- •Event risks

- •Valuation risks

- •Liquidity & volatility risks

- •Top 10 risks poll

- •Eurozone crisis 2.0

- •2019 rising risk, depleted ammunition

- •If stimulus is needed, the eurozone may have a problem …

- •… in a year of (possibly disruptive) leadership changes

- •What if populism overcomes Europeanism?

- •Investment implications

- •The EUR would get close to parity with the USD

- •Another eurozone crisis would present a challenge for weaker credits…

- •EUR IG Credit: Contagion likely to drive bear flattening

- •European equities would probably not be hurt as much as they were in 2011

- •Trade tensions end

- •Taking trade to the brink and back

- •Rising trade risks

- •Turning point?

- •The US and China could make a move in 2019

- •Trade policy bliss

- •Investment implications

- •GEMs would be a near-term winner

- •Brace for (climate) impact

- •Investment implications

- •US corporate margins fall

- •The major driver of US earnings could reverse

- •Investment implications

- •The end of the US equity bull market

- •USD Credit would become vulnerable

- •EM reform surprises

- •Great expectations

- •Could the crowded election cycle pave the way for reforms?

- •EM equities and rates would benefit from reforms

- •The ECB initiates new unconventional policies

- •What if the European economy loses momentum?

- •An unappetising menu

- •Investment implications

- •Weaker EUR

- •10-year Bund yield back to zero

- •Euro non-core reaction depends on the type of measures and circumstances

- •Leverage risks and accounting tactics

- •Refinancing challenges ahead

- •Investment implications

- •Challenging consequences

- •The Fed keeps hiking

- •Fed tightens beyond current expected levels

- •Core inflation could accelerate in 2019

- •Phillips Curve steepens

- •Investment implications

- •A more aggressive Fed tightening path would likely see the USD higher

- •US front end of the yield curve would shift up significantly

- •USD Credit under pressure

- •A tough scenario for emerging markets which favours EXD

- •What if there was a liquidity crisis?

- •But corporate bonds remain a structurally illiquid asset class. In particular:

- •Investment implications

- •Fixed income vol comes back

- •The great unwind

- •Why has fixed income vol been so low?

- •Why might this go into reverse?

- •What is happening with fixed income vol now?

- •Investment implications

- •Not all vols are equal

vk.com/id446425943 |

|

MULTI-ASSET ● GLOBAL |

|

11 December 2018 |

|

The ECB initiates new unconventional policies

Chris Hare

Economist

HSBC Bank plc chris.hare@hsbc.com +44 20 7991 2995

Dominic Bunning Senior FX Strategist

HSBC Bank plc dominic.bunning@hsbcib.com +44 20 7992 2113

Dominic Kini

Analyst, Quantitative Credit Strategy

HSBC Bank plc dominic.kini@hsbcib.com +44 20 7991 5599

Song Jin Lee

European Credit Strategist

HSBC Bank plc songjin.lee@hsbc.com +44 20 7991 5259

Wilson Chin, CFA Fixed Income Strategist

HSBC Bank plc wilson.chin@hsbcib.com +44 20 7991 5983

Chris Attfield Strategist

HSBC Bank plc christopher.attfield@hsbcib.com +44 20 7991 2133

Daniel Grosvenor*

Equity Strategist

HSBC Bank plc daniel.grosvenor@hsbcib.com +44 20 7991 4246

* Employed by a non-US affiliate of HSBC Securities (USA) Inc, and is not registered/ qualified pursuant to FINRA regulations

The ECB might enter the next downturn with negative rates…

…so would need to look at restarting QE and, possibly, a range of other unconventional measures…

…which could lead to a weaker EUR, lower bond yields and delay the credit sell-off

What if the European economy loses momentum?

Starting the next downturn with negative rates?

Eurozone growth is slowing (Chart 1), core inflation remains stuck around 1% and lower oil prices mean headline inflation is set to fall back sharply next year. We only expect a single ECB rate rise before the US rates cycle starts turning in 2020 (Chart 2). There is a high risk, therefore, that the ECB will face the unprecedented challenge of entering the next downturn with rates still below zero. With limited likely scope for fiscal action, the ECB might need to deploy an increasing array of stimulus options and initiate new unconventional policies.

An unappetising menu

We discussed these options in An unappetising menu: Options for the ECB in another downturn, 26 November 2018. They range from (limited) rate cuts, to more QE (which would require rule changes), to more 'exotic' measures including helicopter money, equity purchase and changing the inflation target. We think further rate cuts or QE can only be piecemeal, and that political and legal constraints, and financial stability risks, could impede measures that might have a larger economic impact. So the ECB might end up falling short – the next downturn might be prolonged and painful.

1. Eurozone growth is slowing… |

2. …and we only expect one ECB deposit |

|

rate rise before the US cycle turns |

% q-o-q |

|

Eurozone GDP and survey forecasts |

% q-o-q |

% |

||||||||||

1.2 |

|

|

|

|

|

|

|

|

|

|

|

1.2 |

4 |

|

0.6 |

|

|

|

|

|

|

|

|

|

|

|

0.6 |

3 |

|

0.0 |

|

|

|

|

|

|

|

|

|

|

|

0.0 |

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

-0.6 |

|

|

|

|

|

|

|

|

|

|

|

-0.6 |

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

-1.2 |

|

|

|

|

|

|

|

|

|

|

|

-1.2 |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

-1.8 |

|

|

|

|

|

|

|

|

|

|

|

-1.8 |

-1 |

|

07 |

08 |

09 |

10 |

11 |

12 |

13 |

14 |

15 |

16 |

17 |

18 |

19 |

||

|

||||||||||||||

|

|

|

|

Survey model average |

|

|

|

|||||||

|

|

|

|

GDP |

|

|

|

|

|

|

|

|

||

|

|

|

|

90% confidence interval |

|

|

|

|||||||

|

|

Key policy rates |

% |

||

|

|

|

|

|

4 |

|

|

|

|

|

Forecasts |

|

|

|

|

|

3 |

|

|

|

|

|

2 |

|

|

|

|

|

1 |

|

|

|

|

|

0 |

|

|

|

|

|

-1 |

15 |

16 |

17 |

18 |

19 |

20 |

|

Eurozone (Deposit) |

|

US |

Eurozone (Refi) |

|

Source: ECB, Eurostat, HSBC calculations. For methodology, see Surveying the |

|

Source: Bloomberg, HSBC forecasts |

|

surveys: A slowdown, not a slump, for the eurozone, 4 September 2018. |

|

|

|

13

vk.com/id446425943

MULTI-ASSET ● GLOBAL 11 December 2018

The EUR could fall towards parity with the USD

The euro-zone curve would likely bull flatten

Extended forward guidance might have the most effect

The resumption of corporate bond purchases is a risk to our core view

European financials would suffer in this scenario

Investment implications

Weaker EUR

The single currency would likely weaken in anticipation of the announcement of a new round of easing measures, with the implementation itself not necessarily causing further weakness. We saw this in 2014 and 2015 when expectations around ECB easing were rising and EUR-USD fell from around 1.35 to around 1.05. One impediment to depreciation this time around is that the EUR is already somewhat cheap. Our long-term fair value metrics suggest equilibrium would be in the 1.20-1.32 range. A fall towards parity would be likely, but to move into significantly undervalued territory below there may also require an increase in structural or political pressure for the EUR. With EUR-CHF, EUR-SEK and EUR-CEE all facing downward pressure, the respective central banks may be forced to reconsider their own domestic policies at a time when they would all still have very low policy rates. The response might involve direct FX intervention or targeting of currency levels.

10-year Bund yield back to zero

Although the resumption of ECB QE would not increase the net purchases in German public sector purchases (PSPP) issues markedly (due to hard constraints), market expectations that reinvestments would remain for a prolonged period and renewed forward guidance on interest rates, should keep core yields low. The gloomy macro-economic outlook and benign inflation projections would likely bull flatten the eurozone core curves with the 10-year Bund yield potentially heading back towards the 0% level. Supranational bonds could play a more important role as substitute purchases (for German bonds).

Euro non-core reaction depends on the type of measures and circumstances

Investor response would depend on the modalities of the new programme and the situation in Italy. Equity purchases may have a second-round positive effect on sovereign spreads if they caused non-core equity markets to perform. A lower EUR might have beneficial effect on nominal growth, but limited impact on spreads. An extension of PSPP would cause spreads to compress versus CDS but the net impact on yields might also be small. Extended forward guidance might have the most effect, as low rates could impact debt sustainability over time.

Delay the EUR Credit sell off

Our analysis shows that idiosyncratic risks are temporarily suppressed by the announcement of measures such as the Outright Monetary Transactions (OMT) in 2012 and corporate bond purchases (CSPP) in 2016. A key risk to our bearish view on EUR Credit would be if the ECB restarted CSPP. EUR IG spreads could tighten, but in the context of deteriorating corporate earnings, this might just delay a market sell-off but wouldn’t reverse the credit cycle.

Negative impact for European equities

Under this scenario European equities would probably suffer. European earnings are already disappointing versus consensus expectations, and a more pronounced downturn in domestic growth would be likely to drive a significant miss. We would therefore expect further de-rating for the region ahead of any announcement. However, as with previous rounds of stimulus, we would expect the initial reaction to any announcement to be positive, particularly if the ECB moves towards equity purchases as our economists discuss. A weaker Euro would likely drive relative sector returns whilst lower bond yields should support longer duration sectors. An extension of non-standard monetary policy measures would shift the balance of power from lenders to borrowers and would be negative for European banks due to its impact on net interest margins and top-line growth.

14

vk.com/id446425943

MULTI-ASSET ● GLOBAL 11 December 2018

Leverage risks and accounting tactics

Edward Marrinan

Head of Credit Strategy, North America

HSBC Securities (USA) Inc. edward.b.marrinan@us.hsbc.com +1 212 525 4436

Dylan Whitfield

Head of Forensic Accounting (ESG)

HSBC Bank plc dylan.b.whitfield@hsbc.com 44 20 7992 3676

US nonfinancial corporate debt is at its all-time high and average credit ratings of investment grade debt have fallen sharply

Elevated leverage and risk of higher funding costs point to debt servicing and refinancing challenges ahead

Some companies may resort to accounting tactics to meet expectations or covenants

Refinancing challenges ahead

After a period of balance sheet repair and replenishment in 2009-2013, US companies began to actively re-leverage their balance sheets from 2014 onward, tempted by historically low borrowing costs and the desire to capitalize on the gathering US economic recovery. Indeed, US corporate debt as a percentage of GDP is now at a record level, well above the previous peak in 2008.

1. US nonfinancial corporations (core debt) as a share of GDP

|

75% |

|

|

|

|

|

|

|

|

|

70% |

|

|

Nonfinancial corporate debt (LHS) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

(%) |

65% |

|

|

|

|

|

|

|

|

|

Average from |

|

|

|

|

Average from |

|||

GDP |

60% |

|

|

|

Average from |

2008 to 2018 |

|||

|

1962 to 1980 |

|

|

|

|

(69.3%) |

|||

of |

55% |

|

(46.3%) |

|

|

|

2000 to 2008 |

|

|

|

|

|

|

|

|

||||

a share |

|

|

|

|

|

Average from |

(64.8%) |

|

|

50% |

|

|

|

|

|

|

|

||

|

|

|

|

1980 to 2000 |

|

|

|

||

|

|

|

|

|

|

|

|

||

as |

45% |

|

|

|

|

(58.7%) |

|

|

|

|

40% |

|

|

|

|

|

|

|

|

|

35% |

|

|

|

|

|

|

|

|

|

1962 |

1970 |

1978 |

1986 |

1994 |

2002 |

2010 |

2018 |

|

Source: HSBC, BIS total credit statistics

A bigger concern, in our view, is the degraded credit profile of the USD IG nonfinancial corporate universe. According to our calculations, about 50% of the debt capitalization of the USD IG index carries a Bloomberg composite credit rating of BBB. Specifically, the debt market capitalization of the BBB category (i.e. BBB+/BBB/BBB-) of the USD IG corporate bond index is over 2x larger than the debt market capitalization of the entire USD HY cash bond index (see US Credit Strategy, US corporate leverage: Viewer discretion advised, 19 November 2018).

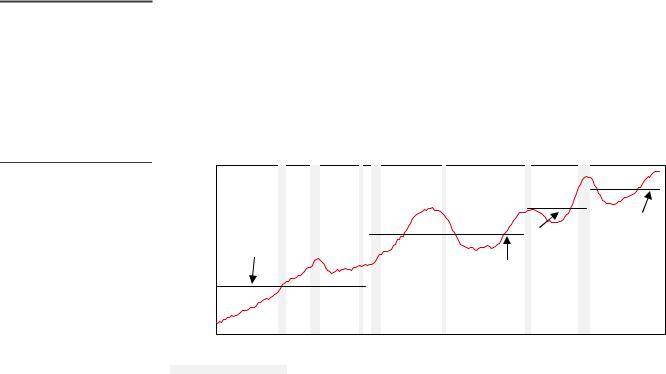

The US corporate sector currently has plenty of cash but net debt to EBITDA for the USD IG nonfinancial corporate universe increased in H1’18 to a 15-year high despite reporting doubledigit percentage earnings growth over the same period.

15

vk.com/id446425943 |

|

MULTI-ASSET ● GLOBAL |

|

11 December 2018 |

|

2. USD IG nonfinancial corporates – Net debt to EBITDA, June 03 – June 18

|

2.7 |

|

|

|

|

|

|

|

|

|

|

|

2.6 |

|

|

|

|

|

|

|

|

|

2.5x |

|

2.5 |

|

|

|

|

|

|

|

|

|

|

(x) |

2.4 |

|

|

|

|

|

|

|

|

|

|

2.3 |

|

|

|

|

|

15-year average |

|

|

|

||

EBITDA |

|

|

|

|

|

|

|

|

|||

2.2 |

|

|

|

|

|

|

|

|

|

|

|

2.1 |

|

|

|

|

|

|

|

|

2.0x |

|

|

to |

2.0 |

|

|

|

|

|

|

|

|

|

|

debt |

|

|

|

|

|

|

|

|

|

|

|

1.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net |

1.8 |

|

|

|

|

|

|

|

|

|

|

1.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.6 |

|

|

|

|

|

|

|

|

|

|

|

1.5 |

|

|

|

|

|

|

|

|

|

|

|

Jun-03 |

Dec-04 |

Jun-06 |

Dec-07 |

Jun-09 |

Dec-10 |

Jun-12 |

Dec-13 |

Jun-15 |

Dec-16 |

Jun-18 |

Source: HSBC, Bloomberg

Investment implications

If corporates were to be faced with the combined challenge of the increased cost of borrowing, and potentially lower operating profits in an economic downturn, then it is likely that some would struggle. The pressure to keep reported results to forecasts and balance sheets within covenant limits could increase the risk that some companies will be tempted to use accounting judgements and decisions to overstate their financial performance and position. For those who that do, the methods are varied and often specific to the circumstances, but include:

Recognising revenue early, for example, by changing an accounting policy to recognise on shipment rather than delivery or, using an aggressive judgement to determine the level of completion on a long-term contract thereby increasing income.

Deferring costs, for example, by capitalising items that should be recognised immediately in the income statement, or re-aging debtors to not recognise a provision for doubtful debts.

Not recognising liabilities for example, taking an overly positive view of an outcome of a claim and therefore not providing for it.

Changing assumptions, for example on fixed assets, if the useful life and residual value are increased then the annual depreciation charge can be reduced and the value of the assets on the balance sheet is maintained.

Deferring large cash payments, for example payments into pension schemes.

Reclassification of one-off items into/out of operating income and cash flows, into financing or “one-offs” when the item is negative and vice versa. This is particularly acute when companies provide investors and lenders with non-GAAP1 measures.

Challenging consequences

Such accounting practices often ultimately unravel, and when that happens the consequences are challenging and sometimes painful for the company. The risk is therefore that a handful of large corporates could face significant hurdles in 2019. Some might be able to restructure their way out of trouble. Others might not be so fortunate.

1 Generally Accepted Accounting Principles

16