Global Asset Allocation Strategy (ENG) April 2019 M_watermark

.pdf

vk.com/id446425943

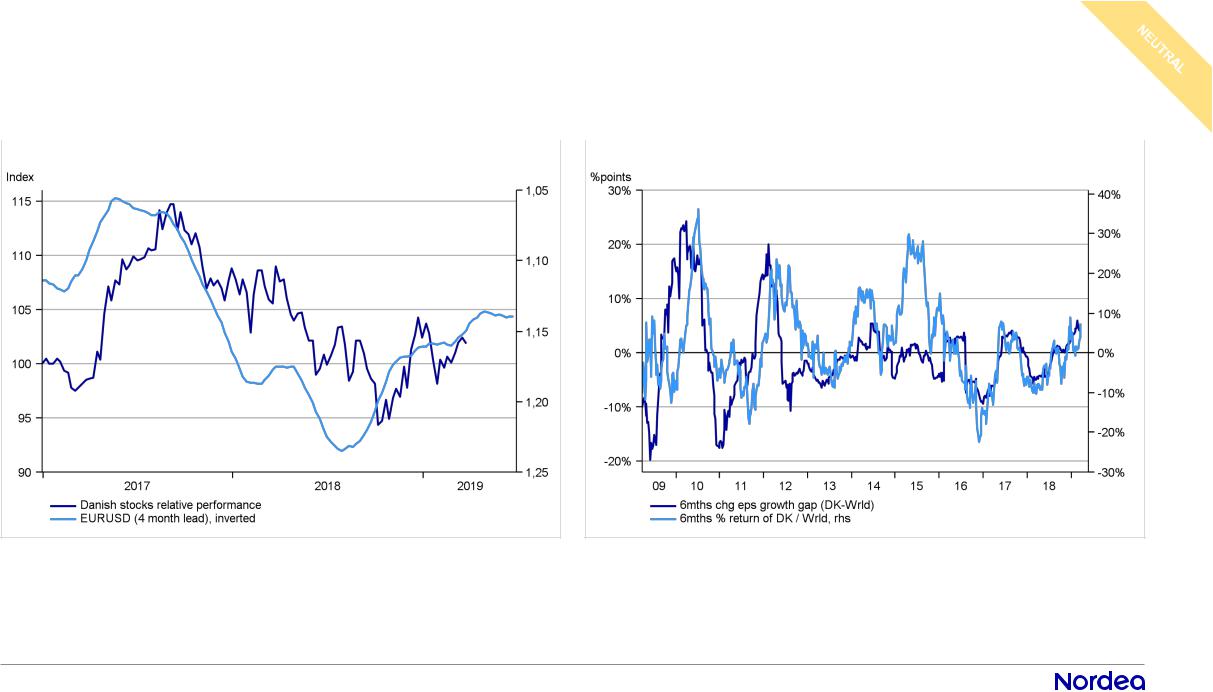

Denmark│ Tactical outlook balanced, but more positive given the sector composition

A stronger dollar tends to support Danish companies earnings |

|

Despite fluctuations the relationship holds up well |

|

||

|

|

|

Source: Thomson Reuters / Nordea |

Source: Thomson Reuters / Nordea |

•Danish stocks have continued to catch up during March with defensives now again leading and earnings revisions favor DK stocks.

•Latest earnings season prospects seems marginally better than global earnings picture for DK stocks, but the overweight in industrials is a headwind.

•Valuation remains a headwind but given shifts in FX and the heavy weight of health care in the index is positive. We remain neutral with a positive tilt.

This material was prepared by Investments |

vk.com/id446425943

Norway │ Solid growth, but mixed outlook for oil

Violent turn in oil prices, outlook is mixed |

|

Norwegian equites are getting more expensive |

|

|

|

Source: Thomson Reuters / Nordea |

Source: Thomson Reuters / Nordea |

•Oil prices has been a tailwind so far this year, but the structural outlook is mixed, which means the support could easily turn again.

•The outlook for the Norwegian economy is solid and will support strong expected earnings growth, however a lot is already priced.

•We don’t expect support from weaker NOK, also due to the more hawkish central bank. In sum, a balanced outlook for Oslo Børs, we remain neutral.

This material was prepared by Investments |

vk.com/id446425943

Sweden │Industrial cycle still warrants some caution

Industrials-heavy Sweden is dependent on the global momentum |

|

Swedish equities lagging behind global |

|

|

|

Source: Thomson Reuters / Nordea |

Source: Thomson Reuters / Nordea |

•As previously flagged for, the EZ manufacturing slump and weaker Chinese data has weighed on the industrial cycle.

•The recent bounce in Swedish industrials appears premature given the worsening Chinese industrial cycle, stay neutral.

•The Swedish economy is doing well, but the housing sector remains a risk, and could continue to weigh on the large banking sector.

vk.com/id446425943

Japan │ Better value is to be had elsewhere, lower to underweight

Clear underperformance in Japan, which we believe will continue |

|

Earnings are lagging the rest of the world |

|

|

|

Source: Thomson Reuters / Nordea |

Source: Thomson Reuters / Nordea |

•We lower Japan to underweight on weaker relative potential. Simply put, Japan continues to be an uninspiring story from an investment perspective.

•The earnings outlook is dismal and estimates points towards negative earnings growth this year. Margins are also well below the other regions.

•Valuation is low but not a positive given the earnings picture, and foreign investors are leaving Japan. We think the money is better deployed elsewhere.

vk.com/id446425943

Sectors│ Returns (in SEK)

EXCESS

vk.com/id446425943

Industrials│ Industrial cycle remains under pressure

Trade hopes and risk-on sentiment buoy industrials… |

|

…but global manufacturing woes are not over |

|

|

|

Source: Thomson Reuters / Nordea |

Source: Thomson Reuters / Nordea |

•The risk-on sentiment, spurred by a dovish Fed and hopes of a trade deal have, has triggered a comeback for industrials.

•Our view is that the trade conflict has played a very limited role in the global slowdown, which is why we choose to fade the partly trade driven rally.

•As evident from recent Eurozone PMIs, global manufacturing woes are not over. Signs of acceleration in China also remain limited. UW industrials.

vk.com/id446425943

Consumer Discretionary │ Idiosyncratic factors distorts the tactical call

Consumer Discretionary has done ok in 2018 |

|

US consumer might experience some downside |

|

|

|

Source: Thomson Reuters / Nordea |

Source: Thomson Reuters / Nordea |

•Consumer Discretionary is torn between the waning brick-and-mortar business and the booming online retail business, making the outlook hard to assess.

•The sector usually performs well in an early-cycle environment which was distorted by the US tax-reform in 2018 – but effects are waning.

•As the cycle matures the labour-intensive part of the sector will struggle while online retailers (e.g. Amazon) might perform.

vk.com/id446425943

Consumer Staples │ Short term upside from rates

Lower rates favors Consumer Staples |

|

Earnings growth for 2019 are close to the 2018 figures |

|

|

|

Source: Thomson Reuters / Nordea |

Source: Thomson Reuters / Nordea |

•The pressure from rates on bond proxies has eased, and the lower rates favors Consumer Staples, and fundamentals look more attractive.

•Structural long term challenges remain in the sector, where especially E-commerce is changing the landscape.

•Earnings have held up well compared the rest of the sectors. Margin pressure from freights costs have abated, although labor cost pressure persist.

vk.com/id446425943

Healthcare │ A good late cycle play

Healthcare typically performs well in late cycles |

|

High drug prices has lead to pollical pressure |

|

|

|

Source: Thomson Reuters / Nordea |

Source: Thomson Reuters / Nordea |

•Major M&A activity in the sector as a series of deals involving big pharma acquiring cheap biotech companies sparked off lately over the Christmas.

•Renewed focus from Trump on curbing prices, but so far the pressure is on the middlemen instead of big pharma.

•Fundamentals are still strong and Healthcare is typically a good late cycle sector.

vk.com/id446425943

Financials │ Cheap, but growth limits the upside

Flat US curve compress interest rate margins |

|

Weak ec. momentum and loan growth weights on European financials |

|

|

|

Source: Thomson Reuters / Nordea |

Source: Thomson Reuters / Nordea |

•Financials has underperformed the market YTD but are still very cheap versus history. The banking sector is split between US and EU banks.

•European banks struggle with several things, among this weaker macro momentum and political uncertainty.

•European risks and regulation are a headwind, while US deregulation provides a tailwind. Put together, we recommend neutral.