- •Fundamental Economic Principles and Economic Models. Фундаментальные принципы экономики и экономические модели.

- •Supply and Demand. Спрос и предложение.

- •Consumer and Producer Surplus. Market Reaction to Government Intervention. Излишек потребителя и производителя. Реакция рынка на вмешательство правительства.

- •Elasticity. Эластичность.

- •Theory of Consumer Behavior and Rational Choice. Теория потребительского поведения и рационального выбора.

- •Basic Economic Theory of Risk. Expected Utility Function, Risk Premium and Risk Aversion Measures. Основы экономической теории риска. Функция ожидаемой полезности. Премия риска и избегание риска.

- •Profit Maximization and Theory of Firm and Industry Supply. Максимизация прибыли и теория предложения фирмы и отрасли.

- •Production Costs in Short Run vs. Long Run. Производственные затраты в краткосрочном и долгосрочном периоде.

- •The Model of Perfect Competition. Модель совершенной конкуренции.

- •The Theory of Monopoly. Теория монополии.

- •Oligopoly and Game Theory. Олигополия и теория игр.

- •Monopolistic Competition. Монополистическая конкуренция.

- •The Economic Theory of Taxation. Экономическая теория налогообложения.

- •The Economics of Welfare State. Экономика государства всеобщего благоденствия.

- •Externalities and Transaction Costs. Экстерналии и транзакционные затраты.

- •Public Goods, Common Resources, and Artificially Scarce Goods. Общественные товары, общие ресурсы и искусственно редкие товары.

- •Information Asymmetry. Adverse Selection and Moral Hazard. Информационная асимметрия. Враждебный выбор и моральный ущерб.

- •Aggregate Demand and Aggregate Supply. Model ad-as. Совокупный спрос и совокупное предложение.

- •Consumption, Savings, and Investments. Income and Expenditure. "Keynesian Cross". Потребление, сбережение. Инвестирование. Доход-затраты. Кейнсианский крест.

- •Long Run Economic Growth. Долгосрочный экономический рост.

- •The Theories of Business Cycles. Теории экономических циклов.

- •Inflation, Disinflation, and Deflation. Инфляция, Дизинфляция и Дефляция.

- •Unemployment and Inflation. Безработица и инфляция.

- •Fiscal Policy. Фискальная политика.

- •Monetary Policy. Монетарная политика.

- •28. The Theories of International Trade. Теории международной торговли.

- •29. Open Economy Macroeconomics. (Balance of Payments, Exchange Rates, ppp). Открытая экономика (платежный баланс, обменные курсы валют, ппс)

- •30. The composition of the global financial market: instruments, participants, sources of information. Состав глобального финансового рынка: инструменты, участники, источники информации.

- •32. Types of banks and their role in the international financial market. Типы банков и их роль на международном финансовом рынке.

- •33. The global equities market: size, indicators, principles of organization. Глобальный рынок капитала: размер, индикаторы, принципы организации.

- •34. The global debt securities market: types, composition, principles of organization. Глобальный долговой рынок ценных бумаг: типы ценных бумаг, состав, принципы организации.

- •36. The government bond markets: size, composition, significance. Рынки правительственных облигаций: размер, состав, значение.

- •37. Rating agencies and their role in the global financial market. Рейтинговые агентства и их роль и значение на глобальном финансовом рынке.

- •38. Types of institutional investors and their role in the global financial markets. Типы институциональных инвесторов и их роль на мировых финансовых рынках.

- •39. The functions of the international financial organizations (imf, World Bank, bis). Функции международных финансовых организаций (мвф, Всемирный банк, Банк международных расчетов.)

- •International trade financing: International banks are the leading source of credit for multinational corporations and many governmental units. They provide both st & lt financing.

- •41. Fighting International Money Laundering and Offshore Banking Markets. Борьба с международным отмыванием денег и оффшорные банковские рынки.

- •42. Mergers and Acquisitions in Financial Services Markets. Слияния поглощения на рынках финансовых услуг.

- •43. International Financial Centers. Международные финансовые центры.

- •46. European Stability Mechanism and Fiscal Compact. Европейский стабилизационный механизм и пакт о финансовой стабильности и росте.

- •47. European Debt Crisis, us Fiscal Cliff, and Federal Budget Sequester. Европейский долговой кризис. Фискальный обрыв и секвестр федерального бюджета сша.

- •48. Wto and the problems of the Russian Federation participation in it. Вто и проблемы участия в ней рф.

- •50. Stabilization Funds. Стабилизационные фонды.

- •51. Necessity and preconditions of Appearance and Applications of Moneys. Evolution of Forms and Types of Moneys.Необходимость и предпосылки появления и применения денег. Эволюция форм и видов денег.

- •52. The Problem of Money Supply Measurements in Modern Economy. The Specifics of Russia.Проблемы измерения денежной массы в современной экономике. Особенности России.

- •53. Monetary Emission and Printing Money.Выпуск денег в хозяйственный оборот и денежная эмиссия.

- •54. Modern Basics of Cash at Bank monetary Circulation: Russian Specifics. Современные основы организации безналичного денежного оборота: особенности России.

- •55. The Development of Forms of Credit and their Role in Modern Economy. Развитие форм кредита и их роль в современной экономике России.

- •56. Economic Foundations of Forming the Level of Loan Interest and its Role in the Market Economy.Экономические основы формирования уровня ссудного процента и его роль в рыночной экономике.

- •57. The Conditions and Specifics of Modern Banking System in Russia. Состояние и особенности развитие современной банковской системы России.

- •58. The Role of Banks and Non-Banking Credit Organization in Modern Market Economy in Russia.Роль банков и небанковских кредитных организаций в современной рыночной экономике России.

- •61. Classified Financial Statements and Ratios. Corporate Financial Statements. Классифицированные финансовые отчеты и показатели. Корпоративная финансовая отчетность.

- •62. Merchandising Operations. Merchandising Income Statement. Inventories. Торговые операции. Отчет о прибыли торговой организации. Товарные запасы.

- •63. Internal Control. Внутренний контроль.

- •64. Cash and Receivables. Денежные средства и дебиторская задолженность.

- •65. Short-Term Investments, Long-Term Investments (Debt, Equity). Краткосрочные инвестиции. Долгосрочные инвестиции (долг, капитал).

- •66. Current Liabilities. Текущие обязательства.

- •67. Long Term Liabilities. Долгосрочные обязательства.

- •68. Long Term Assets. Долгосрочные активы.

- •69. Contributed Capital. Акционерный капитал.

- •Cash Flow Statement. Отчет о движении денежных средств.

- •71. Consolidated Financial Statements. Консолидированная финансовая отчетность.

- •74. Capital Structure Concept. Dividend Policy. Концепция структуры капитала. Дивидендная политика.

- •75. Arbitrage Pricing Theory (apt). Capital Asset Pricing Model (capm). Теория арбитражного ценообразования. Модель оценки капитальных активов.

- •77. Asset Based Valuation Model, Residual Income Valuation Model. Модель оценки на основе активов. Модель оценки на основе остаточного дохода.

- •78. Dividend Discount Model. Discounted Cash Flow Valuation Model. Модель дисконтированных денежных потоков.

- •Risky assets and portfolio optimization problem. Рисковые активы и проблема оптимизации портфеля.

- •Credit Risk Models. Модели кредитного риска.

- •Translation Exposure. Трансляционная экспозиция.

- •Transaction Exposure. Транзакционная экспозиция.

- •Operating Exposure. Операционная экспозиция.

- •Classification and comparative characteristics of derivatives: options, swaps, futures, forwards. Классификация и сравнительные характеристики деривативов: опционы, свопы, фьючерсы, форварды

- •Interest Rate Derivatives: Interest Rate Agreements, Interest Rate Swaps, etc. Деривативы процентных ставок: соглашения по процентным ставкам, свопы процентных ставок, и т.П.

- •Exotic Derivatives.Экзотические деривативы.

- •Advanced Structured Financial Products.Продвинутые структурные финансовые продукты.

- •Financial Risk Forecasting Techniques. Методы прогнозирования финансовых рисков.

65. Short-Term Investments, Long-Term Investments (Debt, Equity). Краткосрочные инвестиции. Долгосрочные инвестиции (долг, капитал).

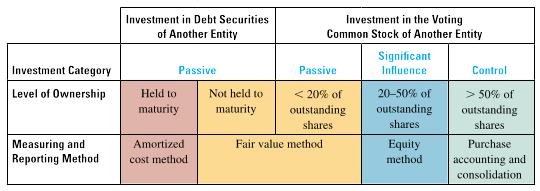

The accounting methods used to record investments are directly related to how much is owned and how long management intends to hold the investments.

Passive investments are made to earn a return on funds that may be needed for future short-term or long-term purposes. This category includes both investments in debt (bonds and notes) and equity securities (stock). Debt securities are always considered passive investments. If the company intends to hold the securities until they reach maturity, the investments are measured and reported at amortized cost. If they are to be sold before maturity, they are reported using the fair value method. NB! Under IFRS amortized cost of bonds are not extracted from its value, rather capitalized into equity!

For investments in equity securities, the investment is presumed passive if the investing company owns less than 20 percent of the outstanding voting shares of the other company. The fair value method is used to measure and report the investments.

Significant influence is the ability to have an important impact on the operating, investing, and financing policies of another company. Significant influence is presumed if the investing company owns from 20 to 50 percent of the outstanding voting shares of the other company. The equity method is used to measure and report this category of investments.

C ontrol

is the ability to determine the operating and financing policies of

another company through ownership of voting stock. Control is

presumed when the investing company owns more than 50 percent of the

outstanding voting stock of the other company. Purchase accounting

and consolidation are applied to combine the companies. These

investment categories and the appropriate measuring and reporting

methods can be summarized as follows:

ontrol

is the ability to determine the operating and financing policies of

another company through ownership of voting stock. Control is

presumed when the investing company owns more than 50 percent of the

outstanding voting stock of the other company. Purchase accounting

and consolidation are applied to combine the companies. These

investment categories and the appropriate measuring and reporting

methods can be summarized as follows:

Bond Purchases. On the date of purchase, a bond may be acquired at the maturity amount (at par), for less than the maturity amount (at a discount), or for more than the maturity amount (at a premium). The total cost of the bond, including all incidental acquisition costs such as transfer fees and broker commissions, is debited to the Held-to-Maturity Investments account. Depending on management’s intent, passive investments at fair value may be classified as trading securities or securities available for sale.

Trading securities are actively traded with the objective of generating profits on short-term changes in the price of the securities. This approach is similar to the one taken by many mutual funds. The portfolio manager actively seeks opportunities to buy and sell securities. Trading securities are classified as current assets on the balance sheet.

Most companies do not actively trade the securities of other companies. Instead, they invest to earn a return on funds they may need for future operating purposes. Other than debt securities to be held to maturity, these debt and equity investments are called securities available for sale. They are classified as current or noncurrent assets on the balance sheet depending on whether management intends to sell the securities during the next year.

Under the equity method, the investor’s 20 to 50 percent ownership of a company presumes significant influence over the affiliate’s process of earning income. As a consequence, the investor reports its portion of the affiliate’s net income as its income and increases the investment account by the same amount.