- •Unit 7 Prices and their formation

- •Price and its formation

- •Grammar

- •V ed or Past Simple (II column)

- •Continuous

- •When prices draw us.

- •Outstanding Economists

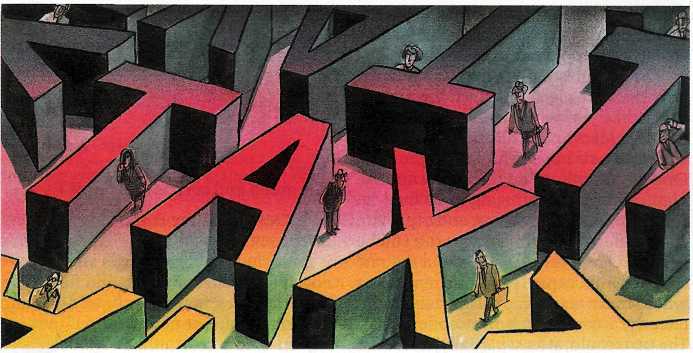

- •Unit 8 Taxes and Taxation

- •Vocabulary notes

- •Read the definitions of the following economic concepts, try to remember them and be ready to use.

- •Taxes and taxation

- •Grammar

- •Simple Perfect

- •Perfect Continuous

- •Sources of government revenue

- •Public spending

- •Unit 9 Business organization

- •Read the definitions of the following economic concepts, try to remember them and be ready to use.

- •Text I forms of business ownership in the u.S.A.

- •Advantages and Disadvantages of the Three Forms of Business Ownership

- •The Formal Organization.

- •Board of Directors

- •Info. Systs

- •Text III Up and Down of People Express

- •Burr’s Business

- •Unit 10 Business organization. Small and Middle Business Enterprises.

- •Vocabulary notes

- •Forms of business small business

- •How to make business plan.

- •2. If the verb in the principle clause is in one of the past tenses, a past tense (or future in the past) must be used in the subordinate clause.

- •Sequence of Tenses is not Applied:

- •Unit 11 Franchising.

- •Read the definitions of the following economic concepts, try to remember them and be ready to use.

- •Franchising

- •Evaluate your franchise opportunities

- •Let’s Ponder: case study

- •In what ways does an investment in a Duds 'n Suds franchise seem risky? In what ways does it seem worthwhile?

- •What are the pros and cons of starting your own laundromat versus buying a Duds 'n Suds franchise?

- •If you were to invest in a Duds 'n Suds franchise in your area, what unique products or services would you offer to attract business? text II

- •Franchise

- •Deplete

- •6. Depend

- •7. Fraud

- •Outstanding Economists.

- •Vernon l. Smith

- •Unit 12

- •International Trade

- •International trade

- •Your Opinion.

- •Text II

- •How to avoid business blunders abroad

- •Some useful language for interviewer and interviewee

- •Keys to unit 7

- •Keys to unit 8

- •Keys to unit 9

- •Keys to unit 10

- •Keys to unit 11

- •Keys to unit 12

- •Список литературы

- •Content

Grammar

Past Tenses

Simple Perfect

had + Participle II

Action referring to an earlier past

He got the loan but unfortunately the court had declared him a bankrupt.

They started discussing their budget as soon as the Chief Execute had arrived.

He was excited because he had never taken part in such representative meetings

Action referring to unfulfilled hopes and wishes with verbs expect, hope, mean, suppose, think, and want.

I had hoped to return the loan in time, but I didn’t manage to do it.

Perfect Continuous

Had been + Participle I (Ving)

Action in progress through out a period

They looked very tired because they had been making a very important order days and nights.

Read the text about the attempts of German politicians to change tax system in the country

Will Germany start tax reform?

Paul Kirchhof, a lawyer at Heidelberg University tried to persuade Germany that the country's tax system needs radical reform. He suggested the country would do away with most tax exemptions and cut the top marginal income-tax rate to 25%.

Angela Merkel said that she did not expect tax reform this year.

That Germany badly needs tax reform has been recognised for years. What is new is the attention being paid to simplicity, which is popular with voters. Hardly a day passes without a politician demanding that tax returns be made no larger than a "beer mat", or quoting the claim that Germany produces over two-thirds of the world's academic tax literature.

Germany is hardly the only country to suffer from fiscal complexity. But marginal and average tax rates are high, especially for companies. That matters, as it makes the country a less attractive place in which to invest. Other countries have responded to a similar lack of competitiveness by lowering marginal tax rates and scrapping tax breaks, broadening the tax base and simplifying the system. But Germany has managed only incremental reforms. These have left a patchwork that, says the German council of economic experts, "is fast losing any semblance of being a structured, rational system".

One often cited explanation for this is Germany's federal system, which gives the opposition a de facto veto over tax changes. Less well known is the role of the country's Constitutional Court, says Steffen Ganghof, a researcher at the Max Planck Institute for the Study of Societies in Cologne, in a forthcoming book. The court often has the last say in tax policy. It is widely assumed that it would strike down any law openly breaking with one tradition of German taxation: those corporate- and income-tax rates must be about the same. Combined with the Gewerbesteuer, a court-protected local trade tax, this has meant that politicians are limited in their ability to respond to tax competition without losing revenue.

The CDU*, adds Mr. Ganghof, has often proposed bolder tax reforms than other right-wing parties. One recent plan drawn up by Friedrich Merz, a CDU parliamentary leader, would have put Germany ahead of other countries in simplicity. It suggests three tax rates: 12%, 24% and 36%, for incomes above €8,000, €16,000 and €40,000 respectively. Such radicalism does not make for easy compromises. Despite scrapping many tax breaks, Mr. Merz's plan would cut revenues by €24 billion in the first year - which the government cannot afford. Anyway, the governing Social Democrats (SPD) dislike low tax rates, because they want progressive taxes to balance high social-security contributions, which tax lower incomes proportionately more than higher ones.

More surprisingly, the Christian Social Union, or CSU, the CDU’s sister party in Bavaria, has qualms of its own. It recognises that the CDU's tax ideas do not square with its health-care plans, which would make social-security contributions more regressive. The CSU has come up with a rather less ambitious proposal, which gets rid of some tax breaks and lowers the top rate only from 45% to 39%. So what way will the government choose?

One option would be to copy Scandinavian countries by bringing in a "dual income tax" that treats labour and capital income differently. While wages can still be taxed progressively, this allows a flat rate for dividends, capital gains and rents. That would mean taxing capital and labour differently, according to how mobile each is. The CDU could, at least partially, test its flat tax; the SPD and CSU would keep their progressive income tax. But this would not be legal, says Mr. Kirchhof, who once sat on the Constitutional Court.

“The Economist”

*CDU – Christian Democratic Union.

COMPREHENSION CHECK.

Exercise 1. Match the definitions with the words from the text.

1. competitiveness |

a. increasing |

2. incremental |

b. to make smth. die or become so bad that it can exist no longer |

3. semblance |

c. refusal from cutting the tax rate |

4. strike down |

d. a thick piece of card that you use for putting your drink on esp. in a bar |

5. right-wing parties |

e. reduction of the tax rate |

6. exemption |

f. if one idea, opinion, explanation is in conformity with another, they both seem good or reasonable |

7. beer mat |

g. difficult nature of smth. which may be hard to understanding, to do, to deal with |

8. oft-sited |

h. the most conservative parties

|

9. tax break |

i. thoughts that what you are doing might be bad or wrong |

10.marginal tax rate |

j. the ability to compete in markets for goods and services |

11.patch work |

k. the situation in which smth. only appears in a small amount |

12.complexity |

l. permission to ignore smth. such as a rule, obligation, payment |

13.academic tax literature |

m. mostly referred to |

14.tax return |

n. smth. in great disorder, chaos |

15.scrapping tax breaks |

o. manuals and books devoted tax problems |

16.to square with |

p. additional tax paid on each unit in the revenue increased |

17.qualms |

q. a report by a tax payer to the tax authorities of his or her income |

Exercise 2. Read the text again and complete the following sentences:

Germany badly needs tax reform because …

Marginal and average tax rates are very high for …

Other countries attract foreign investments by …

Now German system of taxation is far from …

The complexity of German tax system is explained …

The main opponent of breaking a tradition of German taxation is …

The main traditional law in tax system says that …

Friedrich Mezz suggests 12%, 24% and 36%tax rates for …

That tax system if introduced …

People with less incomes pay tax …

Duel income tax …

Exercise 3. Insert the proper word

CRACKDOWN ON “ALCOHOL DISORDER ZONES”

P

will

be imposed, troublemakers,

to

impose charges, the

revenue,

target,

will

stay

away, to

cut alcohol-related

crime,

to

reduce, the

opposite effect,

to

pay a

levy, licensed

premises

be given powers 1… on pubs, nightclubs

and other 2 … in binge drinking trouble

spots, writes Andrew Porter.

Charles Clarke, the home secretary, believes

the new policy could help 3 … and disorder by10%.

He is proposing that areas blighted by disorder caused by drinking can be identified as "alcohol disorder zones" (ADZs), where licensed premises would have 4 … if they did not clean up their act.

The Home Office estimates that up to 30 police forces are ready to declare ADZs. Under the plans the police will keep 5 … that is raised.

Licensed premises in trouble spots will be given 12 weeks 6 … alcohol-related crime significantly.

If this 7 … is not met, the police will declare the area a "live" ADZ and levies - a minimum of £100 a week — 8 … .

Mark Hastings, of the British Beer and Pub Association, said yesterday: "Imposing alcohol disorder zones will have 9 … to what the government wants.

"People they want to attract to pubs and bars 10 … and the 11 … are likely to carry on coming."

LEXICAL AND GRAMMAR EXERCISES

I. Make up sentences.

And, security, taxes, are, state, benefits, spent, usually, social, particular, for.

Government, police, taxes, to, due, state medical healthcare, our, are, even, kept, army.

Holland, assets, Switzerland, in, as, 40%, about, makes, tax, up, countries, all, of, some, inheritance.

Such, individuals, incomes, tax, income, interest, all, is, from, dividends, as, rent, of, wage, kinds, paid.

Used, for, communities, local, needs, by, taxes, usually, are, their.

Duties, to, have, too, not, pay, only, customs, manufacturers, individuals, sometimes, but.

Drinks, gambling, on, education, alcoholic, morality, the, money, spirit, high, duties, received, especially, children, of, in, should, on, of, excise, spent, be, from, tobacco.

Legally, try, to, is, riches, taxes, and, ignore, many, evade, but, prosecuted, it.

OUTSTANDING ECONOMISTS.

Exercise 2. Chose the right sentence.

Finn Kydland, a professor from UC Santa Barbara, has got/got/had been getting the Nobel Prize in Economics in 2004.

He had shared/had been sharing/shared $1.3 mln prize equally with his colleague Edward Prescot from Arizona State University.

The first research of Kydland and Prescot had been published/was published/had been publishing in1977.

It had found/found/had been finding that economic decision-makers shall commit/should commit/shall have committed to a specific long-term policy.

Also they stressed/had stressed/had been stressing that it is better not make short-term changes in times of economic troubles.

The first research is found/had been found/was found very influential because of its mathematical models.

In their second part of research they had studied/studied/had been studying the driving forces behind business cycles, and had published/published/has published it in 1982.

They refuted/had refuted/have refuted that business cycles are dependant on consumer demand.

The scientists proved/have proved/had proved that large changes in supply, dramatic events and technological innovations have more far reaching effects on the economy.

Exercise 3. Chose the correct tense.

Lily 1(start) her business recently. Two days ago she 2(buy) new commodity and at that moment she 3(display) it for sale. Suddenly a fragile vase 4(slip) out of her hands and 5(fall) before she 6(have) a chance to catch it. Of course it 7(break). And it 8(be) a very valuable, old Chinese vase. Its price 9(exceed) the price of any good in the shop. What 10(do)? She picked up the pieces and remembered that a very rich client 11(order) such vase not long ago. He even 12(leave) his address. She quickly 13(pack) the pieces into the box, 14(put) customs declaration, price list and certificate of validity and 15(send) it to Mr. X. Before sending the parcel she 16(write) a message where she kindly 17(ask) to pay the check as soon as possible. Also she 18(congratulate) Mr. X with the coming holiday and added that she 19(make) him a good discount. Can you imagine her disappointment when she 20(get) the parcel back with many thanks and apologizes and her astonishment when she 21(unwrap) the paper and 22(see) a beautiful intact vase!

Exercise 4. Comment on the sources of government revenue and public spending in the U.K.