- •Property, Plant, and Equipment

- •Cost assignment

- •Lump-sum acquisition

- •It is important to note that the preceding allocation approach would not be used if the asset package constituted a “business.” Those procedures were briefly addressed in the previous chapter.

- •Judgment

- •Inadequacy -- An economic determinant of service life which is relevant when an asset is no longer fast enough or large enough to fill the competitive and productive needs of a company.

- •Depreciation methods Depreciation Concepts

- •Some important terminology

- •In any discipline, precision is enhanced by adopting terminology that has very specific meaning. Accounting for pp&e is no exception. An exact understanding of the following terms is paramount:

- •The straight-line method

- •The double-declining balance method

Inadequacy -- An economic determinant of service life which is relevant when an asset is no longer fast enough or large enough to fill the competitive and productive needs of a company.

Factors such as these must be considered in determining the service life of a particular asset. In some cases, all three factors come into play. In other cases, one factor alone may control the determination of service life. Importantly, service life can be completely different from physical life. For example, computers are often replaced even though still physically functional.

Recognize that some assets have an indefinite (or permanent) life. One prominent example is land. Accordingly, it is not considered to be a depreciable asset.

Depreciation methods Depreciation Concepts

Once the cost and service life of an asset are determined, it is time to move on to the choice of depreciation method. The depreciation method is simply the pattern by which the cost is allocated to each of the periods involved in the service life. There are many methods from which to choose. Three popular methods are: (1) straight-line, (2) units-of-output, and (3) double-declining balance.

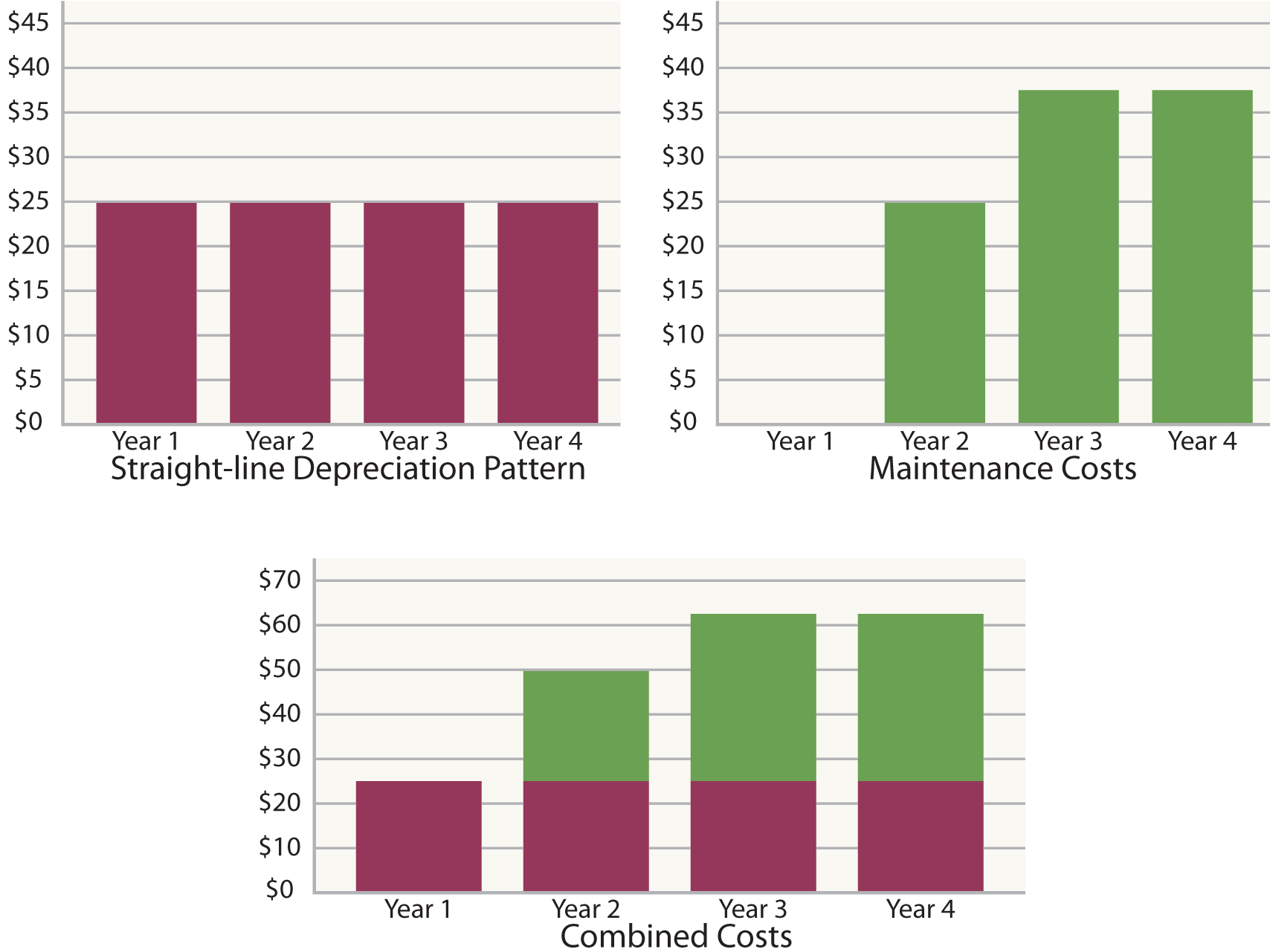

Why so many choices? To explain, begin by assuming that a $100 asset is to be depreciated over four years. Under the straight-line approach, depreciation expense is simply $25 per year (shown in red below). This may seem very logical if the asset is used uniformly over the four-year period. But, what if maintenance costs (shown in green) are also considered? As an asset ages, it is not uncommon for maintenance costs to expand. Assume the first-year maintenance is $0 and rises each year as shown. Combining the two costs together reveals an increase in total cost, even though the usage is deemed to be constant.

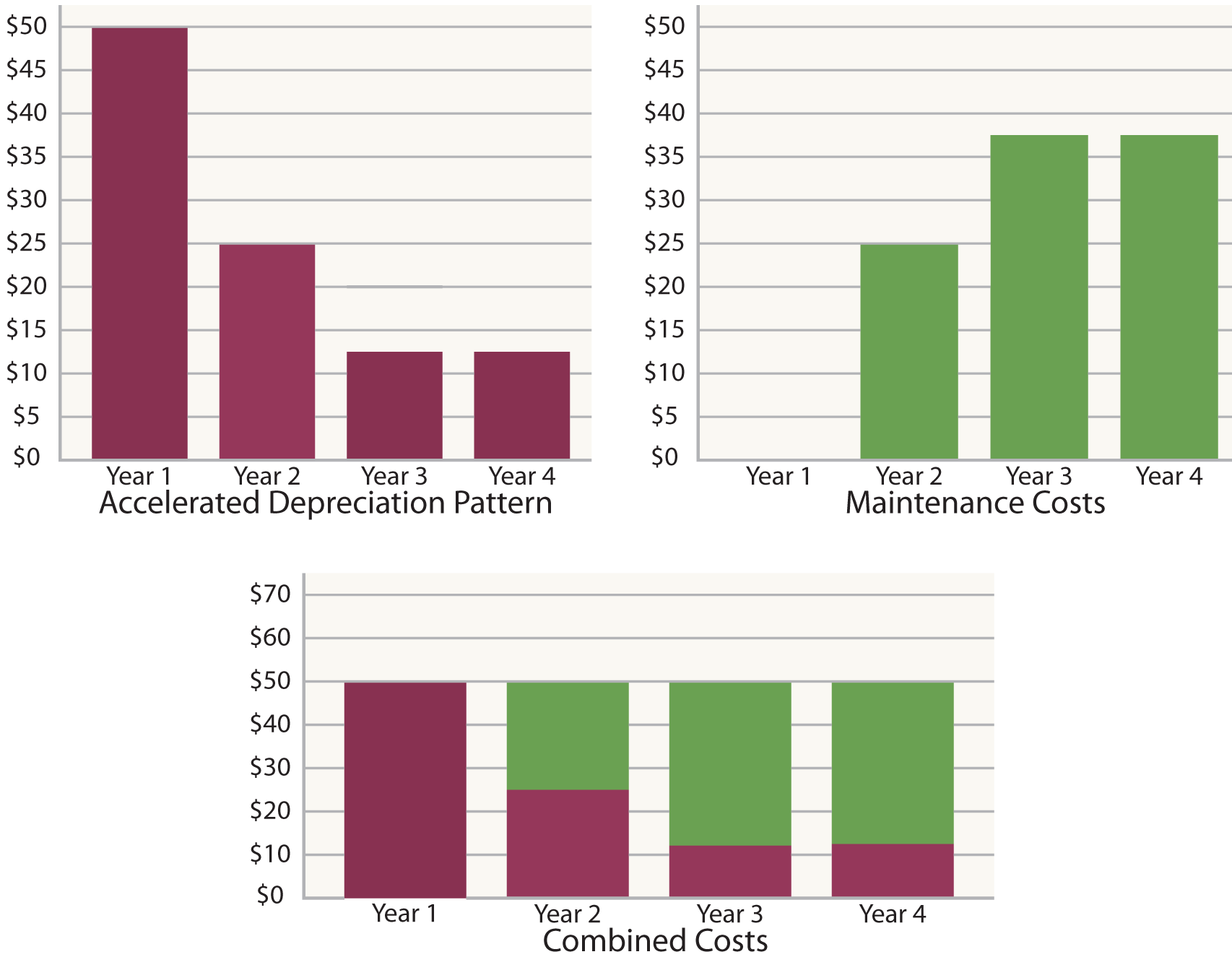

With accelerated depreciation (shown below), the combined amount of depreciation and maintenance provides a level measure of total cost. This may achieve a better matching of total costs and benefits in this particular scenario. Does this mean that accelerated depreciation is better? Not necessarily. Facts can vary, and the point is to show why multiple methods exist and can be justified.

Straight-Line Effects

Accelerated Effects

Some important terminology

In any discipline, precision is enhanced by adopting terminology that has very specific meaning. Accounting for pp&e is no exception. An exact understanding of the following terms is paramount:

Cost: The dollar amount assigned to a particular asset, usually the ordinary and necessary amount expended to get an asset in place and in condition for its intended use.

Service life: The useful life of an asset to an enterprise, usually relating to the anticipated period of productive use of the item.

Salvage value: Also called residual value. This is the amount expected to be realized at the end of an asset’s service life; for example, the anticipated future sales proceeds for used equipment.

Depreciable base: The cost minus the salvage value. Depreciable base is the amount of cost that will be allocated to the service life.

Book value: Also called net book value. This refers to the balance sheet amount at a point in time that reveals the cost minus the amount of accumulated depreciation (book value has other meanings when used in other contexts, so this definition is limited to its use in the context of PP&E).

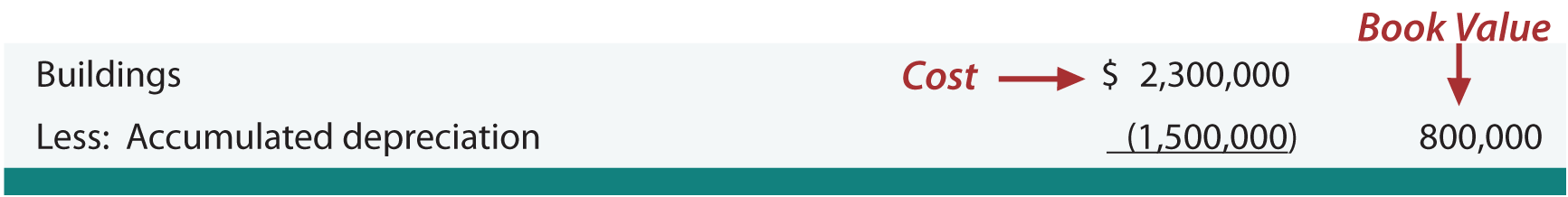

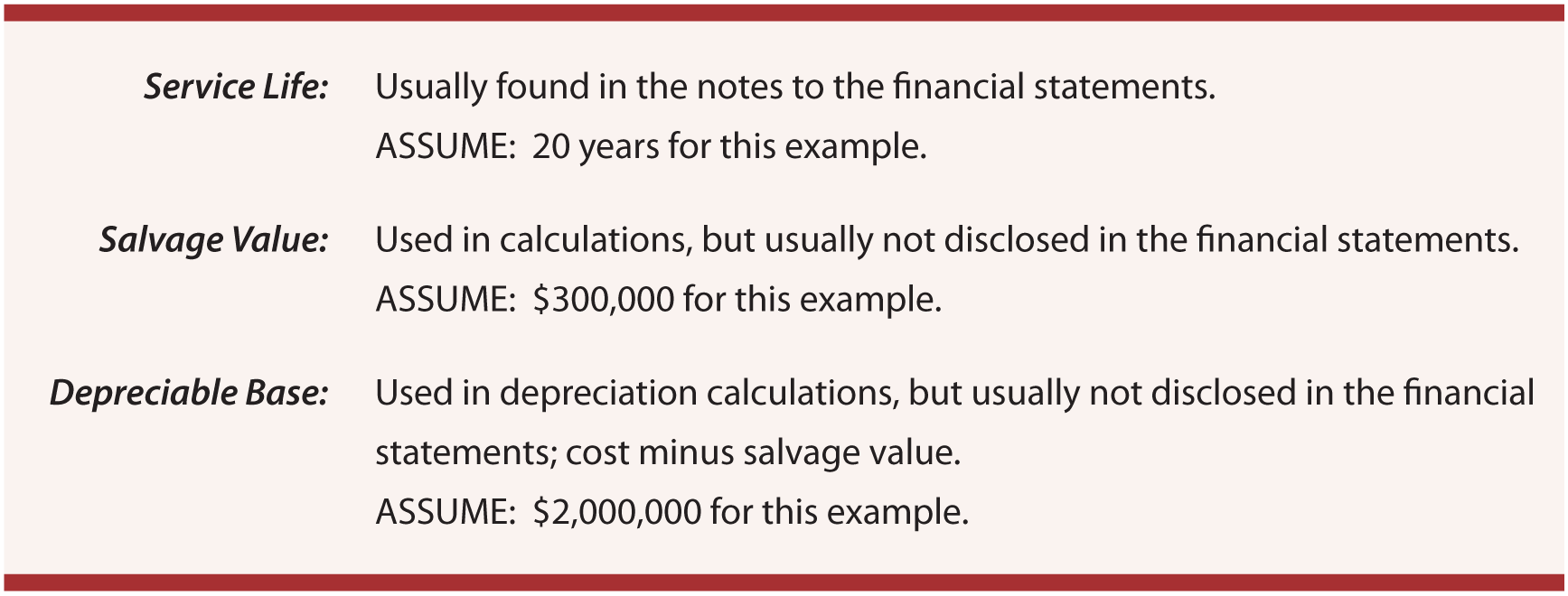

Below is an illustration relating these terms to the financial statement presentation for a building:

In the preceding illustration, assuming straight-line depreciation, what is the asset’s age? The $2,000,0000 depreciable base ($2,300,000 - $300,000) is evenly spread over 20 years. This produces annual depreciation of $100,000. As a result, the accumulated depreciation of $1,500,000 suggests an age of 15 years (15 X $100,000).

There are many possible depreciation methods, but straight-line and double-declining balance are the most popular. In addition, the units-of-output method is uniquely suited to certain types of assets. The following discussion covers each of these methods. Intermediate accounting courses typically introduce additional techniques that are sometimes appropriate.