- •Методичні рекомендації по вивченню лексичного матеріалу

- •Методичні рекомендації по вивченню лексичного матеріалу

- •Методичні рекомендації по вивченню лексичного матеріалу

- •Мета курсу:

- •Структура курсу

- •Контроль засвоєння знань

- •Мовний матеріал

- •Морфологія

- •Синтаксис

- •Правила читання

- •Тематичний план

- •The english language

- •II. Read and translate the text.

- •III. Answer the questions:

- •Great britian

- •II. Read and translate the text.

- •III. Answer the questions:

- •II. Read and translate the text.

- •III. Answer the questions:

- •The united states of america

- •I. Read and translate the text.

- •Status - a Federal Republic union of 50 states

- •II. Retell the text. Australia

- •I. Read and translate the text.

- •II. Retell the text. New zealand

- •I. Read and translate the text.

- •II. Retell the text. My future speciality (Responsibilities of the Financial Manager)

- •II. Read and translate the text.

- •III. Discuss:

- •Interviewing

- •Weakness недолік, уразливе місце

- •Iі. Read and translate the text.

- •Iiі. Retell the text. Telephoning

- •I. Read and translate the text.

- •II. Make your own dialogue.

- •III. Retell the text. Telephone etiquette

- •Iі. Read and translate the text.

- •Аррlication of computers

- •Iі. Read and translate the text.

- •III. Complete as in the text:

- •What is accounting?

- •I. Study the vocabulary:

- •Iі. Read and translate the text.

- •Iiі. Аnswer the following questions:

- •The field of accounting

- •I. Study the vocabulary:

- •II. Read and translate the text.

- •III. Answer the following question:

- •Bookkeeping and accounting

- •I. Study the vocabulary:

- •II. Read and translate the text.

- •III. Answer the questions:

- •Managerial and financial accounting

- •I. Study the vocabulary:

- •II. Read and translate the text.

- •III. Answer the following questions:

- •IV. Retell the text. Methods of accounting

- •I. Read and translate the text.

- •II. Retell the text. Financial institutions

- •I. Study the vocabulary:

- •II. Read and translate the text.

- •III. Retell the text. So what bookkeepers and accountants do?

- •I. Study the vocabulary:

- •II. Read and translate the text.

- •III. Retell the text. Accountants and balance sheets

- •II. Read and translate the text.

- •Inventory

- •Iiі. Write down the Ukrainian equivalents:

- •IV. Write down the English equivalents:

- •V. Find the answers in the text:

- •Bookkeepers, accountants and controllers

- •II. Read and translate the text.

- •_______________? - They interpret the results of the operations and the plan the future operation of the company.

- •Auditors and their reports

- •II. Retell the text. Taxes and taxation

- •I. Study the vocabulary:

- •II. Read and translate the text.

- •Computers

- •I. Study the vocabulary:

- •II. Read and translate the text.

- •III. Answer the following questions:

- •Financial statements

- •I. Study the vocabulary:

- •II. Read and translate the text.

- •III. Answer the following questions:

- •What is finance?

- •I. Read and translate the text.

- •II. Write out unknown words. Budgeting

- •I. Read and translate the text.

- •II. Retell the text. Organization of financial activity

- •I. Read and translate the text.

- •II. Retell the text. Financial indexes

- •I. Read and translate the text.

- •II. Retell the text. Business letter

- •I. Read and translate the text.

- •II. Write your own business letter based on the sample.

- •Transportation documents

- •I. Read and translate the text.

- •II. Retell the text.

- •I. Read and translate the text.

- •Closing the account

- •Overdraft

- •Investment of capital

- •Presenting a check for payment

- •Payment order

- •Application for credit

- •Delay in payment or non-payment

- •A letter sent when the remittance has not been received

- •Central bank The Bank of England

- •I. Study the vocabulary:

- •II. Read and translate the text.

- •III. Answer the questions using the information from the text.

- •Commercial banks

- •I. Read and translate the text.

- •II. Retell the text. English banks

- •I. Study the vocabulary:

- •Iі. Read and translate the text.

- •Federal reserve system of the u.S.A.

- •I. Study the vocabulary:

- •II. Read and translate the text.

- •Federal Reserve Banks

- •III. Retell the text. Banks of ukraine

- •I. Read and translate the text.

- •II. Retell the text. The national bank of ukraine

- •I. Read and translate the text.

- •II. Retell the text. Types of banks

- •I. Study the vocabulary:

- •Iі. Read and translate the text.

- •Banking services

- •Opening an account

- •II. Read and discuss the dialogue:

- •III. Answer the questions:

- •Functions and characteristics of money

- •I. Study the vocabulary:

- •II. Read and translate the text.

- •III. Study the following words and phrases. Recall the sentences in which they are used in the text. Use them in sentences of your own.

- •IV. Replace the Ukrainian words and phrases by appropriate English equivalents. Translate the sentences.

- •Hryvnia-the official currency of ukraine

- •I. Study the vocabulary:

- •II. Read and translate the text.

- •III. Answer the questions:

- •IV. Translate into English:

- •Financial centres (markets)

- •I. Study the vocabulary:

- •II. Read and translate the text.

- •III. Retell the text. Financial instruments

- •I. Read and translate the text.

- •II. Retell the text. People in accounting profession

- •I. Read and translate the text.

- •II. Retell the text.

- •Insurance companies

- •I. Read and translate the text.

- •II. Retell the text.

- •International finance

- •I. Read and translate the text.

- •II. Retell the text.

- •International trade

- •I. Study the vocabulary

- •II. Read and translate the text.

- •III. Retell the text.

- •International development

- •I. Read and translate the text.

- •II. Retell the text.

- •Vocabulary of business terms and notions

- •Список рекомендованих джерел Основний Підручники та навчальні посібники

- •Додатковий

- •Інтернет-ресурси

II. Read and translate the text.

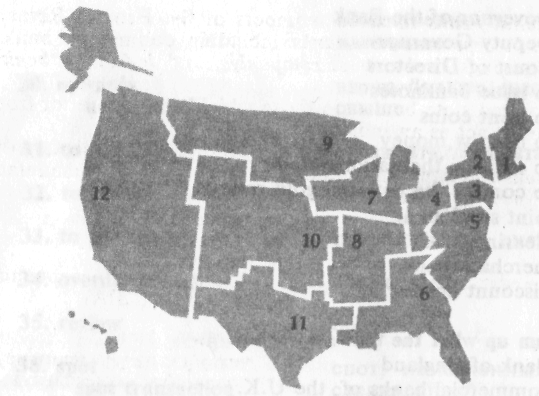

Federal Reserve System is the central banking system of the United States of America, set up by the Federal Government in 1913. On account of the vast area of the country, and the greater difficulties of travelling at that time, the country was divided into twelve Federal Reserve Districts, each with its own Federal Reserve Bank.

Here is the map showing FR Districts and the cities where PR Banks are located:

Federal Reserve Banks

1 Boston 7 Chicago

2 New York 8 St. Louis

3 Philadelphia 9 Minneapolis

4 Cleveland 10 Kansas City

5 Richmond 11 Dallas

6 Atlanta 12 San Francisco

There are also twenty five branches of the Federal Reserve Banks to serve particular areas within each district. The activities of the Federal Reserve Banks are coordinated through the Federal Reserve Board of governors in Washington.

The Board exercises general supervision over the Federal Reserve Banks.

The Federal Reserve Banks hold the reserves of the member banks, i.e. the commercial banks which are members of the Federal Reserve System. The FR Banks supply the member banks with currency if necessary and act to them as lenders by rediscounting bills. The Board determines the reserve requirements of the commercial banks. The Board too really determines discount rates. The Board discount rate corresponds in nature to the English Bank rate, though the Federal Reserve Banks do not always have the same discount rate.

The Federal Reserve System, in collaboration with the Government of the U.S.A.,determines monetary policy and, aided by the Federal Reserve Banks, carries it out.

All national banks must be members of the Federal Reserve System. Incorporated state banks including commercial banks, mutual savings banks, trust companies, and industrial banks, may also join the System.

Incorporated state banks are those which have a charter from the state to act as an individual.

Mutual savings banks are savings banks owned by their depositors. Industrial banks make loans for the purchase or manufacture of industrial products.

III. Retell the text. Banks of ukraine

I. Read and translate the text.

The evolution of the national banking system in Ukraine started in March, 1991, after the adoption of the Law of Ukraine "On Banks and Banking" by the Ukrainian Verhovna Rada. The Ukrainian banking system is a two-tier structure consisting of the National Bank of Ukraine and commercial banks of various types and forms of ownership including the state-owned Export-Import Bank and a specialized commercial Savings Bank.

The National Bank of Ukraine serves as the country's central bank which pursues a uniform state monetary policy to ensure the national currency stability.

Commercial banks are formed as joint-stock companies or as companies on an equal footing with both legal and natural persons involved. The range of commercial banks activities includes: receiving deposits of enterprises, institutions and households, crediting of economic entities and households, investments in securities, formation of cash balance and reserves, as well as other assets, cash and settlement servicing of the economy, foreign exchange operations and other services to natural persons and legal bodies.