Налогообложение и бюджетно-налоговая политика Учебное пособие

..pdf

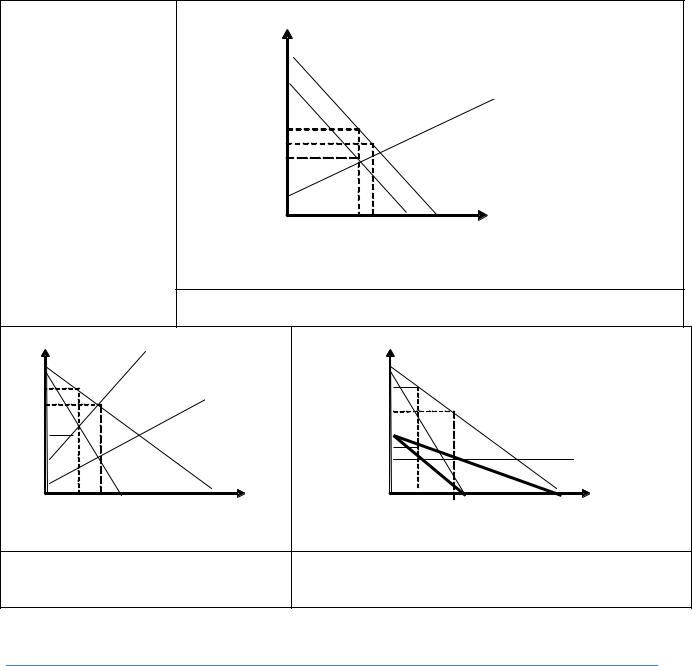

Specific tax on the byuer (рис.2.4.):

pS b kQ; pD c lQ; pDt c lQ t

where t – tax rate in money unit

P

S

P

D

Pe

D

Q

Qt Qe Dt

Dt

Рис. 2.4. Tax burden shifting in perfect competition: specific tax on the byuer

Р |

MCt |

|

Р |

MCt |

|

|

|

|

|

||

PDt |

|

|

PDt |

|

|

Pe |

MC |

|

Pe |

MC |

|

P |

|

|

|

|

|

mt |

|

|

|

|

|

|

|

|

Рmt |

|

|

|

D |

Q |

|

D |

Q |

|

|

|

|

||

Qt Qe MR |

MC |

|

Qt Qe MR |

MC |

|

Рис. 2.5. Tax burden shifting on Рис. 2.6. Tax burden shifting on monopolzed market: monopolzed market: value added tax on value added tax on the buyer; МС – constant, D – linear the seller; МС – increasing

Questions and Problems on Topic # 2

1.(ПК – 2, З1) Give definitions of “tax”, “levy”, and “duty”.

Tax is_______________________________________________________________

____________________________________________________________________

____________________________________________________________________

Levy is______________________________________________________________

____________________________________________________________________

____________________________________________________________________

Duty is______________________________________________________________

____________________________________________________________________

2. (ПК – 7, У1) Give a characteristic of VAT and Tax on Income of Physical Persons (TIPP), in accordance with Russian Tax Code

21

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Criteria |

VAT |

TIPP |

|

|

|

|

1.Tax objects |

|

|

|

|

|

|

2.Purpose of taxation |

|

|

|

|

|

|

3.Tax rate |

|

|

|

|

|

|

4.Dependence on business |

|

|

|

|

|

|

cycle |

|

|

|

|

|

|

5.Tier of authority which set |

|

|

|

|

|

|

tax |

|

|

|

|

|

|

6.Dynamics of the unit weight |

|

|

|

|

|

|

of tax in income of tax |

|

|

|

|

|

|

payment |

|

|

|

|

3.(ПК – 7, У1, В1) Assume that the demand curve is given by p=10 – q and the supply curve is given by p=4. A unit tax equal to 2 is imposed on the producers. Show in a figure and derive the produced quantities with and without the tax. Show the welfare loss and explain why it

arises. How large are the tax incomes for the government?

Consider the introduction of a $20 per unit tax in this market1. Use the diagram below to answer the following THREE questions.

4.(ПК – 7, У1, В1)

A)Which areas represent the loss to consumer AND producer surplus as a result of this tax? a) k + f.

b) j + g. c) k + j.

d) k + f + j + g.

B)Which areas represent the gain in government revenue as a result of this tax?

a)k + f.

b)j + g.

c)k + j.

d)k + f + j + g.

C. Which areas represent the deadweight loss associated with this tax?

a)f + g.

b)k – g.

1 https://pressbooks.bccampus.ca/uvicecon103/chapter/4-6-taxes/

22

c)j – f.

d)k + f + j + g.

5.(ПК – 7, У1, В1) Assume that the marginal cost of producing socks is constant for all sock producers, and is equal to $5 per pair. If government introduces a constant per-unit tax on socks, then which of the following statements is FALSE, given the after-tax equilibrium in the sock market? (Assume a downward-sloping demand curve for socks.)

a) Consumers are worse off as a result of the tax.

b) Spending on socks may either increase or decrease as a result of the tax. c) Producers are worse off as a result of the tax.

d) This tax will result in a deadweight loss.

6.(ПК – 7, У1, В1) Refer to the supply and demand diagram below.

If an subsidy of $3 per unit is introduced in this market, the price that consumers pay will equal ____

and the price that producers receive net of the subsidy will equal _____.

a)$2; $5.

b)$3; $6.

c)$4; $7.

d)$5; $8.

7. (ПК – 2, У1, В1) If a subsidy is introduced in a market, then which of the following statement is TRUE? Assume no externalities

a)Consumer and producer surplus increase but social surplus decreases.

b)Consumer and producer surplus decrease but social surplus increases.

c)Consumer surplus, producer surplus, and social surplus all increase.

d)Consumer surplus, producer surplus, and social surplus all decrease Use the diagram below to answer the following TWO questions.

A. If a $6 per unit tax is introduced in this market, then the price that consumers pay will equal ____

and the price that producers receive net of the tax will equal _____.

a)$10; $4.

b)$9; $3.

23

c)$8; $2.

d)$7; $1.

B. If a $6 per unit tax is introduced in this market, then the new equilibrium quantity will be:

a)20 units.

b)40 units.

c)60 units.

d)None of the above.

8.(ПК – 2, У1, В1) Which of the following statements about the deadweight loss of taxation is TRUE? (Assume no externalities.)

a) If there is a deadweight loss, then the revenue raised by the tax is greater than the losses to consumer and producers.

b) If there is no deadweight loss, then revenue raised by the government is exactly equal to the losses to consumers and producers.

c) Both a) and b). d) Neither a) nor b).

9.(ПК – 2, У1, В1) Which of the following correctly describes the equilibrium effects of a perunit tax, in a market with NO externalities?

a) Consumer and producer surplus increase but social surplus decreases. b) Consumer and producer surplus decrease but social surplus increases. c) Consumer surplus, producer surplus, and social surplus all increase. d) Consumer surplus, producer surplus, and social surplus all decrease.

10.(ПК – 2, У1, В1) Which of the following correctly describes the equilibrium effects of a per unit subsidy?

a) Consumer price rises, producer price falls, and quantity increases. b) Consumer price falls, producer price falls, and quantity increases. c) Consumer price rises, producer price rises, and quantity increases. d) Consumer price falls, producer price rises, and quantity increases.

11.(ПК – 7, У1, В1) Refer to the supply and demand diagram below.

If an output (excise) tax of $5 per unit is introduced in this market, the price that consumers pay will equal ____ and the price that producers receive net of the tax will equal _____.

a)$5; $10.

b)$6; $11.

c)$7; $12.

d)$8; $3.

12. (ПК – 7, У1, В1) Consider the supply and demand diagram below.

24

If a $2 per unit subsidy is introduced, what will be the equilibrium quantity?

a)40 units.

b)45 units.

c)50 units.

d)55 units.

13. (ПК – 7, У1, В1) Consider the supply and demand diagram below. Assume that: (i) there are no externalities; and (ii) in the absence of government regulation the market supply curve is the one labeled S1.

If a $5 per unit tax is introduced in this market, which area represents the deadweight loss?

a)a.

b)a + b.

c)b + c.

d)a + b + c.

25

TOPIC 3. THE ANALYSIS OF EXPENDITURE POLICY

Questions for the lectures and the seminars:

Budget of a Federal state: main expenditures of the state. Forms of public spending: Public purchases and transfers. The problem of balancing the state budget. Public debt: types, structure, funding sources. Fiscal Federalism. The division of responsibilities. Principles of fiscal federalism.

Budget is a form of generation and withdrawal of monetary funds intended for financial support of the federal government and local authorities.

Main expenses of any country can be divided into five groups:

1)costs of public administration (defense, law enforcement, etc.);

2)social expenditures (healthcare, education, culture, social security);

3)financing of economy (transport, information infrastructure, science, agriculture);

4)inter-budgetary equalization, i.e. redistribution of budget resources to smoothing territorial differences;

5)debt service.

The ratio between these groups is determined by many factors: the level of socio-economic development of the country, its relations with other countries, historical traditions and a commitment to a particular model of economic regulation.

The share of public expenditure in GDP in the leading industrial countries is shown in table

3.1..

Table 3.1. The share of public expenditure in GDP in the leading industrial countries 1950-2015., %

|

|

|

|

|

|

Social expenses |

|

|

||

Country |

Year |

Total |

government |

defence |

law |

|

|

|

|

others |

enforcement |

total |

education |

Public |

pensions, |

||||||

|

|

|

|

|

health |

grants |

|

|||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

1880 |

8,0 |

|

|

|

|

|

|

|

|

|

1913 |

8,0 |

|

|

|

|

|

|

|

|

USA |

1938 |

19,8 |

|

|

|

|

|

|

|

|

|

1950 |

24,9 |

0,8 |

13,1 |

0,5 |

7,0 |

3,2 |

0,5 |

3,2 |

3,5 |

|

1980 |

33,5 |

1,5 |

8,5 |

1,3 |

18,2 |

6,6 |

1,5 |

10,1 |

4,0 |

|

|

|

|

|

|

|

|

|

|

|

26

|

1990 |

35,0 |

1,6 |

6,9 |

1,5 |

19,0 |

6,9 |

1,6 |

10,5 |

6,0 |

|

|

2000 |

35,7 |

1,7 |

4,7 |

1,6 |

20,8 |

7,2 |

1,9 |

10,7 |

6,9 |

|

|

2015* |

36,5 |

1,0 |

2,6 |

1,4 |

24,6 |

7,7 |

2,3 |

14,6 |

6,9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1880 |

10,0 |

|

|

|

|

|

|

|

|

|

|

1913 |

17,7 |

|

|

|

|

|

|

|

|

|

|

1938 |

42,4 |

|

|

|

|

|

|

|

|

|

Germany |

1950 |

28,4 |

1,9 |

4,3 |

1,4 |

18,4 |

2,7 |

3,5 |

12,2 |

2,4 |

|

1980 |

42,4 |

3,2 |

4,4 |

2,4 |

25,6 |

4,8 |

6,8 |

14,0 |

6,8 |

||

|

|||||||||||

|

1990 |

42,9 |

3,2 |

4,2 |

2,6 |

26,5 |

5,1 |

7,1 |

14,1 |

6,7 |

|

|

2000 |

42,9 |

3,5 |

4,0 |

2,7 |

27,1 |

5,4 |

7,2 |

14,5 |

5,6 |

|

|

2015* |

42,8 |

2,6 |

2,5 |

2,5 |

27,7 |

5,7 |

7,5 |

14,5 |

7,5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1880 |

15,0 |

|

|

|

|

|

|

|

|

|

|

1913 |

8.9 |

|

|

|

|

|

|

|

|

|

|

1938 |

23,2 |

|

|

|

|

|

|

|

|

|

France |

1950 |

31,4 |

2,0 |

7,8 |

0,8 |

19,6 |

4,7 |

2,4 |

12,5 |

1,2 |

|

1980 |

45,3 |

2,8 |

5,0 |

1,7 |

32,6 |

8,3 |

4,4 |

19,9 |

3,3 |

||

|

|||||||||||

|

1990 |

47,2 |

3,5 |

5,7 |

1,3 |

33,5 |

8,7 |

4,8 |

20,0 |

3,3 |

|

|

2000 |

47,5 |

3,3 |

4,7 |

1,4 |

34,3 |

8,7 |

5,1 |

20,5 |

3,8 |

|

|

2015* |

45,5 |

2,5 |

3,0 |

1,3 |

34,8 |

8,8 |

5,6 |

20,5 |

3,8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1880 |

10,0 |

|

|

|

|

|

|

|

|

|

|

1913 |

13,3 |

|

|

|

|

|

|

|

|

|

|

1938 |

28,8 |

|

|

|

|

|

|

|

|

|

UK |

1950 |

32,1 |

1,5 |

4,6 |

1,5 |

17,9 |

5,1 |

5,1 |

7,7 |

6,4 |

|

1980 |

40,6 |

1,9 |

6,9 |

2,5 |

22,5 |

6,9 |

6,9 |

8,8 |

6,9 |

||

|

|||||||||||

|

1990 |

42,9 |

1,9 |

6,7 |

2,4 |

25,6 |

6,9 |

6,9 |

11,9 |

6,3 |

|

|

2000 |

43,1 |

2,0 |

5,7 |

2,4 |

26,8 |

7,0 |

7,3 |

12,5 |

6,1 |

|

|

2015* |

43,4 |

1,7 |

3,5 |

2,3 |

29,8 |

7,2 |

8,1 |

14,5 |

6,1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1950 |

22,5 |

1,5 |

3,0 |

1,5 |

14,5 |

3,5 |

3,0 |

8,0 |

2,0 |

|

|

1980 |

38,1 |

2,8 |

3,2 |

2,8 |

24,7 |

6,3 |

5,1 |

13,3 |

4,5 |

|

Italy |

1990 |

47,9 |

3,7 |

3,7 |

3,2 |

31,8 |

7,4 |

6,5 |

18,0 |

5,5 |

|

|

2000 |

49,0 |

3,6 |

3,2 |

3,2 |

34,3 |

7,2 |

6,5 |

20,6 |

4,8 |

|

|

2015* |

45,5 |

2,8 |

2,0 |

2,8 |

33,1 |

6,7 |

6,5 |

19,8 |

4,8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Japan |

1880 |

11,0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

27

|

1913 |

14,2 |

|

|

|

|

|

|

|

|

|

1938 |

30,3 |

|

|

|

|

|

|

|

|

|

1950 |

13,2 |

1,6 |

1,1 |

1,6 |

6,8 |

3,2 |

0,5 |

3,2 |

2,1 |

|

1980 |

25,0 |

1,9 |

1,0 |

1,9 |

16,2 |

5,4 |

0,6 |

10,3 |

3,9 |

|

1990 |

26,9 |

2,1 |

1,0 |

2,1 |

18,4 |

5,6 |

0,7 |

12,0 |

3,4 |

|

2000 |

27,2 |

2,0 |

1,0 |

2,0 |

18,8 |

5,6 |

0,8 |

12,4 |

3,3 |

|

2015* |

29,7 |

1,4 |

0,9 |

2,0 |

21,8 |

5,7 |

1,2 |

14,9 |

3,7 |

|

|

|

|

|

|

|

|

|

|

|

|

1950 |

54,4 |

3,4 |

13,6 |

2,7 |

25,9 |

12,9 |

4,8 |

8,2 |

8,8 |

USSA/ |

1980 |

47,7 |

2,2 |

19,8 |

1,7 |

17,2 |

8,6 |

3,3 |

5,3 |

6,8 |

Russia |

1990 |

52,2 |

2,3 |

21,7 |

2,0 |

18,8 |

9,9 |

2,9 |

6,1 |

7,2 |

|

2000 |

42,4 |

2,8 |

9,2 |

2,3 |

20,3 |

10,6 |

3,2 |

6,5 |

7,8 |

|

2015* |

43,3 |

3,1 |

7,8 |

2,7 |

22,4 |

11,8 |

4,0 |

6,7 |

7,3 |

|

|

|

|

|

|

|

|

|

|

|

*2015 forecast |

|

|

|

|

|

|

|

|

||

Source: World Development Report 1991/ Washington. 1991. P. 139; OECD. Economic Outlook. 1998. Jun http://www.oecd.org/eco/public-finance/ and http://vasilievaa.narod.ru/ptpu/1_3_02.htm

According to the table, the share of public expenditure in most developed countries is

increasing steadily.

Increase of public spending in social sphere has the following reasons:

Increasing role of human capital in a modern economy.

Total population growth, caused by the increase of the life level and increase in life

expectancy.

Smoothing of income inequality of different social groups.

Fiscal federalism

Fiscal federalism is the division of revenue collection and expenditure responsibilities between different levels of government. Most countries have a central (or federal) government, state, county or regional governments, town councils and, at the lowest level, parish councils. Each level has restrictions on the tax instruments it can employ and the expenditures that it can make. Together they constitute the multi-levelled and overlapping administration that governs a typical developed country.

The central government can usually choose whatever tax instruments it pleases and, although it has freedom in its expenditure, it usually focuses upon national defence, law enforcement,

28

infrastructure and transfer payments. The taxation powers of state governments are more restricted. In the UK they can levy only property taxes; in the US both commodity and local income taxes are allowed. Their responsibilities include education, local infrastructure and the provision of health care. Local governments provide services such as rubbish collection and parks. The responsibility for the police and fire service can be at either the state or local level. These levels of government are connected by overlapping responsibilities and transfers payments between levels.

The issue of fiscal federalism is not restricted to the design of government within countries. Indeed, the recent impetus for the advancement of this theory has been issues involving the design of institutional structures for the European Union. The progress made towards economic and monetary integration has begun to raise questions about subsidiarity, which is the degree of independence that individual countries will maintain in the setting of taxes. Such arguments just involve the application of fiscal federalism. Vertical distribution of split taxes between levels of budget system in Germany is shown in table 3.2.

Table 3.2.

Vertical distribution of split taxes between levels of budget system in Germany

Type of tax |

Share, % |

|

|

|

Federal |

lands |

municipalities |

|

|

|

|

Income tax |

42,5 |

42,5 |

15,0 |

|

|

|

|

Profit tax |

50,0 |

50,0 |

0 |

|

|

|

|

VAT |

56,0 |

44,0 |

0 |

|

|

|

|

Questions and Problems on Topic # 3

1. (ПК – 7, У1, В1) In the following table you can find a set of tasks that are usually carried out by different levels of the state. Could you indicate which tasks belongs to which state function?

Tasks |

allocation |

distribution |

stabilization |

|

|

|

|

to provide social transfers from rich to poor |

|

|

|

|

|

|

|

to provide social security |

|

|

|

|

|

|

|

to handle unemployment |

|

|

|

|

|

|

|

to provide national defense |

|

|

|

|

|

|

|

to build highways |

|

|

|

|

|

|

|

to control inflation |

|

|

|

|

|

|

|

to run the public health system |

|

|

|

|

|

|

|

to guarantee legal certainty |

|

|

|

|

|

|

|

to create an efficient local government system |

|

|

|

|

|

|

|

to provide public lighting |

|

|

|

|

|

|

|

29

to carry out regional policy, to transfer

resources to the less developed regions from

the richer ones

to manage the national debt

2.(ПК – 2, З1, У1) Explain the notion “Expenditure Assignments in Intergovernmental Fiscal Relations”

3.(ПК – 2, З1, У1) Explain the notion “The Primacy of Expenditure Assignment in Intergovernmental Fiscal Relations Design”

4.(ПК – 2, З1, У1) List the conditions required for efficient decentralization

5.(ПК – 2, З1, У1) What does mean “Fiscal Federalism”?

6.(ПК – 2, У1) Are the following statements true (T) or false (F)?

a)A unitary state generally is more centralized than a federal one.

b)In a unitary state one government makes all fiscal decisions.

c)Federalism is a compromise between a unitary state and complete decentralization.

d)Only in federalism can different governments exist independently of one another.

e)The goal of decentralization of government decision making is to increase technical efficiency.

30