- •Introduction to corporate finance

- •Investors expecting change at LogicaCmg

- •It's all champagne, Ferraris and penthouses - let the good times roll for the investment bankers

- •91 Go to the web

- •1. Higher share price volatility

- •2. Demand from hedge funds

- •3. An ever growing stream of new innovative products

- •Ipo values Hargreaves at £750 m

- •Valuing Sainsbury's

91 Go to the web

Go the ECB's official website at: www.ecb.int/home/html/index.en.html

Find the current level of the ECB's main refinancing operation minimum bid. Now go to the section on monetary policy.

a. What are the main aims of monetary policy?

b. What are the benefits of price stability?

Research

For a good understanding of what moves the financial markets on a daily basis there is no shortcut. You need to read the Financial Times regularly, particularly after days when there have been significant movements in the main financial markets. Read the articles regularly (look at the Lex column as well) and you will soon get a feel for what drives the financial markets.

Go to www.pearsoned.co.uk/boakes or iTunes to download Podcast 7, which pro-iPODCASTl vides further analysis of key issues for you to listen to at your leisure. The podcasts are easily downloadable to your PC or iPod/MP3 player.

Debt finance

The term debt finance refers to the money that a business has to borrow in order to fund its various activities. In practice, we normally divide this debt finance into short-term and long-term borrowing. The longer-term borrowing takes place in the international bond markets which are an increasingly important area in terms of financial market activity. Every day there are many new bond issues from companies, governments and a wide range of large organisations. The first article in this topic look at the process of launching a new bond issue. In the second and third articles we discuss some of the more innovative products that now feature in the bond markets.

The following three articles are analysed in this section:

Article 10

Athens prepares 50-year bond issue worth €500 m-1 bn

Financial Times, 1 8 January 2007

Article 11

Convertibles stage return to fashion

financial Times, 8 February 2007.

Article 12

Record samurai deal by Citigroup

Financial Times, 6 September 2005

These articles address the following issues:

Different types of bonds defined

Liquidity in bond markets

Bond auctions

Bond yield spreads and credit rating

Budget deficits

The convertible bond market

Exotic products

Book runners

Arbitrage

Liquid yield option notes

Greek government launches new bond issue

The international bond markets are an increasingly important area in terms of financial market activity. Every day we see many new bond issues from companies, governments and a wide range of large organisations. There are three main definitions for these new bond issues.

Firstly, there is a domestic bond where the issuer launches a bond in its local currency and home country. For example, a UK company might launch a new £500 m bond issue in London.

Secondly, there is a foreign bond where an issuer goes to another country to issue a bond in a foreign currency. For example, a German company might launch a new $500 m bond issue in the United States. This type of foreign bond issue is called a Yankee bond.

Finally, there is a Eurobond where the issue takes place outside of the country of the currency that the bond is denominated in. For example, a German company might launch a new $500 m bond issue in France. This type of bond is called a Eurobond because the issue is in US dollars and it takes place outside of the United States. You should be aware that the term Eurobond does not mean that the issue has to take place within the European financial markets.

This article examines the process of a government looking to issue a very long-term debt security. It clearly shows the relationship between a country's credit rating and the expected yield on the new bond issue.

Athens prepares 50-year bond issue worth €500m-€lbn

Kerin Hope

Greece is planning to issue a 50-year bond make private placements for a 50-year bond in the first half of this year to take advantage of strong liquidity in international markets and a flat yield curve, Petros Doukas, the deputy finance minister, said yesterday. already popular with the market as the

Mr Doukas put the size of the issue at €500m-€lbn.The funds would be raised through an auction process rather than a syndication. Greece has already received several offers from banks to make private placements for a 50-year bond.

'With the yield curve flat, the cost of the 50-year bond will not be above that of 30- year paper1, Mr Doukas said. Greece is already popular with the market as the eurozone's high-yield borrower, with spreads of 30-35 basis points above the bund on its 30-year paper. Greece, which would be following in the footsteps of France and the UK last year, would be the

smallest country to date to launch a 50- prudent for an issuer to borrow at the

year bond. long end, and there's definitely appetite in

While Greece's credit rating is still the the market for a Greek bond of this tenor,'

lowest in the eurozone, Moody's last week said George Kofinakos, managing director

changed the outlook on its single A rating of Citigroup Greece.

from 'stable' to 'positive', indicating an Greek prospects are picking up, with

upgrade may be on the way. Market- GDP growth this year projected at about

watchers said they expected the 50-year 4 per cent for the fifth successive year,

issue to take place at the end of the first The country is poised to emerge from

quarter or beginning of the second. It the European Union's excessive budget

would follow 15- and 30-year issues that deficit procedure, after reducing the 2006

are already planned under this year's deficit below the 3 per cent of GDP euro-

€33.5 bn borrowing programme. 'It's zone ceiling.

■ The analysis

In this article the focus is on a prospective new international bond issue from Greece which was planning to launch a 50-year bond in the first half of 2007. The move was announce! by the deputy finance minister Petros Doukas. The new bond issue was timed to take advantage of strong liquidity in financial markets and the presence of a relatively flat yield curve. Greater liquidity in financial markets suggests that there would be plenty of demand for a new large bond issue. And the flat yield curve suggests that the costs of issuing longer-dated bond would be relatively cheap compared to shorter-term maturities. The article quotes Mr Doukas as saying that 'the cost of the 50-year bond will not be above that of a 30-year paper'. We would normally expect to see an upward-sloping yield curve where longer-term bond yields would be significantly higher than short-term bond yield In the context of the European government bond market, Greece stands out as the market with the highest level of yields among the eurozone economies. Its bonds have a positive yield spread of some 30-35 basis points above the equivalent German 30-year bonds. This reflects the fact that Greece's credit rating is the lowest in the eurozone. Or rating agency, Moody's, rated Greece's credit risk at a single A with the outlook recent upgraded from stable to positive. Against the background of a favourable economic outlook, the article concludes with a glowing assessment from the managing director Citigroup Greece. Economic growth is expected to hit an annual rate of 4 per cent for U fifth successive year and the budget deficit has been reduced to below the Europe. Union's ceiling of 3 per cent of GDP.

• Key terms

Flat yield curve A flat yield curve shows the level of yields being broadly similar across t maturity spectrum. (See Article 4 for a detailed explanation of yield curves.)

Liquidity

In financial markets this normally refers to how easily an asset can be converted into cash. Therefore, notes and coins are the most liquid financial asset. In general, the more liquid

an asset, the lower is its return. In this article it is used to indicate that there is a great deal of cash available to invest in new government bonds.

Bond auction process Most new government bond issues are sold through a system of auctions. Normally the country's Treasury is in charge of new issues. They will give an early warning of the maturity of the issue. And then a week or so before it will firm up details of the size of the issue, the total amount being raised, the maturity and the bond's annual coupon.

This very simple example might show how the bidding works.

A government invites bids for a new bond auction. The new issue is a £3 bn 6 per cent bond issue due to mature in 2035.

The following bids come in:

Price bid How much accepted?

£100 mat £98.65 100% - £100 m

£125 m at £98.60 100% = £125 m

£135 mat £98.50 100% - £1 35 m

£140mat £98.45 100% - £140m

£160 mat £98.40 100% - £160 m

£2200mat £98.35 100%-£2200m

£1400 mat £98.30 10% = £140m

This gets us to the £3 bn available.

Any bids below £98.30 will be rejected. This is a competitive bidding process so you pay the price you bid if it is accepted.

Bond yield spreads This refers to the yield on a particular bond issue minus the yield on the nearest comparable government bond issue. So in this case we are comparing 30-year bonds from Greece with those from Germany (bunds).

German 30-year bunds yield = 4.1 7%

The spread equals 30-35 basis points

So the Greek 30-year bonds yield = 4.47-52%

Note:

100 basis points = an extra 1 percentage point on the yield.

50 basis points = an extra 0.5 percentage point on the yield, etc.

The spread is determined by a combination of the bond's credit rating, liquidity and the market's perception of its risk relative to the other bond.

Bond credit rating Most new bond issuers are assigned credit ratings by the various companies that are involved in this activity. They include Standard and Poor's and Moody's. The highest credit rating allocated by Moody's is a triple A. For example, this is awarded to the German government's bond issues. In this article we learn that Greece has a rating of single A. And this under review with a ‘ positive’ outlook favoured.

Short summary of Moody's credit ratings

AAA - Capacity to pay interest and principal extremely strong

AA = Differs only in a small degree

A = More susceptible to adverse changes in circumstances

BBB = Adequate capacity

BB, B = Speculative

C = No interest being paid

D = In default

Budget deficit A country's budget deficit refers to the difference between its spending and its revenue. It is normal for any government to spend more money on health services, education, defence, etc. than it can raise revenue from income taxes, sales taxes, etc. The result is a fiscal deficit or a budget deficit. We normally like to compare a country's budget deficit by expressing it as a percentage of the country's gross domestic product or income.

This would be just the same for an individual. It is fine for a premiership footballer with an income of £5 m per year to run a deficit of £1000 in a particular year. This amounts to a tiny percentage of his annual income. So he can repay this debt very easily in the next year. It is quite another matter for a student running up a deficit of £1000 in a particular year when her income is only £5000 per year. Her deficit is 20 per cent of her annual income and it will be much harder for her to repay this debt until her income rises significantly when she lands that lucrative job with an investment bank after graduation!

■ What do you think?

1. What are the main factors that will determine the sovereign risk on a new international bond issue?

Hint sovereign refers to the risk of a particular country.

2. Are the following bonds: Eurobonds (E) Foreign bonds (F) Domestic bonds (D)?

(i) The Swiss government issues a euro-denominated bond in Germany.

(ii) Microsoft issues a US dollar bond in the United States.

(iii) Deutsche Telecom issues a yen bond in Japan.

(iv) The French government issues a Swiss franc bond in London.

(v) The World Bank (based in New York) issues a euro-denominated bond in Paris.

■ Why is the Greek deputy finance minister expecting to be able to issue this new long-term bond issue at a particularly low cost at the time of the article? What are the potential financial market risks that could result in a much higher yield on this new bond issue in reality?

What are the advantages for Greece in raising these funds through a bond auction compared with a placement process?

There is a very positive view on the prospects of the Greek economy expressed here by the managing director of a large investment bank's Greek office. Why should we read these comments with a degree of caution?

Undertake some research and set out a balanced view of the current prospects for the Greek economy.

Investigate FT data

You will need the Companies and Market section of the Financial Times. Go to the Market Data section and look at the bottom left-hand side of the page. In this section you will see a section called Benchmark Government Bonds.

Answer these questions:

What is the current level of 30-year bond yields for Germany?

What were they a year ago?

By looking at the four US government bond issues, describe the current shape of the US bond yield curve.

Which country has the highest 10-year bond yield?

What has happened to the level of 10-year Greek government bond yields in the last day, week, month and year?

Now look to the right of this column and examine the High-Yield and Emerging Market Bonds section.

Answer these questions:

Choose any four bonds in the emerging US-dollar section. Discuss the link between their spreads versus US Treasuries (see the last column) and their credit rating.

In the high-yield euro section, which bond has the largest spread compared with US Treasuries?

Go to the web

Go to the official website of the Financial Times at: www.ft.com/home/uk.

Find the Market Data section. Go to the Bond and Rates section. Go to the International Bond Issues section. You will be able to access details of the last five days' worth of new international bond issues.

a. Find a recent example of a new bond issue from a sovereign nation.

b. Compare the yield on this bond with a bond issue from a more risky corporate issuer in the same currency and with a similar maturity.

c. Calculate the yield spread between these two issues.

d. Explain the rationale for the size of this spread.

e. Which larqe international banks tend to be the book runners on most of the new issues?

■ Research

Arnold, G. (2008) Corporate Financial Management, 4th edn, Harlow, UK: FT Prentice should especially look at Chapter 11.

Pilbeam, K. (2005) International Finance, 3rd edn, Basingstoke, UK: Palgrave Macmillan. Chapter 12 provides a very good overview of the Eurobond market.

Valdez, S. (2006) An Introduction to Clobol Financial Markets, 5th edn, Basingstoke, UK:

Macmillan. You should look at Chapter 6. This provides a good general introduction

markets.

Watson, D. and Head, A. (2007) Corporate Finance: Principles and Practice, 4th edn, Harlow, UK:

FT Prentice Hall. You should look at Chapter 6.

Go

to www.pearsoned.co.uk/boakes

or

iTunes

to

download Podcast 8, which

PODCAST

vides further analysis of key issues for you to listen to at

your leisure. The poi are easily downloadable to your PC or

iPod/MP3 player.

Japanese convertibles back in fashion

The fundamental financial market products are shares, bonds, foreign exchange and also cash traded in the money markets. However, over time the banks have created a range of more complex products with each one designed for a specific purpose. One new type of bond might reduce the debt issue costs for a particular company. Others might have a tax advantage for the issuer, at least until the tax authorities clamp down on this practice.

This article examines one of the first innovative financial market products to be created. These are convertible bonds which are a delightfully simple instrument. A convertible is a debt issue that allows the holder to convert the bond into shares in the issuing company at a set price at some stage in the future. This article looks at the strong rebound in the convertible bond market in Japan during 2006.

Article 11

Convertibles stage return to fashion

Article David Turner

A couple of years ago, Japan's convertible bond market looked on the brink of extinction. Annual issuance by Japanese companies was running at just $2.7bn -less than a sixth of the level of issuance in 2004 and the lowest amount since 1998.

But in recent months, the sector has started to make a spectacular return, spurred by higher share-price volatility, the hunger of hedge funds and a continuing stream of new and exotic products.

Last year total issuance bounced back to $12.6 bn through more than 50 deals. Investment bankers say it could be even higher this year if share prices remain volatile.

The biggest reason why convertible issuance has risen so fast is exactly the same reason why it fell so far in 2005: share price volatility. This allows issuers to gain a good price for their convertibles on the grounds there is a strong chance that the underlying shares will reach the

price at which investors can convert the bonds into equity.

Because of low volatility in 2005 'the condition of the market was terrible', says Takashi Masuda, a senior official in the syndicate department of Nomura, Japan's biggest book runner of convertibles last year in both value and number of deals. Some investment banking departments responded pessimistically by trimming the number of convertibles staff in Japan.

Among bankers there were fears this was more than a mere temporary blip caused by market conditions. In particular, they feared structural changes might be afoot - most notably because Japanese companies are increasingly scared of hostile takeovers and afraid convertibles could be used a weapon to storm the ramparts.

The wary could point to the example of Sumitomo Warehouse. In 2005 activist shareholder Yoshiaki Murakami became

the leading shareholder in the company by using convertibles.

But other investment bankers thought these fears of a permanent souring against convertibles were excessively pessimistic. And these days the optimists are starting to look right.

Higher volatility was not the only blessing that restored the market. Gareth Lake, managing director of equity capital markets at Nikko Citigroup, one of Japan's biggest convertible book runners, says 'the dearth of issuance' in 2005 encouraged funds to start 'looking for new paper'. The biggest investors are the global convertible arbitrage hedge funds, which often follow a strategy of buying an issuer's convertible bonds while shorting its shares (or betting that its share price will fall). Japanese pension funds have also shown interest.

The market has been further boosted by the spectre of rate rises from the Bank of Japan. The bank has lifted rates only once in the current cycle, back in July, but is expected to start raising them again soon - albeit rather slowly.

Alex Woodthorpe, Tokyo-based chairman of Pacific Rim equity capital markets at Merrill Lynch, says: 'The ability to fund at zero coupon ahead of the interest rate curve is appealing to issuers'.

For those investors reluctant to buy zero-rate products because they think the bank may raise rates more rapidly than the market expects, there is a solution: liquid yield option notes, or 'lyons'.

These are convertibles that are issued at sub-par, thus generating a yield despite the zero coupon. Merrill Lynch arranged

Japan's first ever lyon, a 1.022 bn deal for leasing company Orix, in 2002.

The range of styles of convertible that is being offered in Japan is mind-boggling and is used by different underwriters to jockey for competitive position. This creates a relentless quest for further innovation to find something new for Japan to offer issuers, though Japanese issuers are reluctant to experiment with outright 'firsts' for the world. This innovation cycle means, according to Mr Woodthorpe, that 'whatever you did yesterday becomes plain vanilla today'.

But one factor that could help the market even more than innovation is something more prosaic: regulation. One investment banker who arranges the small and mid-size convertible deals sold into the domestic rather than international market says issuance is hampered by the seven-day rule that applies to all deals sold to retail investors.

After announcing a convertible issue, issuers have to wait a week before setting the conversion price. But in the week that has elapsed, the share price may have fallen sharply, leaving issuers with a much lower conversion price than they first expected.

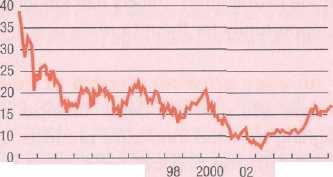

1990 92 94 96

Source. Thomson Dataslream

04 06

Japanese equities Nikkei 225 Average ('000)

■ The analysis

In 2006 the Japanese convertible bond market was very much back in favour with 50 new corporate issues raising over $12.5bn. This article looks at the main reasons behind this on9 rebound in the market. It argues that it was due to three principal factors.