Global Asset Allocation Strategy (ENG) April 2019 M_watermark

.pdf

vk.com/id446425943

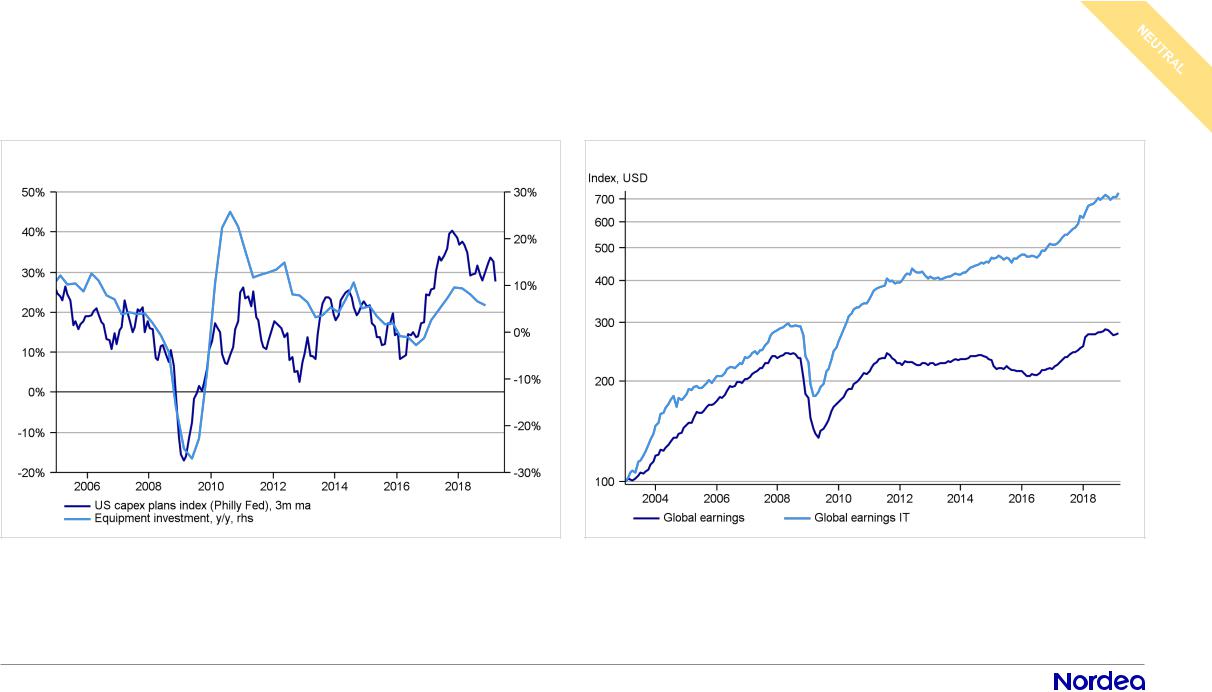

IT │ Earnings outlook is weak

Companies expect strong growth in investments |

|

Extremely strong earnings growth |

|

|

|

Source: Thomson Reuters / Nordea |

Source: Thomson Reuters / Nordea |

•IT has reclaimed lost ground in the recent rally, despite semi-cycle weakness and previous China cycle warnings from behemoths Apple and Samsung.

•The cyclical outlook has deteriorated, though both consumption, capex and the structural outlook (digitalization) supports the sector.

•Protectionism and trade war are obvious risks, and the risk/reward is no longer there for an overweight. We stick to a neutral weight.

vk.com/id446425943

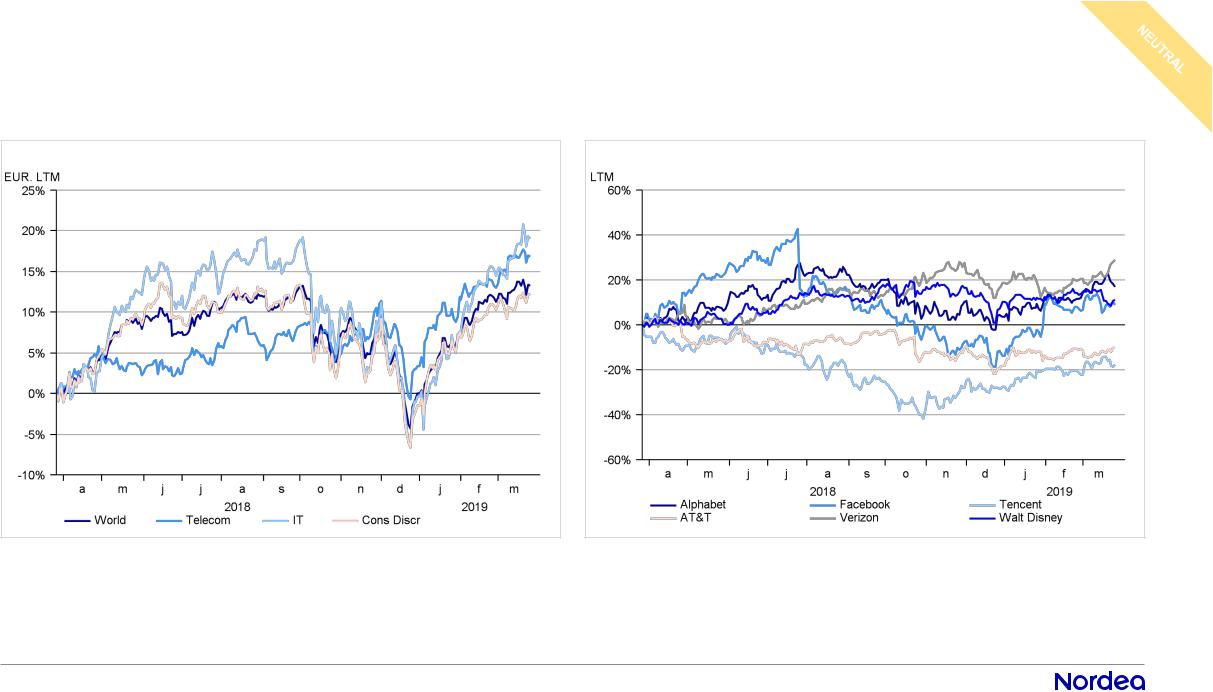

Communications Services│ Estimated earnings are holding up

Stocks moved from IT & Consumer Discretionary into Telecom |

|

Biggest names in the new sector |

|

|

|

Source: Thomson Reuters / Nordea |

Source: Thomson Reuters / Nordea |

|

•Earnings estimates has fared much better for the communication sector than for the rest of the cyclicals, and that is a support.

•The new sector includes companies that facilitate “communication & offer related” content and information through media.

•Housing a majority of the FAANGs and their Chinese counterparts, the concentration of higher valued names poses a risk in a shakier environment.

vk.com/id446425943

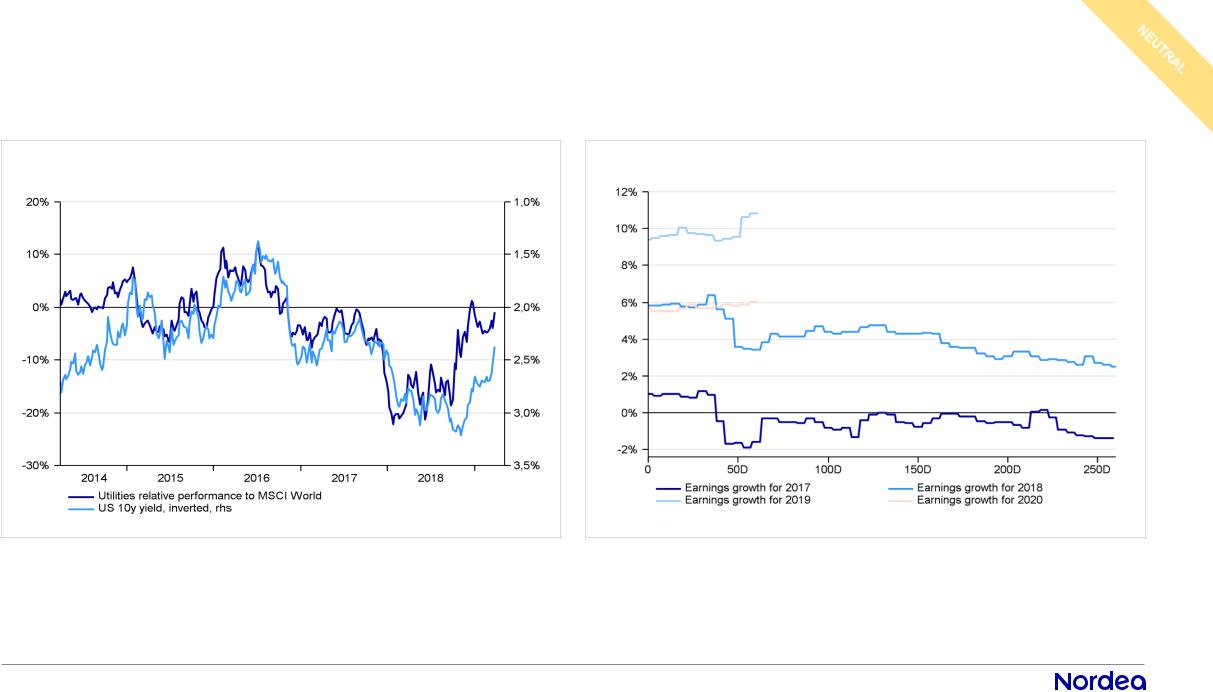

Utilities │Stable earnings outlook

Less pressure from higher yields |

|

Better earnings outlook for Utilities |

|

|

|

Source: Thomson Reuters / Nordea |

Source: Thomson Reuters / Nordea |

•There is signs of overcapacity in the USA, which is not good for pricing power in the sector. We are also running at low levels of capacity utilization.

•Earnings revisions have turned positive, and the growth outlook for next year is improving.

•Utilities is highly levered and pay high dividends. If rates go higher it could hurt Utilities through higher costs, but this pressure has recently dropped.

vk.com/id446425943

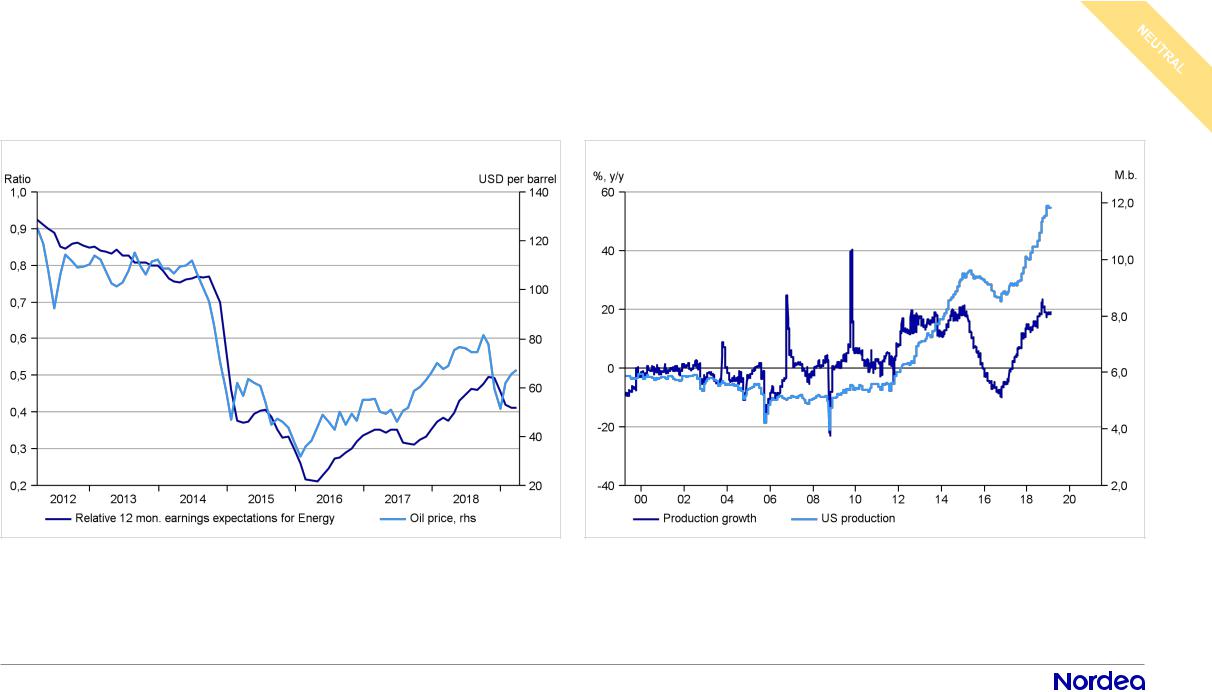

Energy │ Risks are high

The falling oil price is taking its toll on earnings |

|

Booming US shale production |

|

|

|

Source: Thomson Reuters / Nordea |

Source: Thomson Reuters / Nordea |

•Positive output surprise, US waivers for Iranian oil importers and technical headwind led to a bear market in oil, but has rebounded 30% since the bottom.

•Structurally, the outlook is mixed due to the battle between the rise in shale production vs. underinvestment in traditional oil (depletion of traditional wells).

•Earnings estimates has been slashed, despite the recent uptick in oil prices, the risk is high and we stick to a neutral weight on the sector.

vk.com/id446425943

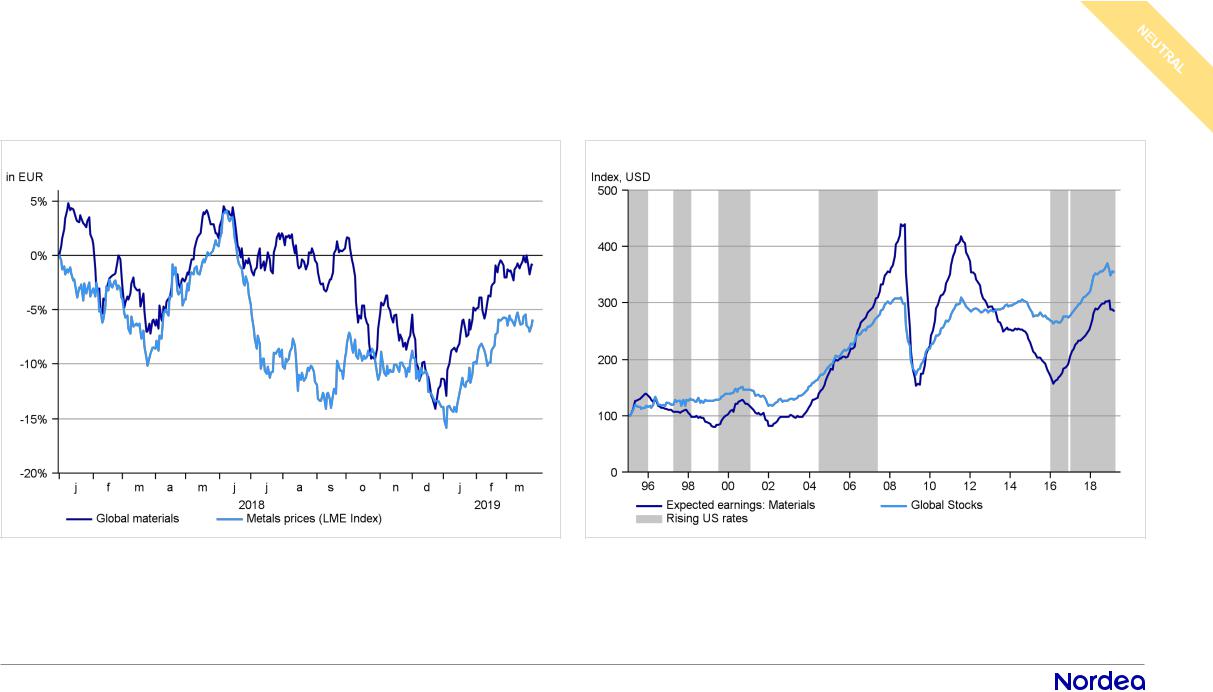

Materials │ Chinese cycle risk still weighs

The recent jump in industrial metals has lent support |

|

Earnings tend to outperform towards the end of the cycle |

|

|

|

Source: Thomson Reuters / Nordea |

Source: Thomson Reuters / Nordea |

•Materials tend to perform well towards the end of the cycle, but as the dominant player within most metals markets, China is a risk for the outlook.

•Despite recent rebound, China-worries continues to haunt the sector. Going forward, Chinese easing could provide a boost, but we wait for the evidence.

•Valuation is relatively attractive, but estimated earnings are being slashed, so we do not think valuation will be in the driver’s seat for now.

vk.com/id446425943

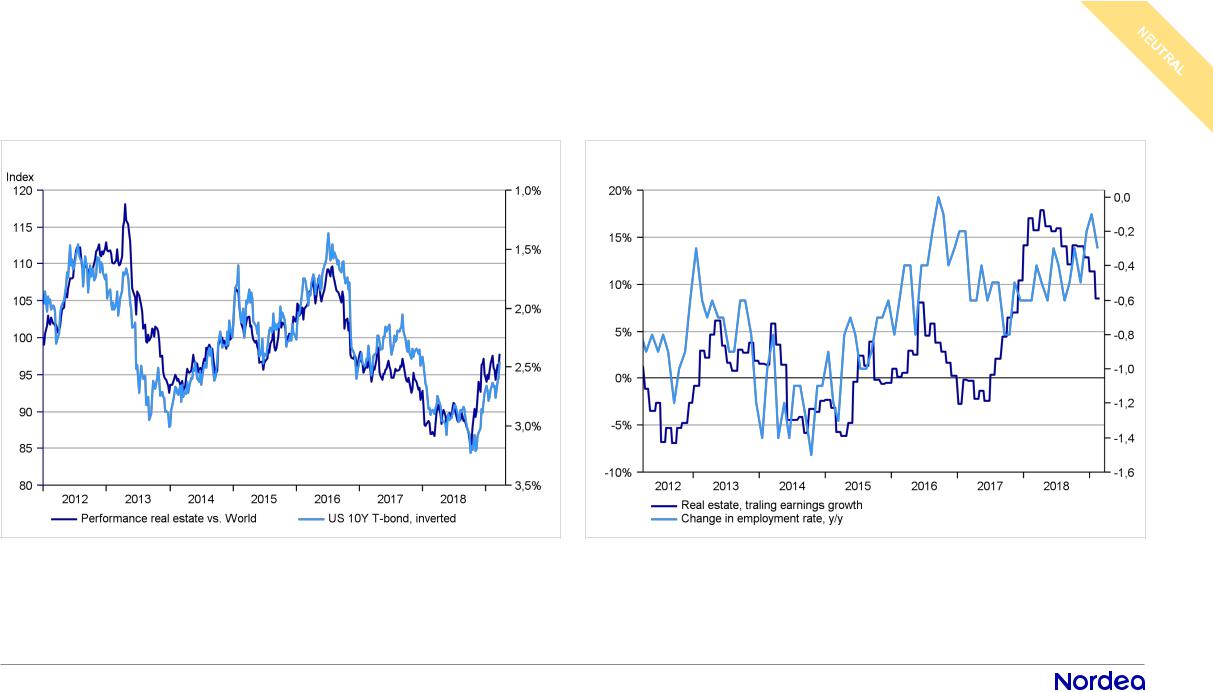

Real Estate │Strong fundamentals but limited upside from yield

Tight relationship with rates |

|

Tight labour markets supports earnings in the sector |

|

|

|

Source: Thomson Reuters / Nordea |

Source: Thomson Reuters / Nordea |

•The real estate sector has experienced strong performance since end of 2018 in the backdrop of the correction, risk off moves and importantly lower rates.

•Where as strong economic momentum in the US and tight labour makets support the sector the strong relationship with rates are expected to hold.

•Since we don’t see significant evidence for significant lower rates from here then the combination of strong fundamentals warrants a neutral position.

vk.com/id446425943 |

April 2019 |

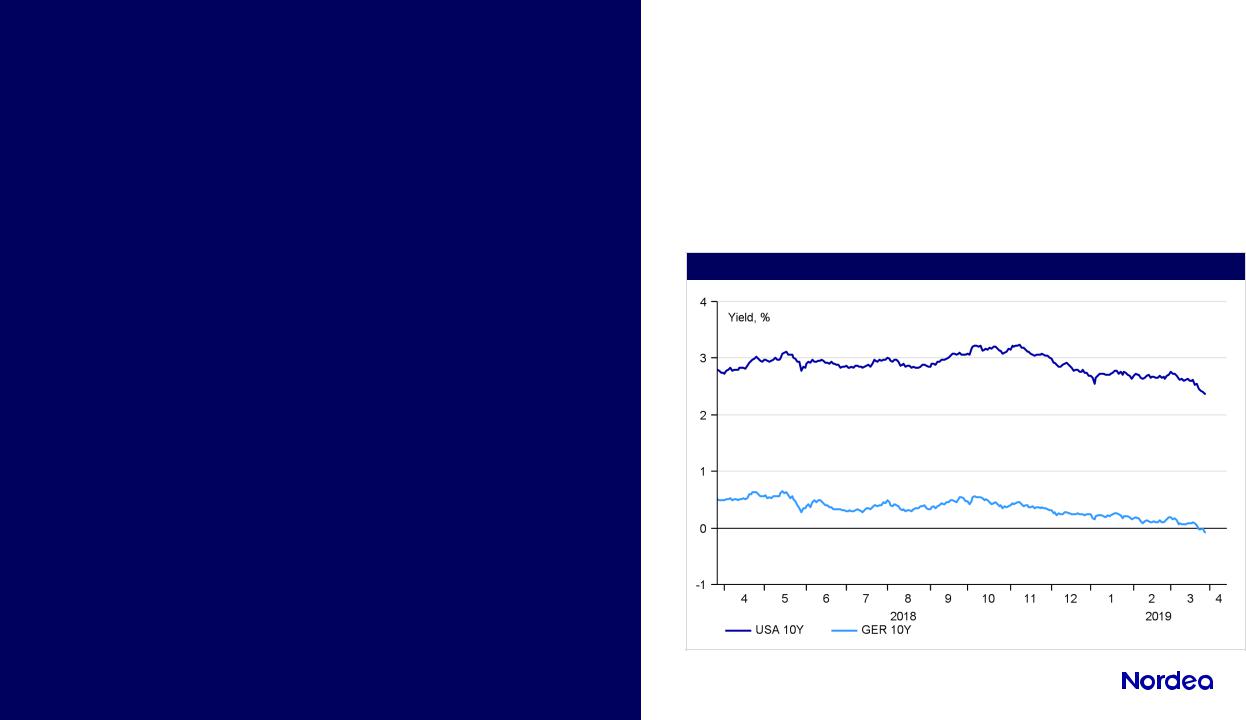

Fed shelves rate hikes for 2019

• Government yields decreased considerably in March. We recommend neutral allocation between the fixed income segments.

• Moderating global growth has made central banks to turn towards more cautious monetary policy, which has pushed yields lower.

German 10-year yield touches negative again

FIXED INCOME

NEUTRAL

Source: Thomson Reuters / Nordea

This material was prepared by Investments |

vk.com/id446425943

Fixed income markets │ April 2019

Corporate bonds Neutral

-Decent economic growth and solid balance sheets still support corporate bonds and issuer credit metrics.

-Government yields have decreased and central banks have shifted towards easier, which means less headwind for corporate bonds. We favour US bonds over European ones.

-Returns from corporate bonds will remain low, but they offer stability to the portfolio.

High-yield bonds Neutral

-High-yield bonds credit metrics are still supported by good level of corporate earnings and low financing costs. Default rates are expected to higher later this year, but the level is still low.

-Moderating growth and tighter financial conditions could cause challenges for high-yield a bit longer term. Currently, however, moderate central banks provide support also for high-yield bonds.

Cash Neutral

-Negative euribor rates mean that return is still basically zero for cash

-Cash provides liquidity to the overall portfolio and it also has an opportunistic role if attractive investment opportunities open up in the markets

Emerging market bonds Neutral

-A dovish turn from the Fed and better FX performance has been supportive for EM bonds this year.

-However, with deteriorating global growth momentum, it is challenging for EM bonds to outperform.

-We estimate risks regarding EM bonds as balanced, and we keep a neutral weight.

Government bonds Neutral

-Government bonds have shown good returns this year, as more dovish central banks have made the environment more duration friendly.

-However, return prospect going forward is modest due to already very low yield.

-Government bonds provide diversification and stability to the overall portfolio

This material was prepared by Investments |

vk.com/id446425943

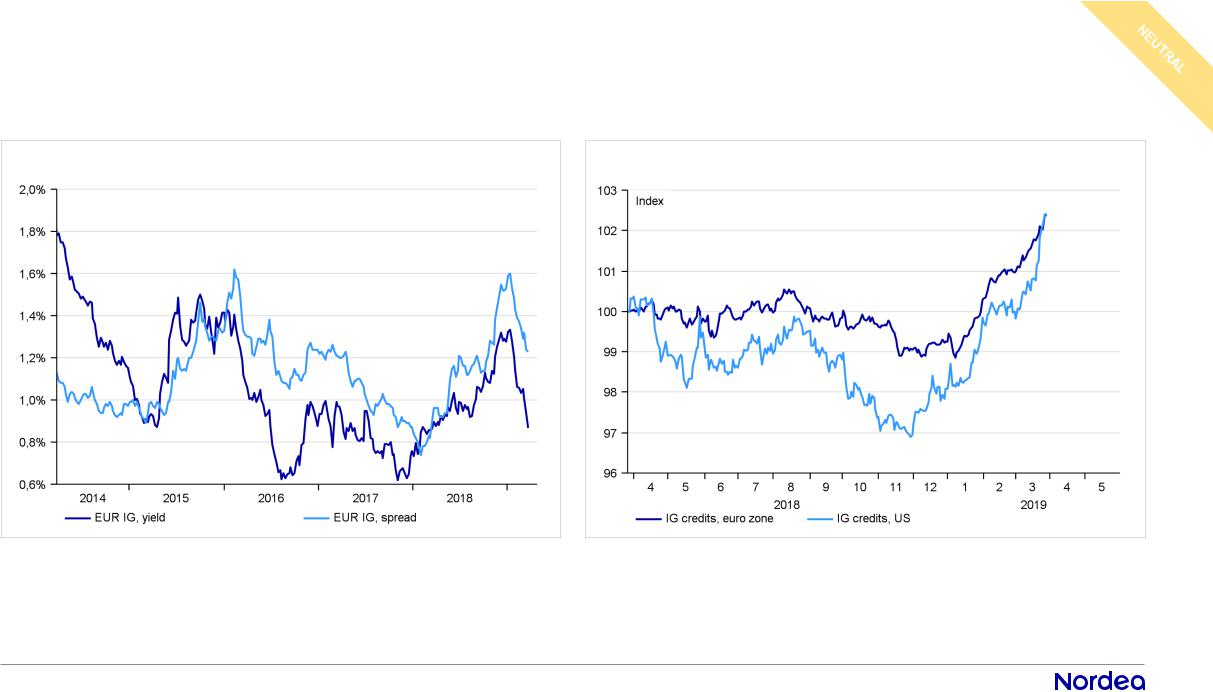

EUR IG │ Continued low yields

Lower yields as government yields dive |

|

Lower yields has helped performance greatly in 2019 |

|

|

|

Source: Thomson Reuters / Nordea |

Source: Thomson Reuters / Nordea |

•Slowing economic growth leaves limited upside pressure in government yields. Combined with healthy corporate balance sheets this limits investment risk.

•After widening considerably last year, corporate bond credit spreads have recovered this year due to a more dovish central banks.

•Return prospect from investment grade credits will remain low, as spreads are tight in a historic context. Corporate bonds offer stability for the portfolio.

This material was prepared by Investments |

vk.com/id446425943

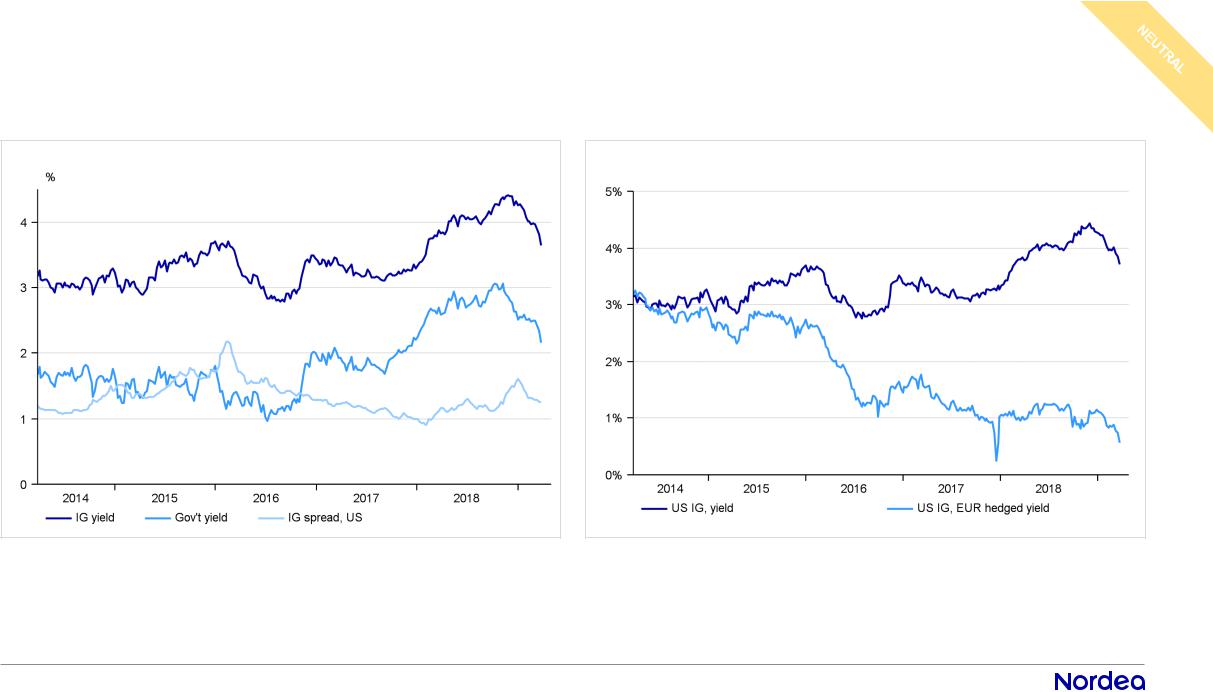

US IG │Environment is more duration friendly

Fed turning more dovish has increased appetite for duration |

|

Currency-hedge eats most of the yield in US IG |

|

|

|

Source: Thomson Reuters / Nordea |

Source: Thomson Reuters / Nordea |

•Corporate credit fundamentals are still decent in the US. Economic growth is decelerating, but still relatively strong.

•Major central banks indicating a pause in monetary tightening supports IG performance prospects in general, although we expect returns to be low.

•We favour US investment grade credits over Eurozone, as the longer US duration appears attractive compared to European.

This material was prepared by Investments |