crack the case

.pdf

MoMo Mui |

I |

Interviewer Fact Sheet

Pack: 010 page 7 of 39

CaseCaseQuestionQuestion

MoMo Mui is one of the oldest and most prestigious names in Japanese women’s beauty. Founded in 1950, MoMo Mui MoMo Mui is one of the oldest and most prestigious names in Japanese women’s beauty. Founded in 1950, MoMo Mui

has been the mecca for Japanese women, starlets and models from around the world. Considered to be a high quality but has been the mecca for Japanese women, starlets and models from around the world. Considered to be a high quality but underdeveloped brand, MoMo Mui has caught the eye of three Stanford female MBA's looking to purchase the brand underdeveloped brand, MoMo Mui has caught the eye of three Stanford female MBA's looking to purchase the brand

rights to North America. They are struggling with whether it is a good idea to buy this brand. Their lead investor will only rights to North America. They are struggling with whether it is a good idea to buy this brand. Their lead investor will only lend start-up capital if he can be shown that the salons can produce annual profit of $3M by year six. Can you develop lend start-up capital if he can be shown that the salons can produce annual profit of $3M by year six. Can you develop

an approach for the trio to help them meet these targets? Given what you find out during the case, recommend if an approach for the trio to help them meet these targets? Given what you find out during the case, recommend if

they should buy the rights to N.A. they should buy the rights to N.A.

AAFewFewTipsTipsfromfromDavidDavid

•This case is heavy on the slides. Some of this data is not necessary for solving the case. Candidates often ask for more information than they need, so expect to entertain quite a few tangential questions.

•Your goal is to lead the candidate to perform analysis on both the products and new salonss.

•If the candidate’s final recommendation is too aggressive, be sure to discuss start-up limitations.

IntroIntro FactsFacts

(Tell(Te lthetheCandidateCandidateififAsked)Asked)

•Salons:

•Salons:

Loyalty – women tend to be loyal to their stylist/salon. Loyalty – women tend to be loyal to their stylist/salon.

Switching rates are < 20%. Switching rates are < 20%.

Salon Utilization – it takes roughly 5 years to reach Salon Utilization – it takes roughly 5 years to reach “full” utilization (usually “full” is defined as each “full” utilization (usually “full” is defined as each

chair being utilized 70% of the time). chair being utilized 70% of the time).

Competitor concentration – the industry is very Competitor concentration – the industry is very fragmented. Rejuva, the largest chain, only fragmented. Rejuva, the largest chain, only

controls a small portion. controls a small portion.

Failure rate – No actual data available; in general, Failure rate – No actual data available; in general,

most salons succeed if given enough time most salons succeed if given enough time

•Products:

•Products:

Breadth – MM product line includes a full range of Breadth – MM product line includes a full range of

haircare products (shampoos, conditioners, styling haircare products (shampoos, conditioners, styling products) and bath products (bath & shower gel, products) and bath products (bath & shower gel, soap).

soap).

Quality – currently carried by high quality Tokyo Quality – currently carried by high quality Tokyo retailers, including Murui-Murui and Seibu. retailers, including Murui-Murui and Seibu.

Manufacturing – all products are manufactured in Manufacturing – all products are manufactured in

Hong Kong, with the exception of soaps, which are Hong Kong, with the exception of soaps, which are manufactured in Japan.

manufactured in Japan.

Competition – there are few competitors; it is a very Competition – there are few competitors; it is a very

fragmented industry fragmented industry

•Investors:

•Investors:

Financing – one investor is driving the funding, so the Financing – one investor is driving the funding, so the

team wants to meet his demand team wants to meet his demand

Team – The three entrepreneurs are smart and Team – The three entrepreneurs are smart and driven, but have little domain experience

driven, but have little domain experience

On-Track Indicators

Clear logic – parses the data into distinct groups and knows what s/he is looking for with each piece of analysis

Clear logic – parses the data into distinct groups and knows what s/he is looking for with each piece of analysis

Common sense – shows a strong understanding of the challenges of a startup and the need to focus on drivers of value through clear prioritization

Common sense – shows a strong understanding of the challenges of a startup and the need to focus on drivers of value through clear prioritization

Speed– quickly creates a plan to plow through the data and develops a P&L to evaluate the salon potential

Speed– quickly creates a plan to plow through the data and develops a P&L to evaluate the salon potential

Keyey InsightsInsights

(Do(DoNotNotTellTe lthetheCandidate)Candidate)

• Salons are too expensive to launch at

• Salons are too expensive to launch at first:first: OpeningOpeningsalonssalonsisisaawaywaytotopushpush productsproductsandandincreaseincreasebrandbrandawareness,awareness,butbut thetheinitialinitialcapitalcapitaloutlayoutlayforforthethesalonssalonsisishighhigh.. ItIttakestakesupuptotofivefiveyearsyearstotoreachreachfullfu l utilizationutilization..

• Leverage the existing brand rights to

• Leverage the existing brand rights to products: The brand rights to MoMo Mui products: The brand rights to MoMo Mui come with a silver lining, a fully developed come with a silver lining, a fully developed productproductlineline.. AlthoughAlthoughthethepackagingpackagingandand somesomeformulationsformulationswillwi lchangechangeoverovertime,time,thethe productproductisisalreadyalreadyveryverysuccessfulsuccessfulasasisis.. TheThefocusfocuswillwi lbebeononmarketingmarketingititandand determiningdetermininghowhowlargelargethethebusinessbusinesswillwi l growgrowononproductproductsalessalesalonealone..

•• NearNeartermtermproductproductgrowthgrowthisiscriticalcriticaltoto success: There is a clear need to create success: There is a clear need to create value early for investors and for those value early for investors and for those involved in building the business. The plan involved in building the business. The plan shouldshouldfocusfocusononsomesomenearnear--termtermgoalsgoals aroundaroundproductproductgrowthgrowthandandlonglong--termtermgoalsgoals aroundaroundsalonsalonbuildbuild--outout..

Off-Track Indicators

Creative without content – spends too much time pondering the need for this kind of product without doing the math

Creative without content – spends too much time pondering the need for this kind of product without doing the math

Slow with numbers – does not recognize the need to round up and make simple assumptions

Slow with numbers – does not recognize the need to round up and make simple assumptions

Has “blinders” on – fails to question the deal as it is suggested; does not explore the product-only path or some form of a hybrid approach

Has “blinders” on – fails to question the deal as it is suggested; does not explore the product-only path or some form of a hybrid approach

Purchase additional cases and the book Crack the Case: How to Conquer Your Case Interviews at www.consultingcase.com. |

010 - MoMo Mui 7 |

|

Copyright © 2004 Turtle Hare Media |

||

|

MoMo Mui |

I |

Case at a Glance

Pack: 010 page 8 of 39

1

2

3

4

Part

A

5

6

Typical Case |

|

Interviewer |

Candidate |

|||||

|

Questions & |

Questions & |

||||||

Flow |

|

|||||||

|

Comments |

Answers |

||||||

|

|

|||||||

|

|

|

|

|

|

|

|

|

Present the main |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Candidate takes notes, |

|

|

|

|

|

|

|

|

||

question. Ask for a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

asks for a minute, forms |

|

recommendation at the |

|

|

|

|

|

|

|

|

|

|

~0:01 min. |

|

a plan and presents it. |

||||

end of the case. |

|

|

|

|||||

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Answer any basic fact |

|

|

|

|

|

|

|

|

questions. These may |

|

|

|

|

|

|

|

|

come up after you |

|

|

|

|

|

|

|

|

present the question. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Clear connections |

|

|

|

“Tell me more about |

|

|

||||

Ask for clarification if |

|

|

|

between each part of the |

||||

|

this area (you choose). |

|

|

|||||

|

|

|

plan and an |

|||||

necessary. Be sure to |

|

What are you thinking |

|

|

||||

|

|

|

understanding of how |

|||||

make him explain |

|

about here.” or “Tell |

|

|

||||

|

|

|

each part contributes to |

|||||

anything you do not fully |

|

me how the parts of |

|

|

||||

|

|

|

the whole. Solid logic on |

|||||

understand. |

|

your structure link to |

|

|

||||

|

|

|

how this plan will get |

|||||

|

|

each other.” |

|

|

||||

|

|

|

|

some answers. |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Let the candidate start |

|

|

|

|

|

|

|

|

|

When the candidate is |

|

|

Questions about: |

||||

wherever he likes. |

|

|

|

|||||

|

|

|

“Industry . . . ?” |

|||||

Expect questions like, |

|

reviewing Handouts, ask |

|

|

||||

|

|

|

“Competitors . . . ?” |

|||||

“Do you have any market |

|

“What does this |

|

|

||||

|

|

|

“Geography . . . ?” |

|||||

information?” Give data |

|

information tell you?” |

|

|

||||

|

|

|

“Product information . . ?” |

|||||

and discuss. |

|

or “How does this data |

|

|

||||

|

|

|

“Product profitability . . .?” |

|||||

|

|

affect your thinking?” |

|

|

||||

|

|

|

|

Other questions |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

After discussing some of the handout topics and their implications, focus the discussion on opening MM salons.

Brainstorm on what would drive profit as you open salons.

“How would you determine how many salons need to be opened to meet the investor’s requirements?”

“I would need to understand some basic profitability by salon and the timing of that profit.”

Data &

Answers to

Provide

See Intro Facts on the Interviewer Fact Sheet.

No data. Ask questions about his approach.

In the next 5 minutes you need to discuss salon openings, so avoid giving data on products or discussing that topic yet.

Ask the key question for each handout (p.10).

Handout A, Industry (OK) B, Competitors (OK)

C, Geography (OK)

D, salon Revenue (Hold) E, Product Market (Hold) F, Product Margin (Hold) G, Salon Inc Stmt (Hold)

After brainstorming together give Handout D and ask, “Given this data, what would a basic income statement look like for salon openings over several years?”

|

|

|

|

Brainstorming Break |

|

|

|

|

|

|

|

|

|

• Have the candidate try to think of the drivers of profitability in a typical MoMo Mui salon |

|

|

|

|

|

|

|

|

|

• Give hints where necessary |

~0:08 min. |

• Most obvious include: number of customers x price x days per year minus rent, salaries and marketing |

|||

|

|

|

|

• Less obvious include: number of chairs x hours used per day x hourly rate x days per year minus rent, |

|

|

|

|

salaries and marketing |

|

|

|

|

|

Expect the candidate to struggle with this question a bit. Income Statement may be a document that is not as familiar to the candidate. Use your judgment on how many hints to give.

If the candidate is stuck, ask “Look back at your basic variables. How would you expect those to change over time?”

“I would expect the utilization of the chairs to change over time so the total number of hours would go up.” Candidate will be trying to develop a simple statement like that shown in Handout G.

No additional data is necessary. Candidate should be able to use Handout D for data and create a simple revenue and cost table.

Purchase additional cases and the book Crack the Case: How to Conquer Your Case Interviews at www.consultingcase.com. |

010 - MoMo Mui 8 |

|

Copyright © 2004 Turtle Hare Media |

||

|

MoMo Mui |

I |

Case at a Glance

Pack: 010 page 9 of 39

7

Part

A

8

9

Part

B

Typical Case |

Interviewer |

Candidate |

Data & |

|

Questions & |

Questions & |

Answers to |

||

Flow |

||||

Comments |

Answers |

Provide |

||

|

Don’t let this analysis go on too long before giving Handout G. Ask to see the Candidate’s

approach for reaching the  investor’s $3M. Ask

investor’s $3M. Ask

about their approach and what their answer implies about the business.

“At what rate do we have to open salons to reach our investor’s target of $3M of profit per year?”

There are a variety of answers. Candidates usually understand that they need to open quite a few salons, but they are not certain of how many are feasible per year given MM’s startup team.

Give Handout G.

Review Handout H but do not give it to the candidate.

|

|

|

|

|

|

Insight Checkpoint (Redirect the discussion to these areas if necessary) |

|

|||||

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

• Salons don’t start making solid profit until years 5 and 6. |

|

|||||

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

• If MM launches 2 salons in year one and then 5 the next year and 6 in year three, they can meet the |

||||||

~0:12 min. |

investor’s demands. |

|

|

|

|

|||||||

• But, trying to open 13 salons over 3 years will likely be very difficult given MM’s start-up mode and |

||||||||||||

|

|

|

|

|

|

implied small team. Common sense will tell you that if you grow too quickly, you’ll collapse. |

||||||

|

|

|

|

|

|

• The Candidate needs to understand that there might be other ways to meet the target (products!). |

||||||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Now it is time to move |

|

“You have found that it |

|

“Clearly they need to sell |

|

Give any handouts that |

||||||

the discussion to the |

|

|

|

the candidate has not |

||||||||

|

may take a long time to |

|

products. Let me look at |

|

||||||||

product side. MM North |

|

|

|

seen yet. Here are the |

||||||||

|

get the salons built, |

|

the data we have on |

|

||||||||

America will be acquiring |

|

|

|

best ones to use for |

||||||||

|

running and profitable. |

|

potential market size and |

|

||||||||

the brand rights to all |

|

|

|

product analysis: |

||||||||

|

What are other ways to |

|

the kinds of products we |

|

||||||||

products available, so |

|

|

|

|

||||||||

|

meet the investor’s |

|

have. Do you have any |

|

E, Product Market |

|||||||

they do not have to |

|

|

|

|||||||||

|

demands?” |

|

data on either topics?” |

|

||||||||

create any new products. |

|

|

|

F, Product Margin |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Candidate will be |

|

|

|

“I would need to know the |

|

|

||||||

thinking through the size |

|

|

|

|

|

|||||||

|

“How would you |

|

number of products, how |

|

|

|||||||

of the market, how much |

|

|

|

Prompt with data from the |

||||||||

|

determine the product |

|

much we’re selling in |

|

||||||||

MM can reasonably |

|

|

|

analysis below if the |

||||||||

|

potential of the |

|

terms of units and dollars |

|

||||||||

capture and the gross |

|

|

|

Candidate needs help. |

||||||||

|

business?” |

|

and what the potential |

|

||||||||

margins that they will |

|

|

|

|

||||||||

|

|

|

growth rates are.” |

|

|

|||||||

receive for product sales. |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

Math Zone – Solving for Product Sales Required to Meet Investor Demands |

|

|||||

|

|

|

|

|

|

• Review Handout E and consider the market MM needs to capture to generate profit of $3M per year. |

||||||

|

|

|

|

|

|

• To get to profit, use the margin information on slide F. Some of it is not available, but you can make a |

||||||

~0:16 min. |

good estimate. Franchised salon margin would likely be less than company owned margin because MM |

|||||||||||

|

|

|

|

|

|

has to share margin with the franchisee. Direct product sales would probably provide more margin than |

||||||

|

|

|

|

|

|

a company owned salon because there is no overhead. To be conservative on this mix, assume a |

||||||

|

|

|

|

|

|

margin of about 55%. |

|

|

|

|

||

•Doing the math: (target annual sales) x .55 = $3M. Solving for sales you get $5.5M.

•This number implies that MM would have to get $5.5M/$210 of the market or about 3%. Of course this number would need to be increased to cover basic operating expenses, which would be lower than when opening a salon. But even with the additional expenses, this goal seems realistic.

Purchase additional cases and the book Crack the Case: How to Conquer Your Case Interviews at www.consultingcase.com. |

010 - MoMo Mui 9 |

|

Copyright © 2004 Turtle Hare Media |

||

|

MoMo Mui |

I |

Case at a Glance

Pack: 010 page 10 of 39

Part

C

Typical Case |

Interviewer |

Candidate |

Data & |

|

Questions & |

Questions & |

Answers to |

||

Flow |

||||

Comments |

Answers |

Provide |

||

|

|

|

|

“Now that we’ve |

|

|

|

|

|

Now that the Candidate |

|

|

|

|

|

|

|

|

discussed both salon |

|

Expect additional |

|

Answer questions but |

|

|

has covered both the |

|

|

|

|||

|

|

openings and product |

|

|

|||

|

salon and product side, |

|

|

questions about the |

|

push for a specific |

|

10 |

|

sales, how would you |

|

|

|||

they need to bring it all |

|

|

market, suppliers and |

|

recommendation and |

||

|

together and give a |

|

advise our three |

|

competitors. |

|

logic to support it. |

|

|

MBAs? Should they do |

|

|

|||

|

recommendation. |

|

|

|

|

|

|

|

|

this deal?” |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Range of Answers

Wait to see what direction the Candidate takes the conclusion. If you have time, feel free to discuss

•Pursue the salon openings and meet the investor’s demands

-To achieve the required return, an aggressive number of salons must be opened in the first 3 years

-Similar to the sample math, at least 12 salons must have been opened and be at their 5 year profit steady state to meet the investor’s goals

-If the profit and loss for one salon is different from the sample answer, adjust the salon count accordingly

-Good business judgment would question if this is the only route to success

•Suggest selling products for a few years before opening new salons

-Since opening salons is so capital intensive and slow to provide a strong return, we should compare it to other alternatives

-To meet the 6 year target with this approach, MM would have to capture about 3-4% of the prestige women’s market. Is this reasonable?

Yes, when you consider that there are few national brands that are well marketed

Yes, when you consider they have 6 years to achieve it

No, when you consider the limits of their present line (mainly hair care products)

•Suggest selling products in year one and then opening salons (hybrid)

-This is probably the best option as it gives you something to focus on in year one that is already proven (product sales); you can eventually add salons, which are more complicated

-A good discussion point here is that new entrepreneurs have a steep learning curve.

Purchase additional cases and the book Crack the Case: How to Conquer Your Case Interviews at www.consultingcase.com. |

010 - MoMo Mui 10 |

|

Copyright © 2004 Turtle Hare Media |

||

|

MoMo Mui |

I |

Handout Guide

Pack: 010 page 11 of 39

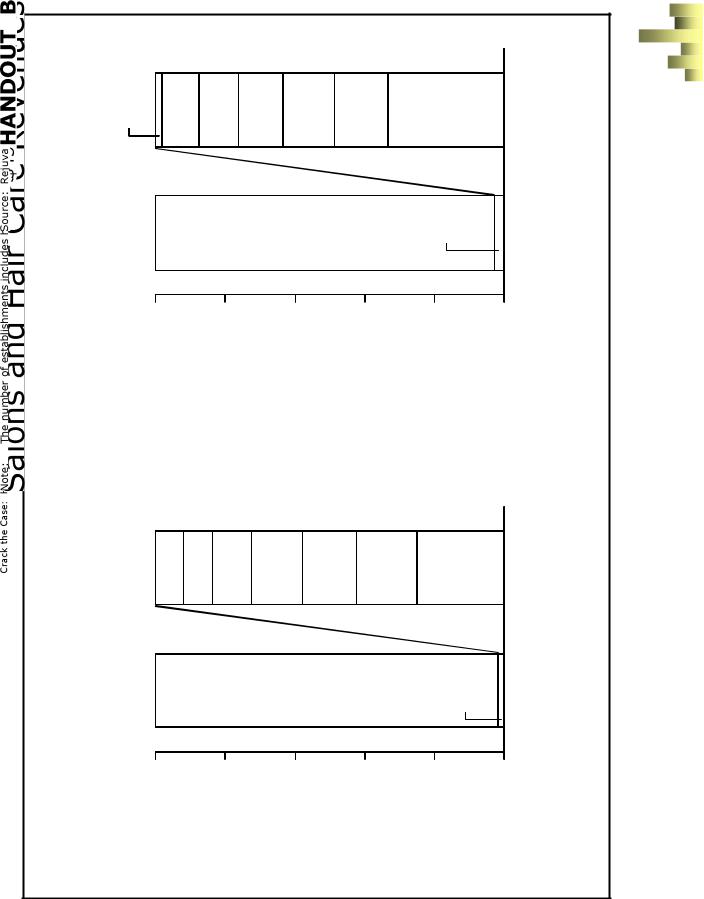

Women’s Prestige Hair Care Market

Share of US Market

|

100% |

$45B |

|

|

|

|

80 |

Women's |

|

|

|

A |

60 |

|

|

40 |

|

|

|

Men's |

|

20 |

|

|

0 |

Total Hair |

|

|

|

|

|

Care Market* |

$15.3B |

$.8B |

Prestige |

|

Mass |

Prestige |

|

Market |

Budget |

|

Women's |

Prestige |

Market |

Women's |

|

Market |

Salons and Hair Care Revenues

Share of total US hair |

|

|

cutting establishments |

|

|

100% |

350,000 |

6,317 |

|

Kidsnips |

|

|

|

|

|

|

Cuttery |

80 |

compan y |

|

Other |

|

owned |

B |

60 |

|

Wal-mart |

|

|

||

|

|

Rejuva |

|

|

40 |

|

Cost |

|

|

|

|

|

|

|

cutters |

|

20 |

|

|

|

|

Rejuva |

Supercuts |

|

|

|

|

|

0 |

Total # |

Rejuva Corp |

|

|

||

|

|

of shops |

# of shops |

C |

|

Potential Salon Location Map |

|

|

|

Chicago |

|

|

|

|

Detroit |

San |

|

|

Boston |

Francisco |

|

|

|

|

|

|

New Yo rk and |

|

|

|

Tri-state area |

|

|

|

Philadelphia |

Las Vegas |

|

|

|

|

|

|

Washington D.C. |

Los Angeles |

|

|

|

San Diego

Denver |

Atla nta |

|

Naples |

Dallas |

West Palm Beach |

Houston

Miami

D |

Candidate: |

Do you have data on the industry? |

|

||||

Interviewer: |

Here’s some market information for |

|||||

|

the last year. |

|

|

|

|

|

Interviewer: |

How would you go about sizing |

|

||||

Good Approach: |

their market? |

|

|

|

|

|

Since we are going after a very |

|

|||||

|

specific market I would first want to |

|||||

|

define it (who’s in “prestige”). Then I |

|||||

|

would want to know how big that |

|

||||

|

market is in the US. |

|

|

|

|

|

Candidate got the insight?: |

|

Yes |

|

|

No |

|

Candidate: |

What do you know about competitors? |

|||||

Interviewer: |

Here’s some information on the number |

|||||

|

of competitors in this industry. |

|

||||

Interviewer: |

What does this information tell you? |

|||||

Key Insight: |

No one competitor dominates this |

|

||||

|

market. It is very fragmented. We see |

|||||

|

some evidence of a chain doing well, |

|||||

|

but there won’t be any strong |

|

||||

|

competitors to edge us out. |

|

||||

Candidate got the insight?: |

|

Yes |

|

|

No |

|

|

|

|

||||

Candidate: Does the company know where it wants to locate salons?

Interviewer: Here’s a preliminary location map that the team put together.

You Might Ask: How do you think they came to highlight these areas?

Main Insight: Per capita income threshold (team used $125k), concentration of competitor salons (not an issue)

Candidate got the insight?: |

|

Yes |

|

No |

Candidate: |

Do you have any salon revenue data? |

|||||

|

Here are some average stats on a |

|

||||

|

typical salon. |

|

|

|

|

|

Interviewer: |

Go ahead and calculate how much |

|||||

|

revenue a salon would make in five |

|||||

|

years. Can you estimate costs? |

|

||||

Main Insight: |

No main insight. The candidate |

|

||||

|

needs these numbers to do the math. |

|||||

Candidate got the insight?: |

|

Yes |

|

|

No |

|

|

|

|

||||

Purchase additional cases and the book Crack the Case: How to Conquer Your Case Interviews at www.consultingcase.com. |

010 - MoMo Mui 11 |

|

Copyright © 2004 Turtle Hare Media |

||

|

MoMo Mui |

I |

Handout Guide

Pack: 010 page 12 of 39

Share of US Market |

Product Market |

|

|

Skin Care |

|

|

|

100% |

$3,723M |

$3,723M |

$213M |

|

Hair Care |

Prestige |

|

|

|

|

|

||

|

|

|

|

|

|

|

Fragrances |

|

|

|

80 |

|

|

|

E |

|

Personal |

|

|

60 |

Hygiene |

|

|

|

|

Mass |

|

||

|

40 |

|

|

|

|

|

Shave |

|

|

|

20 |

|

|

|

|

0 |

|

Budget |

|

|

Men's Grooming |

By Segment |

Prestige |

|

|

|

|||

|

|

Product Market |

|

Product Market |

F |

|

Product Margin |

|

|

|

|

|

||

=MM sells to retailer or salon

=Retailer sells to end customer

=MM sells directly to end customer

Manufacturer

MoMo Mui North America

|

GM |

50% |

NA |

>60% |

NA |

|

|

Specialty |

|

Franchised |

Company |

Direct |

||

|

Retailers |

|

|

salons |

|||

|

|

|

|

|

|

||

|

|

|

|

Consumers |

|

|

|

G |

Estimated Salon Income Statement |

||||||

REVENUE |

Year 1 |

|

2 |

3 |

4 |

5 |

|

Chairs |

|

1 |

2 |

3 |

4 |

4 |

|

Hourly |

|

70 |

90 |

90 |

90 |

90 |

|

|

Hors Per Day |

|

3 |

4 |

5 |

6 |

7 |

|

Days per Year |

|

300 |

300 |

300 |

300 |

300 |

|

Cutting Total |

|

$60k |

200k |

400k |

650k |

750k |

|

Products @ 25% |

|

$15k |

54k |

100k |

160k |

200k |

|

Total Revenue |

|

$75k |

$250k |

$500k |

$800k |

$950k |

|

COSTS |

|

|

|

|

|

|

|

Start-up |

|

250k |

|

|

|

|

|

Lease Rate |

|

6 |

6 |

6 |

6 |

6 |

|

Square Footage |

|

1500 |

1500 |

1500 |

1500 |

1500 |

|

Monthly Lease |

|

9k |

9k |

9k |

9k |

9k |

|

Annual Lease |

|

100k |

100k |

100k |

100k |

100k |

|

Stylist Salary |

|

50k |

50k |

50k |

50k |

50k |

|

(your guess) |

|

|

|

|

|

|

|

Total Direct Costs |

|

50k |

100k |

150k |

200k |

200k |

|

(ba(Stylisti salaries |

|

|

|

|

|

|

|

Total Indirect Cost |

|

30k |

100k |

200k |

300k |

400k |

|

(@40% of revnues) |

|

|

|

|

|

|

|

Total Costs |

|

430k |

300k |

450k |

600k |

700k |

Total Profit |

-355k |

50k |

50k |

200k |

250k |

H |

Salon Roll-out Potential Answer – |

Do Not Give to Candidate |

|

Take the results of this single salon income statement and |

|

|

determine how many salons you would have to open to meet |

|

our investor’s demands of $3M in year 6. From Handout G |

|

you know that the salons start making solid profit in years 4 |

|

and 5. The following combination of openings would meet |

|

our investor’s demands and not overload the team in the first |

|

year. |

Year |

Approach |

YR 1 |

YR 2 |

YR3 |

YR4 |

YR 5 |

YR 6 |

1 |

Open 2 Shops |

|

|

|

0.4 |

0.5 |

0.5 |

2 |

Open 5 |

|

|

|

|

1 |

1.25 |

3 |

Open 6 |

|

|

|

|

|

1.2 |

|

Total |

|

|

|

$.4M |

$1.5M |

$2.95M |

Candidate: Do you have data on the products or the market for products?

Interviewer: Here’s some information about the women’s prestige product market.

What portion of the prestige market do you think MM can capture?

Good Approach: 10% seems large, considering that the category includes products MM may not carry. 5% would imply $10M annually for revenue. MM’s bottom line take will vary by channel.

Candidate got the insight?: |

|

Yes |

|

No |

Candidate: |

Do you have any product margin data? |

||||||

|

Here are some margin estimates by |

||||||

|

retail channel. |

|

|

|

|

||

Interviewer: |

What portion of MM’s product sales |

||||||

|

do you think will come through |

|

|||||

|

each channel? What would that |

|

|||||

Good Approach: |

imply for total profit? |

|

|

|

|

||

Margins are highest in direct sales, the |

|||||||

|

area that MM will least emphasize. |

|

|||||

|

Margins vary little by channel. |

|

|||||

Candidate got the insight?: |

|

|

Yes |

|

|

No |

|

Candidate: How much profit does a typical salon generate in a year?”

You Might Ask: At what rate do we have to open salons to reach our investor’s target of $3M of profit per year?

Main Insight: Need to open at least 13 salons over 3 years in order to meet the investor’s target with salon-only strategy.

Candidate got the insight?: |

|

Yes |

|

No |

Main Insight: This table shows one approach to rolling out salons. You can see that to reach the $3M goal, several salons must be opened in years 2 and 3. Opening too many in year 1 may stress the small organization too heavily.

Purchase additional cases and the book Crack the Case: How to Conquer Your Case Interviews at www.consultingcase.com. |

010 - MoMo Mui 12 |

|

Copyright © 2004 Turtle Hare Media |

||

|