Global Asset Allocation Strategy (ENG) April 2019 M_watermark

.pdf

vk.com/id446425943

Searching for new drivers

Global Asset Allocation Strategy April 2019

Investments │ Wealth Management

vk.com/id446425943 |

April 2019 |

Searching for new drivers

KEEP EQUITIES NEUTRAL

•The equity rally has tapered off in March, but global equities have already delivered more than a yearly return YTD.

•At the same time downside risks for global growth has increased, and it is too early to call a stabilization in the deterioration in the earnings outlook.

•We still believe we will not see a recession this year, and that decent growth together with relative valuation support equities. On the other hand, trade war risks, a weak industrial cycle and Brexit clearly creates a cloudy outlook. We keep our neutral allocation while markets are searching for new drivers.

EQUITY STRATEGY: Lift Europe

•We recommend to lift Europe to an overweight position. We think investors are too pessimistic as we expect fundamentals to stabilize, and the region is fairly priced.

•Japan is uninspiring on all counts, especially earnings, and we lower Japan to underweight.

•Within equity sectors we move Industrials to underweight on the back of weakness in the cycle, and lift Consumer Staples to neutral. Hence we are moving to a more defensive stance.

FIXED INCOME STRATEGY: Keep neutral

•Government yields decreased considerably in March. We recommend neutral allocation between the fixed income segments.

•Overall, we still expect modest returns from bonds in 2019, as spread and yield levels are low in a historic context.

This material was prepared by Investments |

vk.com/id446425943

Market performance & recommendations

Equity markets the big performer YTD, but taking a bit more cautious turn in March

Source: Thomson Reuters / Nordea

ASSET ALLOCATION |

|

- |

|

N |

+ |

|

|

Comments |

||||

|

|

|

|

|

|

|

|

|

|

|

||

Equities |

|

|

|

|

|

|

|

|

|

|

||

Fixed Income |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

EQUITY REGIONS |

|

- |

|

N |

+ |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

||

North America |

|

|

|

|

|

|

|

|

|

|

||

Europe |

|

|

|

|

|

|

|

|

|

|

||

Japan |

|

|

|

|

|

|

|

|

|

|

||

Emerging Markets |

|

|

|

|

|

|

|

|

|

|

||

Denmark |

|

|

|

|

|

|

|

|

|

|

||

Finland |

|

|

|

|

|

|

|

|

|

|

||

Norway |

|

|

|

|

|

|

|

|

|

|

||

Sweden |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

EQUITY SECTORS |

|

- |

|

N |

+ |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

||

Industrials |

|

|

|

|

|

|

|

|

|

|

||

Cons Discretionary |

|

|

|

|

|

|

|

|

|

|

||

Cons Staples |

|

|

|

|

|

|

|

|

|

|

||

Health Care |

|

|

|

|

|

|

|

|

|

|

||

Financials |

|

|

|

|

|

|

|

|

|

|

||

IT |

|

|

|

|

|

|

|

|

|

|

||

Comm. Services |

|

|

|

|

|

|

|

|

|

|

||

Utilities |

|

|

|

|

|

|

|

|

|

|

||

Energy |

|

|

|

|

|

|

|

|

|

|

||

Materials |

|

|

|

|

|

|

|

|

|

|

||

Real Estate |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

BOND SEGMENTS |

|

- |

|

N |

+ |

|

|

|

||||

Government |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|||

Investment Grade |

|

|

|

|

|

|

|

|

|

|

||

High Yield |

|

|

|

|

|

|

|

|

|

|

||

Emerging Markets |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current allocation |

|

|

|

Previous allocation |

|

|||||

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

This material was prepared by Investments |

vk.com/id446425943

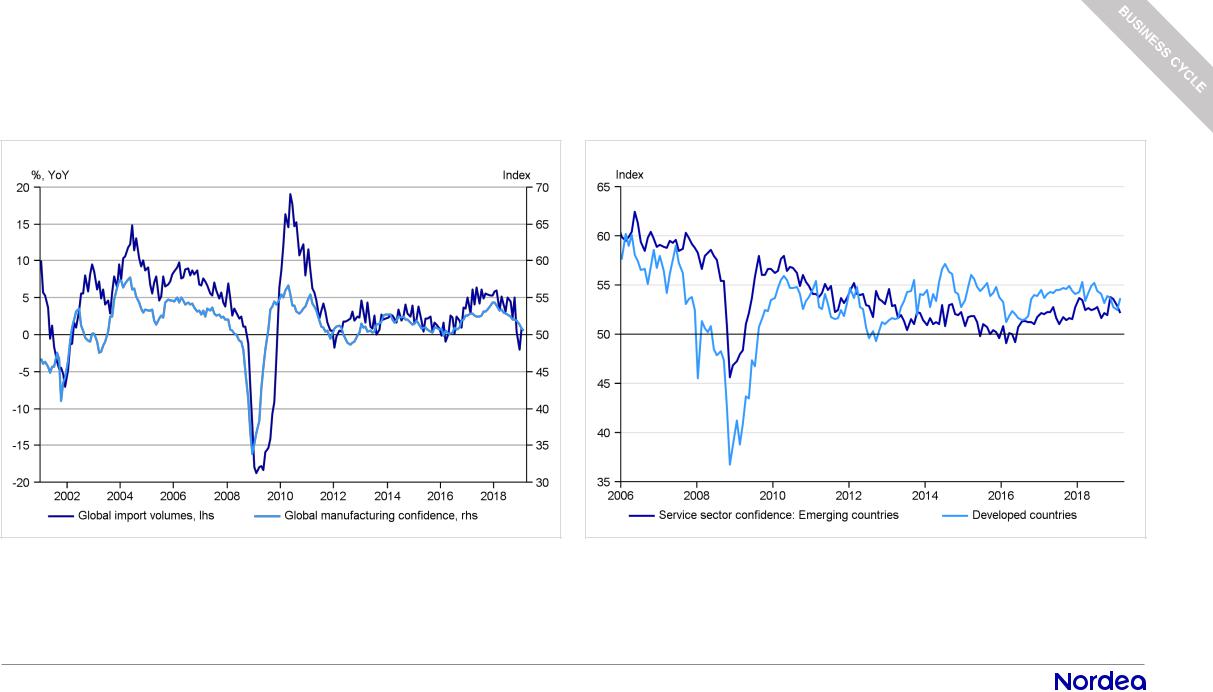

Risks to the growth outlook are increasing

Trade and manufacturing sending troubling signals |

|

But the broad outlook remains reasonably solid |

|

|

|

Source: Thomson Reuters / Nordea |

Source: Thomson Reuters / Nordea |

•The risks to the global economic outlook have increased. Although signs of stabilisation have emerged, the macro backdrop remains a key risk.

•Europe should sooner or later turn around by virtue of the current low activity in the manufacturing sector and an expected turnaround in autos.

•Troublingly, however, global trade volumes have declined as uncertainty over both the US-China situation and Brexit has lingered.

This material was prepared by Investments |

vk.com/id446425943

Too early to call a stabilisation in earnings

On the face of it, it looks like the estimates for 2019 has levelled off |

|

And the revisions seems to recover as well |

|

|

|

Source: Thomson Reuters / Nordea |

Source: Thomson Reuters / Nordea |

•While the bad start for earnings seems to have stabilized, we remain healthy sceptics. Down revisions of this size don’t happen without a reason.

•Q1 is already discounted to be a bad quarter, no news there, but the big question is Q2/Q3 given the string of less than good economic data YTD.

•This years gain will need support from the earnings side to be sustainable, and at the moment, we’re still waiting for that support.

vk.com/id446425943

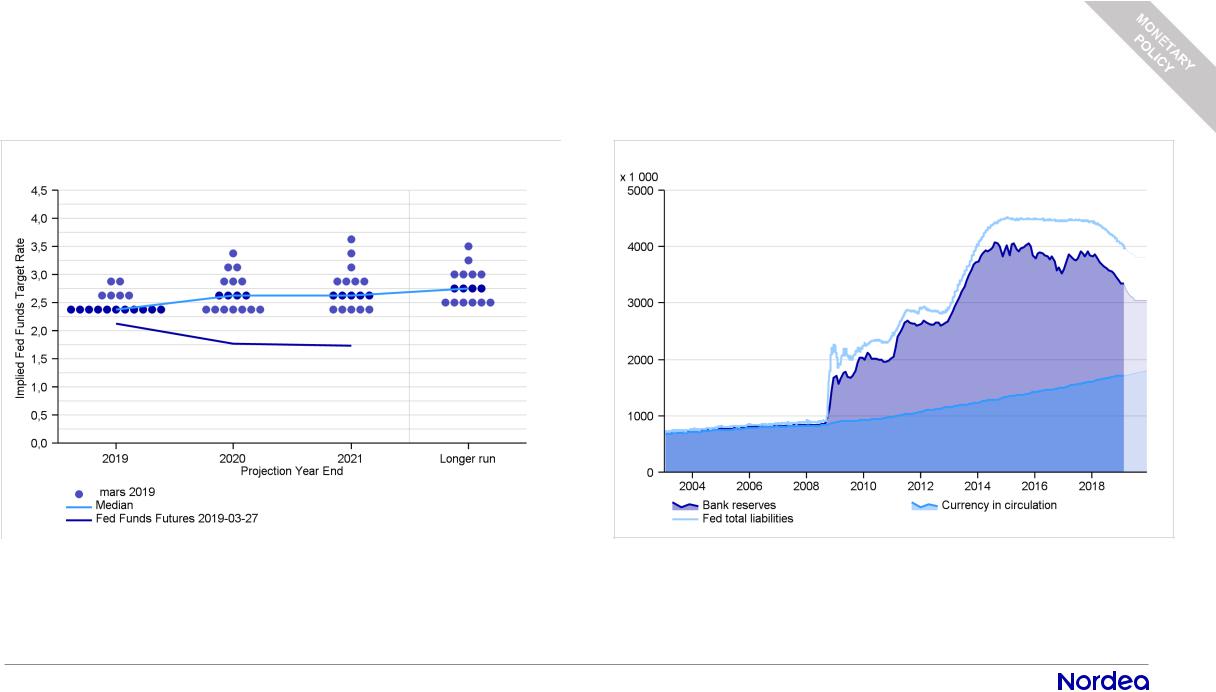

Fed’s dovish pivot: The end (market) or a pause (economists)?

Recently, markets have guided Fed’s expected rate path lower |

|

The end of Q/T might imply shrinking excess reserves |

|

|

|

Source: Thomson Reuters / Nordea |

Source: Thomson Reuters / Nordea |

|

|

|

|

•The Fed catches up with markets and does not expect further rate hikes in 2019. Fixed income markets go further though, pricing in a full cut for 2020.

•Balance sheet contraction (Q/T) will end in Sept. as expected, but the balance sheet will be held constant afterwards, implying falling excess reserves.

•Markets’ assessment is thus hardly “goldilocks”: an end of the Fed hiking cycle is rarely positive for risk assets – shrinking excess reserves neither.

vk.com/id446425943

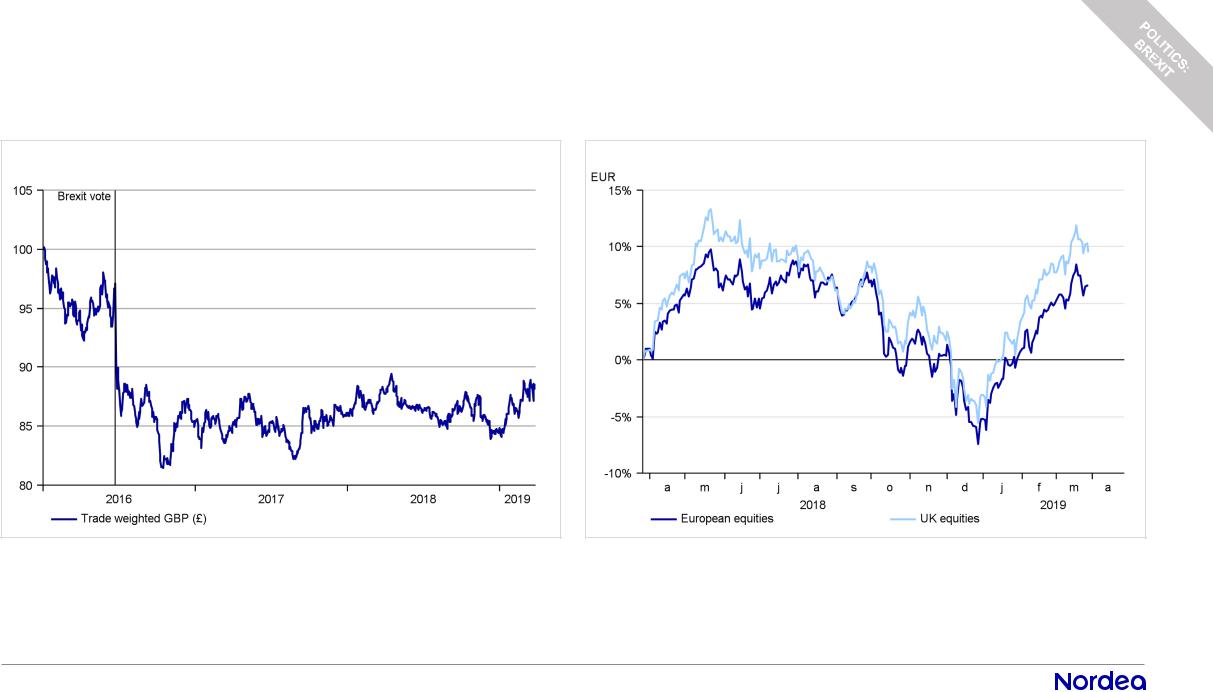

Brexit: no, no and no, but no hard Brexit please

Brexit or not? Here is where the reaction will most probably come |

|

Brexit has so far not affected UK equities more than European ones |

|

|

|

Source: Thomson Reuters / Nordea |

Source: Thomson Reuters / Nordea |

•The indecision of the UK establishment is monumental. Theresa May’s deal has twice been voted down and presently, it looks dead in the water.

•At the same time, parliament has wrested control from the government to break the gridlock but so far hasn’t been able to reach any conclusion.

•The only consensus seems that no one wants a hard Brexit. However, it doesn’t help much when no other option seems to prevail. Wait and see applies.

vk.com/id446425943

Re-rating continues, and yields keep falling

Higher, but not high, valuation in the wake of the rally |

|

Higher “valuation” also in the bond space; yields have cratered |

|

|

|

Source: Thomson Reuters / Nordea |

Source: Thomson Reuters / Nordea |

•After the massive de-rating in 2018, valuation has bounced back on the rally and falling earnings estimates. In absolute terms, valuation has worsened.

•While not high, equity valuation is hardly attractive with the earnings uncertainty. How much re-rating can markets withstand given the earnings outlook?

•On the bond side, lower yields also means less absolute value. In relative terms however, there has been less of a change between equities and bonds.

This material was prepared by Investments |

vk.com/id446425943

Relapse in sentiment during the month, back at stretched levels

The lows in volatility get higher, more to come? |

|

Being bullish is in vouge again |

|

|

|

Source: Thomson Reuters / Nordea |

Source: Thomson Reuters / Nordea |

•Markets took a step back in the middle of the month, as did sentiment. However, the relapse was short and we’re back at early-March levels.

•We still think the optimism is partly misplaced; real money is not yet buying into rally and the bond market is clearly signaling anything but bullishness.

•Our base case still applies: during the rally all news (also bad) has been good news; should this change, sentiment is a risk at current levels.

This material was prepared by Investments |

vk.com/id446425943

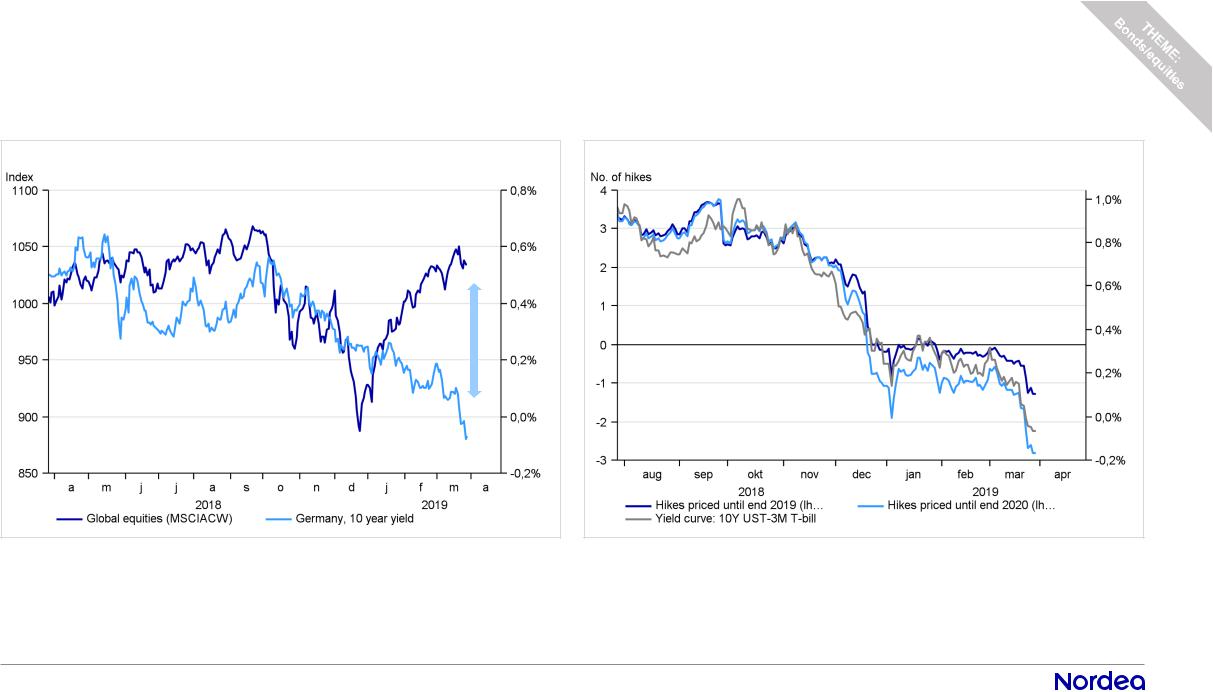

A tale of two markets: Something has to give

Falling rates decoupled from rising equities |

|

Rate cuts and yield curve inversion reflect rising recession risks |

|

|

|

Source: Thomson Reuters / Nordea |

Source: Thomson Reuters / Nordea |

|

•Equities are on track for the strongest 1st quarter start since 1998, closing in on last year’s all-time highs in various indices.

•But the end of the Fed cycle is currently priced and the 3M-10Y US yield curve inverted for the first time since 2007, implying end-cycle recession risks.

•Who’s right – equities (late cycle) or bonds (end-cycle)? If history is any guide, equity investors should watch out. Medium term, it pays to be prudent.