EXAM IN MICROECONOMICS

(January, 2009)

Variant 1

SOLUTIONS

Section 1. Multiple choice questions

You have 60 minutes to do this part of the exam.

Marking scheme: 1 point for a correct answer, -0.25 for a wrong answer, 0 if the answer has not been given.

1. Compared with firms in a perfectly competitive industry, firms in a monopolistically competitive industry are inefficient because they

Make economic profits in the long run

Do not lower the product price if input prices fall

Restrict their output level to maximize profits

Charge the highest price that consumers will pay

Waste resources by producing an excess amount of output

Use the information below to answer Questions 2-3:

Suppose that a monopolistic competitor producing an output of 100 units faces the following revenues and costs: Price = $100; marginal revenue = $50; marginal cost = $75, and average total cost = $90.

2. In order to maximize profit, the firm should:

Reduce output and raise price.

Increase output and raise price.

Increase output and lower price.

Keep output and price the same.

Keep output the same but raise price.

3. At its current output of 100 units, the firm:

Realizes a loss of $4,000.

Realizes a loss of $2,500.

Just breaks even.

Earns a profit of $ 1,000.

Earns a profit of $2,500.

4. A kinked demand curve, under oligopoly, necessarily implies

A gap in the marginal revenue schedule

A gap in the marginal cost schedule

That price need not be above marginal revenue

"Satisficing" rather than optimizing behavior

Formal collusion in price determination

5. Which of the following would you NOT expect to characterize a monopolistically competitive industry?

Positive short-run profits

Zero long run profits

Marginal revenue equal to marginal cost

Price equal to marginal cost

Location used to differentiate products.

6. Which of the following payoff matrices represents the “prisoner’s dilemma” game?

(6;2) (1;7)

(5;3) (0;0)

(4;4) (3;6)

(6;3) (2;2)

(1;1) (3;2)

(2;3) (0;0)

(4;4) (2;3)

(3;2) (5;5)

(2;2) (4;1)

(1;4) (3;3)

Use the following data for Questions 7 -8.

A monopolistic competitor is in the long-run equilibrium at an output of 5,000. Price is $30, and marginal revenue is $10.

7. The marginal cost of the 5,000th unit of output is:

$10.

$30.

$50,000.

$150,000.

Equal to the ATC.

8. Average total cost is:

At a minimum at $30.

Above its minimum point at $30.

At a minimum at $10.

Above its minimum at $10.

Indeterminate without additional information.

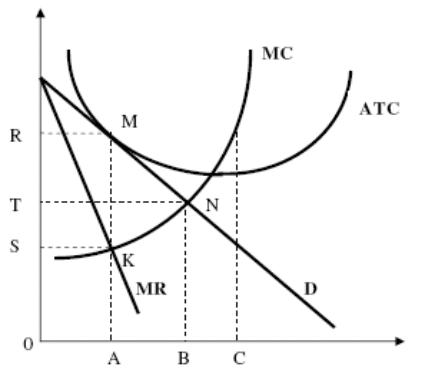

9. The diagram above shows the cost and the revenue curves for a monopolistic competitor. Which of the following is correct?

The profit maximizing output is OA.

The long-run equilibrium price is OT

In the long-run the monopolistic competitor will not operate

The economic profit earned by the monopolistic competitor is SRMK

The long-run average total cost is OS

10. Long-run profit is zero for monopolistic competitors because:

New competitors drive profit to zero in the long run.

They are innovative firms that use their economic profit to develop new products.

They produce at an average total cost greater than the minimum.

They fail to operate at the efficient scale.

All of the above.

11. A monopolistic competitor

Faces horizontal demand curve and earns zero long-run economic profit

Faces downward slopped demand curve and earns zero long-run economic profit

Faces horizontal demand curve and earns positive long-run economic profit

Faces downward slopped demand curve and earns positive long-run economic profit

Faces homogeneous supply curve.

12. The essential characteristic of all cases of imperfect competition is that the single firm's:

Demand curve has a downward slope.

Marginal revenue exceeds the price it charges.

Average cost curve falls over a substantial or large range of outputs.

Product is "differentiated" from one firm to the next.

Average cost curve rises over a substantial or large range of outputs.

13. Which of the following does not represent a barrier to entry into a market?

Import quotas

Patent laws

Government franchises

Anti-trust legislation

Environmental regulation imposed on all producers in a given industry

14. Consider a perfectly competitive market for bananas. In equilibrium:

There is a shortage of bananas

At market price, an individual seller can sell as much bananas as he wants

Quantity of bananas demanded equals quantity of bananas supplied

There is a surplus of bananas

More than one answer is correct

15. Consider a perfectly competitive market for milk, with supply and demand curves of usual shape. Which of the following would most likely increase consumer surplus?

The government introduces a new per-unit tax on milk production

The government introduces a binding price floor on milk market

An improvement in farming technology lowers milk production costs

A successful advertising campaign induces more kids to prefer Coca-Cola

The Public Health Service bans imports of powdered milk

The following figure illustrates the short-run cost curves of a typical perfectly competitive firm:

16. Given the graph above, the minimal output that a profit-maximizing firm would produce is:

q1

q2

q3

anything between q2 and q3

greater than q3

17. Given the graph above, we can say that if a profit-maximizing firm produces more than q3:

The firm behaves irrationally, since for any q > q3 average costs are not at their minimum

The firm should increase its output even further

The government should intervene to correct this situation

The market price will likely decrease in the future.

There must be too many firms in the industry now

18. Consider a perfectly competitive wheat market with demand and supply curves of typical shape. If the government introduced a per-unit subsidy on wheat production, in long-run equilibrium:

A typical farmer would earn positive economic profit

A typical farmer would not break even

For a ton of wheat, a consumer would pay more than what a farmer would get from selling it

Equilibrium quantity of wheat would not be Pareto-optimal

More than one answer is correct

19. How should a competitive firm decide, whether it should shut down in the short run?

Compare TR to TC

Compare P to ATC

Do not produce if TR does not cover FC

Compare AVC to MR

Produce the highest quantity demanded, regardless of price

20. Which of the following statements about SR and LR cost curves are true?

SMC curves are typically flatter than the LMC curve

SAC curves are typically flatter than the LAC curve

SAC curves intersect the LAC curve at its minimum

SAC curves touch the LAC curve at their minimums

If the LAC curve reaches its minimum at some point, one of the SAC curves must also reach its minimum at this point.

21. The graph above depicts a perfectly competitive industry with initial equilibrium at (q2, p2). After government intervention, deadweight loss emerged. Which of the following policies could have caused such a loss?

A. A price ceiling set at p4

B. A price floor set at p1

C. A per-unit tax of (p4 – p1) on the good’s production

D. A per-unit subsidy of (p4 – p1) on the good’s production

E. A lump-sum tax of (p4 – p1)q2 on the good’s production

22. Which of the following could indicate that there are economies of scale in an industry?

Two firms can produce any amount of output with lower cost, than one firm

MC is constant for all levels of output

Whenever output increases by 1%, TC increases by 2%

When a typical firm doubles the quantity of all inputs used, its output rises by 200%

No right answer

23. A perfectly competitive firm and a monopoly are the same in that:

They cease production when MR < min(AVC)

Their technologies are equally likely to have economies of scale

A binding price ceiling would increase their profits

At the profit-maximizing level of output, market demand for their output is elastic

More than one answer is correct

24. Which of these situations is NOT an example of price discrimination?

Policeman Boots works night shifts, so he chooses to buy bread at 7 a.m. rather than 7 p.m.

Sean buys 6 bottles of Coke for $6, while Sheila buys them one at a time, paying $1.50 for each.

At weekends, John prefers to go to the movies in the morning, when tickets are cheaper. Jane, however, likes to stay in bed till noon, so she goes to the movies in the evening, paying a higher price.

Mary and Susan are offered 5% discount at a sports shop, if they fill a marketing questionnaire. Mary wastes 1 hour to fill it – and receives the discount, while Susan chooses not to.

Bill has to pay $50 to enter a nightclub, but his girlfriend is let in for free.

25. If, at some level of output q, P(q) > MC(q), motive of profit maximization would require that:

A firm should increase output, no matter whether it is a monopoly, or a competitive firm

A competitive firm should increase output; a monopoly may not.

A monopoly should increase output, a competitive firm may not.

A monopoly should decrease output, a competitive firm may not.

None of the above.

26. Which of the following levels of output (q1,…, q5) would maximize a non-discriminating monopoly’s profit?

q1, such that P(q1) = MC(q1)

q2, such that P(q2) = ATC(q2)

Any q3, such that P(q3) > MR(q3)

q4, such that TR(q4) – TC(q4) > TR(q) – TC(q) for any q ≠ q4

q5, such that MR(q5) = 0

27. Which of the following levels of output (q6,…, q10) would maximize a discriminating monopoly’s profit?