- •The Week Ahead

- •The Long View

- •Ratings Round-Up

- •Market Data

- •Moody’s Capital Markets Research recent publications

- •Weekly Market Outlook Contributors:

- •Credit Markets Review and Outlook

- •Only the Baa3 Spread Was Wider than Its Long-Term Median as of the End of June

- •Corporate Bond Yields and EDFs Provide the Basis for Market Implied Ratings

- •Bond Implied Ratings Offer a Somewhat Negative View of Baa3 Credits

- •EDF-Derived Market Implied Ratings Offered a More Positive View of Baa3 Credits

- •Despite Thinner Spread since End of 2018, Bond Implied Ratings of Baa3 Group Softens

- •The Week Ahead – U.S., Europe, Asia-Pacific

- •Perception versus reality

- •Looking ahead

- •The key data next week include June retail sales, industrial production, business inventories, consumer confidence and jobless claims.

- •EUROPE

- •Asia-Pacific

- •The Long View

- •Credit spreads

- •The recent high-yield bond spread of 421 bp is thinner than what is suggested by both the accompanying long-term Baa industrial company bond yield spread of 186 bp but is wider than what ordinarily accompanies the recent VIX of 12.9 points.

- •Defaults

- •US CORPORATE BOND ISSUANCE

- •US Economic Outlook

- •United Kingdom

- •Asia Pacific

- •china

- •Japan

- •Ratings Round-Up

- •Moody’s Capital Markets Research recent publications

vk.com/id446425943

Ratings Round-Up

Ratings Round-Up

CAPITAL MARKETS RESEARCH

U.S. and European Rating Activity Mixed

By Steven Shields

U.S. credit rating changes were predominantly positive in the latest week, but a single downgrade drove negative rating changes to account for 94% of the affected U.S. debt. Technology firm International Business Machines Corp. received a downgrade to its long-term issuer rating from A1 to A2. The change affected approximately $58 billion total debt. The change comes on the heels of IBM closing its $34 billion acquisition of Red Hat Inc. According to Moody’s Investors Service, its credit rating reflects the company’s strong business model, large scale, strong free cash flow generation, and liquidity. The purchase of Red Hat is considered beneficial for IBM’s long-term cloud computing strategy, but poses integration risk due to the size and scale of the acquisition. Moody’s Investors Service upgraded Hughes Satellite Systems Corp.’s senior unsecured notes to Ba1 from Ba2. The firm’s LTCF also received an upgrade to Ba3 from B1. The U.S. economy remains in good standing overall with none of the sources of past recessions—overheating risk, financial and inventory imbalances, shocks to the economy’s balance sheet—looking worrisome. The Fed’s dovish pivot reduces the risk that financial market conditions will tighten in the near term. Markets are currently expecting a 25 basis point rate cut this month.

European rating activity was relatively quiet with just two rating changes occurring. The single European upgrade was to Bank Saint-Petersburg PJSC. The firm’s long-term foreign currency deposit rating was upgraded to Ba3 from B1, and the outlook was revised to stable from positive. Ferroglobe PLC received the lone European downgrade with its senior unsecured notes lowered to Caa1 from B3. Ferroglobe’s LTCF is under review for downgrade following weak operating performance in the first quarter of 2019.

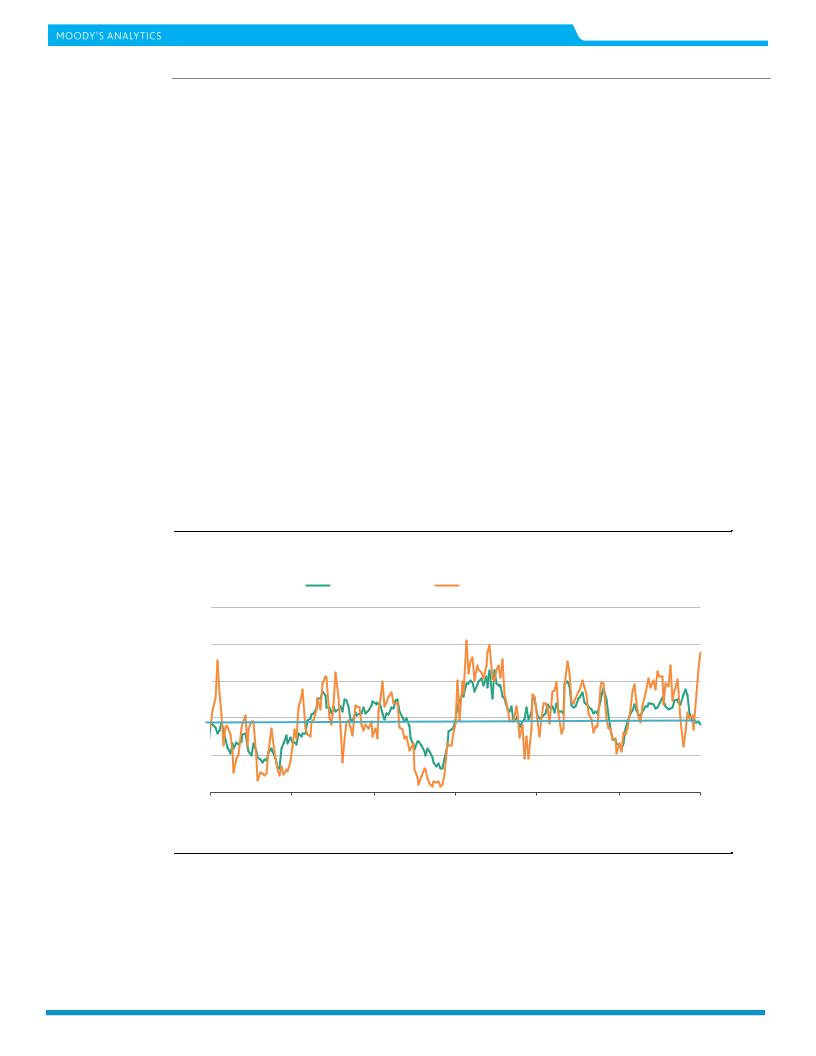

FIGURE 1

Rating Changes - US Corporate & FinancialInstitutions: Favorable as % of Total Actions

|

|

By Count of Actions |

By Amount of Debt Affected |

|

|

|

1.0 |

|

|

|

|

|

1.0 |

0.8 |

|

|

|

|

|

0.8 |

0.6 |

|

|

|

|

|

0.6 |

0.4 |

|

|

|

|

|

0.4 |

0.2 |

|

|

|

|

|

0.2 |

0.0 |

|

|

|

|

|

0.0 |

Apr00 |

Jun03 |

Aug06 |

Oct09 |

Dec12 |

Feb16 |

Apr19 |

* Trailing 3-month average

Source: Moody's

12 |

JULY 11, 2019 |

CAPITAL MARKETS RESEARCH / MARKET OUTLOOK / MOODYS.COM |

vk.com/id446425943 |

CAPITAL MARKETS RESEARCH |

|

Ratings Round-Up

FIGURE 2

Rating Key

BCF |

Bank Credit Facility Rating |

|

MM |

Money-Market |

|

|

|

|||

CFR |

Corporate Family Rating |

|

MTN |

|

MTN Program Rating |

|

|

|

||

CP |

Commercial Paper Rating |

|

Notes |

|

Notes |

|

|

|

|

|

FSR |

Bank Financial Strength Rating |

|

PDR |

|

Probability of Default Rating |

|

|

|||

IFS |

Insurance Financial Strength Rating |

PS |

|

Preferred Stock Rating |

|

|

||||

IR |

Issuer Rating |

|

SGLR |

|

Speculative-Grade Liquidity Rating |

|

||||

JrSub |

Junior Subordinated Rating |

|

SLTD |

|

Shortand Long-Term Deposit Rating |

|||||

LGD |

Loss Given Default Rating |

|

SrSec |

|

Senior Secured Rating |

|

|

|||

LTCF |

Long-Term Corporate Family Rating |

SrUnsec |

|

Senior Unsecured Rating |

|

|

||||

LTD |

Long-Term Deposit Rating |

|

SrSub |

|

Senior Subordinated |

|

|

|

||

LTIR |

Long-Term Issuer Rating |

|

STD |

|

Short-Term Deposit Rating |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FIGURE 3 |

|

|

|

|

|

|

|

|

|

|

Rating Changes: Corporate & FinancialInstitutions – US |

|

|

|

|

|

|

||||

Date |

Company |

Sector |

Rating |

|

Amount |

Up/ |

Old |

New |

IG/ |

|

|

($ Million) |

Down |

LTD |

LTD |

SG |

|||||

|

|

|

|

|

|

Rating |

Rating |

|||

|

|

|

|

|

|

|

|

|

|

|

7/8/19 |

SCRIPPS (E.W.) CO. (OLD)-SCRIPPS |

Industrial |

SrSec/BCF |

|

|

U |

Ba3 |

Ba2 |

SG |

|

(E.W.) COMPANY (THE) |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

7/8/19 |

TRIUMPH GROUP, INC. |

Industrial |

SrUnsec |

|

1,175 |

D |

Caa1 |

Caa2 |

SG |

|

/LTCFR/PDR |

|

|||||||||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

7/8/19 |

MTS SYSTEMS CORPORATION |

Industrial |

SrSec/BCF |

|

|

U |

B1 |

Ba2 |

SG |

|

|

|

|

|

|

|

|

|

|

|

|

7/9/19 |

INTERNATIONAL BUSINESS |

Industrial |

SrUnsec/LTIR 58,388 |

D |

A1 |

A2 |

IG |

|||

MACHINES CORPORATION |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

7/9/19 |

BROOKS AUTOMATION, INC. |

Industrial |

SrSec/BCF |

|

|

U |

B1 |

Ba3 |

SG |

|

/LTCFR/PDR |

|

|

||||||||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

7/9/19 |

HUGHES SATELLITE SYSTEMS |

Industrial |

SrSec/SrUnsec |

4,050 |

U |

Ba2 |

Ba1 |

SG |

||

CORPORATION |

/LTCFR/PDR |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

7/9/19 |

GOBP HOLDINGS, INC. |

Industrial |

LTCFR/PDR |

|

|

U |

B3 |

B2 |

SG |

|

Source: Moody's

FIGURE 4

Rating Changes: Corporate & FinancialInstitutions – Europe

Date |

Company |

Sector |

Rating |

Amount |

Up/ |

Old |

New |

IG/ |

Country |

|

($ Million) |

Down |

LTD |

LTD |

SG |

||||||

|

|

|

|

Rating |

Rating |

|

||||

|

|

|

|

|

|

|

|

|

|

|

7/4/19 |

BANK SAINT |

Financial |

LTD |

|

U |

B1 |

Ba3 |

SG |

RUSSIA |

|

-PETERSBURG PJSC |

|

|||||||||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

7/4/19 |

FERROGLOBE PLC |

Industrial |

SrUnsec |

350 |

D |

B3 |

Caa1 |

SG |

UNITED |

|

/LTCFR/PDR |

KINGDOM |

|||||||||

|

|

|

|

|

|

|

|

Source: Moody's

13 |

JULY 11, 2019 |

CAPITAL MARKETS RESEARCH / MARKET OUTLOOK / MOODYS.COM |

vk.com/id446425943 |

CAPITAL MARKETS RESEARCH |

|

Market Data

Market Data

Spreads

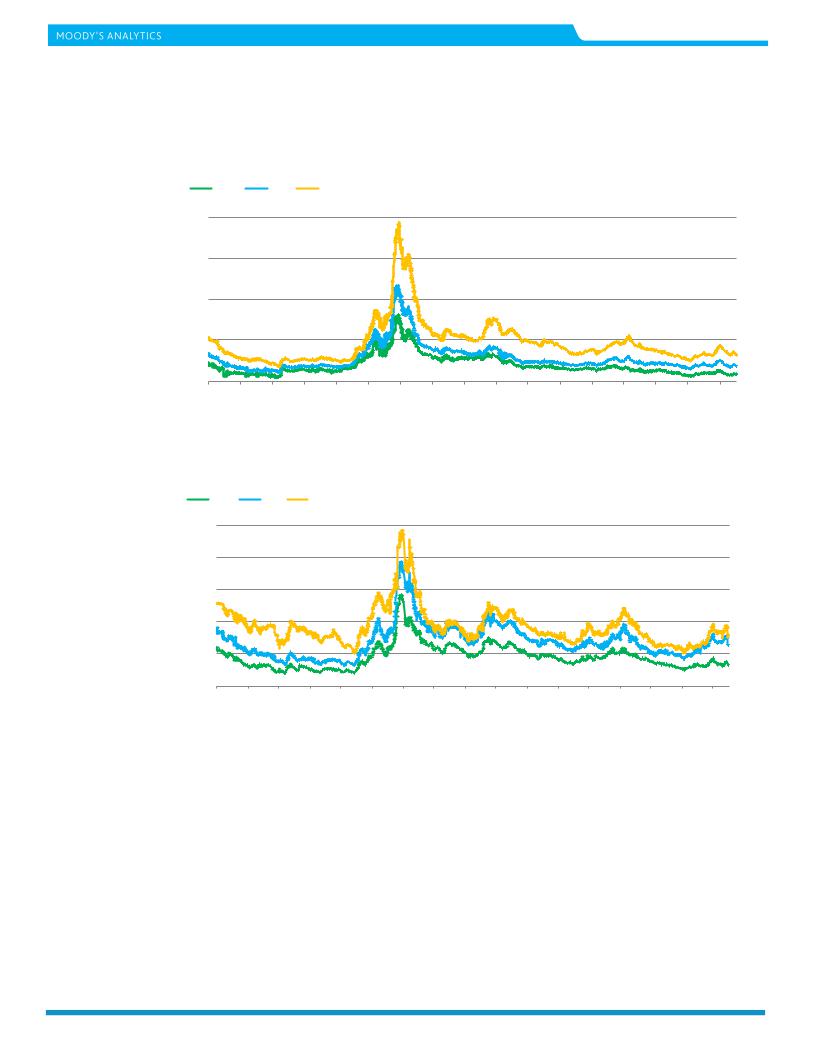

Figure 1: 5-Year Median Spreads-Global |

Data (High Grade) |

|

|

|

|

|

|

|

|

|

||||||

Aa2 |

A2 |

|

Baa2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Spread (bp) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spread (bp) |

800 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

800 |

600 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

600 |

400 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

400 |

200 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

200 |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

2003 |

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

Source: Moody's

Figure 2: 5-Year Median Spreads-Global |

Data (High Yield) |

|

|

|

|

|

|

|

|

|

||||||

Ba2 |

|

B2 |

Caa-C |

|

|

|

|

|

|

|

|

|

|

|

|

|

Spread (bp) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spread (bp) |

2,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,000 |

1,600 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,600 |

1,200 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,200 |

800 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

800 |

400 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

400 |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

2003 |

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

Source: Moody's

14 |

JULY 11, 2019 |

CAPITAL MARKETS RESEARCH / MARKET OUTLOOK / MOODYS.COM |

vk.com/id446425943 |

CAPITAL MARKETS RESEARCH |

|

Market Data

CDS Movers

Figure 3. CDS Movers - US (July 3, 2019 – July 10, 2019) |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||

CDS Implied Rating Rises |

|

CDS Implied Ratings |

|

|

|

|

|||

Issuer |

Jul. 10 |

Jul. 3 |

|

Senior Ratings |

|

||||

PepsiCo, Inc. |

A1 |

A2 |

A1 |

|

|||||

Amgen Inc. |

A1 |

A2 |

Baa1 |

|

|||||

Union Pacific Corporation |

Aa1 |

Aa2 |

Baa1 |

|

|||||

Amazon.com, Inc. |

Aa3 |

A1 |

A3 |

|

|||||

Burlington Northern Santa Fe, LLC |

Aa1 |

Aa2 |

A3 |

|

|||||

CenturyLink, Inc. |

B2 |

B3 |

B2 |

|

|||||

Lowe's Companies, Inc. |

A1 |

A2 |

Baa1 |

|

|||||

Eli Lilly and Company |

Aa2 |

Aa3 |

A2 |

|

|||||

General Mills, Inc. |

A3 |

Baa1 |

Baa2 |

|

|||||

Target Corporation |

Aa2 |

Aa3 |

A2 |

|

|||||

|

|

|

|

|

|

||||

CDS Implied Rating Declines |

|

|

CDS Implied Ratings |

|

|

|

|||

Issuer |

Jul. 10 |

Jul. 3 |

|

Senior Ratings |

|

||||

CSC Holdings, LLC |

Ba3 |

Ba2 |

B3 |

|

|||||

CCO Holdings, LLC |

Ba2 |

Ba1 |

B1 |

|

|||||

PNC Financial Services Group, Inc. |

Baa2 |

Baa1 |

A3 |

|

|||||

Texas Instruments, Incorporated |

Ba1 |

Baa3 |

A1 |

|

|||||

PPG Industries, Inc. |

Ba1 |

Baa3 |

A3 |

|

|||||

Realogy Group LLC |

Caa2 |

Caa1 |

B2 |

|

|||||

Universal Health Services, Inc. |

Baa2 |

Baa1 |

Ba1 |

|

|||||

Iron Mountain Incorporated |

A1 |

Aa3 |

Ba3 |

|

|||||

International Lease Finance Corporation |

Baa3 |

Baa2 |

Baa3 |

|

|||||

Royal Caribbean Cruises Ltd. |

Ba1 |

Baa3 |

Baa2 |

|

|||||

CDS Spread Increases |

|

|

|

|

|

|

|

||

|

|

|

|

|

CDS Spreads |

|

|||

Issuer |

Senior Ratings |

Jul. 10 |

Jul. 3 |

Spread Diff |

|||||

Neiman Marcus Group LTD LLC |

Ca |

3,508 |

|

|

|

3,286 |

222 |

||

Frontier Communications Corporation |

Caa2 |

3,063 |

|

|

|

2,928 |

135 |

||

Penney (J.C.) Corporation, Inc. |

Caa3 |

4,662 |

|

|

|

4,610 |

52 |

||

Nabors Industries Inc. |

B1 |

566 |

|

|

|

526 |

40 |

||

Dean Foods Company |

Caa2 |

2,539 |

|

|

|

2,501 |

38 |

||

AK Steel Corporation |

B3 |

897 |

|

|

|

861 |

36 |

||

Talen Energy Supply, LLC |

B3 |

662 |

|

|

|

628 |

34 |

||

Realogy Group LLC |

B2 |

804 |

|

|

|

772 |

32 |

||

United States Steel Corporation |

B2 |

565 |

|

|

|

533 |

31 |

||

American Axle & Manufacturing, Inc. |

B2 |

347 |

|

|

|

323 |

24 |

||

CDS Spread Decreases |

|

|

|

|

|

|

|

||

|

|

|

|

|

CDS Spreads |

|

|||

Issuer |

Senior Ratings |

Jul. 10 |

Jul. 3 |

Spread Diff |

|||||

Diamond Offshore Drilling, Inc. |

B3 |

398 |

|

|

|

444 |

-46 |

||

Cablevision Systems Corporation |

B3 |

388 |

|

|

|

424 |

-36 |

||

R.R. Donnelley & Sons Company |

B3 |

789 |

|

|

|

822 |

-33 |

||

Beazer Homes USA, Inc. |

B3 |

413 |

|

|

|

441 |

-28 |

||

K. Hovnanian Enterprises, Inc. |

Caa3 |

1,892 |

|

|

|

1,914 |

-22 |

||

Office Depot, Inc. |

B3 |

483 |

|

|

|

505 |

-22 |

||

Dish DBS Corporation |

B1 |

436 |

|

|

|

457 |

-20 |

||

Mattel, Inc. |

B3 |

313 |

|

|

|

332 |

-18 |

||

JetBlue Airways Corp. |

Ba1 |

88 |

|

|

|

105 |

-17 |

||

Univision Communications Inc. |

Caa2 |

293 |

|

|

|

304 |

-11 |

||

Source: Moody's, CMA

15 |

JULY 11, 2019 |

CAPITAL MARKETS RESEARCH / MARKET OUTLOOK / MOODYS.COM |

vk.com/id446425943 |

CAPITAL MARKETS RESEARCH |

|

Market Data

Figure 4. CDS Movers - Europe (July 3, 2019 – July 10, 2019) |

|

|

|

|

|

|

|

||

CDS Implied Rating Rises |

|

|

|

|

|

|

|

||

|

CDS Implied Ratings |

|

|

|

|

||||

Issuer |

Jul. 10 |

Jul. 3 |

|

Senior Ratings |

|

||||

Safeway Limited |

Aa1 |

A1 |

Baa2 |

|

|||||

Wm Morrison Supermarkets plc |

Baa2 |

Ba1 |

Baa2 |

|

|||||

Banque Federative du Credit Mutuel |

Aa2 |

Aa3 |

Aa3 |

|

|||||

Nordea Bank Abp |

Aa1 |

Aa2 |

Aa3 |

|

|||||

Bayerische Landesbank |

A1 |

A2 |

Aa3 |

|

|||||

SEB AB |

Aa1 |

Aa2 |

Aa2 |

|

|||||

DNB Bank ASA |

Aa1 |

Aa2 |

Aa2 |

|

|||||

Siemens Aktiengesellschaft |

Aaa |

Aa1 |

A1 |

|

|||||

Bank of Scotland plc |

A3 |

Baa1 |

Aa3 |

|

|||||

National Grid Plc |

A2 |

A3 |

Baa1 |

|

|||||

|

|

|

|

|

|

||||

CDS Implied Rating Declines |

|

|

CDS Implied Ratings |

|

|

|

|

|

|

Issuer |

Jul. 10 |

Jul. 3 |

|

Senior Ratings |

|

||||

Spain, Government of |

A1 |

Aa3 |

Baa1 |

|

|||||

Banco Bilbao Vizcaya Argentaria, S.A. |

A3 |

A2 |

A3 |

|

|||||

HSBC Holdings plc |

A3 |

A2 |

A2 |

|

|||||

Credit Agricole S.A. |

Aa2 |

Aa1 |

A1 |

|

|||||

Banco Santander S.A. (Spain) |

Aa3 |

Aa2 |

A2 |

|

|||||

Vodafone Group Plc |

Baa2 |

Baa1 |

Baa2 |

|

|||||

Swedbank AB |

Aa3 |

Aa2 |

Aa2 |

|

|||||

RCI Banque |

Ba1 |

Baa3 |

Baa1 |

|

|||||

Credit Suisse AG |

A3 |

A2 |

A1 |

|

|||||

BASF (SE) |

Aa2 |

Aa1 |

A1 |

|

|||||

CDS Spread Increases |

|

|

|

|

|

|

|

||

|

|

|

|

|

CDS Spreads |

|

|||

Issuer |

Senior Ratings |

Jul. 10 |

Jul. 3 |

Spread Diff |

|||||

Galapagos Holding S.A. |

C |

24,036 |

|

|

|

19,775 |

4,261 |

||

PizzaExpress Financing 1 plc |

Caa2 |

4,667 |

|

|

|

3,710 |

957 |

||

Boparan Finance plc |

Caa1 |

3,551 |

|

|

|

3,275 |

276 |

||

CMA CGM S.A. |

B3 |

1,196 |

|

|

|

1,065 |

131 |

||

Casino Guichard-Perrachon SA |

B1 |

949 |

|

|

|

823 |

127 |

||

Novafives S.A.S. |

Caa1 |

460 |

|

|

|

414 |

47 |

||

Matalan Finance plc |

Caa1 |

712 |

|

|

|

675 |

37 |

||

Jaguar Land Rover Automotive Plc |

B1 |

605 |

|

|

|

569 |

36 |

||

Ineos Group Holdings S.A. |

B1 |

210 |

|

|

|

183 |

27 |

||

Altice Finco S.A. |

Caa1 |

362 |

|

|

|

339 |

23 |

||

CDS Spread Decreases |

|

|

|

|

|

|

|

||

|

|

|

|

|

CDS Spreads |

|

|||

Issuer |

Senior Ratings |

Jul. 10 |

Jul. 3 |

Spread Diff |

|||||

Wm Morrison Supermarkets plc |

Baa2 |

66 |

|

|

|

99 |

-33 |

||

METRO Finance B.V. |

Ba1 |

125 |

|

|

|

139 |

-14 |

||

Safeway Limited |

Baa2 |

24 |

|

|

|

35 |

-12 |

||

CaixaBank, S.A. |

Baa1 |

72 |

|

|

|

79 |

-7 |

||

Bankinter, S.A. |

Baa2 |

61 |

|

|

|

68 |

-7 |

||

Vedanta Resources Limited |

B2 |

457 |

|

|

|

464 |

-7 |

||

Bankia, S.A. |

Baa3 |

77 |

|

|

|

83 |

-6 |

||

Banco Sabadell, S.A. |

Baa3 |

99 |

|

|

|

104 |

-5 |

||

Banco Comercial Portugues, S.A. |

Ba2 |

152 |

|

|

|

156 |

-4 |

||

Unione di Banche Italiane S.p.A. |

Baa3 |

157 |

|

|

|

161 |

-4 |

||

Source: Moody's, CMA

16 |

JULY 11, 2019 |

CAPITAL MARKETS RESEARCH / MARKET OUTLOOK / MOODYS.COM |

vk.com/id446425943 |

CAPITAL MARKETS RESEARCH |

|

Market Data

Issuance

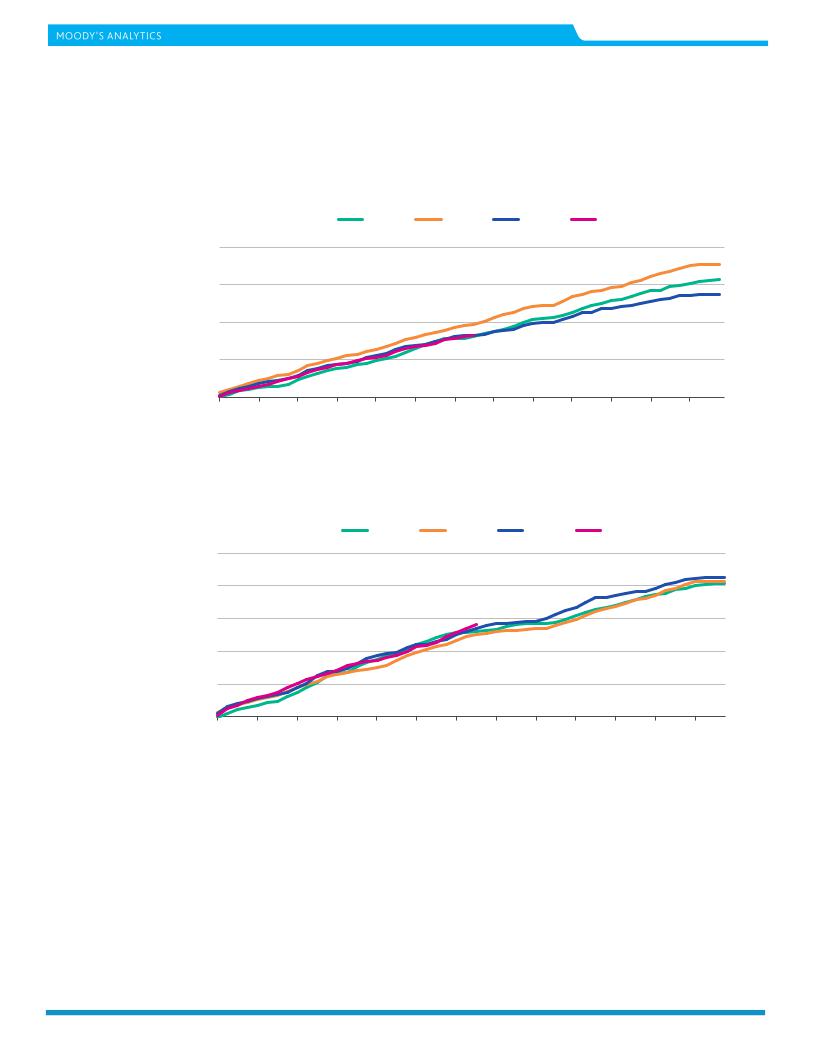

Figure 5. Market Cumulative Issuance - Corporate & Financial Institutions: USD Denominated

Issuance ($B) |

2016 |

|

2017 |

|

2018 |

2019 |

Issuance ($B) |

2,400 |

|

|

|

|

|

|

2,400 |

1,800 |

|

|

|

|

|

|

1,800 |

1,200 |

|

|

|

|

|

|

1,200 |

600 |

|

|

|

|

|

|

600 |

0 |

|

|

|

|

|

|

0 |

Jan Feb Mar |

Apr May |

Jun |

Jul |

Aug |

Sep |

Oct Nov |

Dec |

Source: Moody's / Dealogic

Figure 6. Market Cumulative Issuance - Corporate & Financial Institutions: Euro Denominated

Issuance ($B) |

2016 |

|

2017 |

|

2018 |

2019 |

Issuance ($B) |

1,000 |

|

|

|

|

|

|

1,000 |

800 |

|

|

|

|

|

|

800 |

600 |

|

|

|

|

|

|

600 |

400 |

|

|

|

|

|

|

400 |

200 |

|

|

|

|

|

|

200 |

0 |

|

|

|

|

|

|

0 |

Jan Feb Mar |

Apr May |

Jun |

Jul |

Aug |

Sep |

Oct Nov |

Dec |

Source: Moody's / Dealogic |

|

|

|

|

|

|

|

17 |

JULY 11, 2019 |

CAPITAL MARKETS RESEARCH / MARKET OUTLOOK / MOODYS.COM |

vk.com/id446425943 |

CAPITAL MARKETS RESEARCH |

|

Market Data

Figure 7. Issuance: Corporate & Financial Institutions

|

|

USD Denominated |

|

|

Investment-Grade |

High-Yield |

Total* |

|

Amount |

Amount |

Amount |

|

$B |

$B |

$B |

Weekly |

1.624 |

5.584 |

9.054 |

Year-to-Date |

706.191 |

224.730 |

986.517 |

|

|

Euro Denominated |

|

|

Investment-Grade |

High-Yield |

Total* |

|

|

|

|

|

Amount |

Amount |

Amount |

|

$B |

$B |

$B |

Weekly |

17.344 |

0.903 |

18.839 |

Year-to-Date |

496.443 |

47.359 |

560.323 |

* Difference represents issuance with pending ratings.

Source: Moody's/ Dealogic

18 |

JULY 11, 2019 |

CAPITAL MARKETS RESEARCH / MARKET OUTLOOK / MOODYS.COM |