- •Event risks

- •Valuation risks

- •Liquidity & volatility risks

- •Top 10 risks poll

- •Eurozone crisis 2.0

- •2019 rising risk, depleted ammunition

- •If stimulus is needed, the eurozone may have a problem …

- •… in a year of (possibly disruptive) leadership changes

- •What if populism overcomes Europeanism?

- •Investment implications

- •The EUR would get close to parity with the USD

- •Another eurozone crisis would present a challenge for weaker credits…

- •EUR IG Credit: Contagion likely to drive bear flattening

- •European equities would probably not be hurt as much as they were in 2011

- •Trade tensions end

- •Taking trade to the brink and back

- •Rising trade risks

- •Turning point?

- •The US and China could make a move in 2019

- •Trade policy bliss

- •Investment implications

- •GEMs would be a near-term winner

- •Brace for (climate) impact

- •Investment implications

- •US corporate margins fall

- •The major driver of US earnings could reverse

- •Investment implications

- •The end of the US equity bull market

- •USD Credit would become vulnerable

- •EM reform surprises

- •Great expectations

- •Could the crowded election cycle pave the way for reforms?

- •EM equities and rates would benefit from reforms

- •The ECB initiates new unconventional policies

- •What if the European economy loses momentum?

- •An unappetising menu

- •Investment implications

- •Weaker EUR

- •10-year Bund yield back to zero

- •Euro non-core reaction depends on the type of measures and circumstances

- •Leverage risks and accounting tactics

- •Refinancing challenges ahead

- •Investment implications

- •Challenging consequences

- •The Fed keeps hiking

- •Fed tightens beyond current expected levels

- •Core inflation could accelerate in 2019

- •Phillips Curve steepens

- •Investment implications

- •A more aggressive Fed tightening path would likely see the USD higher

- •US front end of the yield curve would shift up significantly

- •USD Credit under pressure

- •A tough scenario for emerging markets which favours EXD

- •What if there was a liquidity crisis?

- •But corporate bonds remain a structurally illiquid asset class. In particular:

- •Investment implications

- •Fixed income vol comes back

- •The great unwind

- •Why has fixed income vol been so low?

- •Why might this go into reverse?

- •What is happening with fixed income vol now?

- •Investment implications

- •Not all vols are equal

vk.com/id446425943 |

|

MULTI-ASSET ● GLOBAL |

|

11 December 2018 |

|

US corporate margins fall

Ben Laidler

Global Equity Strategist

HSBC Securities (USA) Inc. ben.m.laidler@us.hsbc.com +1 212 525 3460

Daniel Grosvenor*

Equity Strategist

HSBC Bank plc daniel.grosvenor@hsbcib.com +44 20 7991 4246

Alastair Pinder, CFA Equity Strategist

HSBC Securities (USA) Inc. alastair.pinder@us.hsbc.com +1 212 525 4131

Edward Marrinan

Head of Credit Strategy, North America

HSBC Securities (USA) Inc. edward.b.marrinan@us.hsbc.com +1 212 525 4436

* Employed by a non-US affiliate of HSBC Securities (USA) Inc, and is not registered/ qualified pursuant to FINRA regulations

US corporate margins have been the major driver of recent EPS growth, and pressures are building

US profit margins are at an all-time high and forecast to move up…

…but cost pressures are rising

Faster than expected wage growth could cause a significant miss to earnings estimates and derail the equity bull market

The major driver of US earnings could reverse

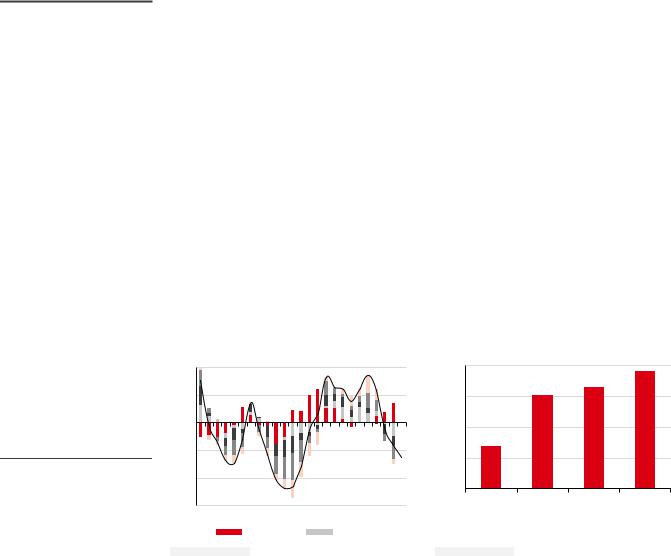

We expect earnings to be the key driver of equities next year. Tax reform provided a significant boost to US earnings this year, with EPS currently estimated to have grown 23% (or c.14% adjusted for the tax reform). This was timely, as equity valuations were beginning to look quite stretched, and earnings growth has been a key support for the market in the face of tighter US monetary policy and higher Treasury yields. But the focus has turned to the outlook for 2019, with slower forecast GDP growth and a marked earnings slowdown, with consensus forecasting 9% growth.

One of the biggest risks to profits comes from margins. Margin expansion has been a key component of higher US earnings, accounting for c.60% of 2018 and 50% of 2019 expected EPS growth. We have argued that a significant negative US earnings surprise would globalise (see Multi-Asset Analysts' Meeting: Autumn risks, 20 September). A 70bp decline in net profit margins would see US index EPS fall in 2019, assuming sales grow in line with consensus expectations. This would probably be enough to see US, and global, equities decline.

US profit margins are at a record high of 11.7% and companies are facing growing cost pressures. Concerns of lower US profit margins have been around for some time but have failed to materialise. Indeed, there are structural reasons why profitability may remain elevated – the reduction of the corporate tax rate to 21%, the growth of tech, and a related increase in industry concentration in the US. But we are now beginning to see a confluence of rising cost pressures which, if corporates are unable to pass onto consumers, could finally bring profit margins down.

1. Lower earnings growth expected in 2019 2. But margins are still expected to expand

30% |

|

MSCI USA earnings growth (Y-o-Y) |

|

|

14% |

|

|

|

|

|

|

|

|

||||||||

25% |

|

|

|

|

|

|

|

|

|

|

|

13% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

20% |

|

|

|

|

|

|

|

|

|

|

margin |

12% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10% |

|

|

|

|

|

|

|

|

|||

15% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

11% |

|

|

|

|

|

|

|

|

|

10% |

|

|

|

|

|

|

|

|

|

|

profit |

9% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

5% |

|

|

|

|

|

|

|

|

|

|

Net |

8% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7% |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

0% |

|

|

|

|

|

|

|

|

|

|

|

6% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

-5% |

|

|

|

|

|

|

|

|

|

|

|

5% |

|

|

|

|

|

|

|

|

|

-10% |

|

|

|

|

|

|

|

|

|

|

|

4% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

03 |

05 |

07 |

09 |

11 |

13 |

15 |

17 |

19 |

||

Q1 |

Q3 |

Q1 |

Q3 |

Q1 |

Q3 |

Q1 |

Q3 |

Q1 |

Q3 |

Q1 |

Q3 |

||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

2014 |

2014 |

2015 |

2015 |

2016 |

2016 |

2017 |

2017 |

2018 |

2018 |

2019 |

2019 |

Net profit margin |

|

Consensus forecast |

|||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

Source: MSCI, Refinitv Eikon, HSBC |

|

Source: MSCI, Refinitv Datastream, IBES, HSBC |

9

vk.com/id446425943

MULTI-ASSET ● GLOBAL 11 December 2018

Wages, tariffs, and financing costs in the spotlight

Wage growth is perhaps the biggest risk. Wages are equal to 12% of US company revenues. So far growth has been subdued. But with the unemployment rate near a 15-year low, the risks are arguably skewed to the upside. Indeed our analysis of corporate conference calls shows over 70% of the discussions on wages indicated upward pressures. Our estimates of sensitivity to wages indicates that a 1ppt rise in wages would take off 1.5ppt of earnings for the MSCI USA, mainly Food Retailing, Transport and Autos (see Laidler, Global Equity Strategy: The greatest threat to global equities, 5 Sept 2018).

The big question is how much tariffs could bite into corporate profits, and this has been widely discussed on US earnings calls (see chart 4). We don’t believe the current 10% tariffs will have too much of an impact on US earnings, potentially taking away just 1ppt of index earnings. But if the situation escalates and a 25% tariff is imposed on all Chinese products this could wipe 4.5ppts from earnings growth in 2019, halving the growth rate from current levels. The Consumer Staples look the most vulnerable (see Laidler, Global Equity Strategy: Sticking to our guns, 6 November 2018).

Borrowing costs are also increasing with the US Fed continuing to tighten monetary policy, and a backdrop of US corporate leverage that has increased significantly in recent years. Whilst maturities have also been extended, short-term debt is relatively low, and cash levels robust; this could however prove a growing headwind as companies have to refinance over the next couple of years (see Laidler, Not a terminal prognosis, 26 June, 2018).

Investment implications

The end of the US equity bull market

A meaningful decline in profit margins – perhaps driven by an acceleration in wage growth – could be enough to derail forecast US profits growth, and hence the US bull market – especially if resurgent wages saw the Fed driven to tighten monetary policy further. Were net profit margins to fall back to their 10-year average of 9%, US EPS would fall by almost 20%. With US equities accounting for over half of global equities, this would have significant impact.

USD Credit would become vulnerable

The prospect of a peak in US corporate profit margins portends a possible decline in US corporate cash flows. With leverage measures already at or close to record high levels, any future weakness in cash flows could further reduce the corporate sector’s overall financial flexibility and increase its vulnerability to adverse economic developments or exogenous shocks. With the corporate sector’s interest coverage ratios already compromised by its currently elevated debt burden, any weakening of corporate profit margins would likely exacerbate debt service challenges.

3. Industry sensitivity to wage growth |

|

|

4. Percentage of companies which have |

|

|||||||||||||||||||||

(MSCI USA) |

|

|

|

|

|

|

|

|

|

|

|

|

indicated they can pass cost of tariffs on |

||||||||||||

6% |

|

Impact of 1ppt wage rise on earnings |

|

|

|

70% |

% of companies that discussed tariffs |

|

|||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

5% |

|

|

|

|

|

|

|

|

on earnings call |

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

60% |

|

|

|

|

|

|

|||||

4% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50% |

|

|

|

|

|

Percentage of |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

companies who have |

|||||

3% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40% |

|

|

|

|

|

indicated they could |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30% |

|

|

|

|

|

offset costs |

|

|

||

1% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20% |

|

|

|

|

|

|

|

|

|

|

Autos |

Equip Retailing |

|

Serv. |

Utilities Energy Durables |

|

Pharma |

Tobacco&Bev |

HardwareTech |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

10% |

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

Goods |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

Capital |

Care |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

retailingFood |

|

Services Telecoms |

|

Media Insurance |

Serv. |

Estate Banks |

|

|

Product |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Cons. |

|

Software& |

Real |

FinancialsDiv. |

Semiconductots Household |

Industrials |

Materials |

StaplesCons |

Energy |

Tech |

DiscCons |

EstateReal |

Utilities |

CareHealth |

Financials |

Telecoms |

||||||||

Transportation |

|

Health |

Materials |

ProfComs& |

|

Cons. |

|

Food, |

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0% |

|

|

|

|

|

|

|

|

|

|

Source: Markit, Refinitiv Datastream, HSBC |

|

|

|

|

|

|

|

|

Source: MSCI, Refinitiv TRKD, IBES, HSBC |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: We look at US earnings calls over the last 90 days |

|

|

|

|

||||||

10

vk.com/id446425943 |

|

MULTI-ASSET ● GLOBAL |

|

11 December 2018 |

|

EM reform surprises

Dr. Murat Ulgen

Global Head of Emerging Markets Research

HSBC Bank plc muratulgen@hsbc.com +44 20 7991 6782

Andre de Silva, CFA Head of Global EM Rates Research

The Hongkong and Shanghai Banking Corporation Limited andre.de.silva@hsbc.com.hk +852 2822 2217

Paul Mackel

Head of Emerging Markets FX Research

The Hongkong and Shanghai Banking Corporation Limited paulmackel@hsbc.com.hk +852 2996 6565

Nicholas Smithie

Senior GEMs Multi-Asset Strategist

HSBC Securities (USA) Inc. nicholas.d.smithie@us.hsbc.com +1 212 525 5350

Ali Cakiroglu

Emerging Markets Strategist

HSBC Bank plc alicakiroglu@hsbc.com +44 20 7991 0547

Tom Russell

Emerging Markets Analyst

HSBC Bank plc thomas.russell@hsbc.com +44 20 3359 5666

We remain broadly cautious on EM going into 2019…

…given the tightening in financial conditions and enduring trade conflicts

But what if EMs start focusing on structural reforms to address their imbalances, boost productivity, and improve efficiency?

Great expectations

The outlook for emerging markets has darkened throughout this year. This reflects a sharp tightening in financial conditions (charts 1 and 2), with many large EM central banks forced to re-couple with the Fed by raising their policy rates either to support their currencies or to prevent capital outflows, in an environment of declining global liquidity and rising funding costs. Moreover, escalation of trade protectionism and its potential impact on global supply chains has further complicated the EM outlook, despite the latest truce following the recent G20 meetings. So we think emerging markets stand on shaky foundations, which is likely to remain the case going into 2019. As such, we are broadly cautious and selective on EM from a top-down perspective (GEMs Investor: Shaky foundations, 7 Oct 2018). But what if external or internal factors were to make EM shine again?

The potential external drivers for a better EM performance are obvious in our view: these include a dovish Fed and a benign US/G3 rate outlook, the end of the USD bull-run, the end of trade tensions, some of which are discussed separately in this report. The domestic drivers, on the other hand, are not equally obvious as EMs are so different from each other. Yet, one common theme could be that EMs surprisingly rekindle their reform stories to help address imbalances, boost productivity and improve efficiency.

1. Financial conditions in EM have tightened distinctly…

4 |

|

2 |

|

0 |

|

-2 |

|

-4 |

|

-6 |

|

4Q12 4Q13 4Q14 |

4Q15 4Q16 4Q17 Nov-18 |

REER |

Lending cond. |

Source: HSBC calculations

2. ...increasing the risks of a slowdown in EM economic activity

0.7

0.6

0.5

0.4

0.3

No lag 1Q ahead 2Q ahead 3Q ahead  Correlation coefficient (FCI vs GDP)

Correlation coefficient (FCI vs GDP)

Source: HSBC calculations

11

vk.com/id446425943

MULTI-ASSET ● GLOBAL 11 December 2018

Reforms could have a strong impact on Brazil and South Africa

Could the crowded election cycle pave the way for reforms?

2018 saw elections in Russia, Turkey, Mexico and Brazil, though 2019 will be even busier, with nearly half (13) of the 30 countries under our coverage holding elections, ranging from presidential, parliamentary to local elections.

Among the larger EMs, markets will closely follow elections in Turkey, Indonesia, India, South Africa, Argentina and Poland, in chronological order. Anecdotally, structural reforms become more pressing when there is economic hardship and/or pressure from financial markets. Similarly, sweeping reforms could arguably be better timed right after the elections in order to capitalise on fresh mandates. This is sometimes referred to as the ‘first 100-day impact’.

In terms of potential reforms, markets could be positively surprised if we see progress on:

Argentina: Fiscal reforms were in line with the IMF programme

Brazil: Social security and fiscal reforms to rein in the budget deficit and public debt, privatisation efforts

India: Continued fiscal reforms and overhaul of the banking system

Indonesia: Continued fiscal reforms and infrastructure investments

Mexico: Earlier energy reforms were implemented, prudent fiscal stance

Russia: President Putin’s “May Decree” actually boosted potential growth (Russia’s “May Decree”: Short-term pain for uncertain long-term gain, 26 June 2018)

South Africa: Labour market and education reform and reforming the parastatal companies

Turkey: Labour market reforms, education reform, food supply management

Investment implications

EM equities and rates would benefit from reforms

Reforms that help improve long-term growth should support equity valuations which are a function of future economic performance and cost of capital. Labour market reforms should be positive for all sectors, while infrastructure investments should support the capex sector. Fiscal reforms could be positive for fixed income markets, especially for long duration by reducing supply and risk premium.

South Africa and Brazil stand out in particular. The former is on the cusp of losing its full investment grade status and with it, potential WGBI exclusion if Moody's downgrades the sovereign. On the other hand, as we saw in early 2018, any positive fiscal news would reduce the risk of a downgrade. In the case of Brazil, the focus on reform starts with social security given the need to stabilise its debt. The incoming administration could also surprise with a more extensive privatisation of state-owned enterprises.

A reform wave, if credible, would lead to strong rally by EM FX carry

Prospects for EM currencies partly hinge on their countries’ growth outlooks improving and/or progress on reforms being made. If China also stimulated its economy further, there could be a lift to broader EM confidence. For many EM countries that are commodity producers, positive impact from terms of trade could re-emerge. This could affect the relative performance in EM currencies, with commodity importing currencies (INR, PHP, and THB) generally underperforming versus the exporters (MYR, RUB, BRL, COP, CLP, PEN and MXN).

Local elections and incoming governments are also important. The ZAR’s poor performance since

President Ramaphosa took office in early 2018 is a cautious reminder. In 2019, the new Mexican and Brazilian governments will face greater scrutiny. Nonetheless, should those governments surprise by making progress on reforms, then the MXN and BRL could stage meaningful recoveries. Other tests for the INR, IDR and TRY will also soon emerge.

12