he can do everything that able bodied people can do-including writing, typing, play drums, brush his teeth.

More...

Aged 17 he began giving talks at a church group and went on to found a non-profit to use his experience to help others.

In 2005 Vujicic was nominated for the 'Young Australian of the Year' Award.

But the preacher and author of 'Life Without Limbs' has now found true happiness - he last week got married.

Tough start: Vujicic was born with no legs, a crippling disability that meant he had little hope of ever living a normal life.

Brave man: Vujicic can do everything that an able bodied person can do, including surfing, writing and typing

Huge: Vijucic and his beautiful new wife Kanae Miyahara, were keen to show off her new rock

And today, the bestselling author and his beautiful new wife Kanae Miyahara, were seen having the time of their lives, as they began married life in Hawaii.

The agile Vujicic had no difficulty taking using his camera to take photos of his stunning bride.

The couple got engaged in August and married on February 10th in California.

Head first: Vujicic demonstrates how he gets up without help during a motivational conference

Natural speaker: Vujicic- seen in his wheelchair -delivers speeches about his life to inspire other disabled people to reach out. He has addressed over three million people in 25 countries

On Nick’s Facebook page, congratulatory remarks poured in from fans from around the world. Nick, 29, has addressed over three million people in 25 countries.

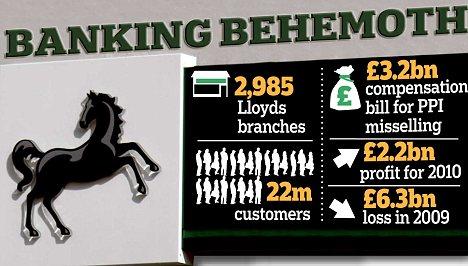

Taxpayers bank on better returns at Lloyds and Royal Bank of Scotland

Taxpayers will find out next week whether their £66bn stake in Lloyds Banking Group and Royal Bank of Scotland has been put to good use.

The state-backed banks are set to report their figures for 2011 on Thursday and Friday.

Although shares in both Lloyds and RBS have rallied recently, taxpayers are still sitting on a £31bn loss on their investment.

And this could increase next week if shareholders are not convinced the two banks are making progress.

The omens for Lloyds are not particularly encouraging after it made a loss of £3.85bn in the first nine months of last year.

Analysts expect the bank to lurch to a £4bn loss for the whole year, largely due to a £3.2bn hit for misselling payment protection insurance.

In 2010 it made a profit – after one-off charges – of £281m.

Ignoring the compensation bill and other writedowns, underlying profits are expected to drop 9 per cent to £2bn.

However this compares favourably with foreign banks, such as Société Générale and BNP Paribas, which have been hit hard by the Greek crisis.

Lloyds needs to bolster its share price from 35.4p to 63.1p before taxpayers break even.

Only then will UKFI – the organisation set up by the Government to oversee state-backed banks – begin the arduous process of selling them back to the private sector.

Last week RBS chief Stephen Hester said the bank was still in a ‘loss-making phase’.

The bank posted a £1.13bn loss in 2010 and will announce its 2011 results on Thursday.

Share prices have to almost double from 27.6p to 50p before the taxpayer – sitting on a £20.4bn loss – breaks even.

Earlier this month it revealed it had spent a further £38bn on clean up costs as it tried to cut down its swollen balance sheet. This involved winding down its investment arm and cutting thousands of jobs.

Much of the focus will be on bonuses. Both Horta-Osório and Hester waived theirs.

Almost 2,000 communities have been left with just one bank branch or none at all, with customers often forced to travel miles to pay in a deposit or cash a cheque.

Some 414 villages and 466 towns have just one bank left, according to new figures from the Campaign for Community Banking Services.

A further 1,000 communities have no bank at all, with 7,500 branches closing down since 1990.

Italian police seize $6 trillion of fake US bonds in Switzerland

A record $6 trillion (£3.9 trillion) of fake US government bonds have been seized by Italian authorities.

The notes, which were dated 1934, were found in three safety deposit boxes in Zurich after a year-long joint investigation by Swiss and Italian authorities known as "Operation Vulcanica". Eight people have been arrested.

Prosecutors in the southern Italian city of Potenza said that the scale of the alleged fraud posed "severe threats" to international financial stability.

The eight people under arrest are accused of counterfeiting bonds, as well as credit card forgery and usury across several Italian regions, including Lombardy in the north of the country.

Authorities had focused their initial investigations on a Sicilian living in Potenza who, according to prosecutors, was "already known for money laundering".

The American Embassy in Rome thanked Italian authorities for the seizure of the bonds, whose alleged value equals just over a third of the entire US national debt. US authorities typically make about 100 investigations a year into allegations of counterfeiting US government bonds, which remain one of the most trusted and liquid financial assets in the world.