- •Fundamental Economic Principles and Economic Models. Фундаментальные принципы экономики и экономические модели.

- •Supply and Demand. Спрос и предложение.

- •Consumer and Producer Surplus. Market Reaction to Government Intervention. Излишек потребителя и производителя. Реакция рынка на вмешательство правительства.

- •Elasticity. Эластичность.

- •Theory of Consumer Behavior and Rational Choice. Теория потребительского поведения и рационального выбора.

- •Basic Economic Theory of Risk. Expected Utility Function, Risk Premium and Risk Aversion Measures. Основы экономической теории риска. Функция ожидаемой полезности. Премия риска и избегание риска.

- •Profit Maximization and Theory of Firm and Industry Supply. Максимизация прибыли и теория предложения фирмы и отрасли.

- •Production Costs in Short Run vs. Long Run. Производственные затраты в краткосрочном и долгосрочном периоде.

- •The Model of Perfect Competition. Модель совершенной конкуренции.

- •The Theory of Monopoly. Теория монополии.

- •Oligopoly and Game Theory. Олигополия и теория игр.

- •Monopolistic Competition. Монополистическая конкуренция.

- •The Economic Theory of Taxation. Экономическая теория налогообложения.

- •The Economics of Welfare State. Экономика государства всеобщего благоденствия.

- •Externalities and Transaction Costs. Экстерналии и транзакционные затраты.

- •Public Goods, Common Resources, and Artificially Scarce Goods. Общественные товары, общие ресурсы и искусственно редкие товары.

- •Information Asymmetry. Adverse Selection and Moral Hazard. Информационная асимметрия. Враждебный выбор и моральный ущерб.

- •Aggregate Demand and Aggregate Supply. Model ad-as. Совокупный спрос и совокупное предложение.

- •Consumption, Savings, and Investments. Income and Expenditure. "Keynesian Cross". Потребление, сбережение. Инвестирование. Доход-затраты. Кейнсианский крест.

- •Long Run Economic Growth. Долгосрочный экономический рост.

- •The Theories of Business Cycles. Теории экономических циклов.

- •Inflation, Disinflation, and Deflation. Инфляция, Дизинфляция и Дефляция.

- •Unemployment and Inflation. Безработица и инфляция.

- •Fiscal Policy. Фискальная политика.

- •Monetary Policy. Монетарная политика.

- •28. The Theories of International Trade. Теории международной торговли.

- •29. Open Economy Macroeconomics. (Balance of Payments, Exchange Rates, ppp). Открытая экономика (платежный баланс, обменные курсы валют, ппс)

- •30. The composition of the global financial market: instruments, participants, sources of information. Состав глобального финансового рынка: инструменты, участники, источники информации.

- •32. Types of banks and their role in the international financial market. Типы банков и их роль на международном финансовом рынке.

- •33. The global equities market: size, indicators, principles of organization. Глобальный рынок капитала: размер, индикаторы, принципы организации.

- •34. The global debt securities market: types, composition, principles of organization. Глобальный долговой рынок ценных бумаг: типы ценных бумаг, состав, принципы организации.

- •36. The government bond markets: size, composition, significance. Рынки правительственных облигаций: размер, состав, значение.

- •37. Rating agencies and their role in the global financial market. Рейтинговые агентства и их роль и значение на глобальном финансовом рынке.

- •38. Types of institutional investors and their role in the global financial markets. Типы институциональных инвесторов и их роль на мировых финансовых рынках.

- •39. The functions of the international financial organizations (imf, World Bank, bis). Функции международных финансовых организаций (мвф, Всемирный банк, Банк международных расчетов.)

- •International trade financing: International banks are the leading source of credit for multinational corporations and many governmental units. They provide both st & lt financing.

- •41. Fighting International Money Laundering and Offshore Banking Markets. Борьба с международным отмыванием денег и оффшорные банковские рынки.

- •42. Mergers and Acquisitions in Financial Services Markets. Слияния поглощения на рынках финансовых услуг.

- •43. International Financial Centers. Международные финансовые центры.

- •46. European Stability Mechanism and Fiscal Compact. Европейский стабилизационный механизм и пакт о финансовой стабильности и росте.

- •47. European Debt Crisis, us Fiscal Cliff, and Federal Budget Sequester. Европейский долговой кризис. Фискальный обрыв и секвестр федерального бюджета сша.

- •48. Wto and the problems of the Russian Federation participation in it. Вто и проблемы участия в ней рф.

- •50. Stabilization Funds. Стабилизационные фонды.

- •51. Necessity and preconditions of Appearance and Applications of Moneys. Evolution of Forms and Types of Moneys.Необходимость и предпосылки появления и применения денег. Эволюция форм и видов денег.

- •52. The Problem of Money Supply Measurements in Modern Economy. The Specifics of Russia.Проблемы измерения денежной массы в современной экономике. Особенности России.

- •53. Monetary Emission and Printing Money.Выпуск денег в хозяйственный оборот и денежная эмиссия.

- •54. Modern Basics of Cash at Bank monetary Circulation: Russian Specifics. Современные основы организации безналичного денежного оборота: особенности России.

- •55. The Development of Forms of Credit and their Role in Modern Economy. Развитие форм кредита и их роль в современной экономике России.

- •56. Economic Foundations of Forming the Level of Loan Interest and its Role in the Market Economy.Экономические основы формирования уровня ссудного процента и его роль в рыночной экономике.

- •57. The Conditions and Specifics of Modern Banking System in Russia. Состояние и особенности развитие современной банковской системы России.

- •58. The Role of Banks and Non-Banking Credit Organization in Modern Market Economy in Russia.Роль банков и небанковских кредитных организаций в современной рыночной экономике России.

- •61. Classified Financial Statements and Ratios. Corporate Financial Statements. Классифицированные финансовые отчеты и показатели. Корпоративная финансовая отчетность.

- •62. Merchandising Operations. Merchandising Income Statement. Inventories. Торговые операции. Отчет о прибыли торговой организации. Товарные запасы.

- •63. Internal Control. Внутренний контроль.

- •64. Cash and Receivables. Денежные средства и дебиторская задолженность.

- •65. Short-Term Investments, Long-Term Investments (Debt, Equity). Краткосрочные инвестиции. Долгосрочные инвестиции (долг, капитал).

- •66. Current Liabilities. Текущие обязательства.

- •67. Long Term Liabilities. Долгосрочные обязательства.

- •68. Long Term Assets. Долгосрочные активы.

- •69. Contributed Capital. Акционерный капитал.

- •Cash Flow Statement. Отчет о движении денежных средств.

- •71. Consolidated Financial Statements. Консолидированная финансовая отчетность.

- •74. Capital Structure Concept. Dividend Policy. Концепция структуры капитала. Дивидендная политика.

- •75. Arbitrage Pricing Theory (apt). Capital Asset Pricing Model (capm). Теория арбитражного ценообразования. Модель оценки капитальных активов.

- •77. Asset Based Valuation Model, Residual Income Valuation Model. Модель оценки на основе активов. Модель оценки на основе остаточного дохода.

- •78. Dividend Discount Model. Discounted Cash Flow Valuation Model. Модель дисконтированных денежных потоков.

- •Risky assets and portfolio optimization problem. Рисковые активы и проблема оптимизации портфеля.

- •Credit Risk Models. Модели кредитного риска.

- •Translation Exposure. Трансляционная экспозиция.

- •Transaction Exposure. Транзакционная экспозиция.

- •Operating Exposure. Операционная экспозиция.

- •Classification and comparative characteristics of derivatives: options, swaps, futures, forwards. Классификация и сравнительные характеристики деривативов: опционы, свопы, фьючерсы, форварды

- •Interest Rate Derivatives: Interest Rate Agreements, Interest Rate Swaps, etc. Деривативы процентных ставок: соглашения по процентным ставкам, свопы процентных ставок, и т.П.

- •Exotic Derivatives.Экзотические деривативы.

- •Advanced Structured Financial Products.Продвинутые структурные финансовые продукты.

- •Financial Risk Forecasting Techniques. Методы прогнозирования финансовых рисков.

Aggregate Demand and Aggregate Supply. Model ad-as. Совокупный спрос и совокупное предложение.

A ggregate

demand (AD)

is the total demand for final goods and services in the economy (Y)

at a given time, price level and inventory levels. Elements:

C consumption spending, I investment spending, G government

transfers, X export, IM import, as the GDP equation (GDP=C+I+G+X-IM)

can be considered as the quantity of domestically produced final

goods & services demanded during the year in case of constant

prices. The

aggregate demand curve

shows the relationship between the aggregate price level and the

quantity of aggregate output demanded.

ggregate

demand (AD)

is the total demand for final goods and services in the economy (Y)

at a given time, price level and inventory levels. Elements:

C consumption spending, I investment spending, G government

transfers, X export, IM import, as the GDP equation (GDP=C+I+G+X-IM)

can be considered as the quantity of domestically produced final

goods & services demanded during the year in case of constant

prices. The

aggregate demand curve

shows the relationship between the aggregate price level and the

quantity of aggregate output demanded.

It is downward-sloping for two reasons. Wealth effect of a change in the aggregate price level—a higher aggregate price level reduces the purchasing power of households and reduces consumer spending. Interest rate effect of a change in aggregate the price level—a higher aggregate price level reduces the purchasing power of households, leading to a rise in interest rates and a fall in investment spending. Shifts: Increases (rightward) when consumers and firms become more optimistic (change in expectations), the real value of household assets rises (change in wealth), the (change in) existing stock of physical capital is relatively small, the government increases spending or cuts taxes (change in fiscal policy), and the central bank increases the quantity of money (change in monetary policy) and vice versa (leftward).

A

ggregate

supply

is the total amount of goods and services that firms are willing to

sell at a given price level and time. The aggregate

supply curve

shows the relationship between the aggregate price level and the

quantity of aggregate output in the economy. The short-run

aggregate supply curve

is upward-sloping because nominal wages are sticky (slow to fall even

in the face of high unemployment and slow to rise even in the face of

labor shortages) in the short run: a higher aggregate price level

leads to higher profits and increased aggregate output in the short

run. Shifts:

Increases when commodity

prices

fall, nominal

wages

fall, workers become more productive

and vice versa.

ggregate

supply

is the total amount of goods and services that firms are willing to

sell at a given price level and time. The aggregate

supply curve

shows the relationship between the aggregate price level and the

quantity of aggregate output in the economy. The short-run

aggregate supply curve

is upward-sloping because nominal wages are sticky (slow to fall even

in the face of high unemployment and slow to rise even in the face of

labor shortages) in the short run: a higher aggregate price level

leads to higher profits and increased aggregate output in the short

run. Shifts:

Increases when commodity

prices

fall, nominal

wages

fall, workers become more productive

and vice versa.

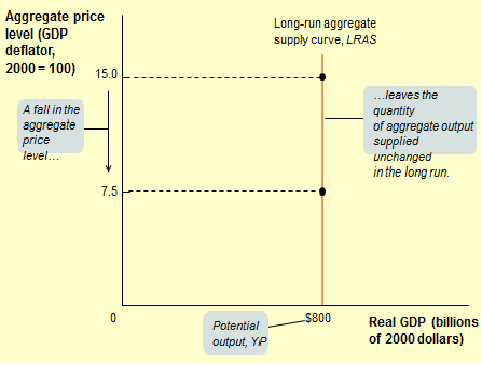

T he

long-run

aggregate supply curve shows

the relationship between the aggregate price level and the quantity

of aggregate output supplied that would exist if all prices,

including nominal wages, were fully flexible.

he

long-run

aggregate supply curve shows

the relationship between the aggregate price level and the quantity

of aggregate output supplied that would exist if all prices,

including nominal wages, were fully flexible.

T![]() he

AS-AD model

uses the aggregate supply curve and the aggregate demand curve

together to analyze economic fluctuations. There is a recessionary

gap

when aggregate output is below potential output, inflationary

when above. The economy is self-correcting when shocks to aggregate

demand affect aggregate output in the short run, but not the long

run.

he

AS-AD model

uses the aggregate supply curve and the aggregate demand curve

together to analyze economic fluctuations. There is a recessionary

gap

when aggregate output is below potential output, inflationary

when above. The economy is self-correcting when shocks to aggregate

demand affect aggregate output in the short run, but not the long

run.

S tabilization

policy

is the use of government policy to reduce the severity of recessions

and rein in excessively strong expansions. Policy

dilemma in the face of supply shocks:

a policy that counteracts the fall in aggregate output by increasing

aggregate demand will lead to higher inflation, but a policy that

counteracts inflation by reducing aggregate demand will deepen the

output slump.

tabilization

policy

is the use of government policy to reduce the severity of recessions

and rein in excessively strong expansions. Policy

dilemma in the face of supply shocks:

a policy that counteracts the fall in aggregate output by increasing

aggregate demand will lead to higher inflation, but a policy that

counteracts inflation by reducing aggregate demand will deepen the

output slump.

The high cost — in terms of unemployment — of a recessionary gap and the future adverse consequences of an inflationary gap => Active stabilization policy, using fiscal or monetary policy to offset shocks.